Ordinary users on cross-chain bridges are more valuable than those on L2.

Original: Money Routers (decentralised)

Author: Joel John

Translator: Luffy, Foresight News

The killer application of cryptocurrencies has emerged, and that is stablecoins. In 2023, Visa's transaction volume approached $15 trillion, while the total transaction volume of stablecoins reached $20.8 trillion. Since 2019, the total amount of stablecoin transfers between wallets has reached $221 trillion.

Over the past few years, funds equivalent to the global GDP have been circulating on the blockchain. Over time, this capital will gradually accumulate in different networks. Users switch between different protocols to obtain better financial opportunities or lower transfer costs; in the era of chain abstraction, users may not even know that they are using cross-chain bridges.

Cross-chain bridges can be seen as routers for capital. When you visit any website on the Internet, there is a complex network behind it. The physical router in your home is crucial to the network, as it determines how to route data packets to help you get the data you need in the shortest time.

Today, cross-chain bridges play the same role in on-chain capital. When users want to move from one chain to another, the cross-chain bridge decides how to route the funds to allow users' capital to obtain the maximum value or transaction speed.

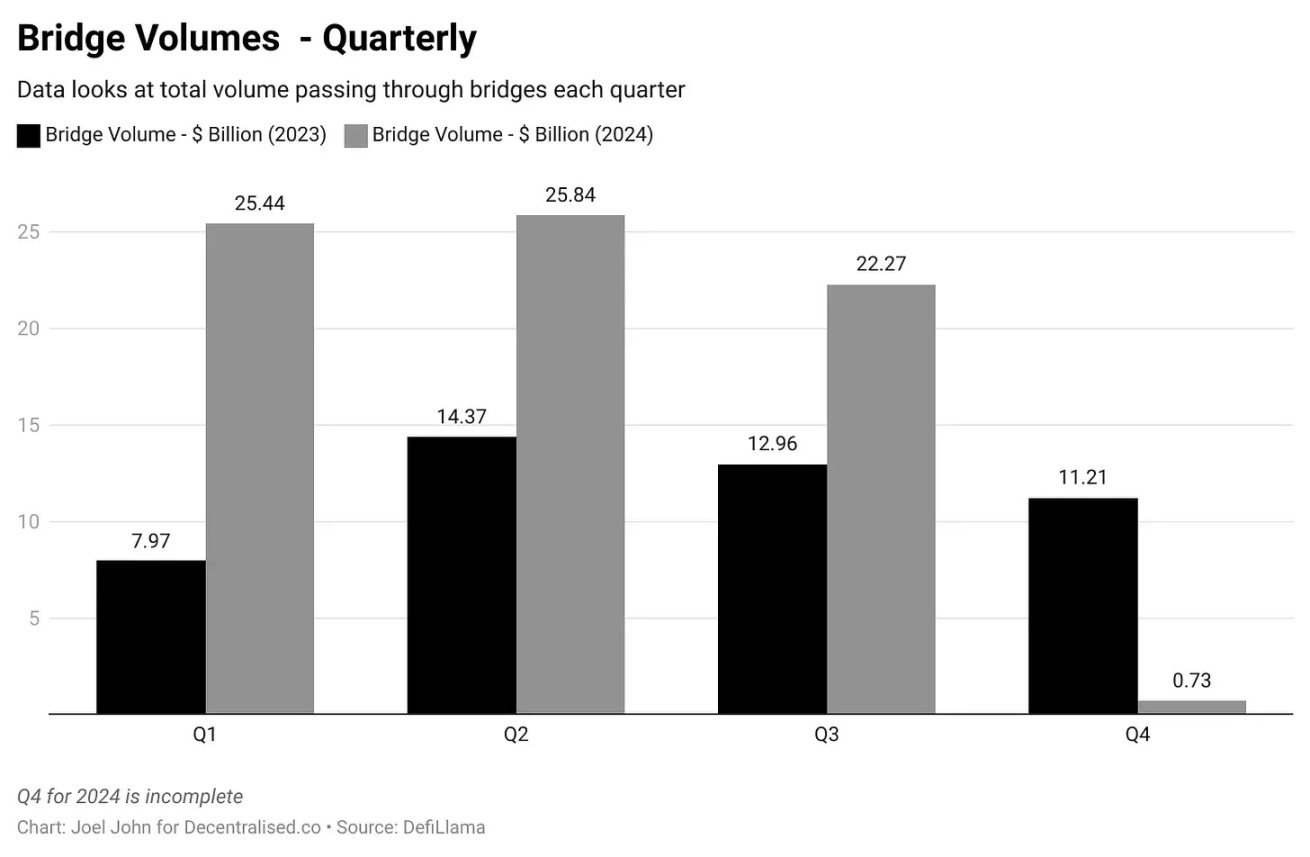

Since 2022, the transaction volume processed through cross-chain bridges has exceeded hundreds of billions of dollars. This is far less than the amount of funds transferred on-chain by stablecoins. But compared to many other protocols, cross-chain bridges earn more profit per user and per locked dollar.

Today's article will explore the business model behind cross-chain bridges and the funds generated through their transactions.

The Business Model of Cross-Chain Bridges

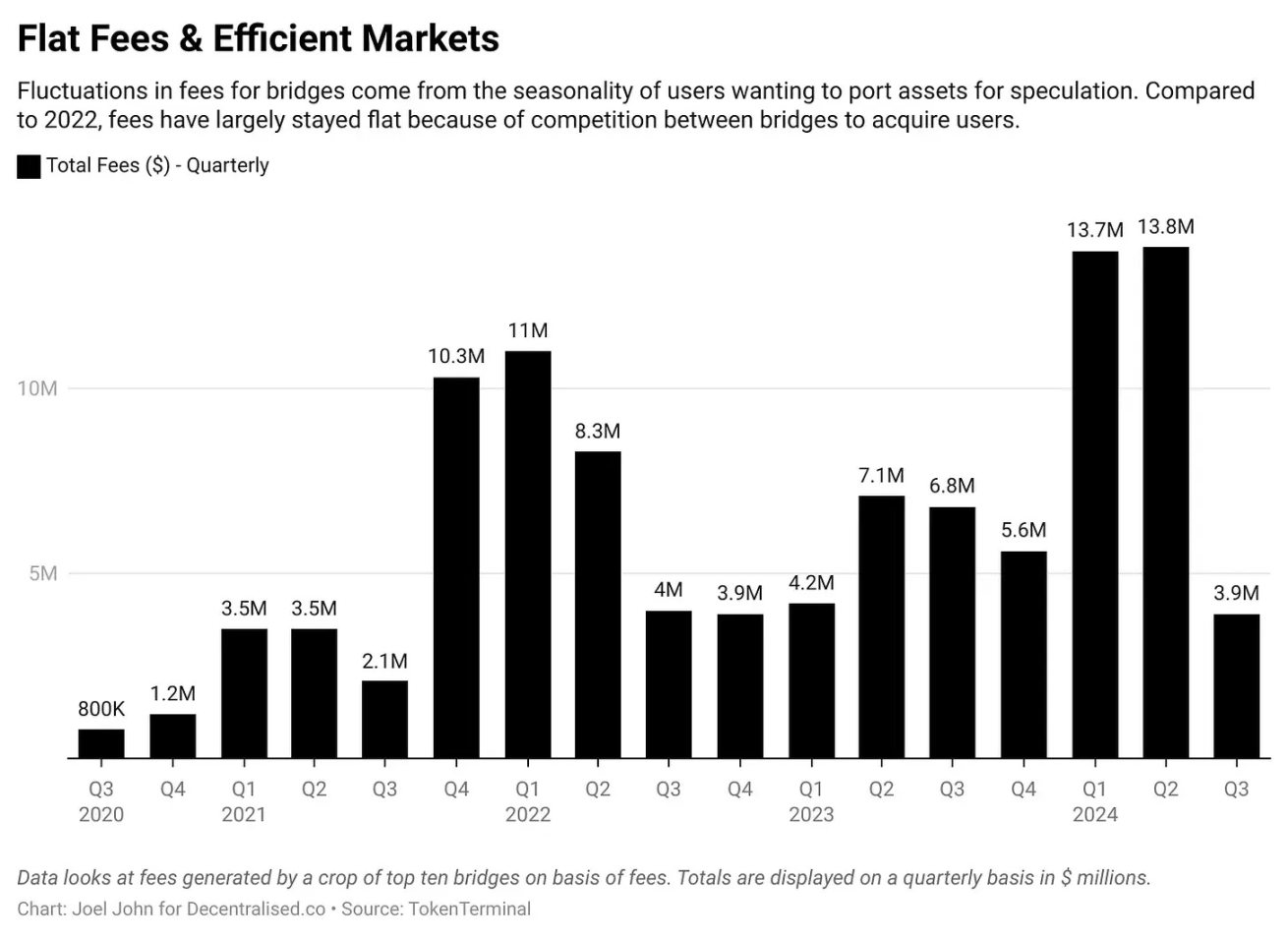

Since mid-2020, blockchain cross-chain bridges have generated nearly $104 million in cumulative fees. This data has a certain seasonality, as users flock to cross-chain bridges to use new applications or seek economic opportunities. If there are no attractive yield opportunities, Memecoins, or financial primitives, the usage of cross-chain bridges will drop significantly, as users will stick to the chains and protocols they use most often.

One sad (but interesting) way to measure cross-chain revenue is to compare it to platforms like Pump.fun, which are Memecoin platforms. When Memecoin platforms had $70 million in fee revenue, cross-chain bridges had $13.8 million in fee revenue.

Although transaction volume has increased, we see fees remain relatively flat, as there is ongoing price competition between blockchains. To understand how they achieve this efficiency, we need to understand how most cross-chain bridges work. One mental model for understanding cross-chain bridges is through the century-old Hawala network.

Although today, people's understanding of Hawala is largely around its association with money laundering, a century ago, it was an effective way to transfer funds. For example, if you wanted to transfer $1,000 from Dubai to Bangalore in the 1940s, you had many options.

You could go to a bank, but it might take several days and require a lot of paperwork. Or you could go to a seller in the Gold Souk, who would take your $1,000 and instruct an Indian merchant to pay an equivalent amount to your designated recipient in Bangalore. The currency changed hands in India and Dubai, but did not cross the border.

How did this work? Hawala is a trust-based system that operates because the Gold Souk sellers and Indian merchants often have ongoing trade relationships. They don't directly transfer capital, but settle the balance later with commodities like gold. Since these transactions rely on the mutual trust and cooperation of the participating individuals, there needs to be a high degree of confidence in the honesty and cooperation of both parties.

How is this related to cross-chain? Many cross-chains adopt the same model. To seek yield, you may want to move capital from Ethereum to Solana. The job of cross-chain bridges like LayerZero is to help convey messages about the user, allowing the user to deposit tokens on one chain and borrow tokens on another chain.

Suppose these two traders are not locking assets or providing gold bars, but instead giving you a code that can be redeemed for assets anywhere. This code is a form of sending messages, which on LayerZero are called endpoints. They are smart contracts that exist on different blockchains. A Solana smart contract may not be able to understand a transaction on Ethereum, and it needs an oracle. LayerZero uses Google Cloud as the verifier for cross-chain transactions, and even at the forefront of Web3, we rely on Web2 giants to help us build a better economic system.

Imagine if the traders involved don't trust their ability to interpret the code, after all, not everyone can get Google Cloud to verify transactions, so what do they do? Another approach is to lock and mint assets.

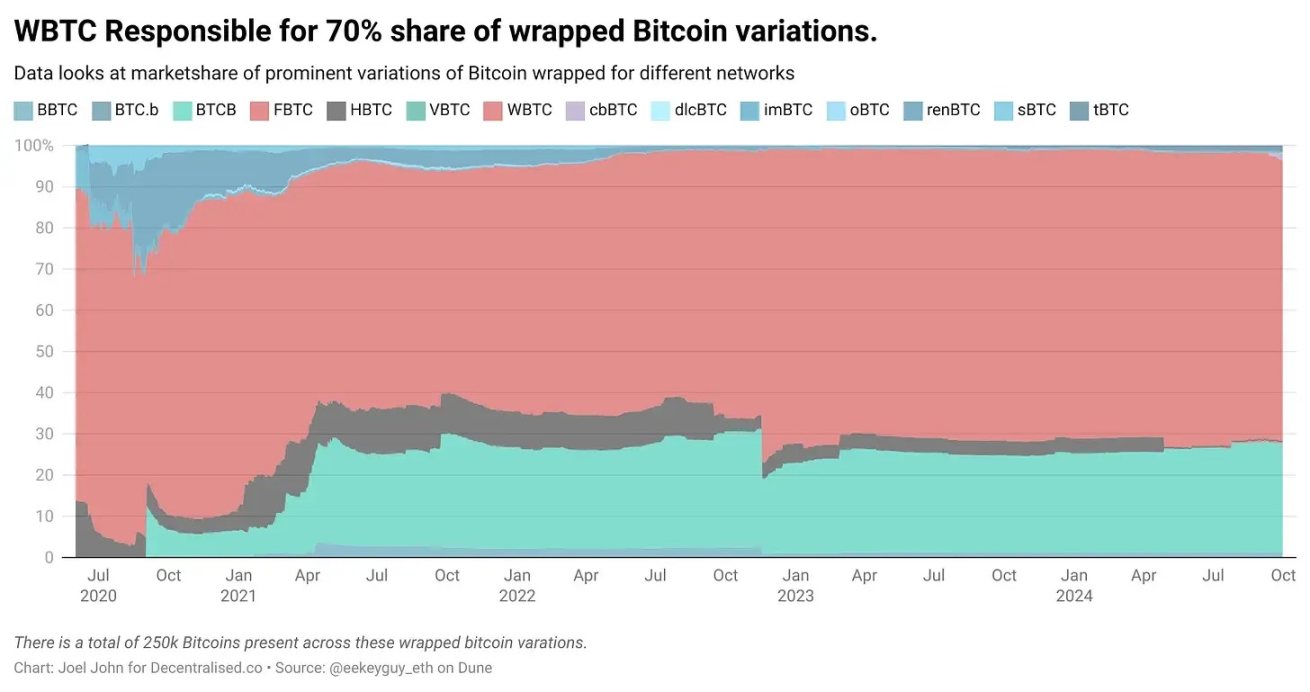

In this model, if you use Wormhole, you will lock the assets in an Ethereum smart contract and then get the wrapped assets on Solana. It's like depositing US dollars in the UAE and then having a Hawala provider in India give you gold bars. You can take the gold, speculate with it, and then return it to reclaim your original capital in Dubai.

The image below shows the wrapped Bitcoin assets today. Most of them were minted during the DeFi summer, with the aim of generating yield for Bitcoin on Ethereum.

There are a few key points to the commercialization of cross-chain bridges:

- TVL: When users come to deposit funds, these funds can be used to generate yield. Today, most cross-chain bridges do not absorb idle capital and lend it out, but rather charge a small transaction fee when users move capital from one chain to another.

- Relay fees: These are fees charged by third parties (such as Google Cloud in LayerZero) that charge a small amount per transaction to verify transactions across multiple chains.

- Liquidity provider fees: Paid to those who deposit funds into the cross-chain bridge smart contract. Imagine you're running a Hawala network, and now someone is moving $100 million from one chain to another. You personally may not have that much capital. Liquidity providers are the individuals who pool these funds to help facilitate the transaction. In return, each liquidity provider gets a small cut of the fees generated.

- Minting costs: Cross-chain bridges can charge a small fee when minting assets. For example, WBTC charges a 10 basis point fee per Bitcoin minted.

The expenses of cross-chain bridges go towards maintaining relayers and paying liquidity providers, while the revenue is the transaction fees and the value they create for themselves by minting assets for the transacting parties.

The Economic Value of Cross-Chain Bridges

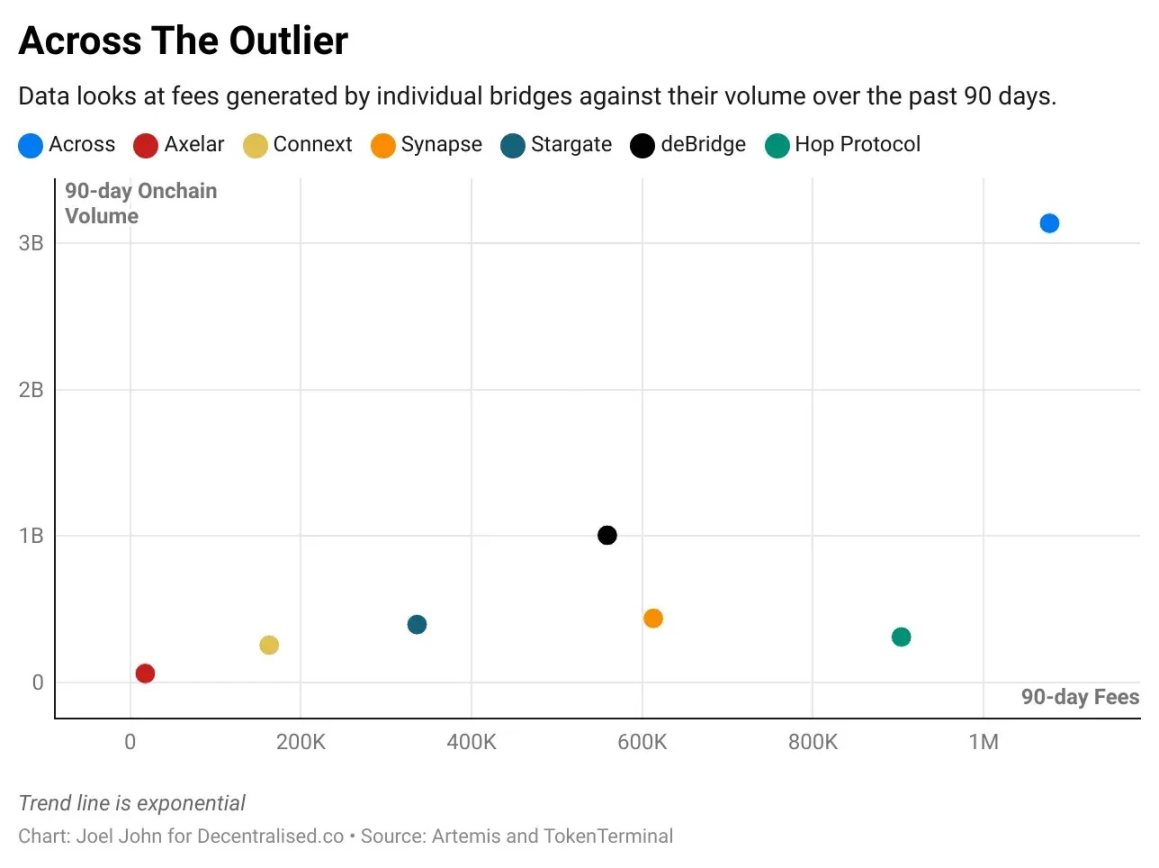

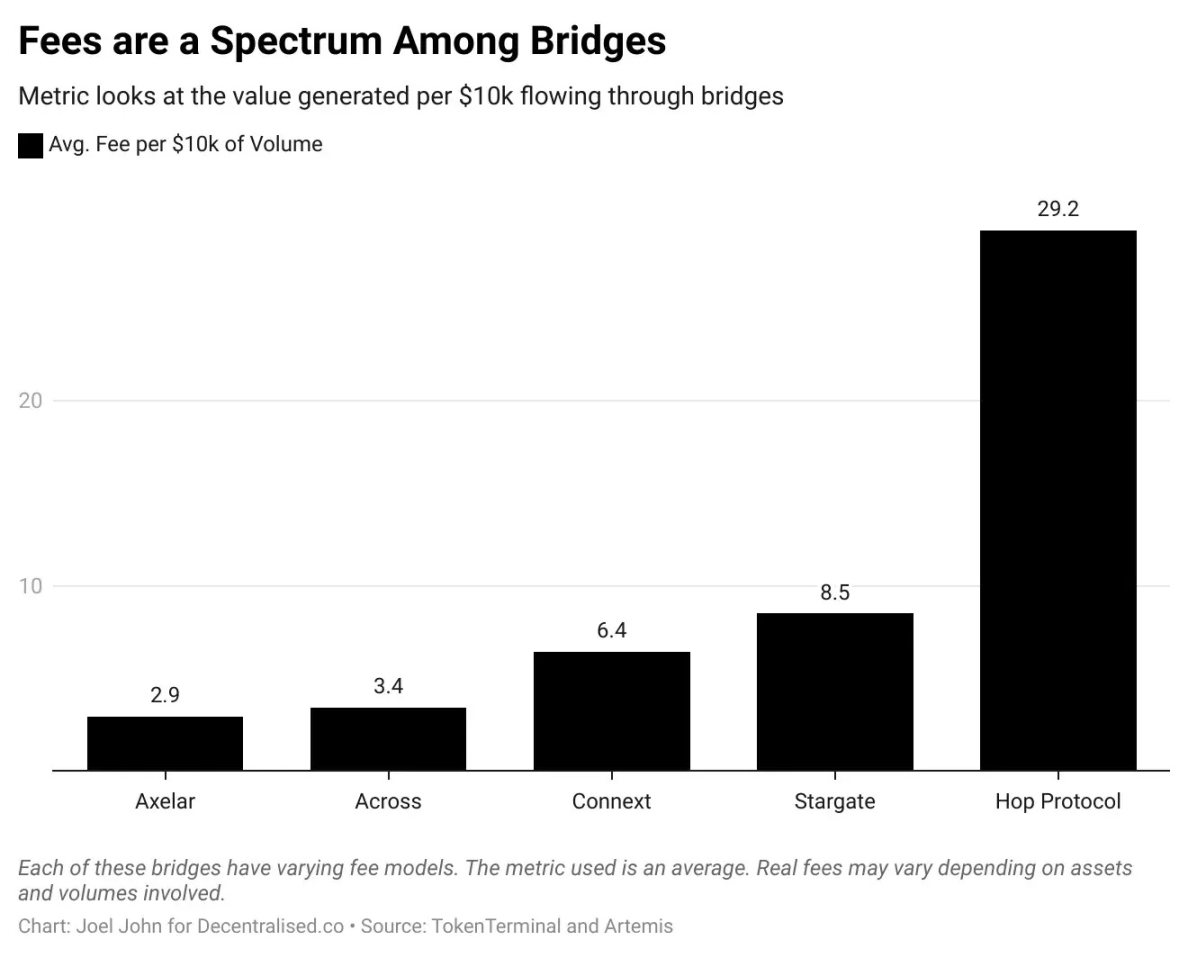

The data below is a bit messy, as not all fees flow to the protocol. Sometimes, the fees depend on the protocol and the assets involved. If the cross-chain bridge is primarily used for low-liquidity long-tail assets, it may also result in users bearing transaction slippage. So the following does not necessarily reflect which cross-chain bridges are better than others when we look at unit economics. What we're interested in is seeing how much value is generated across the entire supply chain during a cross-chain event.

First, we look at 90-day transaction volumes and the fees generated across protocols. The data is as of August 2024, so these numbers are for the subsequent 90 days. We assume Across has higher transaction volume because it has lower fees.

This roughly indicates how much capital flows through the cross-chain bridges in a given quarter and the types of fees they generate in the same period. We can use this data to calculate the fees generated per dollar flowing through these cross-chain transfers. For readability, I'll calculate the fees generated per $10,000 transferred through these cross-chain transfers.

Before we start, I want to clarify that this does not mean Hop's fees are 10x higher than Axelar's. It's saying that on a cross-chain bridge like Hop, every $10,000 transferred can create $29.2 of value across the entire value chain (for LPs, relayers, etc.). These metrics vary because their transaction nature and types are different.

The most interesting part for us is to compare this to the value captured by the protocols and the capital flowing across the chains.

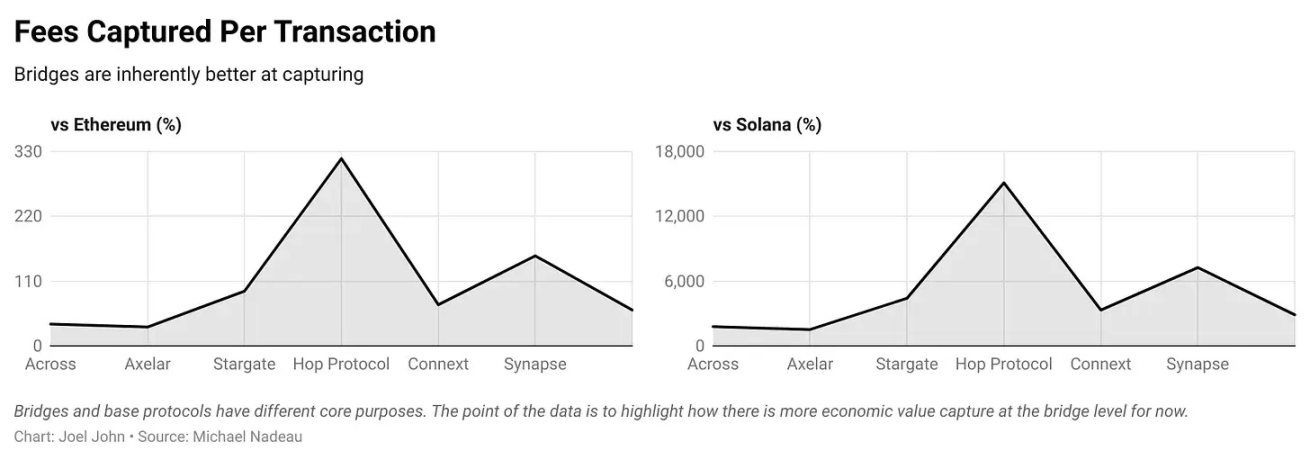

To benchmark, we look at transaction costs on Ethereum. As of writing, the transaction cost on Ethereum is around $0.0009179 in low gas conditions, and on Solana, it's around $0.0000193. Comparing cross-chain bridges to L1s is a bit like comparing a router to a computer. The cost of storing a file on a computer will be orders of magnitude lower. But here, we're trying to understand, from an investment thesis perspective, whether cross-chain bridges capture more value than L1s.

From that lens, and referring to the metrics above, one way to compare the two is to look at the dollar fees each cross-chain bridge charges per transaction and compare that to Ethereum and Solana.

The reason some cross-chain bridges capture fees lower than Ethereum is due to the Gas costs incurred when doing a cross-chain transaction from Ethereum.

Someone might say the Hop protocol captures 120x more value than Solana. But that misses the point, as the fee models of the two networks are entirely different. What we're interested in is the difference between value capture and valuation.

Of the top 7 cross-chain protocols, 5 have fees cheaper than Ethereum L1. Axelar is the cheapest, with average fees over the past 90 days being only 32% of Ethereum. Hop Protocol and Synapse are more expensive than Ethereum. Compared to Solana, we can see that L1 settlement fees on high-throughput chains are orders of magnitude cheaper than today's cross-chain protocols.

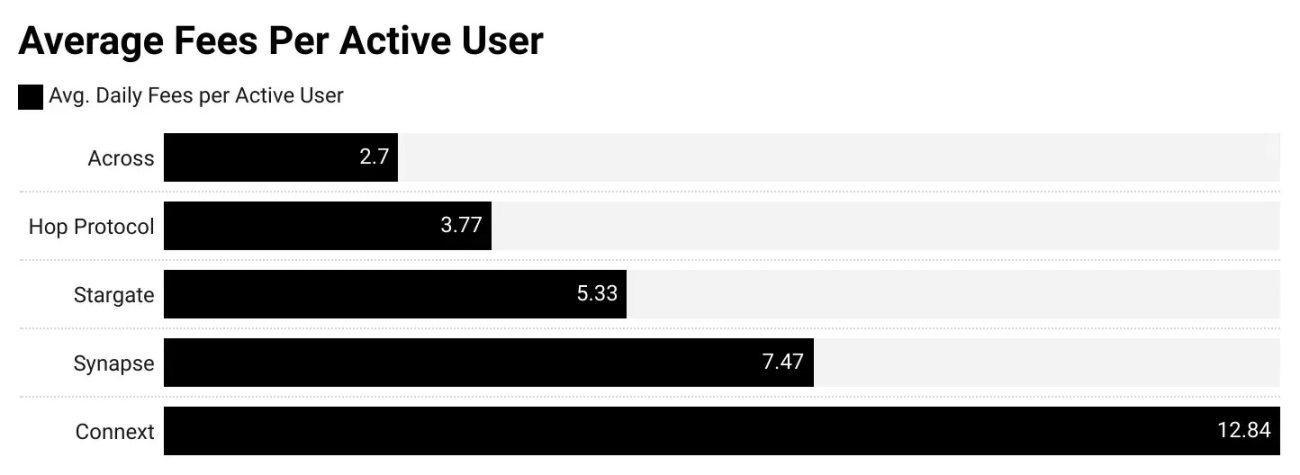

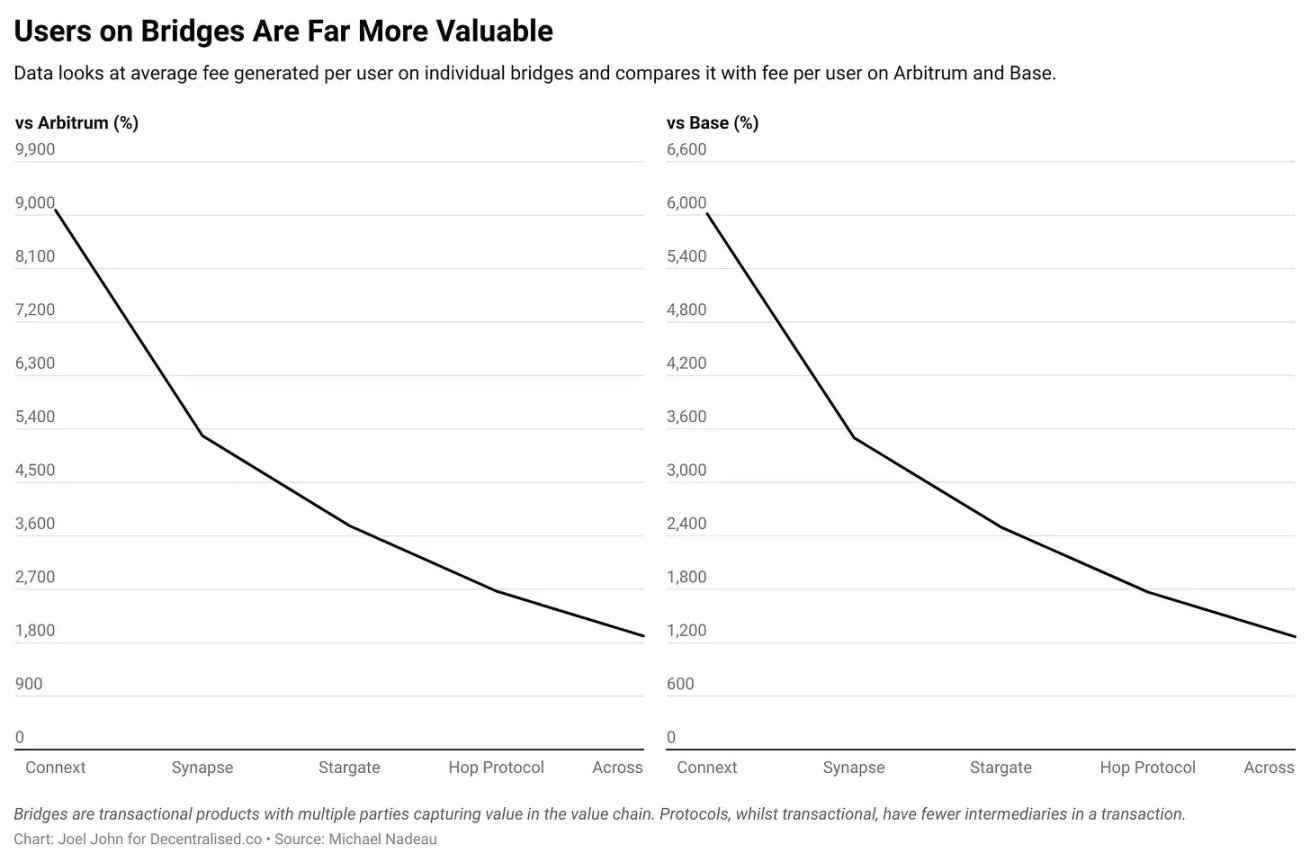

One way to further strengthen this data is to compare the costs of transacting on L2s within the EVM ecosystem. Generally, Solana's fees are about 2% of Ethereum's. To make the comparison, we'll use Arbitrum and Base. Since L2s are designed for low fees, we'll use a different metric to measure economic value - the average daily fee per active user.

In the 90 days we collected data for this article, Arbitrum had an average of 581,000 users per day, generating $82,000 in fees per day. Similarly, Base had 564,000 users and generated $120,000 in fees per day.

In comparison, cross-chain users are fewer, and fees are lower. The highest is Across, with 4,400 users generating $12,000 in fees. Based on this, we estimate Across generates $2.4 in fees per active user per day. We can then compare this metric to the fees generated per active user on Arbitrum or Base to measure the economic value per user.

Today, the average user on a cross-chain bridge is more valuable than the average user on an L2. Connext's average user creates 90x the value of an Arbitrum user.

- Cross-chain bridges, like monetary routers, may be one of the few product categories in crypto that can generate meaningful economic value.

- As long as transaction fees remain high, we may not see users migrate to L1s like Ethereum or Bitcoin. Users may directly join L2s like Base, or we may see users only switching between low-cost networks.

Another way to measure the economic value of cross-chain protocols is to compare them to decentralized exchanges. Think about it, these two primitives have similar functionalities. They allow the transfer of tokens from one form to another. Exchanges allow the transfer of tokens between assets, while cross-chain bridges allow the transfer of tokens between blockchains.

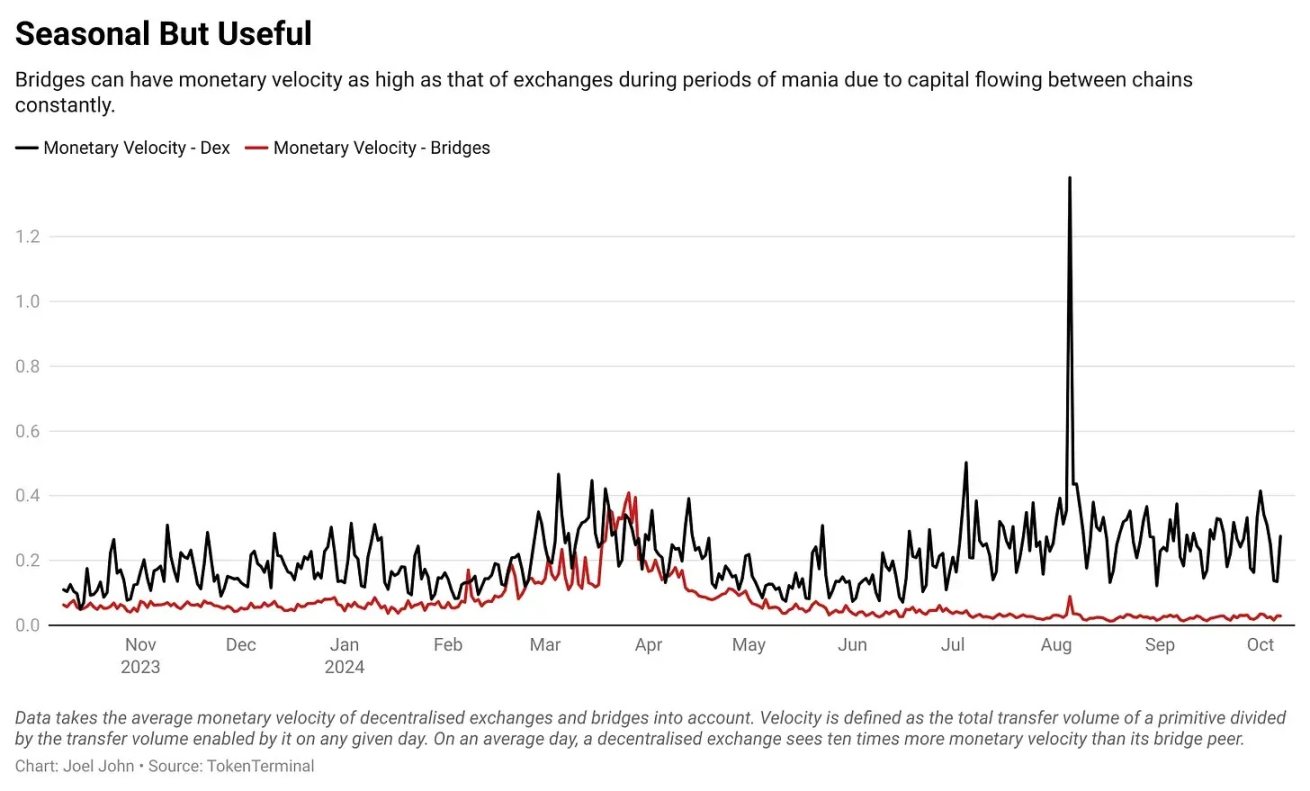

Here, I'm avoiding comparing fees or revenues. Instead, I'm interested in the capital turnover rate. It can be defined as the number of times capital flows between the smart contracts held by the cross-chain bridge or decentralized exchange. To calculate it, I'll divide the daily transaction volume of the cross-chain bridge or decentralized exchange by their TVL.

As expected, the turnover rate for decentralized exchanges is much higher, as users trade assets multiple times a day.

However, interestingly, when you exclude large L2 native bridges (such as the native bridges of Arbitrum or Optimism), the turnover rate is not too far off from that of decentralized exchanges.

Perhaps in the future, we will have cross-chain bridges that limit capital allocations, and instead focus on maximizing returns by increasing capital turnover rates. That is, if a cross-chain bridge can transfer capital multiple times a day, it will be able to generate higher returns.

Are cross-chain bridges routers?

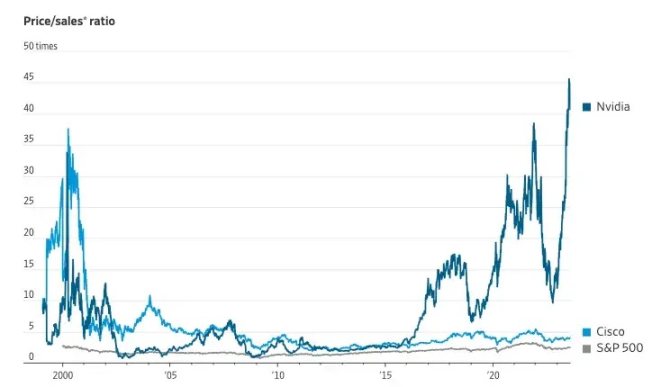

If you think the influx of venture capital into the "infrastructure" space is a new phenomenon, let's take a trip down memory lane. Back in the 2000s, when I was just a young boy, many in Silicon Valley were raving about Cisco. The logic at the time was that if internet traffic increased through internet channels, routers would capture a large portion of the value. Much like NVIDIA today, Cisco was a high-priced stock back then, as they built the physical infrastructure that supported the internet.

Cisco's stock reached a peak of $80 on March 24, 2000. As of the time of writing, it is trading at $52, never having recovered to its heyday. Writing this piece in the midst of the Memecoin frenzy has made me ponder to what extent cross-chain protocols can capture value. They have network effects, but may be a winner-take-all market. This market is increasingly trending towards intent and solutions, with centralized market makers executing orders in the backend.

At the end of the day, most users don't care about the decentralization of the cross-chain bridge they use, they care about cost and speed.

The development of cross-chain bridges has reached a preliminary maturity, and we are seeing various approaches to solving the age-old problem of cross-chain asset transfer. The main driver of change is chain abstraction: a mechanism for cross-chain asset transfer where the user is completely unaware that they have transferred assets.

Another factor driving volume growth is innovation in product distribution or positioning. Last night, while exploring Memecoins, I noticed that IntentX is using intent to package Binance's perpetual contract market into a decentralized exchange product. We also see cross-chain bridges specific to certain chains continuously evolving to strengthen the competitiveness of their products.

Regardless of the approach, it is clear that, just like decentralized exchanges, cross-chain bridges are hubs through which large amounts of monetary value flow. As a primitive technology, they will continue to exist and evolve. We believe that specialized cross-chain bridges (such as IntentX) or user-specific cross-chain bridges (such as those enabled by chain abstraction) will be the main drivers of growth in this industry.

Shlok added a nuance in discussing this article, which is that past routers never captured economic value based on the amount of data they transmitted. You could download TBs or GBs, and Cisco would make the same money. In contrast, cross-chain bridges make money based on the number of transactions. Therefore, their fate may not be the same.

For now, it can be said with certainty that the cross-chain bridges we are seeing are consistent with the physical infrastructure of routing data on the internet.

Disclaimer: As a blockchain information platform, the articles published on this site represent the views of the authors and guests only, and are not related to the position of Web3Caff. The information in the articles is for reference only and does not constitute any investment advice or offer, and please comply with the relevant laws and regulations of your country or region.

Welcome to join the official community of Web3Caff: X(Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram discussion group