Author: James Van Straten, Helene Braun, Coindesk; Translated by Wu Zhi, Jinse Finance

Abstract

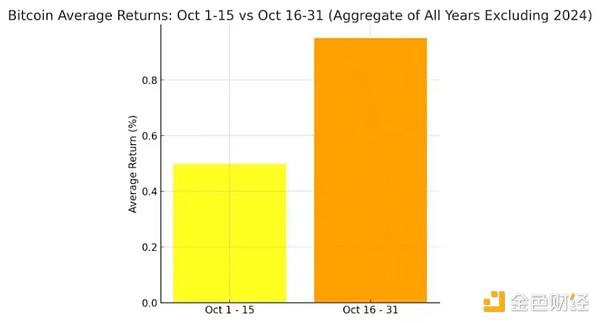

Over the past decade, the average return of Bit in the second half of October is twice that of the first half.

The options market shows a bullish bias for the November and December expiration dates.

The US election has the greatest impact on Doge and Cardano ADA.

With less than three weeks to go until the US presidential election, traders are preparing for the situation after November 5th and how the new government will address factors affecting the financial markets, including cryptocurrencies.

Over the past week, cryptocurrencies have been on an upward trend, with China's stimulus measures, interest rate cuts by Western central banks, and perhaps the US election becoming more clear focal points for the recent rise.

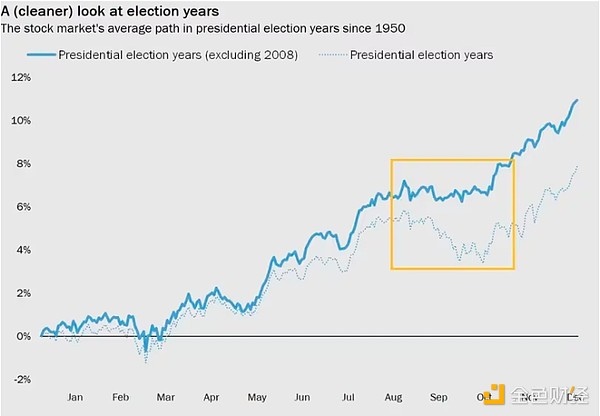

While cryptocurrencies only truly became a popular asset in the last (2020) presidential election, the second half of October typically marks the start of a bullish period for financial assets like stocks, so the recent cryptocurrency trend may not be unusual.

In fact, according to Coinglass data from 2013 to 2023, the performance of Bit (BTC) shows that the return rate in the second half of October (16-31) is twice that of the first half (1-15).

(Source: Coinglass)

Election Impact

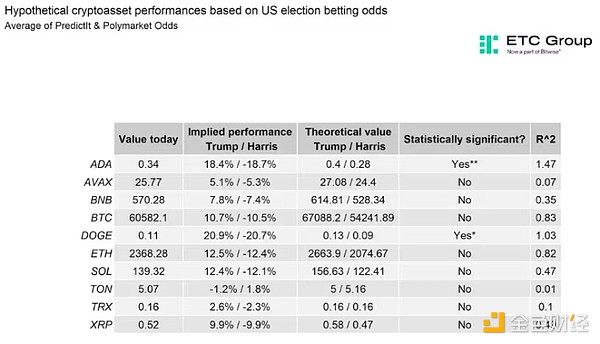

Data from ETC Group, a subsidiary of Bitwise Asset Management, shows that token prices are subject to uncertainty due to election results.

ETC Group's comparison of implied performance and theoretical values found that Bit could rise 10% in either direction depending on the election results. Given the current spot price is slightly below $68,000, a 10% increase would mean a new high above the $73,697 reached in March. The team also found that the election impact could be greatest on Cardano (ADA) and Doge, rising 18% and 20% respectively.

(Source: Bloomberg, Coinmarketcap, ETC Group)

Additionally, Ycharts data shows that in presidential election years since 1950, the stock market has typically bottomed in September and/or October and then rebounded in November. So far, this is what we've seen in the S&P 500 and Nasdaq indices, which have been rising since the beginning of last month.

(Source: Optimisticallie, YCharts)

In addition to the US election, the options market shows a bullish bias for Bit, with most of the open call contracts at strike prices of $70,000 and $80,000. The notional values of the options expiring on November 29 are $141 million and $120 million, respectively.

According to Deribit data, the bullish bias is even more pronounced for the options expiring on December 27, with the majority of call options settling at a strike price of $100,000, with a notional value of over $620 million.

In a report on Tuesday, Geoffrey Kendrick, Head of Global Digital Assets Research at Standard Chartered Bank, wrote: "With the US election approaching, Trump is most likely to win, and even from a digital asset perspective, Harris also looks good, and the broader digital asset ecosystem is indeed increasingly likely to become mainstream."

"For Bit, this means Bit is likely to rise to its historical high of $73,000 before the election."