The price of Bitcoin has recently surged, approaching its highest level in nearly 3 months. This upward trend has brought Bitcoin close to its all-time high (ATH), sparking new optimism among traders and investors.

However, despite this upward momentum, large whale transactions and significant profits could signal an impending market decline, posing a threat to the bullish outlook for Bitcoin.

Bitcoin, the Talk of the Town

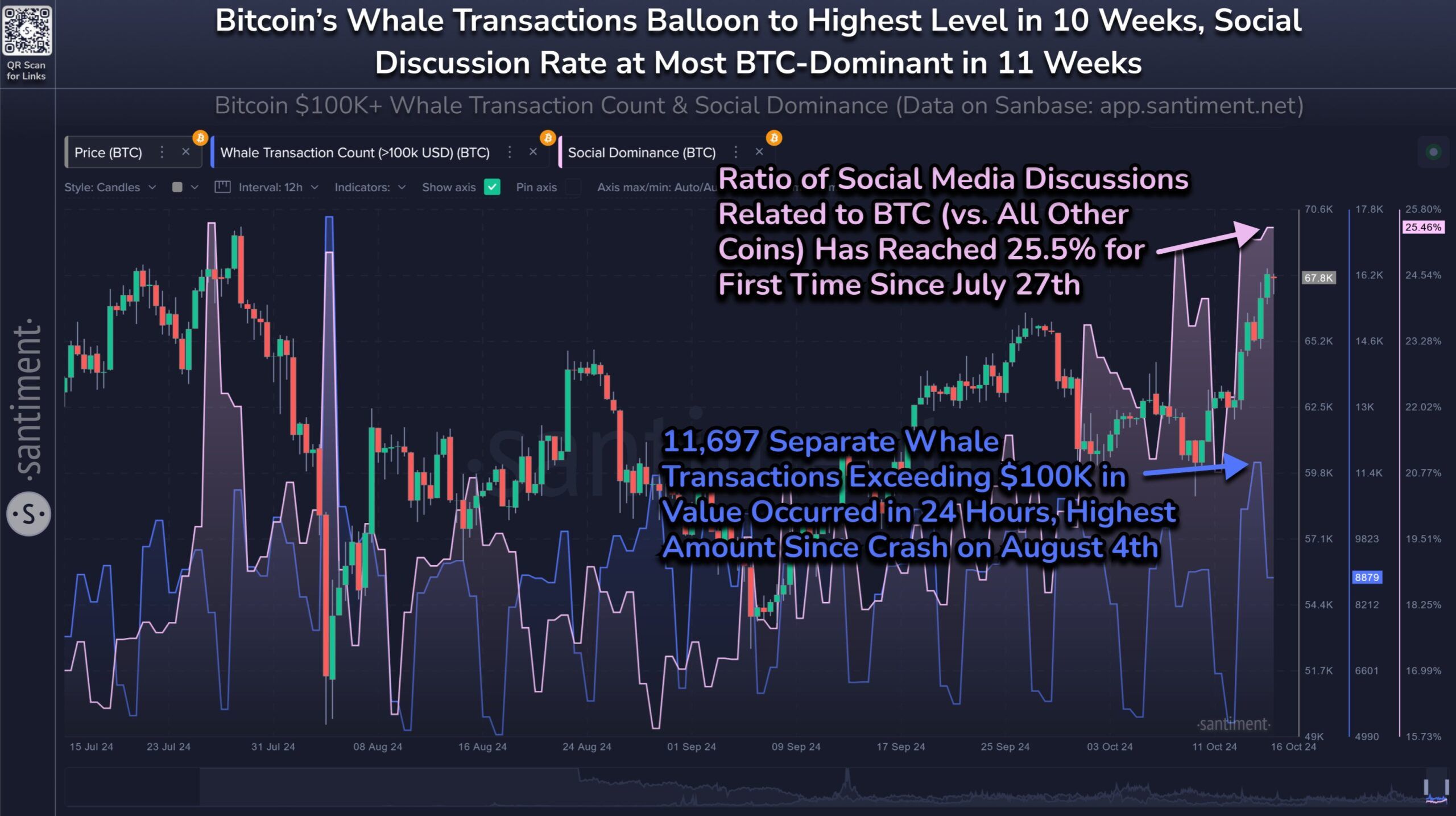

According to the latest data from the cryptocurrency online data platform Santiment, whale investor transactions have increased significantly, with Bitcoin transactions over $100,000 reaching a 10-week high. The increase in whale activity often suggests a change in market behavior, as large holders accumulating or disposing of assets can impact price fluctuations. The current surge in whale transaction volume is raising concerns about the possibility of a price correction.

At the same time, Bitcoin's dominance in social media discussions has increased significantly, accounting for 25% of all cryptocurrency-related discussions. This trend indicates that the focus is shifting away from altcoins and towards Bitcoin's performance. Historically, when Bitcoin has dominated the cryptocurrency spotlight, market volatility has often followed, with a higher likelihood of a downward trend.

"These two signals suggest that the uptrend may temporarily pause due to profit-taking by major stakeholders and high public FOMO. However, the medium-to-long-term indicators remain bullish, so any price correction is expected to be short-lived," Santiment said.

Read more: What Happened During the Last Bitcoin Halving? 2024 Prediction

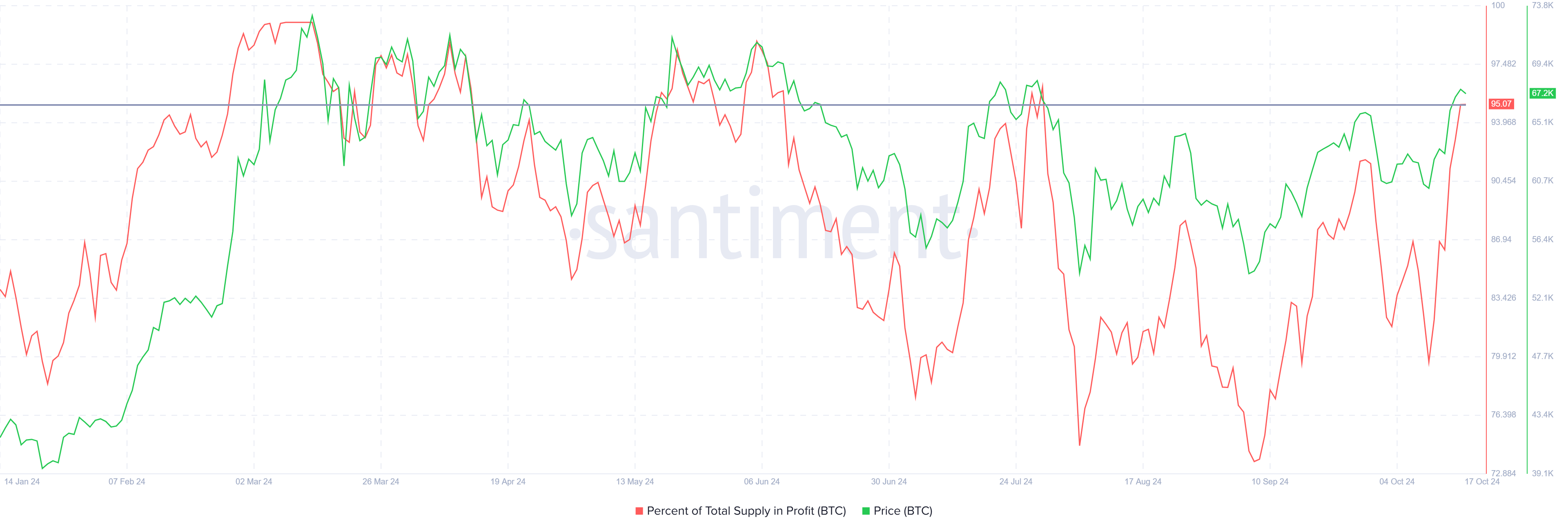

The macroeconomic trends of Bitcoin also paint a similar cautionary picture. Currently, 95% of the circulating Bitcoin supply is in a state of profit, which has historically coincided with market peaks.

When the majority of holders are in a state of profit, selling pressure often increases, leading to price declines. This scenario has occurred in previous market cycles and is now being repeated, suggesting that Bitcoin may be approaching a short-term peak.

The high proportion of the supply in a state of profit echoes the conditions that have previously led to corrections. Profitability encourages many investors to secure their gains, putting pressure on Bitcoin's price. If these conditions persist, a market top may form, triggering a downward trend.

BTC Price Prediction: Breaking the All-Time High Unlikely Without Additional Momentum

Bitcoin is currently trading at $67,432 and is approaching the crucial $68,000 resistance level. It is also attempting to break out of the descending triangle pattern that has been in place since March. If it manages to break out of this pattern, it could potentially surge by as much as 27%, reaching a price of $88,077.

However, based on past patterns, Bitcoin may not be able to sustain this upward momentum. If the upward attempt fails, the price could fall back to $65,000, and this price action could potentially lead to further temporary declines.

Read more: Bitcoin Halving History: Everything You Need to Know

Without the necessary momentum, Bitcoin may struggle to break through its all-time high of $73,800. If it fails to surpass this level, the bullish outlook will be invalidated, and Bitcoin may remain below its previous peak.