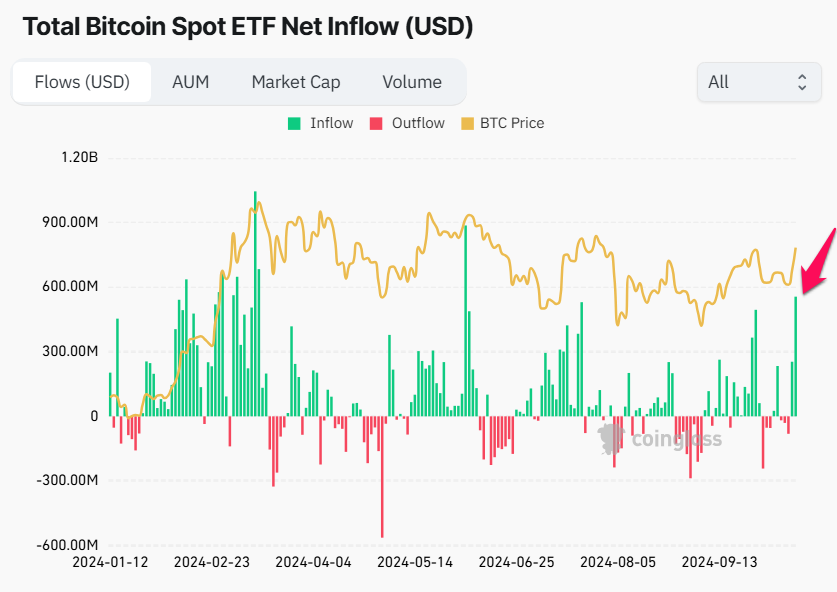

The spot Bit coin ETF in the US recorded a net inflow of over $555 million on Monday.

This is the highest net inflow since June 5, signaling a strong resurgence in investor demand for Bit coin. At the same time, the price of Bit coin also rose.

Bit coin breaks through $66,000

According to data from the crypto derivatives data platform Coinglass, on October 14, all spot Bit coin ETFs recorded a net inflow of $555.9 million. The total ETF trading volume reached $2.78 billion, the highest since August 25.

Meanwhile, the price of Bit coin rose more than 6.3% on the day, surpassing $66,000 again after the price correction in early October. However, at the time of writing, the price of Bit coin has fallen back to around $65,500.

Read more: What is a Bit coin ETF?

According to Farside data, most Bit coin ETFs saw net inflows during the Monday trading session, with the only exception being Wisdom Tree's BTCW, which saw no net inflow. Fidelity's FBTC led the buying activity with $239.3 million, followed by Bit Wise's BITB with $102 million. Even Grayscale's GBTC, which usually sees net selling, recorded $37.8 million in net buying.

Positive sentiment surges as US election nears

According to Bloomberg analysis, the recent rise in Bit coin prices is being driven by investors' optimism that the newly elected president will support the crypto industry through improved regulatory policies. Republican presidential candidate Trump has promised to replace SEC chairman Gary Gensler, while Democratic candidate Kamala Harris has pledged to support a regulatory framework for cryptocurrencies.

However, there are also opinions that not much will change regardless of who wins. Blackrock CEO Larry Fink has stated that the election results may not have a significant impact on the crypto industry.

"First of all, I'm not sure any president or any other candidate can make a difference. But I do believe the utilization of digital assets globally will become more and more of a reality. It's a dialogue we're having with institutions around the world, about how they should think about digital assets, what asset allocation should be. We do believe Bit coin is its own asset class."- Lawrence Fink said.

Read more: Bit coin (BTC) Price Prediction 2024/2025/2030

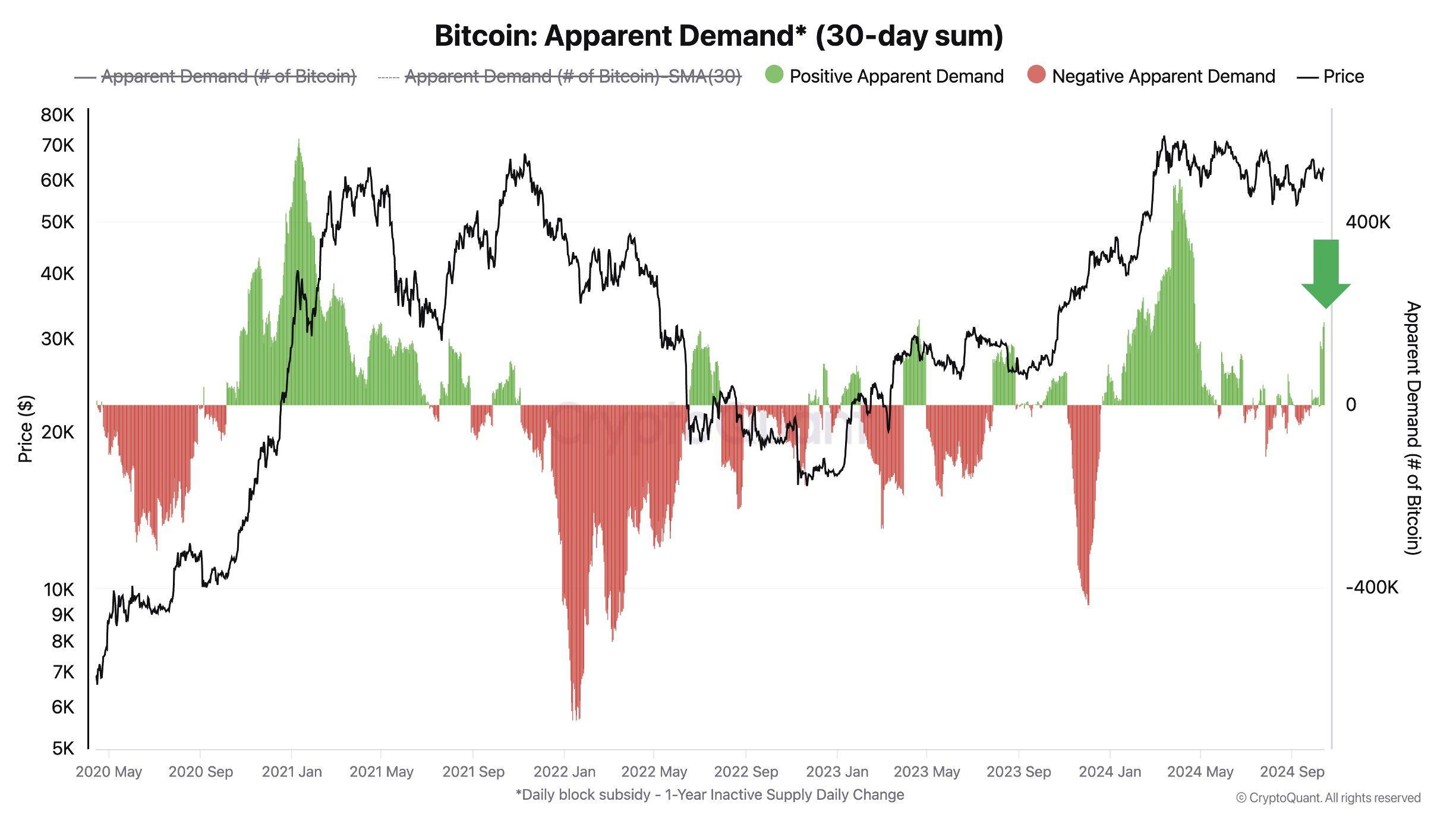

The Bit coin Apparent Demand indicator from the on-chain analytics platform CryptoQuant shows that Bit coin demand is strongly recovering. This metric measures investor demand by comparing newly mined Bit coin to supply that has been inactive for over a year.

The chart shows that when Bit coin Apparent Demand spiked significantly in early 2024, the Bit coin price surged from around $40,000 to over $72,000.