The process of Block finality is like the hardening of concrete, which takes 15 minutes on Ethereum.

Original: WTF is Finality? (X)

Author: BREAD

Compiled by: Golem, Odaily Planet Daily

Editor's Note: In his latest article "Possible futures of the Ethereum protocol, part 1: The Merge", Ethereum founder Vitalik mentioned that Ethereum still needs to improve in areas such as reducing the time for Block finality from 2-3 epochs (~ 15 minutes) to within a single slot (~ 12 seconds). So what exactly is this "Finality" that Vitalik is so focused on? How is it implemented in Ethereum and L2s?

Crypto researcher BREAD's article "WTF is Finality?" explains the concept of Block finality and the implementation process using analogies. Odaily Planet Daily has compiled the translation below, hoping it will be helpful for readers.

Analogy of Finality

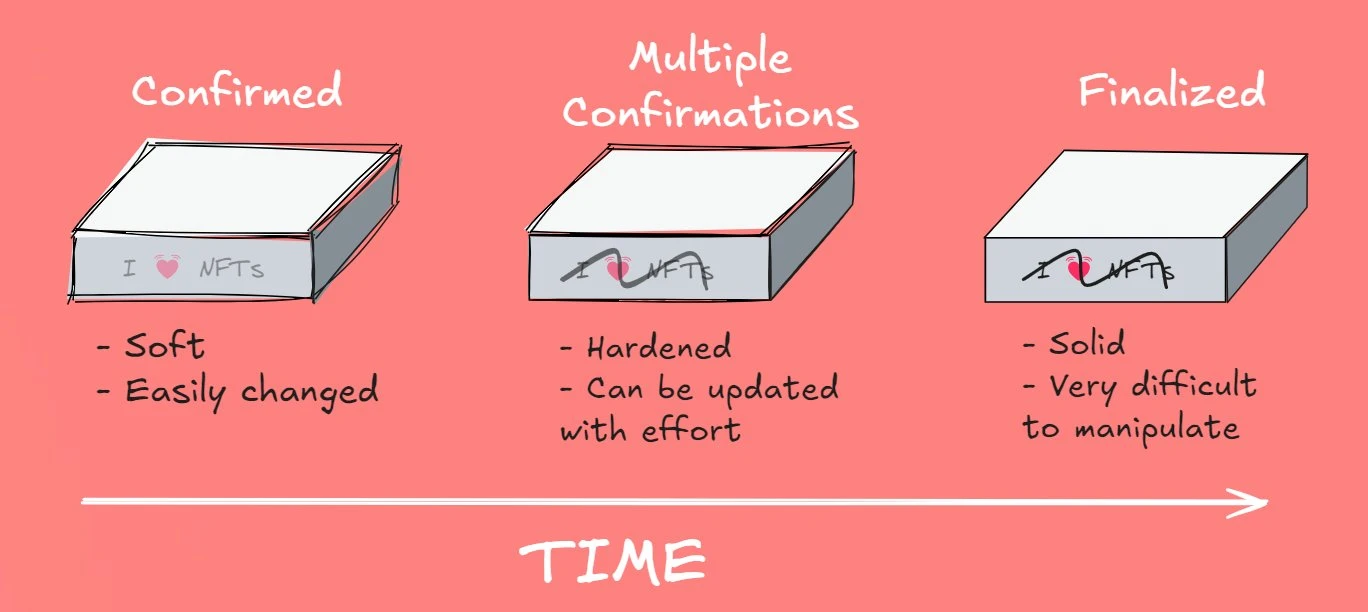

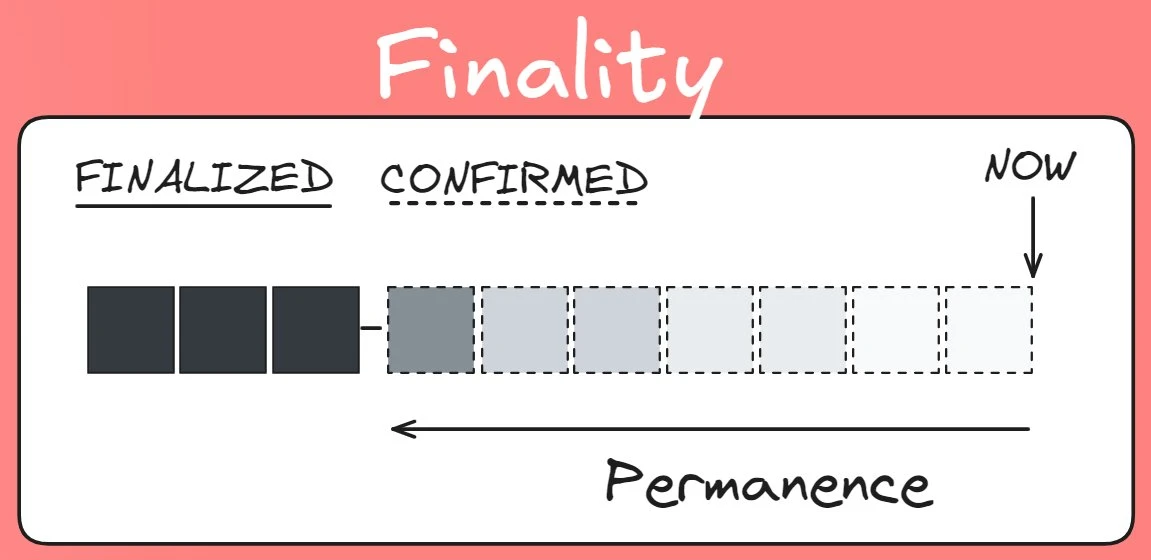

Following the tradition of my "WTF is..." series, I like to start with an analogy from real life. If people don't want to delve into the underlying details, they can just understand the key points. For Finality, we can use the example of concrete hardening over time, as shown in the image:

This is the highest-level explanation of "Finality" in the blockchain world, just like concrete - as time passes, from pouring (initial confirmation) to initial setting (multiple confirmations), it becomes increasingly difficult for the initial block to be judged as "false", until it fully hardens (finalized). Once it reaches the final stage, it's almost impossible to change.

The corresponding sequence in the blockchain is:

Submitted > Confirmed > Finalized

If you want to further understand the methods, content and reasons for Finality (in the Ethereum environment), please continue reading.

What is Finality?

Let's try to understand the structure and meaning of this concept. Here is an explanation of Finality and related concepts: 'Odaily' must be translated into 'Odaily'. 'Block' must be translated into 'Block'. 'Longing' must be translated into 'Longing'. 'Optimistic Rollup' must be translated into 'Optimistic Rollup'. 'Slashing' must be translated into 'Slashing'. 'Stake' must be translated into 'Stake'. 'zk rollup' must be translated into 'zk rollup'. 'Solana' must be translated into 'Solana'. 'TRON' must be translated into 'TRON'. 'Dai' must be translated into 'Dai'. 'Golem' must be translated into 'Golem'. 'Amp' must be translated into 'Amp'. 'NKN' must be translated into 'NKN'. 'ETH' must be translated into 'ETH'. 'SOL' must be translated into 'SOL'. 'HT' must be translated into 'HT'. 'GT' must be translated into 'GT'. 'OP' must be translated into 'OP'. 'AR' must be translated into 'AR'. 'ONT' must be translated into 'ONT'. 'AMP' must be translated into 'AMP'. 'RON' must be translated into 'RON'. 'ONG' must be translated into 'ONG'.

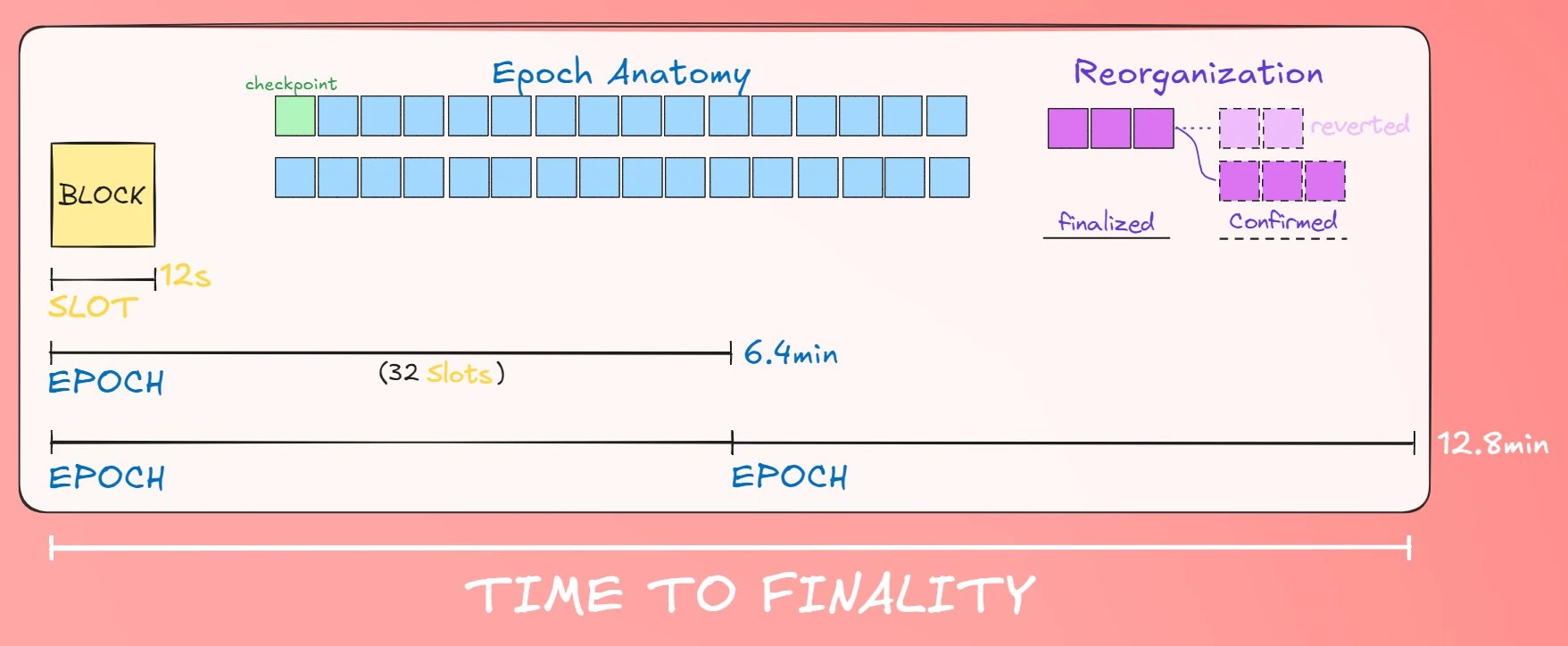

- Slot (also known as block time): The alternative name block time may be more understandable. Slot or block time is the time allotted to the system to generate a new transaction block and append it to the current chain. For example, Ethereum's Slot is 12 seconds, Base is 2 seconds, and Solana is 0.4 seconds.

- Confirmation: This is what happens when a transaction is officially entered into a block that has been added to the current chain. It is now "confirmed" as part of the ledger, and the number of confirmations will increase as subsequent blocks are added to the ledger.

- Epoch: Every 32 Slots is called an Epoch. This is a secondary structure in the blockchain used for delegating roles and responsibilities. Slots are used to build blocks, while Epochs are used for data propagation, reward distribution, validator selection, etc.

- Checkpoint Block: The first block created in an Epoch, used as a reference point to check the chain history.

- Finality: The point at which a transaction is considered irreversibly added to the ledger of a given chain. However, in terms of technical properties, this term is not used uniformly across different chains, so it is best not to assume the same standard in all cases. In the Ethereum ecosystem, finality is achieved when 2 Epochs have passed (~13 minutes); in Optimistic L2, it requires waiting for the fraud dispute period to pass (~7 days); in zk L2, due to the guarantees provided by the validity proofs, there are two points of disputed finality: local (when the proof is generated on L2 [~minutes]) and global finality (when the proof is published to Ethereum and completed there [~13 minutes]).

- Block Reorganization ("Reorg"): When blocks that were previously considered part of the chain are no longer seen as valid, and a new chain is formed. This is usually accompanied by penalties.

The following image attempts to visualize all these terms in a single image to make them easier to understand:

How does finality work?

Above, we have understood the concept of finality and related concepts, so how do they work together? What are the rules?

For Ethereum

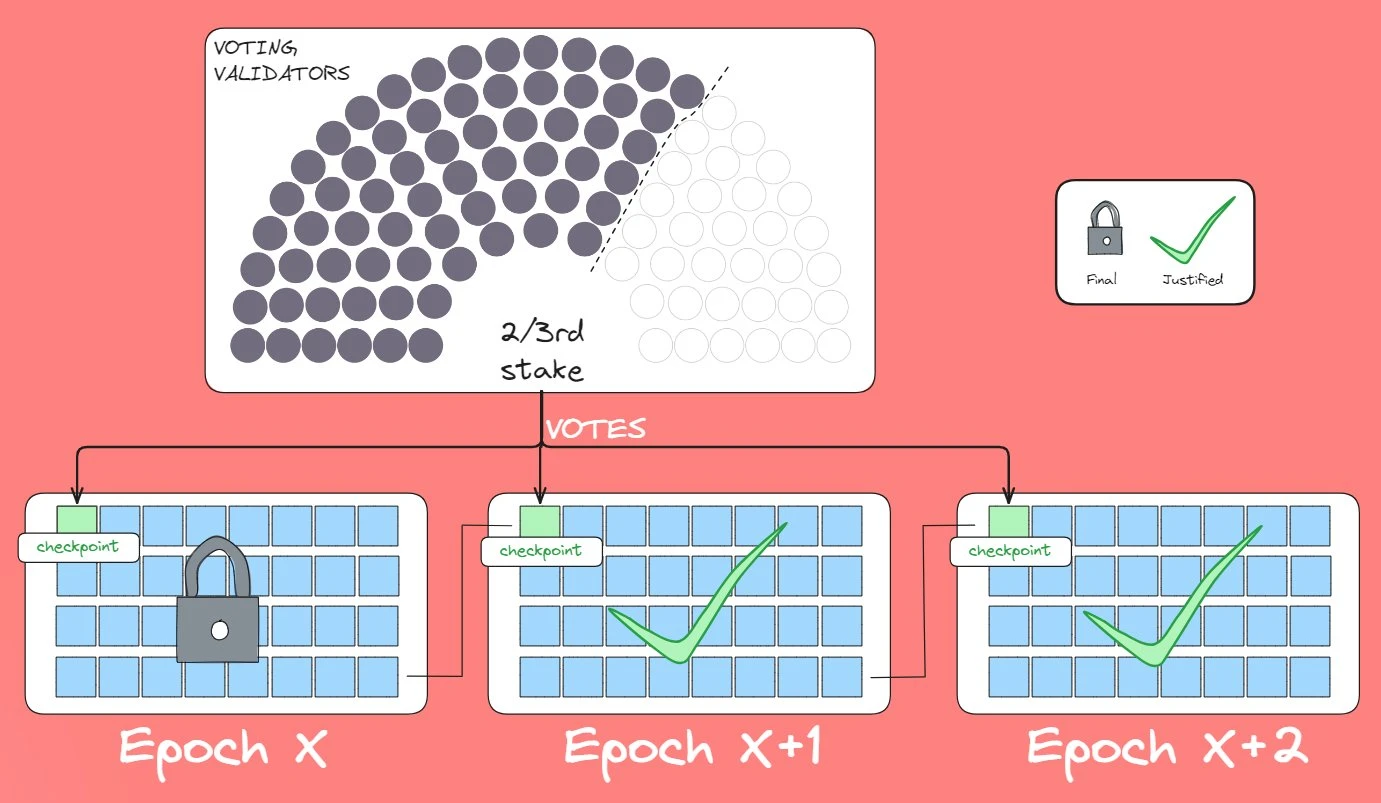

- Validator voting: Validators for each epoch (32 blocks) will vote on the current and previous epoch's checkpoint blocks (Checkpoint Blocks) until that checkpoint block receives 2/3 of the votes from the staked ETH.

- Justified checkpoint: Once a checkpoint block reaches the 2/3 voting threshold, it is considered "justified".

- Absolute majority chain: Once two subsequent justified checkpoint blocks a and b are connected by the next block, the blocks contained in the epochs prior to the first epoch will become final and will no longer be affected by simple block reorganizations.

For L2

L2 is built on Ethereum, so are they basically the same?

The answer can be both yes and no. As mentioned in the article "Will Based Rollups Have a Place in Ethereum's Future?", L2s are independent blockchains, but they rely on Ethereum for final settlement. This means their finality is layered like the chain.

There are two types:

- Local finality: This is the finality of the L2 itself, and only applies to L2s that use validity proofs (also known as zk rollups). This is because validity proofs are mathematically supported, and the mere generation of the proof means it is correct. Therefore, once the zk L2 generates its proof, the L2 state can be considered finalized without waiting for the proof to be published to Ethereum and settled there.

- Global finality: Once the state is finalized, the L2 confirms its local state and generates a proof (fraud or validity), publishes that proof to Ethereum, and then Ethereum confirms the block containing that proof. Even so, for L2s using optimistic rollups, the opportunity to challenge transactions still exists until the 7-day challenge period is over. This is a trade-off made to reduce the computational cost of generating the proof.

L2 networks can have local finality in some cases, but generally, they must wait until Ethereum has completed the challenge window for the validity (zk) or fraud proof they have published.

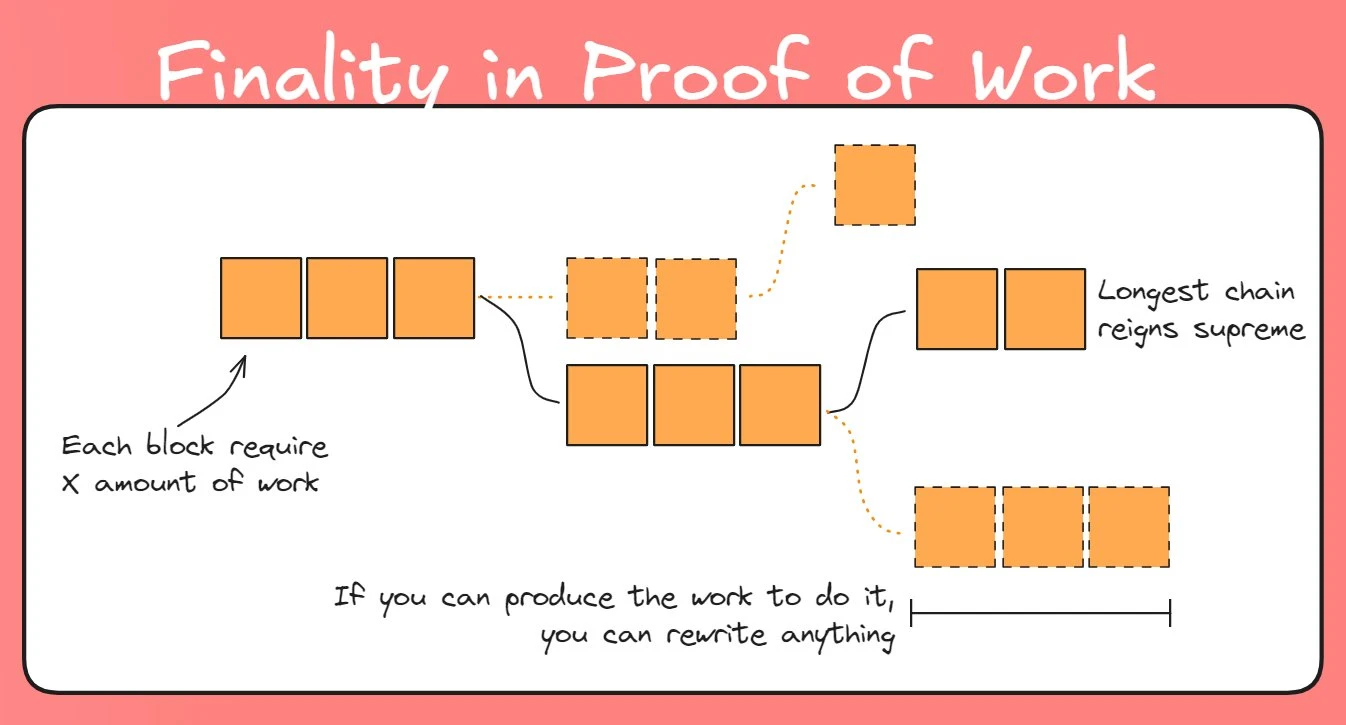

For Bitcoin/PoW chains

In Bitcoin's PoW mechanism, there is no concept of finality, as anyone can produce the longest chain and become the main ledger. This means that, although impractical, as long as there is enough computing power, the history of Bitcoin can be rewritten for the last day, week, or year.

However, although this approach is costly in terms of resources and time, and is not very practical to implement, it does create a meaningful distinction between different systems, and gives rise to several unique types of MEV (Maximum Extractable Value), such as "Longing Attacks" and "Block Withholding". In these cases, miners can choose to produce and hide a block, then add a subsequent block, or continuously mine multiple blocks, creating and capturing unique profit opportunities.

Why do we need finality?

From the above, we know how finality is achieved in PoS chains, and that it requires a significant amount of work. So why do we need to do this? The answer is that there are some benefits to doing so:

- Economic security: The system (and us) can look back at a point and have high confidence that it will not change, giving participants in the ecosystem confidence in the "true state". For example, large transfers and loans, once users are confident the system cannot change without extreme, out-of-protocol intervention, this will give users confidence to participate in the ecosystem based on this certainty. This is also why cross-chain bridges often wait for a certain number of confirmations or complete finality before releasing funds on the secondary chain.

- Faster settlement: Because there is a moment in the system where the state is officially made permanent, this means that participants in the ecosystem only need to wait for this settlement time, whereas in PoW (Proof-of-Work) systems, this moment never comes and is entirely dependent on individual subjective judgment.

- Reduced attack surface: As mentioned earlier, there are some MEV opportunities on PoW chains, PoW chains have only solved the "nothing at stake" problem, where anyone who tries to act maliciously against the system may also face losses. But in PoS chains, if you are a validator and try to change a finalized state, you must violate protocol rules, and therefore face the risk of Slashing your Stake.

Conclusion

This article has briefly explained what finality is, just to make people aware that it is a blockchain mechanism that is often used but not deeply understood. The process of finality is like blocks in the system hardening like concrete, and eventually they become as solid as a rock.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal views of the authors and guests, and are not related to the stance of Web3Caff. The information in the articles is for reference only and does not constitute any investment advice or offer, and please comply with the relevant laws and regulations of your country or region.

Join the official Web3Caff community: X(Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram discussion group