Three On-Chain Data Views to Observe AAVE's Operations

The characteristics of the blockchain are public transparency and immutability. On-chain data is the first-hand information of the blockchain, and for protocols that have real operations on the chain, on-chain data is like their financial reports. We can directly observe and analyze the operating conditions of the protocols from the on-chain data, and compared to the financial reports that are usually released quarterly or even annually, the on-chain data is more timely.

AAVE is a lending protocol that allows people to deposit funds to earn interest, and also pay interest to borrow funds, earning a portion of the spread between borrowing and lending. Here, we mainly examine three types of on-chain data:

Asset Volume and Utilization Rate - TVL / Active loan

Revenue and Profitability - Fee / Revenue

Number of Users - Active user

Asset Volume and Utilization Rate: TVL / Active loan

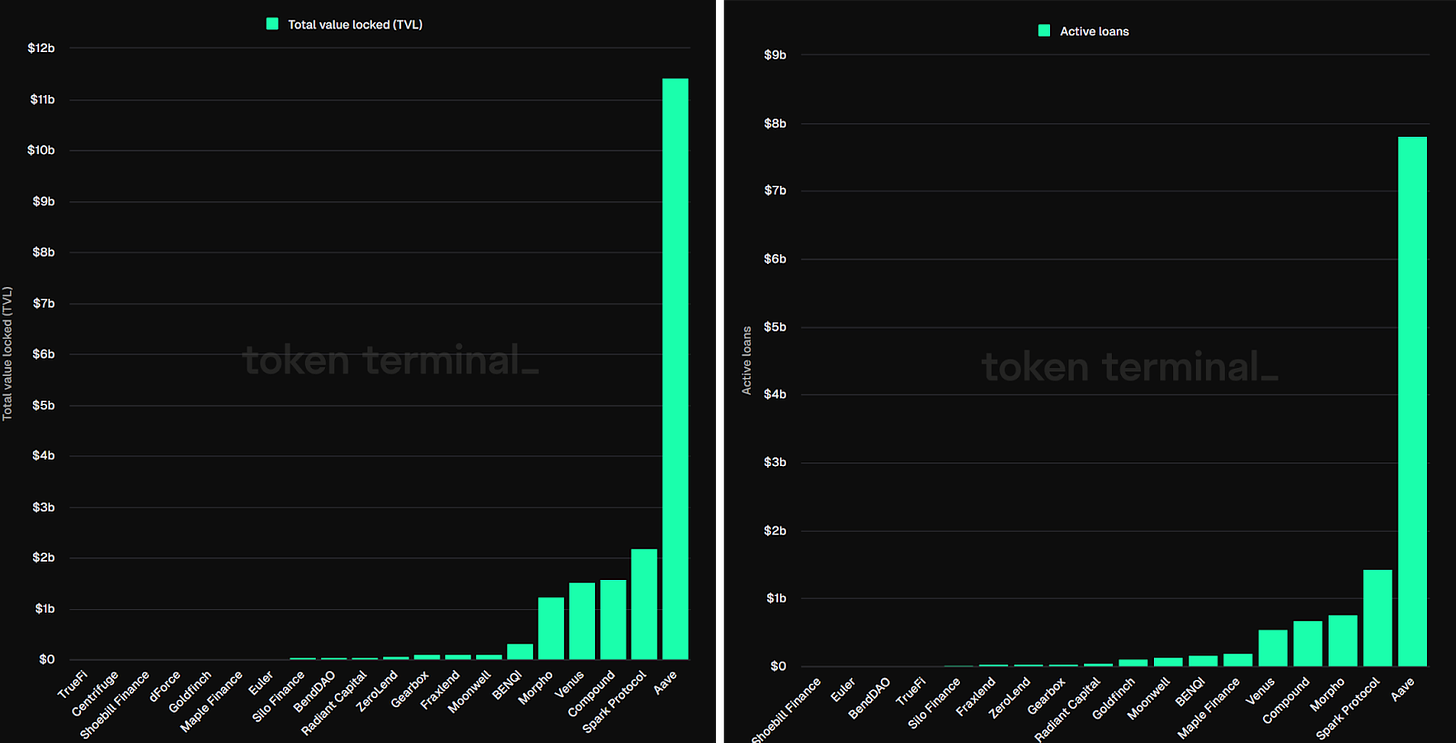

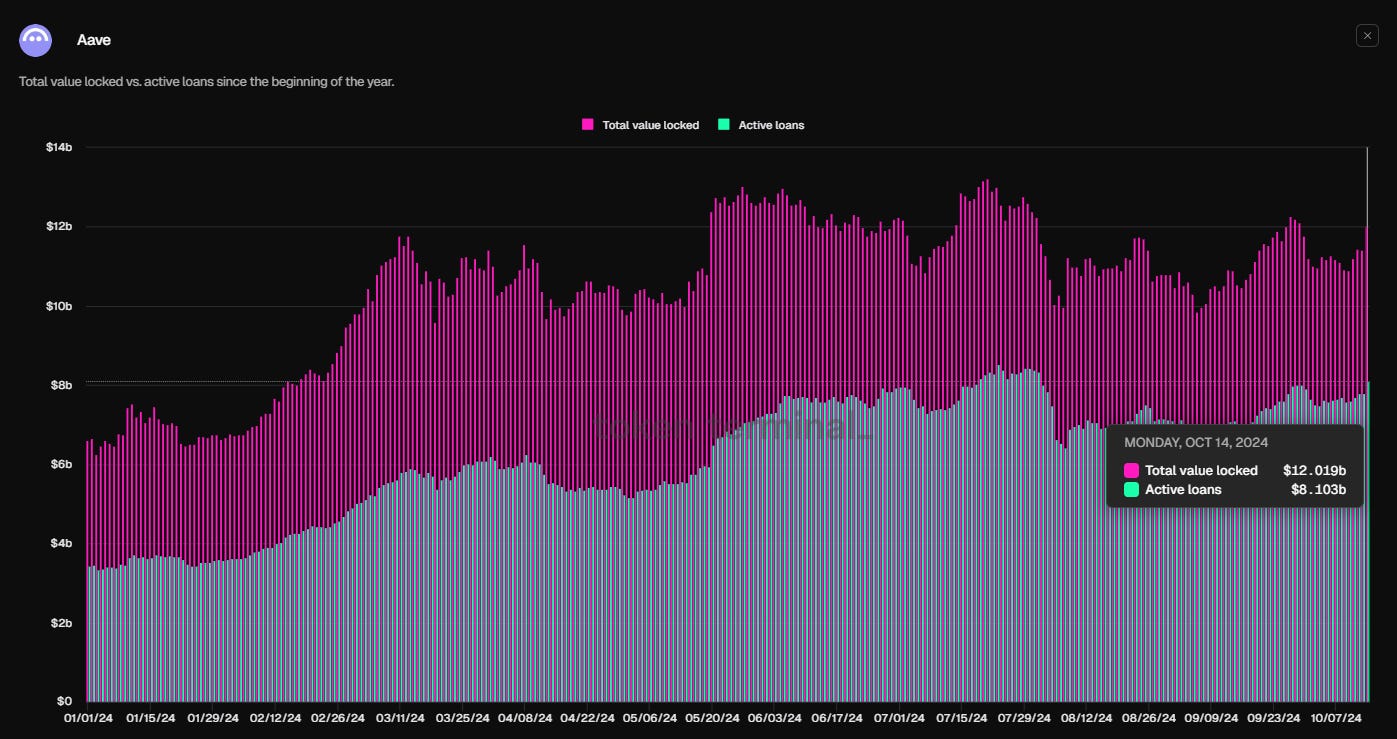

According to Token Terminal data, AAVE's current TVL is $12 billion, more than 5 times that of the second-ranked Spark Protocol, and its Active loan is $8.1 billion, 5.5 times that of the second-ranked Spark Protocol. Both figures are far ahead in the lending protocols.

TVL = Total Value Locked, this figure represents the total value of cryptocurrencies locked in the AAVE protocol, which can be simply understood as the total deposits in AAVE.

Active loan = Active Borrowing Volume, this figure represents the total value of cryptocurrencies borrowed from the AAVE protocol, which can be understood as AAVE's total borrowing.

AAVE is a decentralized lending protocol, and there must be people depositing funds before borrowers can borrow money.

The interest rate is determined by the market supply and demand. The more deposits are borrowed (high utilization rate = strong demand and insufficient supply), the higher the interest rate, and the fewer deposits are borrowed (low utilization rate = insufficient demand and oversupply), the lower the interest rate. Borrowers need to pay interest on the loans, and the protocol takes a portion of the total interest paid by the borrowers as its revenue, with the rest distributed to the depositors as deposit interest.

The key points of the AAVE model can be simply understood as:

Increase TVL - Attract more people to deposit funds, so that AAVE has more money to lend out

Increase Active loan - Let more people borrow money, the higher the utilization rate, the higher the interest rate, the more total interest, the more revenue for AAVE

Ensure asset safety & reduce bad debt risk - Contract security audits, liquidation mechanisms, safety reserves, etc.

Further Reading:

How do DeFi protocols achieve 100% annualized returns? Explanation of interest rates in decentralized lending protocols

What is liquidation in DeFi lending and borrowing platforms? Will liquidation cause a crash to zero?

When observing the data of a lending protocol, it is necessary to examine both TVL and Active loan. A high TVL alone is useless, the money needs to be lent out to generate interest, so that the protocol can have revenue, and distribute more interest to depositors, which will also attract more people to deposit and increase the TVL.

From the chart, we can see that AAVE's asset utilization rate has been quite good, with the Active loan / TVL ratio between 50-70% over the past year.

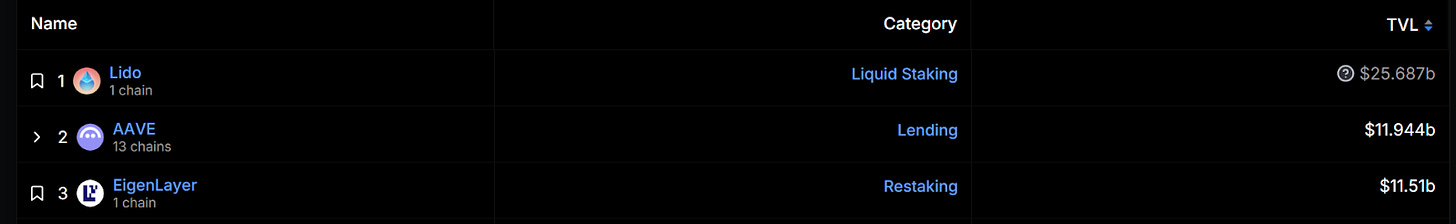

Compared to all DeFi protocols, AAVE's TVL ranks second.

Revenue and Profitability: Fee / Revenue

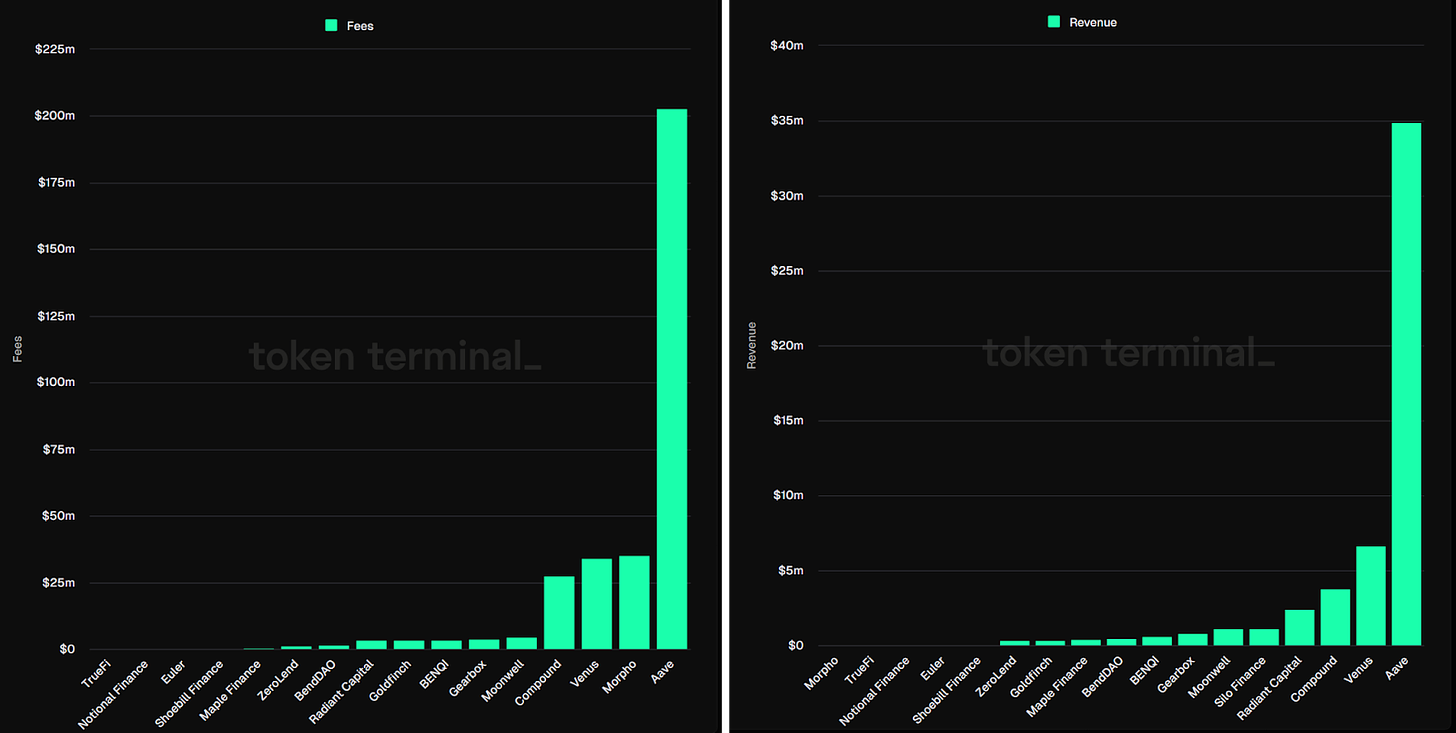

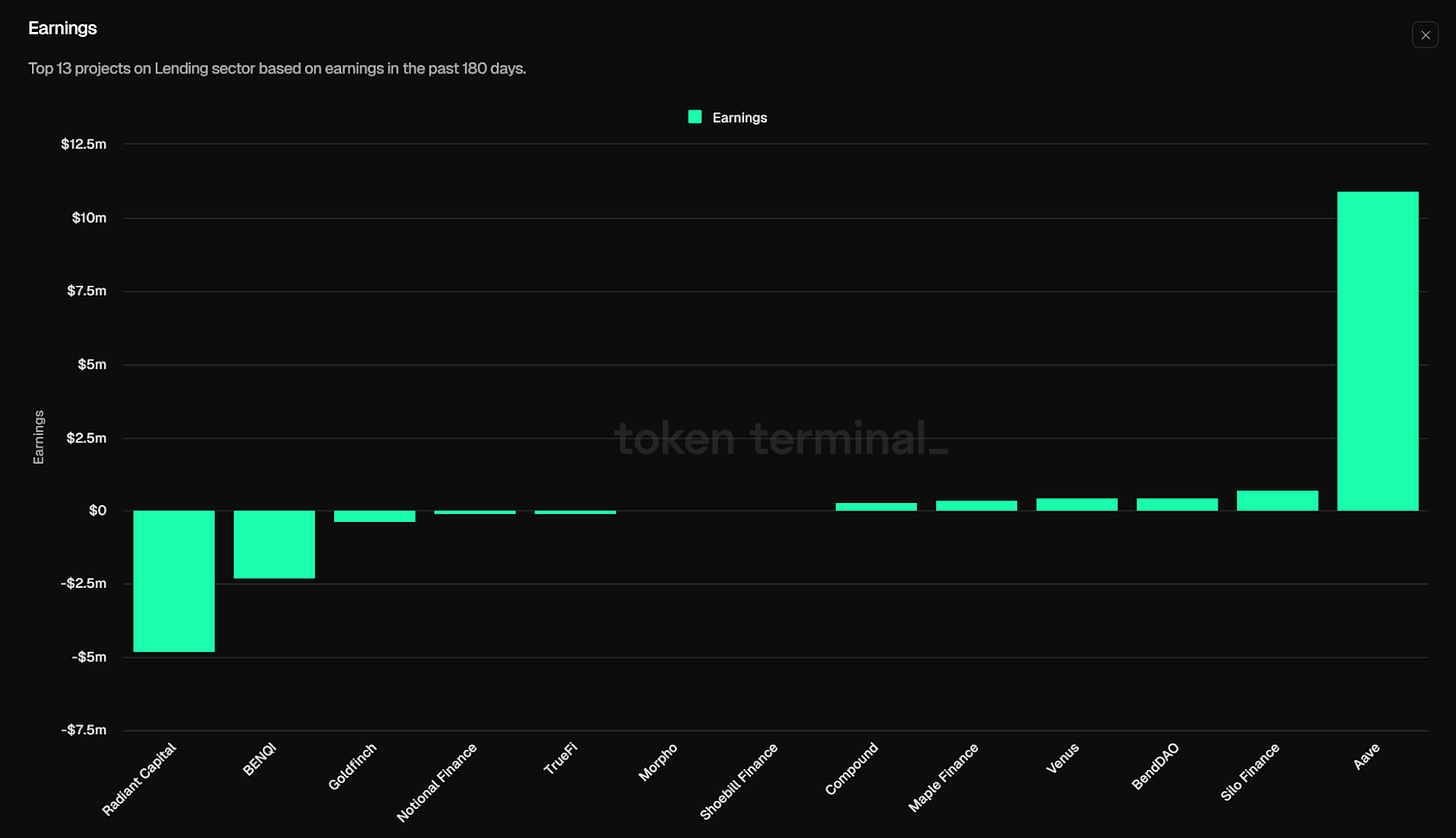

AAVE's semi-annual Fee revenue is around $200 million, and its Revenue is $34.8 million, still leading the lending protocols.

Fee = Fees, the fees that users need to pay to use the protocol, such as transaction fees when trading on an exchange, and in lending protocols, the main fees are borrowing interest and liquidation fees if liquidation occurs. This can be simply understood as the total revenue the protocol receives, similar to the concept of revenue.

Revenue = Net Revenue, the total revenue received in the previous segment, but there are many other participants to distribute to, such as paying interest to depositors in lending protocols. After deducting these other distributions, the actual net revenue the protocol receives is the Revenue, and this revenue minus other costs (such as liquidity incentives) is the Earnings.

AAVE's Earnings data is still unparalleled, with a semi-annual profit of $10.89 million, the highest among lending protocols.

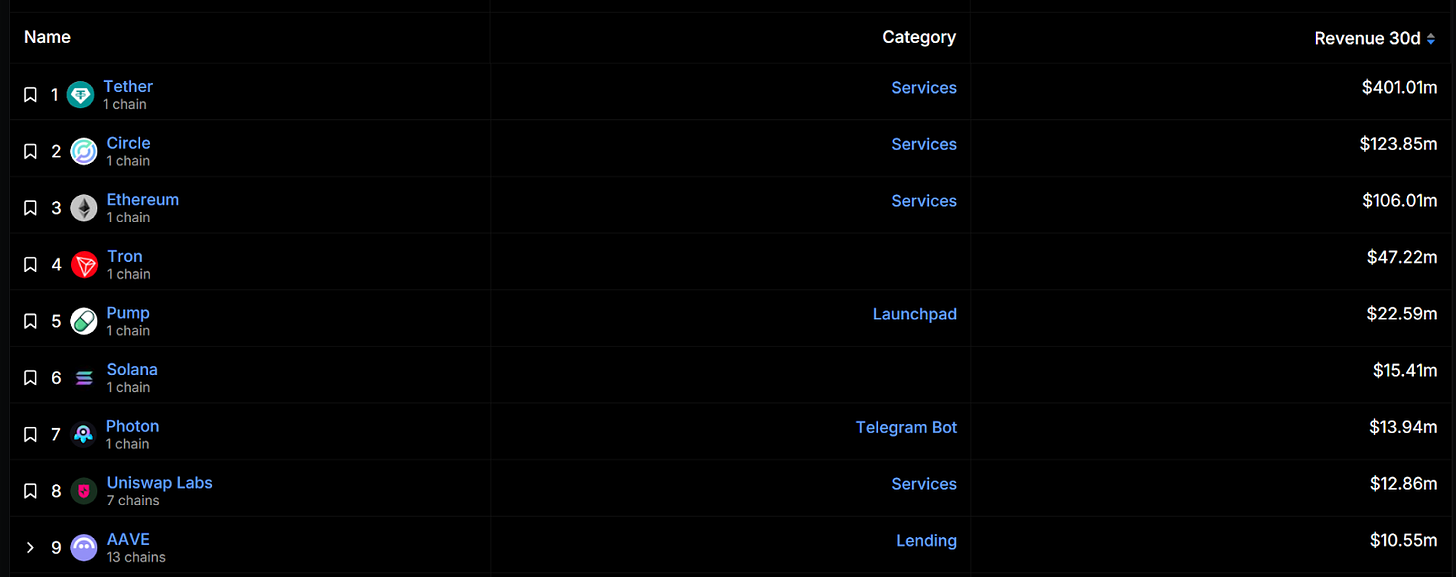

If compared not only with other lending protocols, but with all DeFi protocols, AAVE's Fee ranks 10th, and 4th among DeFi protocols.

Its Revenue ranks 9th, and 2nd among DeFi protocols.

Q: Does high protocol revenue mean the token price will go up?

Here is the English translation:A: Not necessarily. In addition to market sentiment, we also need to examine whether there is a value capture mechanism in the token economic model. In simple terms, what benefits will the protocol revenue bring to the token? The "Buy & Distribute" proposal recently discussed by AAVE, if passed, will use a portion of the revenue to purchase $AAVE tokens and distribute them to stakers. This is a value capture mechanism. If the protocol revenue increases in the future, it will provide more secondary market buying power to drive up the token price. More importantly, the $AAVE token is already close to full circulation, which is also a good reason for Altcoin enthusiasts in this cycle.

Further reading:How to evaluate the potential of a token economic model? Two key factors: "Enablement" and "Value Capture"

Active user

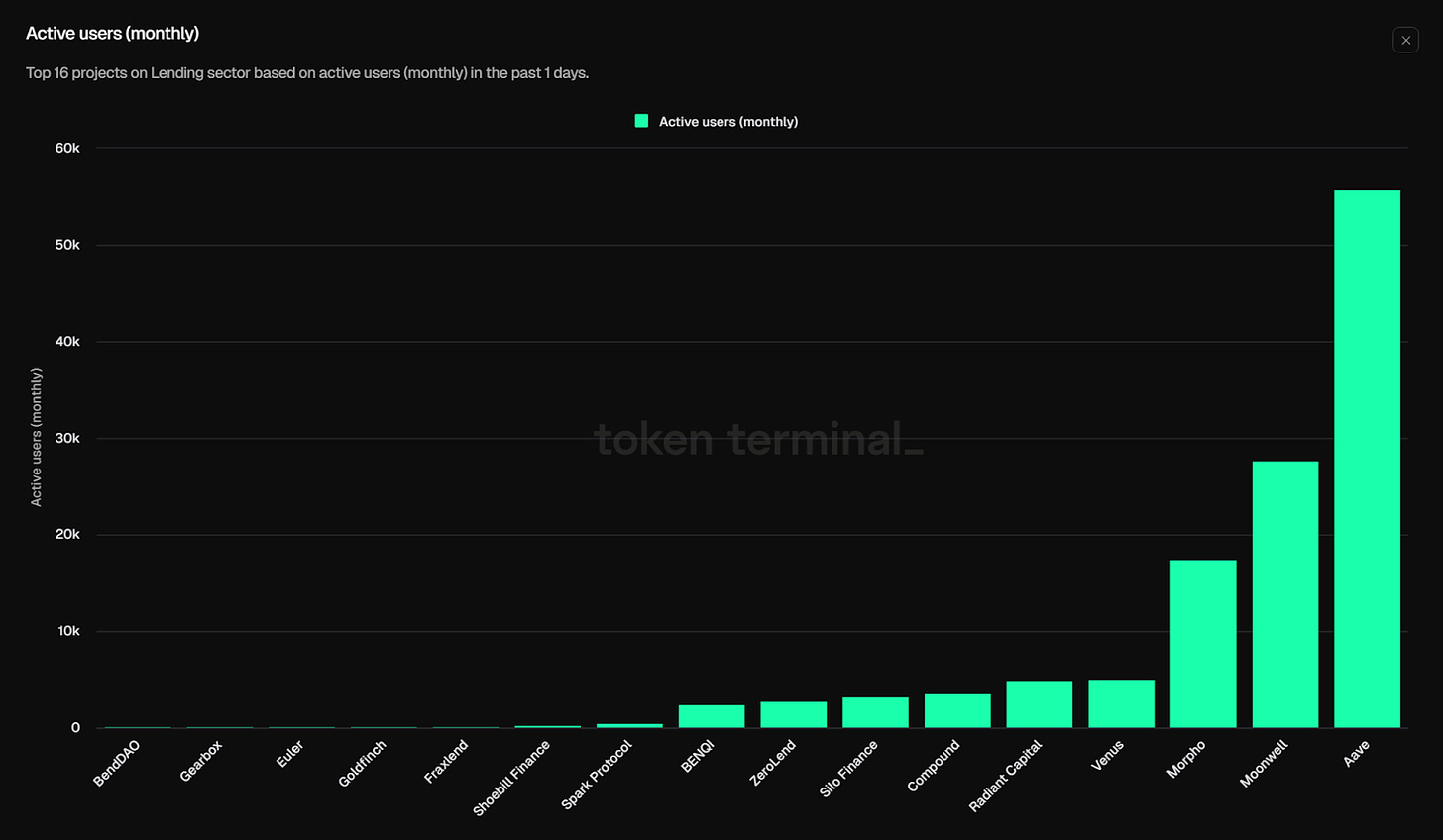

AAVE's monthly active users (MAU) are around 55,000, still ranking first, but the leading margin is not as wide as before, only leading the second place by twice. The second place is the recently hot lending protocol Moonwell on the Base chain, which is the Layer 2 with the most growth this year.

After reviewing the basic indicators, let's evaluate the token price. Is the current price attractive? Are there any factors that can be expected to drive the price up in the future?

$AAVE Token Price Trend

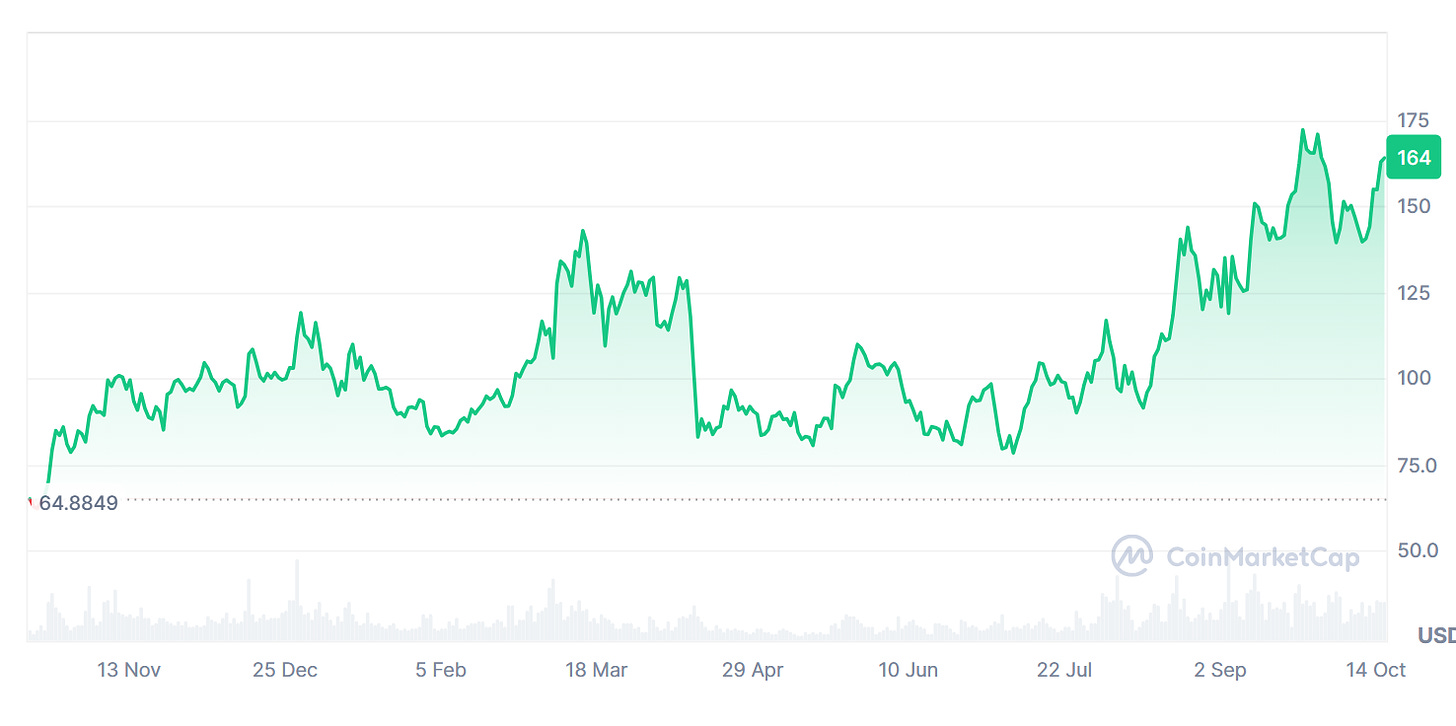

The price performance of $AAVE is not bad. Although it has not had a sharp increase, it has still risen by +150% over the past year. But how do we assess whether the current price is undervalued or overvalued?

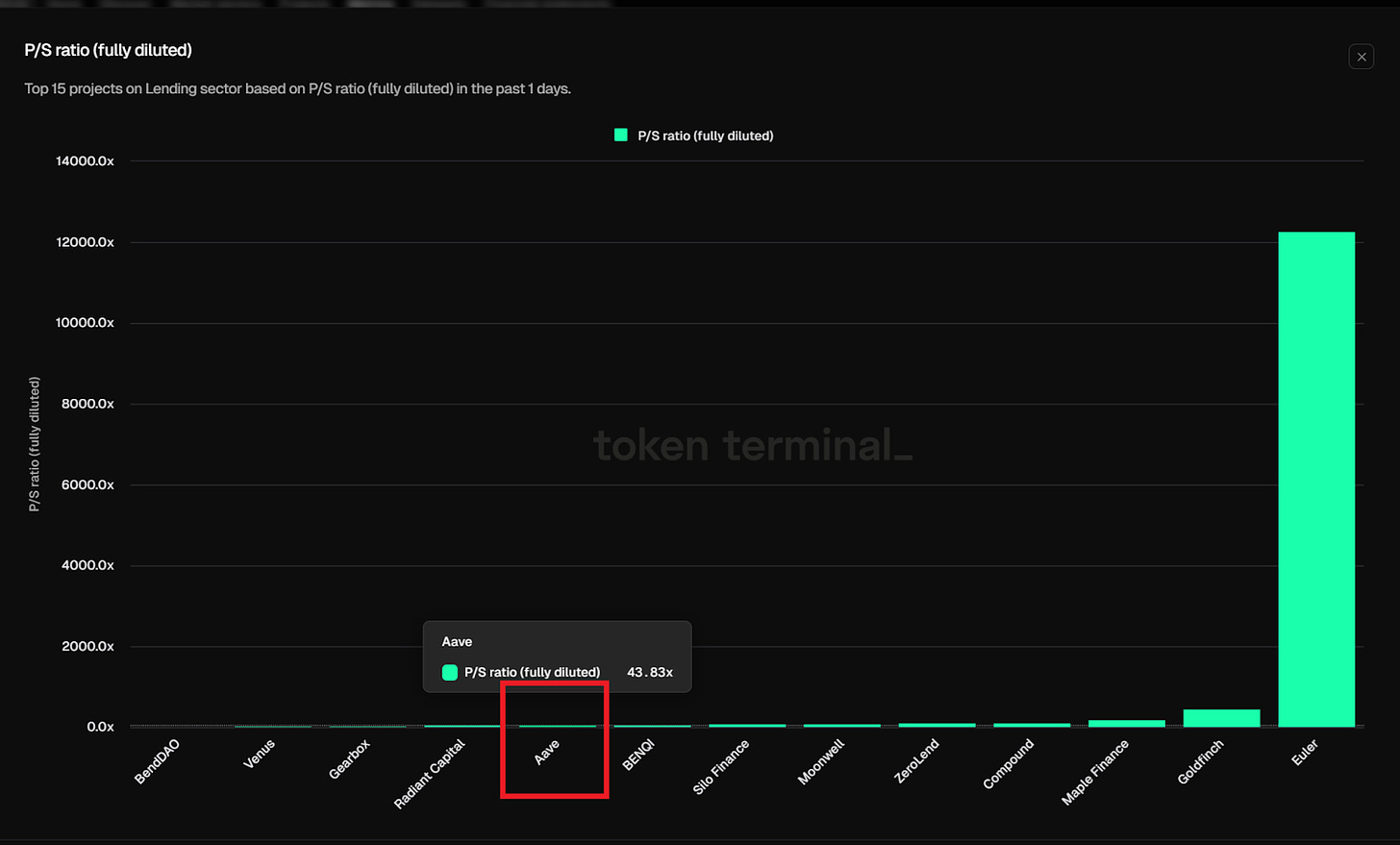

Cryptocurrency valuation indicators: P/F and P/S

P/F ratio = Market Cap / Fees

P/S ratio = Market Cap / Revenue

The commonly used P/E ratio in stocks, P = Price, E = Earnings, has some differences in cryptocurrencies, mainly because the distribution mechanisms of cryptocurrencies are more diverse, and the rewards to holders may not only be profits, but also part of the revenue. This needs to be examined in the token economic model.

The main use of $AAVE now is for governance participation and staking to earn staking rewards. There is no direct revenue distribution mechanism yet. If the "Buy & Distribute" mechanism currently being discussed in the community is passed, there will be direct revenue distribution.

Just like using the P/E ratio for stocks, different sectors have different standards. Here we only compare with similar lending protocols:

AAVE currently has a P/F ratio of 8.11 and a P/S ratio of 43.83, which are not considered high among similar lending protocols. Considering that there is currently no direct revenue distribution mechanism, if the "Buy & Distribute" mechanism is passed in the future, the value capture of $AAVE will be enhanced, and the reasonable value of this figure should be revised upwards.

From the above on-chain data indicators, we can see that AAVE's operational indicators are significantly leading, and the P/F and P/S values are in the middle to lower range among its peers. There is currently no sign of price overvaluation.

What else can we expect?

Summary: Will Interest Rate Cuts Bring a DeFi Revival? "AAVE 2030" Three-Year Development Roadmap

When interest rates are high, funds can earn decent returns just by sitting idle, so there is less need to pursue additional high returns. In the cryptocurrency space, the most direct impact is on DeFi, as DeFi is a track that creates yields for cryptocurrencies. Once interest rates start to decline, the yield on funds will decrease, and the motivation to seek additional returns will increase. The annualized returns offered by DeFi will also become more attractive. As long as the interest rate cuts continue, we should be able to observe capital flowing back into DeFi.

Compared to four years ago, both the underlying public chain performance and the products, mechanisms, ecosystem completeness, and user interfaces of DeFi have evolved and improved significantly. In other words, the current DeFi has much greater growth potential and momentum than in the past.

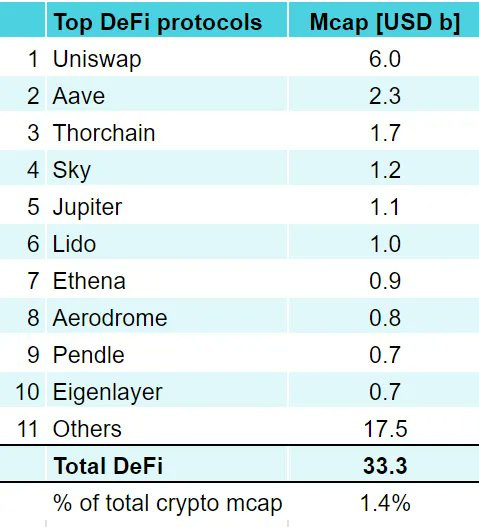

The image is from a tweet by Arthur, the founder of DeFiance Capital. He believes that the DeFi track will occupy 10% of the overall market in the future. In other words, even if the total cryptocurrency market capitalization remains unchanged, the growth potential of DeFi is still more than 6 times. Aave has always been one of the DeFi protocols with high discussion this year.

Q: If you are bullish on DeFi, which projects are worth investing in?

A: DeFi is not a new track, it has a history of several years. The blue-chip projects are relatively stable, but the explosive potential is lower. New projects have higher explosive potential, but the risks are also higher. The specific recommendation is to build a diversified investment portfolio, allocating to some leading projects in the basic categories as well as some innovative projects in newer tracks.

What is DeFi? What are the categories? Leading projects | Category introduction | Fraud prevention

There are many new DeFi tracks and projects. It is recommended to join the community discussion:

▌Join the Crypto Research community to study and discuss together, welcome to the Daily Crypto Research Chinese Discussion Group!

▌Subscribe to the Daily Crypto Research Newsletter (1-2 articles per week, quickly understand the market situation, on-chain data, and potential project dynamics)

The Aave Labs team behind AAVE proposed the "Aave 2030" proposal a few months ago, which is a strategic roadmap for the next three years of development. Combined with the recent community discussion proposals, it can be summarized into three main directions:

Optimize products and mechanisms - Introduce dynamic interest rates, liquidity pricing mechanisms, etc. to increase capital utilization and value; establish a cross-chain liquidity layer to address the problems of fragmented cross-chain liquidity and difficult operations

Improve user experience - The cross-chain liquidity layer reduces the difficulty of cross-chain operations, and the launch of smart accounts, etc.

Expand the ecosystem - Strengthen the connection with other DeFi protocols, expand the application scenarios, and enhance the value capture of the AAVE token

Allocate a portion of the revenue to $AAVE holders - Distribute the protocol's revenue in some way (through buybacks of the token) to $AAVE stakers

In addition to the expansion into non-EVM ecosystems, it can generally be expected that the ecosystem will expand, increase protocol revenue, and increase token value capture.

In summary, rate cuts may bring about a DeFi revival, and if DeFi returns to glory, the blue-chip protocol Aave will certainly not be absent.