Author: Stella L

Data source: Footprint Analytics public chain research page

In September 2024, the blockchain industry saw significant growth, driven by a favorable macroeconomic environment and regulatory progress, resulting in a strong performance in the cryptocurrency market. Bitcoin's Layer 2 performance was particularly impressive, outpacing Ethereum Layer 2 in growth. In the Layer 1 domain, Sui entered the top 15 market cap for the first time, becoming a focus of attention. The Ethereum ecosystem is facing scrutiny, sparking discussions about future development standards, while Bitcoin Layer 2's TVL (Total Value Locked) has seen a significant increase.

The data in this report is sourced from the public chain research page of Footprint Analytics. This page provides an easy-to-use dashboard containing the most critical statistics and metrics for the public chain sector, with real-time updates.

Market Overview

The cryptocurrency market exhibited strong performance in September. Bitcoin opened at $57,429 and closed the month at $63,485, a 10.5% increase. While Ethereum also performed positively, it did not match Bitcoin's gains. Ether started at $2,426 and ended the month at $2,603, a 7.3% increase. Notably, the ETH/BTC price ratio reached a new cycle low of 0.0386 in mid-September.

Data source: Bitcoin and Ether price trends

Several key factors contributed to this positive market sentiment:

Monetary policy shift: On September 18, the Federal Open Market Committee (FOMC) unexpectedly implemented a larger-than-expected 50 basis point rate cut. Later in the month, Chinese policymakers implemented macroeconomic stimulus measures, providing support for global equity markets.

Regulatory progress: The US regulatory environment showed signs of improvement. The SEC approved the listing of spot Bitcoin ETP (Exchange-Traded Product) options, and more similar applications are expected to be approved.

Institutional adoption: The Bank of New York Mellon appears to be preparing to offer crypto asset custody services, a move that could further solidify the legitimacy of cryptocurrencies in the financial sector.

Political support: The political landscape also saw positive changes. Former US President Trump announced a new decentralized finance (DeFi) protocol, and Vice President Harris expressed support for digital assets and blockchain technology.

Layer 1

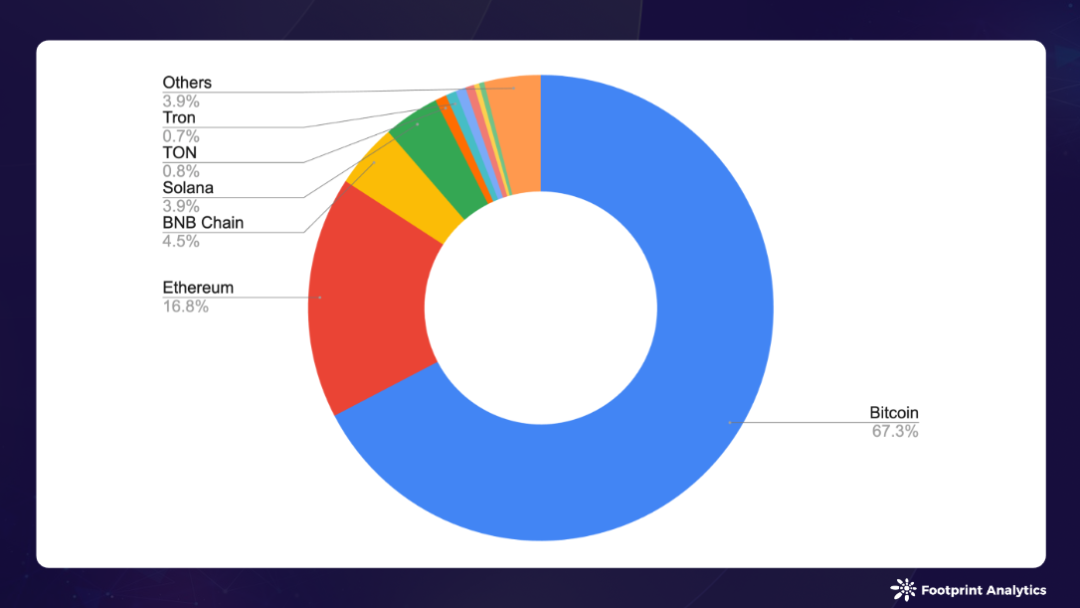

In September 2024, the total market capitalization of blockchain cryptocurrencies reached $1.9 trillion, an increase of 6.9% from August. The market is still dominated by Bitcoin (67.3%), Ethereum (16.8%), BNB Chain (4.5%), and Solana (3.9%). Bitcoin and BNB Chain maintained their market shares, while Ethereum's market share declined by 0.6% in absolute terms, and Solana's increased by 0.3%.

Data source: Public chain token market capitalization

Among the top 15 public chains by market cap, Sui performed exceptionally well, with a 132.2% increase in market value, entering the rankings for the first time at 13th place.

Data source: Public chain token prices and market capitalization as of the end of September 2024

The total TVL in the DeFi sector reached $68.1 billion, an increase of 6.4% from August, with Sui's TVL growing by 67.4%.

Data source: Public chain TVL as of the end of September 2024

September was a breakthrough month for Sui, thanks to the Sui Foundation's efforts to incentivize dApp development. The NAVI protocol in the DeFi sector and the BIRDS Telegram game significantly drove on-chain activity.

At the TOKEN2049 conference in Singapore, Vitalik Buterin emphasized the evolution of cryptocurrencies from the initial stage to usability, highlighting the industry's progress towards mass adoption. The following trends are emerging in this direction:

Web3 gaming continues to be a key driver for blockchain mass adoption. Multiple networks, including TON, BNB Chain, Sui, and Aptos, have leveraged the Telegram ecosystem to expand their user base.

Stablecoins and their financial applications have gained momentum. Celo's success in Africa has demonstrated the potential of stablecoins in emerging markets, while Sui announced upcoming integration with Circle's native USDC.

Efforts to lower the entry barrier are further strengthened. BNB Chain launched the "Gas-Free Carnival" offering zero-gas fee options for specific transactions. Solana introduced its Web3 smartphone terminal Solana Seeker, and Ronin launched Ronin Waypoint, a universal account and keyless wallet for its ecosystem.

These developments highlight the industry's commitment to enhancing the user experience and expanding the influence of blockchain across various domains and demographics.

Bitcoin Layer 2

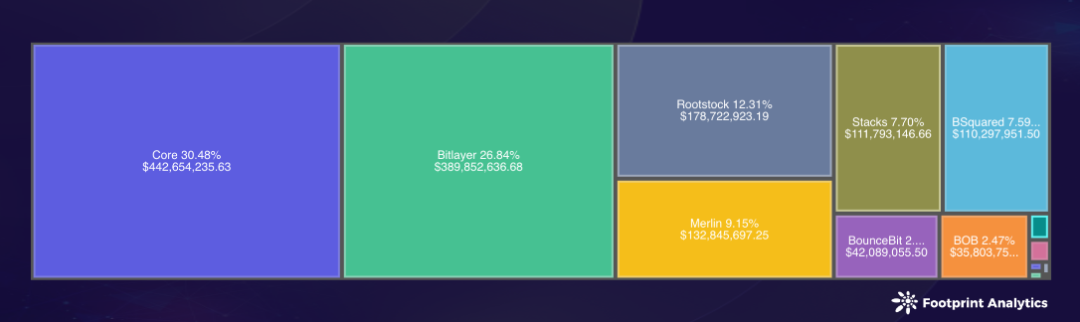

In September 2024, the TVL of the Bitcoin Layer 2 (including sidechains) saw a significant increase, reaching $1.5 billion, a 33% growth from August. Core emerged as the leader in this space with a TVL of $440 million (30.5% market share), followed by Bitlayer ($390 million, 26.8%), Rootstock ($180 million, 12.3%), and Merlin ($130 million, 9.2%).

Data source: Bitcoin ecosystem public chain TVL

Core's performance was particularly outstanding, with its TVL growing by over 100% from August. This surge was primarily driven by the launch of the Core Ignition Drop Season 2, which expanded beyond BTCFi to include Web3 gaming, significantly boosting on-chain activity. As a result, Core surpassed Bitlayer to become the largest Bitcoin scaling solution by TVL, although Bitlayer also saw a healthy 9.4% growth in TVL.

Rootstock maintained a steady growth trajectory, with a 12.5% increase in TVL, remaining in third place. Other notable performers include BSquared (42.8% TVL growth), Stacks (26.5% growth), and BEVM (6.3% growth).

Looking ahead, the Bitcoin staking protocol Babylon announced that Mainnet Phase-1 Cap-2 will be launched in the second week of October. After rapidly staking 1,000 BTC during Cap-1, high expectations have been set for the launch of Cap-2.

The Solv protocol has expanded its Bitcoin staking ecosystem, providing new options for cbBTC holders on Base, and collaborated with Pendle to launch the high-yield SolvBTC.BBN pool. The platform has integrated with 35 blockchains and protocols, leveraging Chainlink's cross-chain technology to operate on Avalanche and Base, in addition to its existing presence. These developments, including becoming the first Bitcoin staking protocol in the Base ecosystem, highlight Solv's growing importance in expanding Bitcoin DeFi opportunities across multiple chains.

Ethereum Layer 2

In September 2024, the TVL of Ethereum Layer 2 (canonically bridged portion) reached $23.2 billion, an 8.31% increase from August, but this growth rate was lower than that of Bitcoin Layer 2.

Arbitrum One, Optimism, and Base continued to dominate the TVL market share, with 48.8%, 19.7%, and 8.1% respectively, with little change from the previous month. However, their combined market share has slightly declined, indicating growth in other Ethereum Layer 2 solutions.

DeGate continued to perform strongly, with a 17.9% increase in TVL in September, following an impressive 20.6% growth in August. Taiko and Scroll also grew by 7.0% and 7.4%, respectively. In contrast, Blast's TVL declined by 18.9%, exacerbating its 18.8% drop in August.

Source: Overview of Ethereum Layer 2 in September 2024 - Rollups (Bridge-related Metrics)

The Ethereum ecosystem has been under strict scrutiny by the community in terms of innovation and development. In response, Vitalik Buterin has been actively engaging on social media, addressing these concerns and outlining the future direction.

One important development is that Vitalik Buterin announced on X platform that starting from 2025, he will "only publicly mention (in blogs, talks, etc.) L2s that have reached Stage 1 or above". This indicates a higher standard for Ethereum Rollups solutions, emphasizing the necessity for Layer 2 solutions to reach "Stage 1" by next year. To reach this benchmark, Rollups must improve decentralization and security, including fraud-proof or validity-proof schemes.

Currently, only two Rollups have reached "Stage 2": DeGate and Fuel. Three others have reached "Stage 1": Arbitrum One, Optimism, and dYdX V3. This classification sets a high bar for projects within the ecosystem. This classification highlights the continuous evolution and maturity of the Ethereum Layer 2 ecosystem, clearly prioritizing security and decentralization as key priorities for future development and recognition.

Blockchain Games

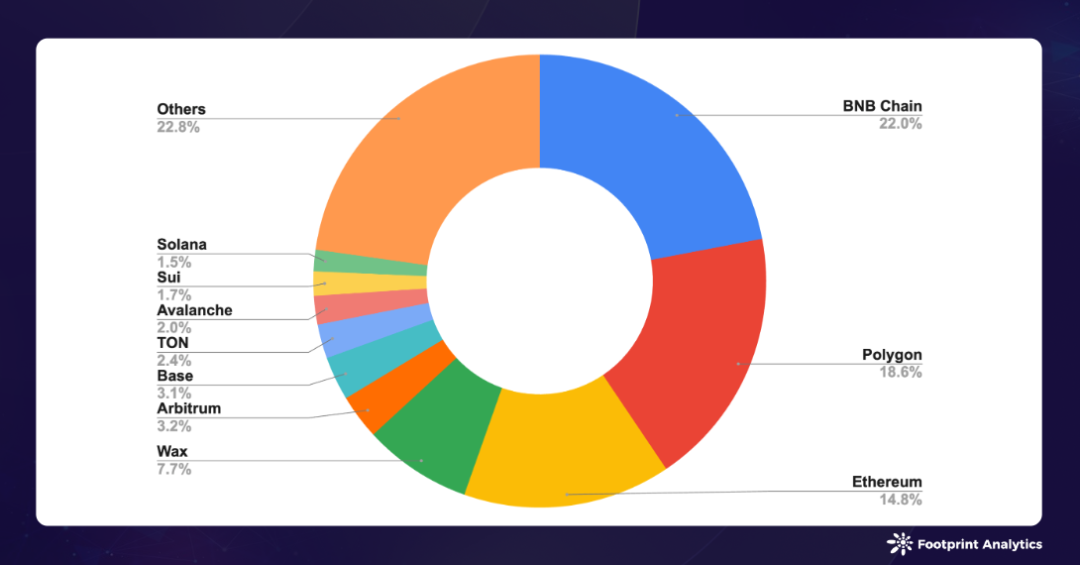

In September, the number of active blockchain games across networks increased to 1,563, a 4.5% growth from August. The market leadership remained stable, with BNB Chain, Polygon, and Ethereum accounting for 22.0%, 18.6%, and 14.8% of the game count, respectively.

Source: Percentage of active blockchain games on different chains

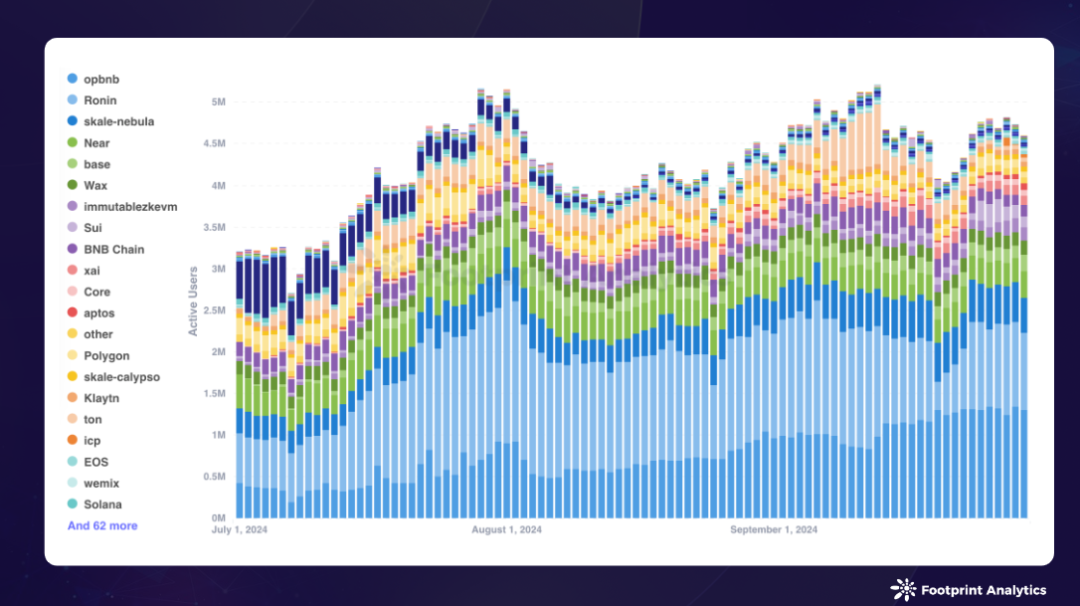

The DAU landscape saw significant changes, with opBNB, Ronin, and Nebula (SKALE subnet) emerging as the best-performing chains, with average DAUs of 1.1 million, 1.1 million, and 458,000, respectively. As of the end of September, these chains' DAU shares were 28.2%, 20.1%, and 9.2%, respectively.

Source: Daily active users of blockchain games on different chains

opBNB exhibited significant growth, with its average September DAU surging 62.0% from August, and its market share increasing from 22.4% to 28.2% within the month. This growth was driven not only by the popular game SERAPH: In The Darkness, but also by the launch of the new game Elfin Metaverse, an esports gaming platform and open-world metaverse, in mid-September.

In contrast, Ronin's DAU share continued to decline, from 29.5% in August to 20.1% in September. This trend was primarily attributed to the declining performance of Pixels, whose DAU dropped from over 700,000 to 470,000 during the month. Notably, while Ronin's average DAU in August was nearly double that of opBNB, opBNB surpassed Ronin in September, marking a significant shift in the competitive landscape.

Sui's average daily DAU grew by 48.4% to 92,000, driven by the success of the Telegram game BIRDS, which attracted a large user base in its first week of launch. This achievement highlights the trend of blockchain leveraging Telegram for user acquisition.

For more blockchain gaming industry trends, please read the report "Blockchain Gaming Report September 2024: Industry Rebounds, Telegram Games Spark Frenzy".

Funding Situation

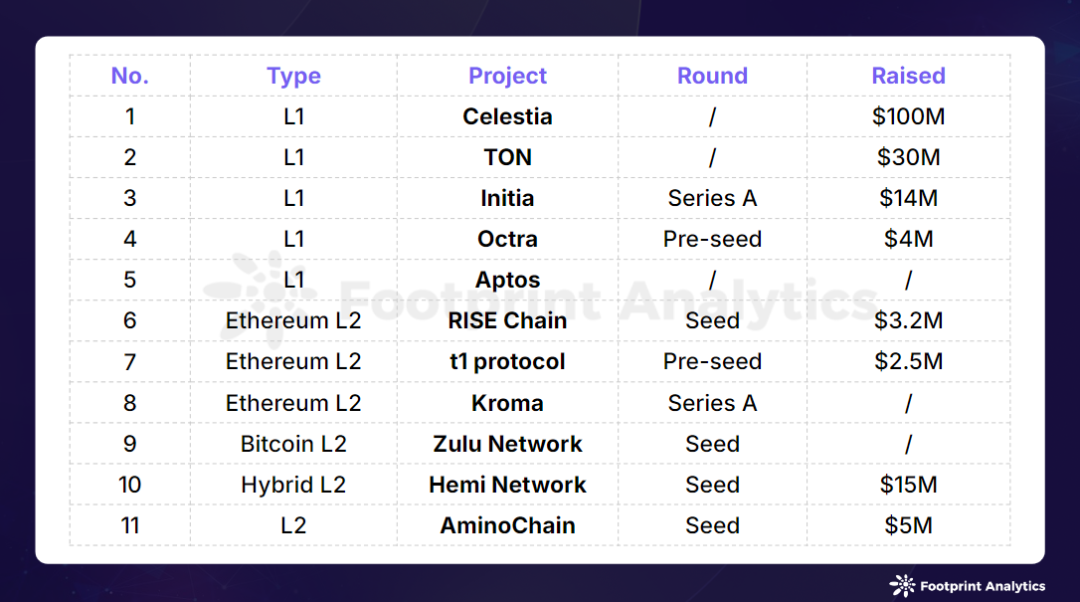

In September 2024, funding activities in the public chain space heated up, with a total of 11 funding events worth $170 million, a 47.3% increase from August. Three of these funding events did not disclose the specific amounts.

Public chain funding events in September 2024 (Data source: crypto-fundraising.info)

Two major events drove the surge in funding this month.

The Celestia Foundation announced that it had raised $100 million in a funding round led by Bain Capital Crypto, bringing its total funding to $155 million. Celestia, launched in 2023, has a unique architecture that separates consensus and data availability from the execution layer, providing greater flexibility for Layer 2 Rollup developers. However, the funding announcement has sparked community skepticism, with concerns raised about "exit pumping", and some arguing that the $100 million in funding was "actually an OTC token sale from a few months ago".

Another significant move was Bitget and Foresight Ventures' $30 million strategic investment in the TON blockchain. This investment aims to strengthen Telegram-based projects, particularly "tap-to-earn" style games like Hamster Kombat and Notcoin.

Additionally, three Layer 1 blockchains announced new funding rounds this month: Initia, Octra, and Aptos. Layer 2 solutions continued to attract investor interest, with funding going to Bitcoin Layer 2 Zulu Network, Ethereum Layer 2 RISE Chain, Kroma, t1 protocol, as well as Hemi Network and AminoChain.