According to the CoinGecko Q3 2024 Crypto Industry Report, the global crypto market capitalization ended the quarter at $2.33 trillion, amid significant volatility due to major geopolitical and macroeconomic events.

The report indicates that the crypto market capitalization decreased by 1% in Q3, equivalent to a loss of $95.8 billion. The quarter's volatility ranged from $2 trillion to $2.61 trillion, heavily impacted by decisions from global central banks, including the interest rate adjustments by the US Federal Reserve (Fed) and the surprise rate hike by Japan.

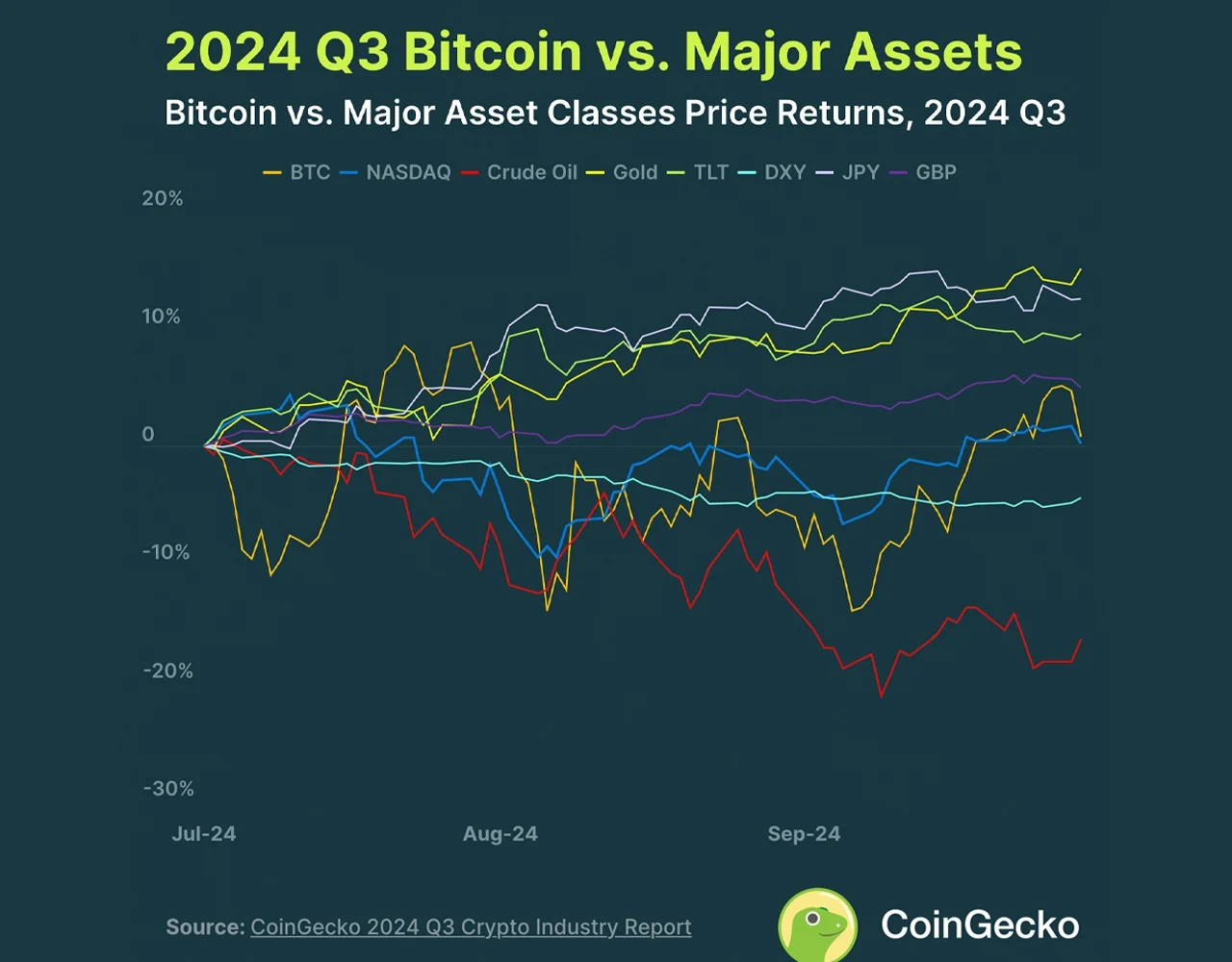

While the overall market declined, BTCD increased to 53.6%, while the market share of altcoins, particularly ETH, decreased. Although BTC only recorded a modest 0.8% growth, other major assets, such as gold, outperformed with a 13.8% increase in the quarter.

Source: Coingecko

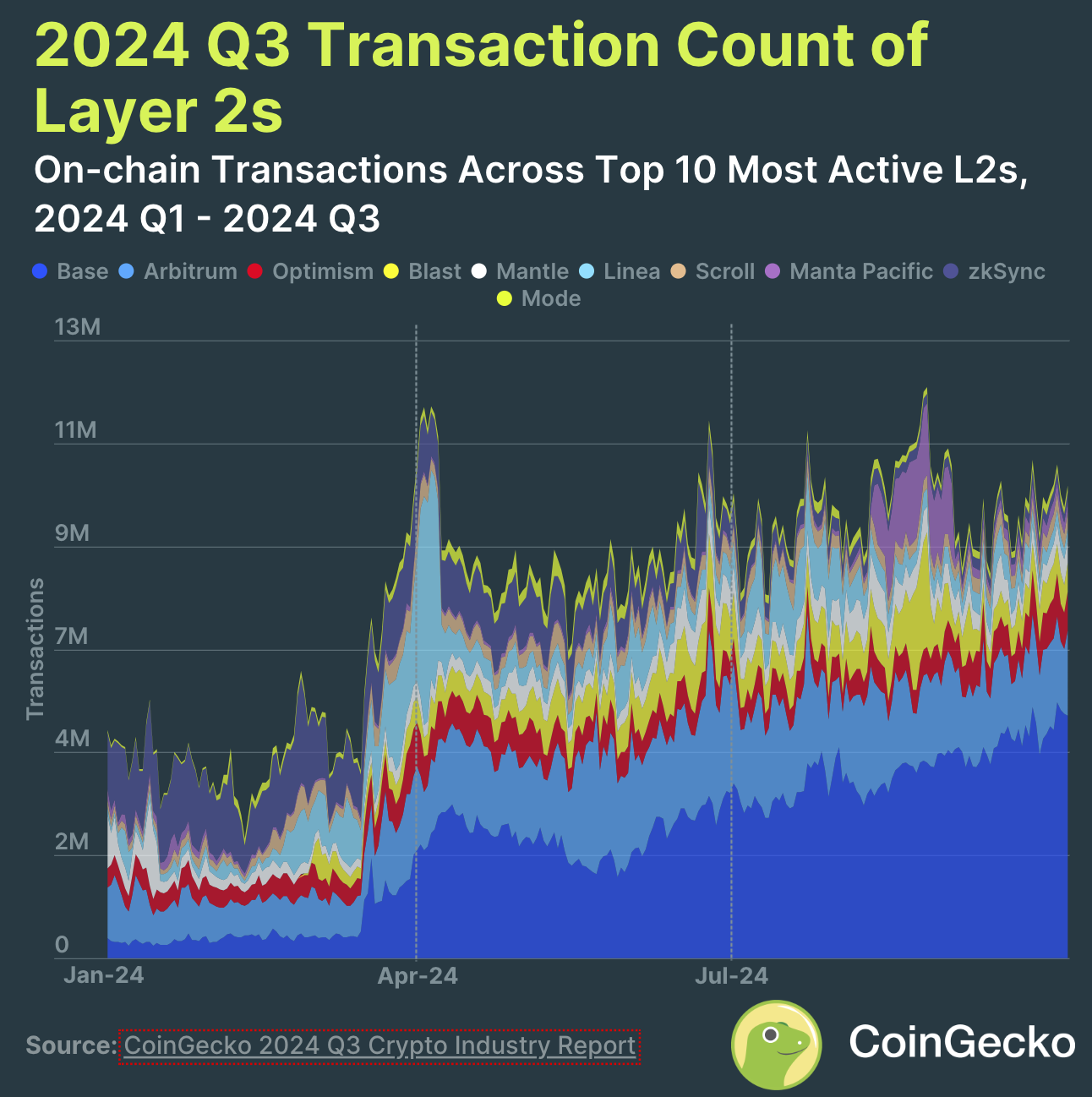

The report also highlights significant developments in the DeFi and Non-Fungible Token sectors, with impressive growth in prediction markets, reaching 565.4%, mainly driven by the dominance of Polymarket, which held 99% of the market share. The Ethereum Layer 2 ecosystem also recorded a 17.2% increase in transactions, with Base leading the charge, accounting for 42.5% of the total activity.

Source: Coingecko

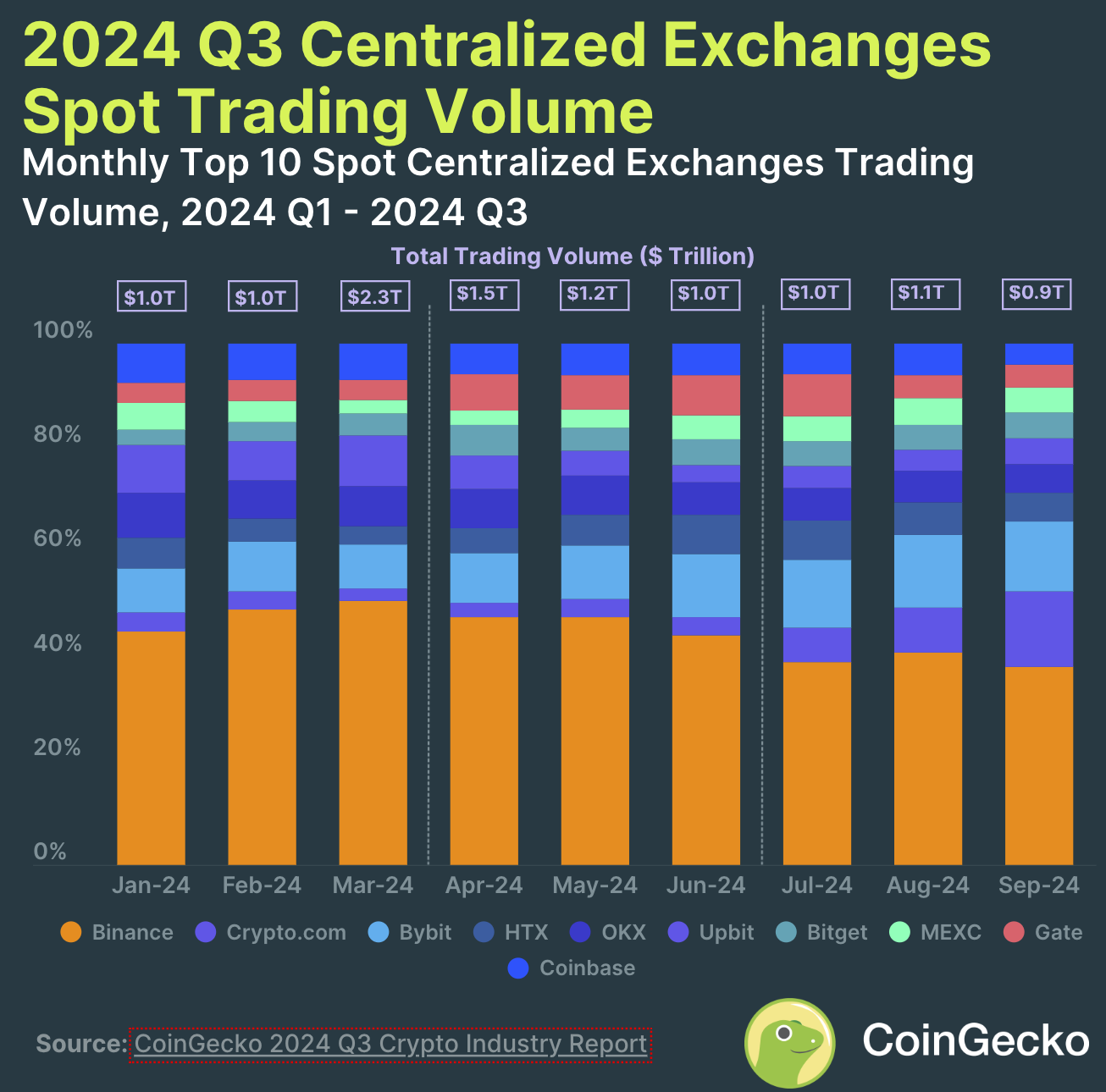

In terms of trading volume, spot trading on centralized exchanges decreased by 14.8%, totaling $3.05 trillion. Binance maintained its position as the largest exchange, but its market share fell below 40% for the first time since 2022. Meanwhile, CoinGecko's research shows that Crypto.com has risen to become the second-largest centralized exchange, with a quarterly growth of 160.8%.

Source: Coingecko

The CoinGecko Q3 report reflects a recovering market and shifting dominance. The intensifying competition among major exchanges indicates that innovation and adaptability will continue to shape the future of the crypto industry.

Bobby Ong, COO and co-founder of CoinGecko, stated:

"In the final quarter of 2024, we will be closely monitoring geopolitical and macroeconomic factors, particularly the US Presidential election and the Fed's monetary policy decisions."

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Annie

According to Newsbitcoin