Author: 1912212.eth, Foresight News

The major market correction in early October has left some investors with deep doubts, worrying that the historically bullish October this time might be "different". However, history seems to have once again proven that "this time is no different".

After soaring to a peak of $66,000 at the end of September, BTC did not stay put, but experienced a nerve-wracking pullback, plunging to a deep valley of $59,000. But it is precisely this volatility that has given birth to an even more raging rebound storm! From October 11th, the market situation changed abruptly, with a fierce 3.67% single-day surge, announcing the return of the bullish trend, the price surging back to the $63,000 high ground, and then even breaking away, rushing to $66,500.

At the same time, Ethereum also broke free from its shackles, surging from $2,300 to $2,650, with a single-day gain of over 6.52%, marking the largest single-day increase since August.

In the market rally ignited by passion and hope, many sectors such as public chain SUI, SEI, APT, stablecoin ENA, AI ARKM, WLD, and meme coins all saw significant surges.

In terms of contract data, short positions suffered heavy losses. $246 million was liquidated across the network in 24 hours, with $210 million in short positions being liquidated. BTC's open interest data also soared to over $37 billion.

The altcoin market is in a frenzy, has the second half of the bull market really begun?

BTC Spot ETF Sees Massive Single-Day Net Inflows

Since early October, while there have been some net outflows, they have largely been balanced by net inflows. Starting October 8th, there were 3 consecutive days of net outflows, totaling nearly $180 million.

On October 11th, the data saw a major reversal, with the Bitcoin spot ETF seeing a single-day net inflow of $253.54 million, a new high for October. After the massive influx of off-exchange capital, BTC prices also surged sharply on the same day.

Off-exchange capital confidence remains quite firm.

The Fed Will Continue to Cut Interest Rates, Market Expectations Stabilize

This week, the US released the September CPI and PPI, the two major inflation data. Overall CPI and core CPI year-over-year and month-over-month growth both exceeded expectations, but the 2.4% year-over-year CPI growth still marked the lowest level since February 2021. PPI was flat month-over-month, indicating that inflation is cooling further.

Goldman Sachs' economists analyzed that while the September CPI and PPI inflation data were mixed, the final readings were still close to expectations, indicating that US inflation is progressing towards the Fed's 2% target, and the Fed is nearing its inflation goal.

After the release of this week's two major inflation data, traders are almost certain that the Fed will cut interest rates by a quarter percentage point at its meetings in November and December.

US Presidential Election

Historically, the US presidential election results often coincide with a bullish trend in the crypto market. On November 5th, the US presidential election results will be announced, with only 20 days left.

Furthermore, Bloomberg reported that even Harris, a presidential candidate who has had little direct connection with the crypto market, is also making efforts to win votes.

On Monday, Harris proposed a new plan to provide loans to black entrepreneurs and others facing financing barriers. According to Harris' campaign platform to attract black male voters, the plan will provide 1 million loans, with up to $20,000 in forgiveness. Harris also promised to support a regulatory framework for cryptocurrencies, providing more investment certainty for the 20% of black Americans who own or have owned digital assets.

The DeFi lending project World Liberty Financial of the Trump family has also been active recently, introducing several experienced executives in addition to planning to publicly offer the WLFI token.

Data from Polymarket shows that as of now, Trump's odds of winning are significantly ahead of Harris.

Currently, the market is more inclined to believe that a Trump presidency would be positive for the crypto industry, but given that both US presidential candidates have expressed crypto-friendly sentiments and views, the negative impact would be minimal regardless of who takes office.

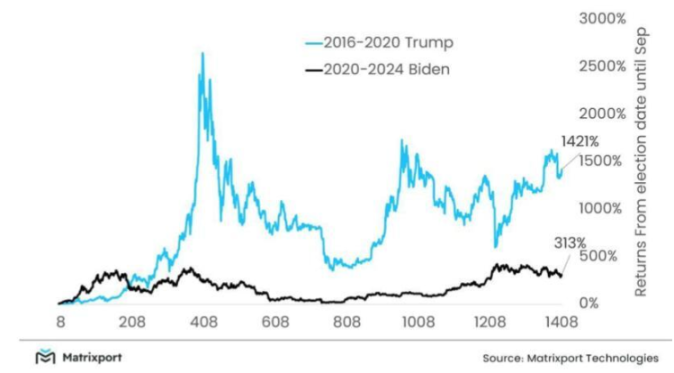

The bull market from 2016 to 2020 was during the Republican Trump administration, while 2020 to 2024 will be under the Democratic Biden administration. The BTC-led crypto market has seen strong bullish trends during both of their respective terms.

Looking at the market performance over the past two cycles, whether a Republican or Democratic presidential candidate takes office, it has not impacted the upward trend of the crypto market.

After the election results are officially announced, some capital that has been waiting and observing may abandon its hesitant and cautious approach and choose to boldly bet on the crypto market.

Future Market Outlook

Coinbase Analyst: Macroeconomic Factors Affecting Crypto Performance Shifting from Monetary Policy to US Election Results

Coinbase analysts David Duong and David Han stated that although Bitcoin's price performance has been lackluster this week, "market sentiment has remained largely unchanged, with the past week's perpetual contract funding rates and open interest remaining stable, indicating this." Coinbase analysts pointed out that the macroeconomic factors affecting crypto performance are shifting from monetary policy to the US election results, despite the recent rise in CPI and core PPI, the market's expectations for rate cuts remain largely stable.

They also mentioned that China's fiscal policy briefing this Saturday may indirectly impact the crypto market, especially during the time when many markets will be closed. The crypto market may be used to express proxy views on the scale and intensity of any fiscal policy announcements.

Bitfinex: BTC Short-Term Holder's Realized Price a Key Resistance

The latest Bitfinex Alpha analysis report emphasizes that the short-term holder's realized price (around $63,000) has become a key resistance level. Breaking through this level could trigger further upside, while failure could lead to a retest of the $59,000 or even $55,000 support levels.

Bitfinex Alpha believes the market is still in a passive state, and the future trend will depend on whether Bitcoin can break through the short-term holder's realized price. It advises traders to be wary of potential pullbacks, while also preparing for the possibility of a strong rebound.