Source: Visa Translation: Conflux

"Money is not just coins, banknotes or credit cards, which are merely forms, not functions. Money is typically a tool for measuring equivalent value and a medium of exchange. Money can become data with just letters and numbers, appearing as orderly energy pulses, flowing at the speed of light through countless diverse paths in the electromagnetic spectrum, at minuscule cost worldwide."

—— Visa Founder Dee Hock

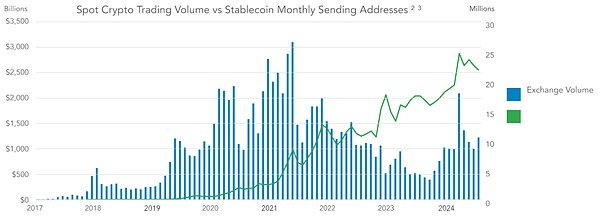

Stablecoins are the tokenized form of fiat currencies circulating on blockchains. Undoubtedly, they are the "killer application" in the crypto space currently. Today, the total value of stablecoins in circulation exceeds $160 billion, while in 2020 this figure was only a few billion dollars. Over 20 million addresses are transacting stablecoins on public blockchains every month. In the first half of 2024 alone, the settlement volume of stablecoins is expected to exceed $26 trillion (based on our adjusted estimates). Stablecoins have significant advantages over existing payment systems: on-chain programmability, strong auditability, instant settlement, self-custody of funds, and interoperability.

Based on the divergence between the activity level of stablecoins and the crypto market cycle, it is clear that the use of stablecoins is no longer just serving crypto users and trading use cases.

In this report, we combine the survey results of crypto users from five key emerging market economies with new on-chain estimation data, along with qualitative analysis of companies operating in these markets, to form a comprehensive picture of global stablecoin usage. We particularly focus on the use of stablecoins in non-crypto domains, such as remittances, cross-border payments, payroll, trade settlement, and business-to-business (B2B) transfers.

Research Methodology

The survey was conducted by YouGov from May 29, 2024 to June 13, 2024.

The purpose of this user survey is to understand the relevant metrics, behaviors, and attitudes around stablecoin usage in major global markets. We surveyed 500 adults (18 years and above) from each of the five countries: Brazil, Turkey, Nigeria, India, and Indonesia. We chose these countries because they are all highly populous nations and have anecdotal evidence of stablecoin penetration among the general population. These surveyed countries averaged a ranking of 6th in the 2023 Chainalysis Global Crypto Adoption Index, with India and Nigeria occupying the top two positions.

To be eligible for the survey, respondents must have used crypto, a blockchain network, or a blockchain wallet in the past 12 months. Prior use of stablecoins was not a requirement, but the majority of respondents (93%) had experience using stablecoins.

The online survey took approximately 15 minutes and was optimized for both computer and mobile devices. The survey was conducted in the respondents' native languages, and text input field responses were also translated.

The on-chain data primarily comes from Artemis, with supplementary data from Coin Metrics and Allium.

Blockchain Data

On-chain data, which are direct usage metrics from the blockchains, clearly show the sustained growth of stablecoins. However, on-chain data requires denoising and careful interpretation, as it is often prone to overestimation. Here, we first provide new estimates on the traction of stablecoins, and then turn to the survey data to translate the still-opaque overall numbers into specific usage patterns.

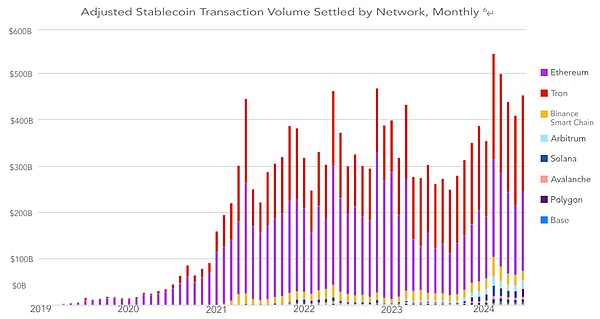

According to our adjustments, we conservatively estimate the total settlement volume of stablecoins to be $3.7 trillion in 2023 and $2.62 trillion in the first half of 2024, with an expected full-year 2024 settlement volume of $5.28 trillion. Notably, even as crypto assets experienced sell-offs and trading volumes declined in 2022 and 2023, the settlement volume of stablecoins has steadily grown through the market cycle. This further reinforces that stablecoins have attracted a new set of users who are interested in using them for purposes beyond just trading settlement.

After denoising, the most popular blockchains by settlement value as of June 2024 are: Ethereum, TRON, Arbitrum, Base, BSC, and Solana.

The growth trend in monthly active addresses is similar, if not more stable. We prefer this metric over transaction counts, as it is typically less susceptible to manipulation (though not entirely).

The most popular blockchains for stablecoin transfers are: TRON, BSC, Polygon, Solana, and Ethereum. Ethereum often has higher fees, meaning its transaction addresses and volumes are typically lower than TRON or BSC, but it still leads in settlement value.

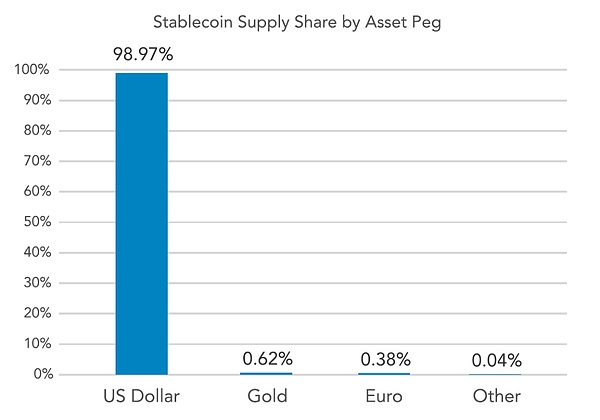

When comparing the settlement volume of stablecoins to native crypto assets, a "dollarization" of blockchains emerges. While historically, Bitcoin and Ethereum have been the primary mediums of exchange on public blockchains, stablecoins - and almost exclusively US dollar-pegged stablecoins - have gradually captured an increasing market share.

Finally, stablecoins remain closely tied to the US dollar. The second most popular currency for stablecoins is the Euro, with a supply of $6.17 billion as of June 2024, accounting for 0.38% of the overall stablecoin market. While there are also stablecoins pegged to the Lira, Singapore Dollar, Yen, and other fiat currencies, none of them, apart from the US dollar and Euro, are backed by more than $100 million.

In fact, this means that when individuals in emerging markets use US dollar-pegged stablecoins, they are indirectly purchasing US debt, such as short-term Treasuries. Some crypto-penetrated countries, including Nigeria (one of the countries surveyed), have regulatory bodies concerned that uncontrolled "dollarization" via crypto could pose risks to their domestic currencies.

Survey Findings

We surveyed approximately 500 individuals each from Nigeria, Indonesia, Turkey, Brazil, and India, for a total sample of 2,541 adults. Since we did not sample the entire population but rather limited the sample to existing crypto users, we cannot infer the overall penetration of stablecoins. Instead, our aim is to better understand how these individuals interact with stablecoins.

The survey data indicates that stablecoin usage is growing, with increased transaction frequency, significant portfolio penetration, and diversification beyond just crypto trading use cases.

Key Findings:

• While the primary motivation for using stablecoins is to acquire Bits (50%), obtaining US dollars (47%), generating yield (39%), and non-crypto use cases like trading are also popular.

• Users prefer stablecoins over US dollar bank accounts due to yield, efficiency, and lower likelihood of government intervention.

• 57% of users reported increasing their stablecoin usage in the past year, and 72% believe they will increase their stablecoin usage in the future.

• In some scenarios, Tether is primarily chosen due to its network effects, followed by user trust, liquidity, and track record relative to other stablecoins.

• In non-trading use cases, currency exchange (to US dollars) is the most reported activity, followed by purchasing goods, cross-border payments, and payroll payment/receipt.

• Ethereum is the most popular blockchain among respondents, followed by BSC, Solana, and TRON.

• The most popular wallets among respondents are Binance (exchange wallet), followed by Trust Wallet, MetaMask, Coinbase Wallet, Crypto.com, and Phantom Wallet. Users utilize a diverse range of wallet types.

Stablecoin Activity Types:

In our sample, the primary purpose for using stablecoins is still trading Bits or Non-Fungible Tokens, but other non-crypto use cases are close behind. Overall, 47% of respondents said one of their main purposes is to store funds in US dollars, 43% mentioned obtaining better exchange rates, and 39% indicated a desire to earn yield. The results are clear: in the countries we surveyed, non-crypto use cases make up a significant portion of how stablecoins are being utilized.

Stablecoin Penetration in User Portfolios:

In terms of national proportions, Nigerians have a significantly higher proportion than other countries, followed by Turkey and India. Among the sample of Indian users, the wealthiest respondents said that the proportion of stablecoins in their financial portfolios is larger.

Survey results classified by country:

The countries with the most active stablecoin usage in the sample are Nigeria, India, Indonesia, Turkey, and Brazil. Ranked by the proportion of stablecoins in investment portfolios, Nigeria is still far ahead, followed by India, Turkey, Brazil, and Indonesia.

On the preference for USDT Tether:

Tether is widely regarded as the most popular stablecoin among emerging market users. We want to understand its lasting advantage. The most common reasons users cite for preferring Tether are its network effects, followed by greater trust in Tether, and Tether's superior liquidity.

Conclusion

In this study, we first proved from a chain perspective that the usage of stablecoins is growing, whether measured by monthly active addresses, total supply, or settlement amounts. In particular, our new transaction volume estimate shows that stablecoins have become an important settlement tool, comparable to existing transfer networks, while avoiding the common overestimation problems in past on-chain data.

Our survey results refute the common perception that stablecoins are only used for speculative cryptocurrency trading. 47% of surveyed crypto users said they use stablecoins for US dollar savings, 43% mentioned efficient currency exchange, and 39% mentioned earning yields. While accessing crypto exchanges remains the primary use case for respondents, a range of ordinary (non-crypto) economic activities are also reflected.

When asked about non-crypto stablecoin activities, the most common use cases are currency substitution (69%), followed by paying for goods and services (39%) and cross-border payments (39%). It is clear that in the surveyed countries, stablecoins have evolved from being merely trading collateral to becoming a widely used digital US dollar tool.

More importantly, almost all stablecoins (about 99%) are pegged to the US dollar. In the discussion of US stablecoin regulation, this fact cannot be ignored, as billions of individuals and businesses in emerging markets rely on these networks for savings, cross-border payments, remittances, and corporate cash management. In almost all surveyed countries, stablecoins are increasingly becoming a substitute for scarce dollar banking services. In discussing the benefits of stablecoins, the potential benefits to billions of users in emerging markets of efficiently accessing an alternative hard currency must be given a place.