Source: Chainalysis; Compiled by: Tong Deng, Jinse Finance

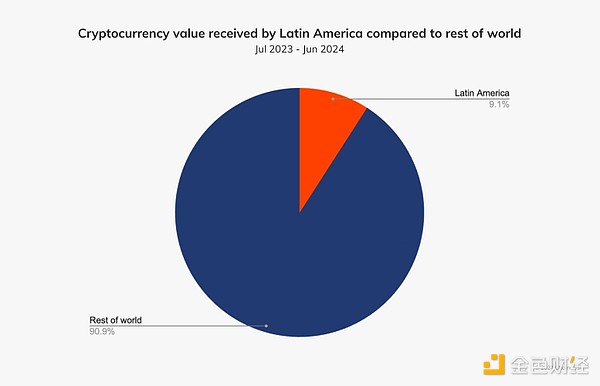

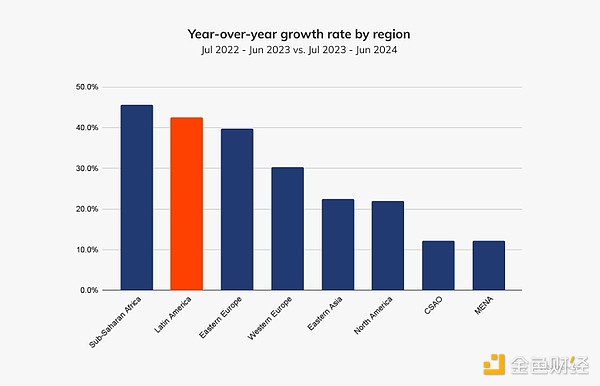

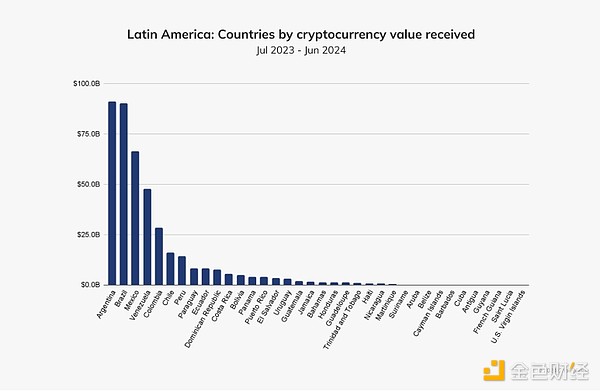

Latin America is the fifth largest region we studied, accounting for 9.1% of the value of cryptocurrency received during the period from July 2023 to June 2024. During this period, the region received nearly $415 billion in cryptocurrency, slightly higher than East Asia.

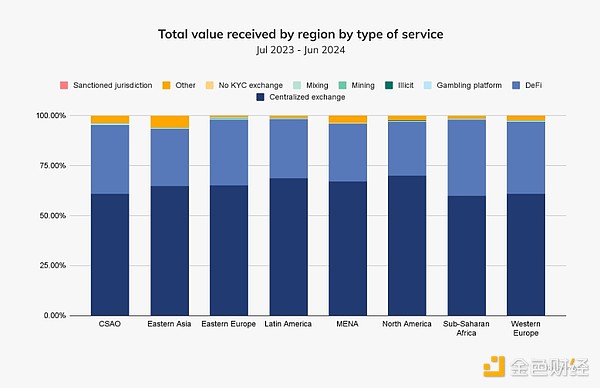

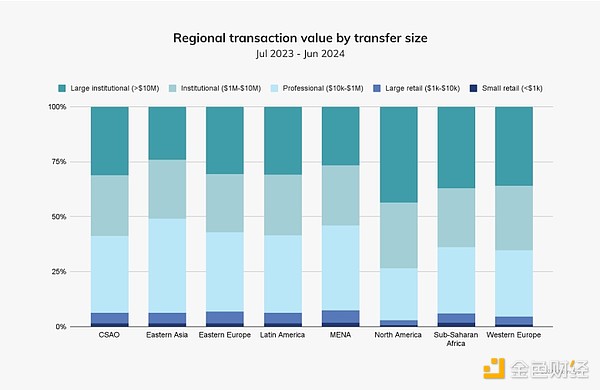

Centralized exchanges (CEXs) are the most commonly used service by Latin Americans, accounting for 68.7% - slightly lower than the CEX usage rate in North America. The regional trading value in Latin America is mainly driven by institutions and professional investors (i.e., entities with transaction volumes exceeding $10,000).

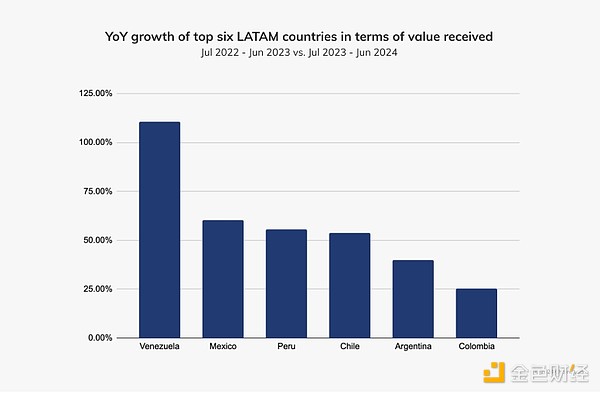

Latin America is the second fastest growing region in our study this year, with a year-over-year growth rate of around 42.5%. As we will discuss later, this growth is largely driven by the strong but diversified cryptocurrency markets in Venezuela, Argentina, and Brazil.

In terms of cryptocurrency value, Argentina ranks first in the region, estimated at $91 billion, slightly higher than Brazil's $90.3 billion.

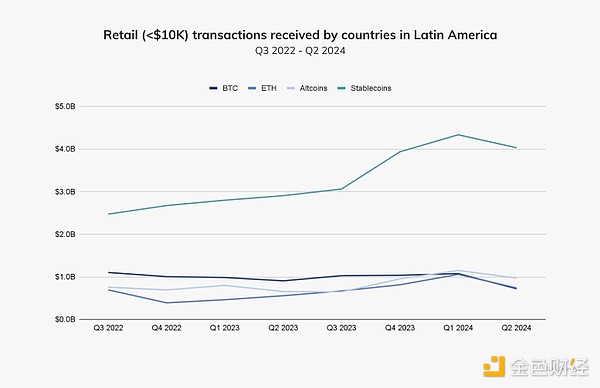

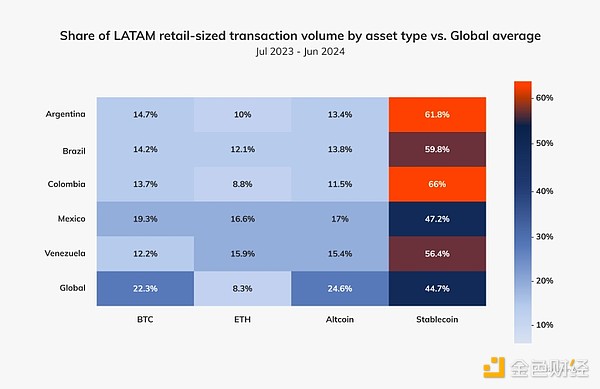

In our Global Adoption Index, 4 out of the top 20 countries are in Latin America: Brazil (9), Mexico (13), Venezuela (14), and Argentina (15). As we will discuss in more detail below, stablecoin-based remittances are becoming increasingly popular in these countries and across Latin America.

Brazil's Institutional Cryptocurrency Activity Indicates Major Financial Institutions Renewing Interest

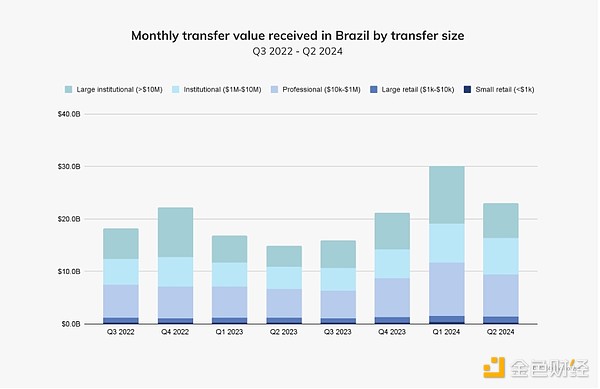

In last year's Geos report, we noted that while Brazil has historically had a developed institutional cryptocurrency market, institutional activity declined in early 2023, likely coinciding with the global cryptocurrency bear market. But this trend reversed mid-year and has since increased, indicating that major financial entities have renewed their interest. For example, the monthly value of institutional-sized trades (i.e., over $1 million) grew by around 29.2% between the last two quarters of 2023, and by around 48.4% between Q4 2023 and Q1 2024.

We interviewed André Portilho, Head of Digital Assets at investment bank BTG Pactual, to understand more about the factors driving this institutional activity. "A key factor is portfolio diversification, especially as the market matures. Investors are increasingly incorporating digital assets into their asset allocation strategies, viewing them as valuable alternative investments with the potential to enhance returns. The integration of Bit and other cryptocurrencies as established investment choices has been crucial in this shift," he explained. "The notable resurgence of institutional cryptocurrency activity in Brazil can be partly attributed to the evolution of regulation and the entry of US institutions into the cryptocurrency market, particularly with the launch of Bit and Ether ETFs."

Aaron Stanley, founder of the Brazil Crypto Report, a newsletter and podcast exploring the latest trends in Brazil's crypto ecosystem, points to similar trends in Brazil's embrace of crypto. "The ecosystem is quite mature already. We've seen several TradFi banks launch crypto brokerage products (e.g., the country's largest bank, Itaú), and most other major banks are actively building their own similar products. We've seen major global exchanges like OKX and Coinbase struggle to launch in the country with local teams and entities. The Drex pilot program, a hybrid CBDC/smart contract platform being developed by the Central Bank of Brazil, has also prompted TradFi banks to be more forward-looking in their digital asset strategies. This has downstream benefits for these institutions and their clients in terms of crypto adoption."

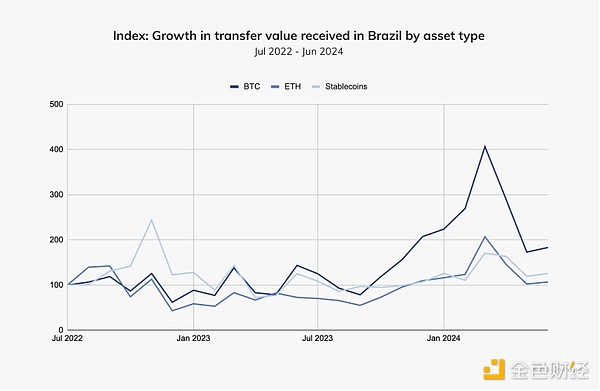

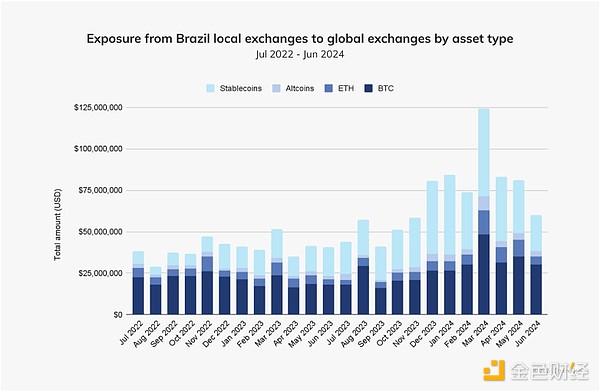

As cryptocurrency activity in Brazil flourishes, we conducted a detailed analysis of the most popular assets among Brazilians. First, we found that Bit trading saw the largest growth during the study period. Bit trading value experienced a particularly sharp increase from September 2023 to March 2024, which may coincide with the SEC's approval of a spot Bit ETF in January 2024. It's also worth noting that during this period, the price of Bit nearly doubled, which may have contributed to the higher trading volumes.

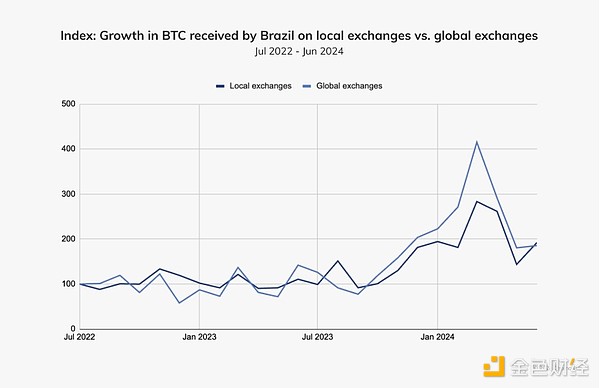

A closer look at this Bit activity reveals that Brazilians received far more value on global exchanges than on regional local exchanges.

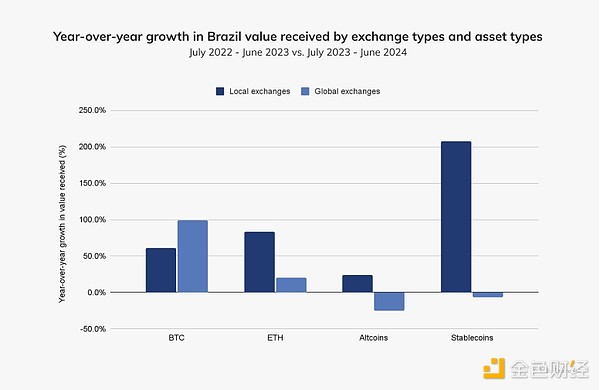

However, the asset types traded on local exchanges present a stark contrast. As shown below, stablecoin trading volume on local exchanges grew significantly year-over-year (207.7%), outpacing Bit, Ether, and Altcoins. Stanley notes, "Many of Brazil's exchanges and fintech brokerages offer their clients stablecoins pegged to the US dollar, with the idea of providing US dollar exposure as a store of value. This has undoubtedly gained traction, but at this stage, the primary use case for stablecoins seems to be in B2B cross-border payments."

Currently, stablecoins account for around 70% of the indirect flow from Brazilian local exchanges to global exchanges. Brazil's high level of stablecoin activity and widespread interest in digital products and services have attracted significant interest from major cryptocurrency players, particularly Circle, which announced its official launch in Brazil in May 2024. A Circle spokesperson stated, "Circle's engagement in Brazil has increased due to the regulatory certainty encouraged by innovative policies and initiatives, with more business-friendly rules expected to be developed in the near future. We are partnering with leading regional enterprises to launch digital asset products, providing near-instant, low-cost, 24/7 USDC access for Brazilian users, and strengthening our local operations to reach a broader user base. Due to our commitment to the region and existing partnerships, the number of users transacting USDC in the region has been growing exponentially."

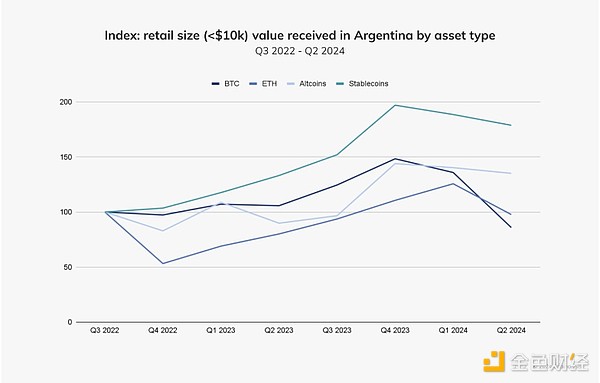

Stablecoins Provide a Path to Stability Amid Argentina's Prolonged Economic Turmoil

Argentina's decades-long struggle with inflation and the devaluation of the Argentine peso (ARS) has led many citizens to seek alternatives to protect their savings and ensure a more stable economic future. Unfortunately, Argentina's economic situation has been particularly unstable this year. By the second half of 2023, the inflation rate is expected to be around 143%, the value of the Argentine peso has plummeted, and four in ten Argentines live in poverty. In December 2023, newly elected President Javier Milei announced a 50% devaluation of the Argentine peso, describing it as a "shock therapy," and the government will cut energy and transportation subsidies. To shield themselves from the impact of this economic crisis, some Argentines have turned to the black market to purchase foreign currency, most commonly the US dollar (USD). This "blue dollar" is the US dollar traded at a parallel, informal exchange rate, often purchased through secret exchange houses called "cuevas" across the country. Others have explored stablecoins pegged to the US dollar, as reflected in our data. We looked at monthly stablecoin trading volumes on Bitso, the leading regional exchange in Latin America, and found that the persistent devaluation of the peso has driven increases in monthly stablecoin trading. For example, when the value of the ARS fell below $0.004 in July 2023, the monthly stablecoin trading volume spiked to over $1 million in the following month. Similarly, when the value of the ARS fell below $0.002 in December 2023 (following President Milei's announcement), the stablecoin trading value exceeded $10 million in the following month.

Despite Maduro Regime Uncertainties, Cryptocurrency Adoption Remains Strong in Venezuela

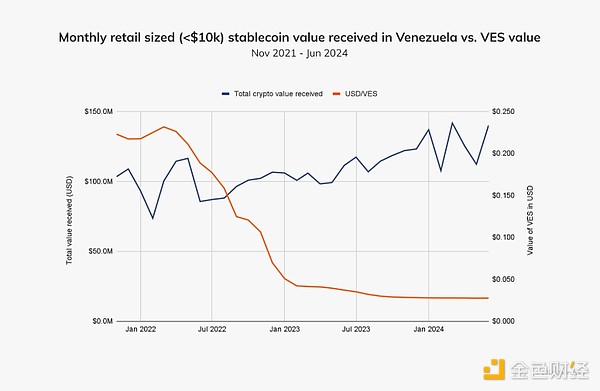

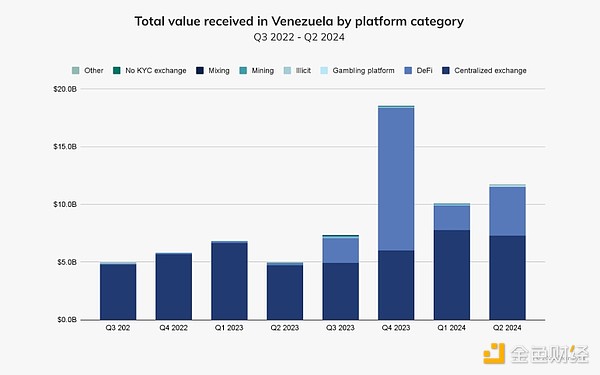

Venezuela's relationship with cryptocurrencies has been turbulent, marked by experiments such as the launch (in 2018) and subsequent abrupt termination (in 2024) of the state-backed Petro (PTR), a stablecoin backed by Venezuela's oil and mineral wealth, as well as crackdowns on Bitcoin mining and blocking access to certain mainstream cryptocurrency exchanges. At the same time, as the Maduro regime seeks ways to circumvent economic sanctions, its illicit oil trade has become entangled with cryptocurrency transactions, leading to high-profile prosecutions by the US Department of Justice. These cryptocurrency-related events highlight a broader shift, with the Maduro regime using it as a tool of corruption, while citizens view it as a means to ensure financial independence. However, despite this turmoil, the Maduro regime has recently hinted at a renewed interest in cryptocurrencies, though without providing specific plans. Regardless of how such political developments unfold, Venezuela remains one of the fastest-growing cryptocurrency markets in Latin America, with a 110% year-over-year growth far exceeding any other country in the region.

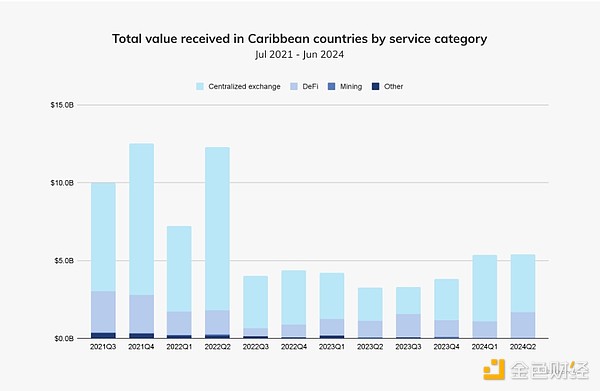

Crypto Activity Accelerates in the Caribbean Region After the FTX Collapse

In the years following the FTX collapse, the Caribbean crypto ecosystem went through a period of uncertainty, and activity slowed due to diminished trust in crypto platforms. However, starting in late 2023, the Caribbean region has witnessed a resurgence of cryptocurrency activity. Users appear to be turning to mainstream centralized exchanges (CEXs), such as Coinbase and Binance.