Source: Chainalysis; Compiled by Wuzhu, Jinse Finance

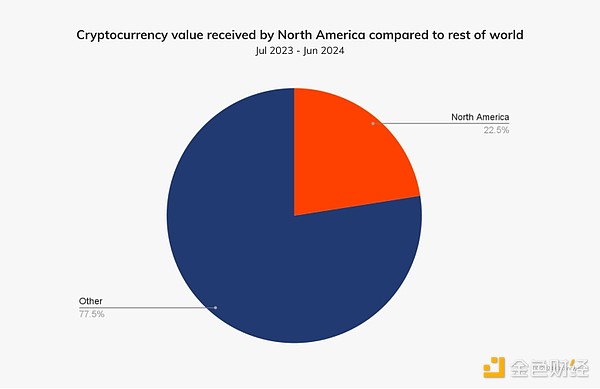

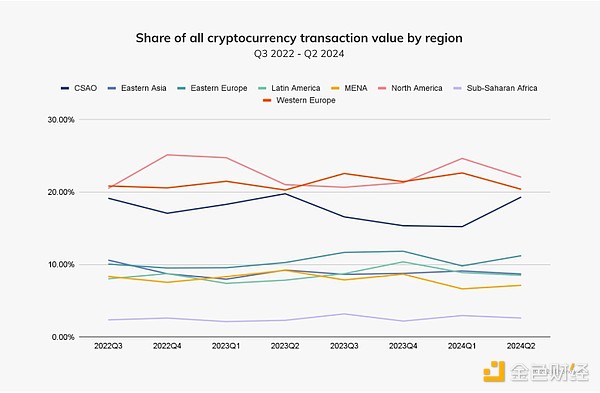

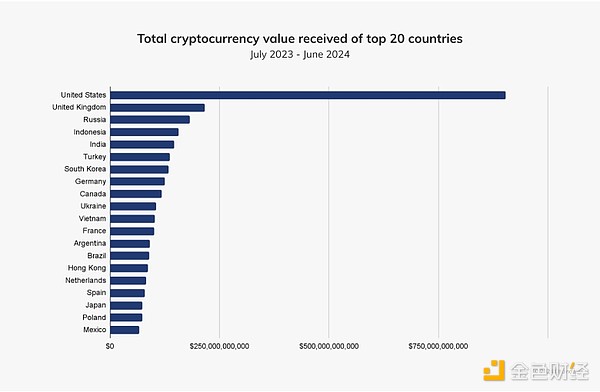

As in previous years, North America remains the world's largest cryptocurrency market, with an estimated on-chain value of $1.3 trillion during the period from July 2023 to June 2024, accounting for about 22.5% of global activity.

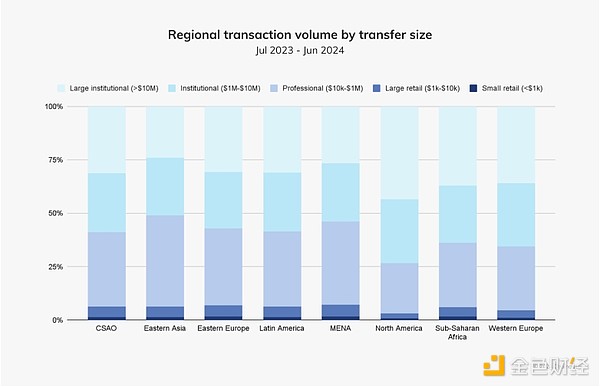

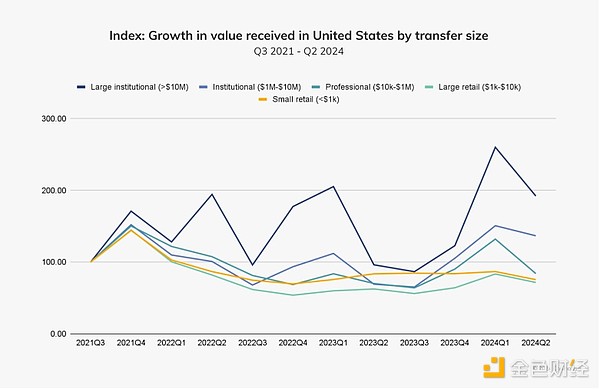

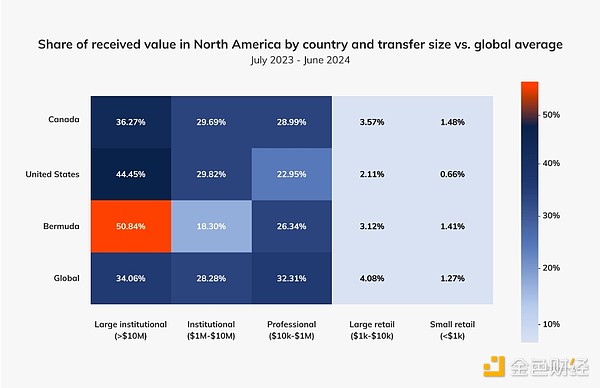

North America's dominance in the cryptocurrency market is largely driven by institutional activity - more important than any other region. About 70% of cryptocurrency activity in the region involves transfers of over $1 million, reflecting the growing influence of major financial players in the cryptocurrency market in the region.

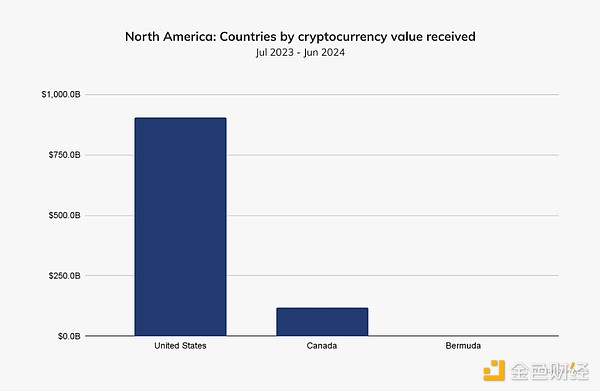

The vast majority of this activity is driven by the United States, proving that 2024 will be a critical year for cryptocurrency adoption and industry growth in the US.

After experiencing a bear market partly driven by the FTX collapse at the end of 2022 and the collapse of Silicon Valley Bank in March 2023, the North American cryptocurrency industry has seen a significant recovery. In March 2024, the price of BTC broke through $73,000, a new all-time high, marking a recovery from the volatile period and ultimately strengthening the integrity and resilience of the ecosystem.

In 2024, the integration of traditional finance (TradFi) and cryptocurrencies has been consolidated, with the launch of spot BTC exchange-traded products (ETPs) in the US market boosting institutional enthusiasm. In particular, exchange-traded funds (ETFs) - the most popular and well-known type of ETP - have attracted the attention of retail and institutional investors.

The cryptocurrency environment in North America is more institutionally driven than ever before. Established financial entities such as Goldman Sachs, Fidelity, and BlackRock, which have been influencing US and global financial markets for decades, are now playing a significant role in the cryptocurrency space. As cryptocurrencies become increasingly integrated into the mainstream, this marks a critical point of maturity for the industry.

The US is the most important pillar of global cryptocurrency adoption

The US cryptocurrency market is the largest and most influential in the world, far ahead of the global market.

This prominent position is largely due to the country's vast wealth, large population, deep and liquid capital markets, and thriving innovation ecosystem. The US also benefits from political stability, a favorable investment environment, and the US dollar's current status as the primary reserve currency in the international financial system. Supported by these factors, the US is a global leader in cryptocurrency adoption, ranking fourth in our annual Global Adoption Index.

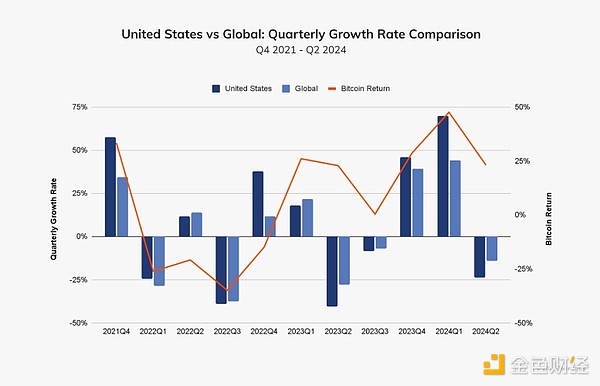

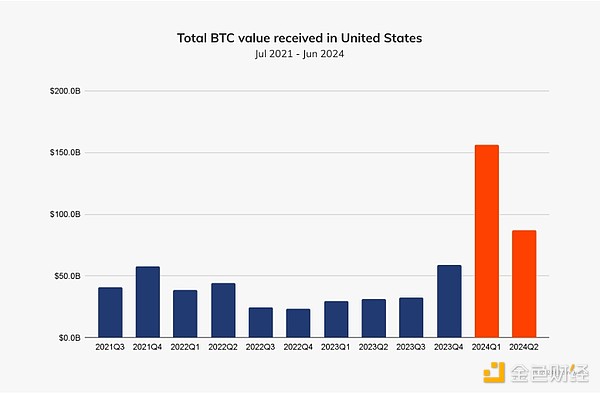

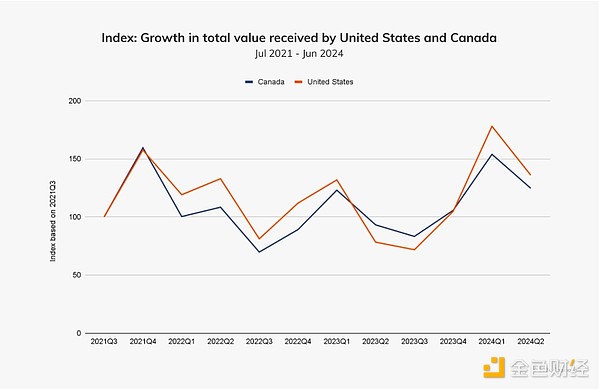

In terms of growth, the volatility of the US market is significantly higher than the global market. In recent quarters, the US has shown high sensitivity to both bull and bear markets. When cryptocurrency prices rise, the growth rate of the US market exceeds the global market, and the opposite is true when the cryptocurrency market declines. We can see this trend below, comparing the growth rates of the US and global markets with the returns of BTC.

This volatility is largely attributed to the significant level of institutional activity within the country, a trend that makes the US market a key driver of global financial trends such as cryptocurrencies and TradFi.

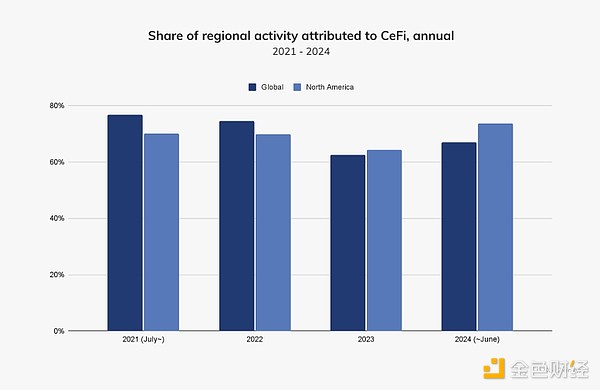

At the same time, the US is becoming a global hub for centralized cryptocurrency services, reflecting an increasing reliance on centralized finance (CeFi) platforms like Coinbase and Gemini for custody and asset management.

The growing demand for crypto-related financial products like ETPs may drive the demand for CeFi (which we will discuss in more detail below).

Gemini, a centralized exchange institution and custodian, emphasized the importance of making digital assets accessible to everyday users through centralized platforms. "At Gemini, we're in the abstraction business - our job is to simplify crypto-native technology so that anyone with a smartphone can securely access digital assets," she explained.

Furthermore, the entry of institutional giants like BlackRock into the cryptocurrency space highlights the increasing integration of TradFi and cryptocurrencies. To better understand this development, we interviewed Kevin Tang of BlackRock's digital assets team. BlackRock's foray into digital assets was carefully planned - including BTC and ETH ETPs as well as tokenization - with strategic CeFi partnerships laying the foundation for its success. For example, in 2022, BlackRock partnered with Coinbase to integrate Coinbase Prime functionality into the company's proprietary investment management platform, Aladdin. This integration allows BlackRock and its clients to seamlessly manage Bitcoin and Ethereum risk alongside traditional assets. "Platform integration is critical for building foundational capabilities, ultimately paving the way for the construction of IBIT [iShares Bitcoin Trust]," Tang explained.

Centralized platforms may continue to play a key role in driving the ongoing TradFi-cryptocurrency integration. "CeFi and centralized institutions are crucial for driving infrastructure development and providing the capabilities that allow firms like BlackRock to operate in the [crypto] space," Tang emphasized.

As ETPs consolidate the link between cryptocurrencies and TradFi, the US market drives global prices

As we explored in other global cryptocurrency markets, the launch of a spot BTC ETP in the US in January 2024 had a transformative impact on the US and global cryptocurrency markets, driving institutional interest and unprecedented capital inflows into BTC.

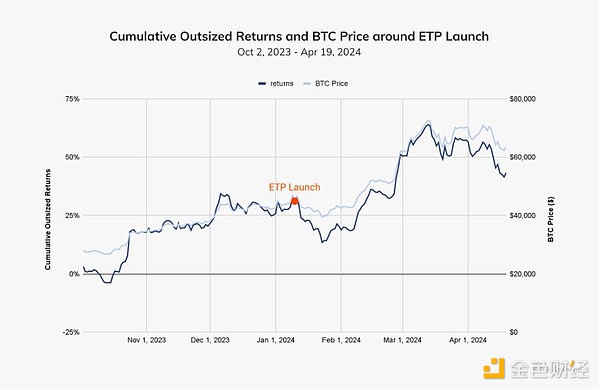

After the approval by the US Securities and Exchange Commission, the market immediately experienced a global price bull run, delivering massive positive returns just weeks after the launch.

While it is impossible to fully isolate the impact of the US BTC ETP launch, there is a widespread belief that ETPs help to boost bullish market sentiment and increase institutional BTC exposure. This demand is attributed to ETPs' ability to simultaneously meet the needs of retail and institutional investors, providing a familiar, regulated tool to gain BTC exposure while avoiding the complexity of managing private wallets or using crypto-native infrastructure.

The launch of a BTC ETP in the US, followed by the launch of a spot ETH ETP a few months later, marked a critical moment in the integration of TradFi and cryptocurrencies, primarily because it impacted institutional interests and broader market sentiment. With the approval of a BTC ETP in the US, the cryptocurrency market experienced a significant upswing.

To better understand the impact of this milestone, we asked Kevin Tang of BlackRock (whose iShares Bitcoin Trust (IBIT) has become the most popular BTC ETP) to discuss its impact. "The launch of a Bitcoin ETP in the US is historic, as it demonstrates the pent-up demand from investors for a low-cost, efficient, and secure way to gain exposure to Bitcoin." IBIT has broken multiple records, including becoming the fastest ETP to reach $10 billion in assets and reaching $20 billion in assets under management (AUM). "We have high expectations for asset gathering through Bitcoin ETPs, and the strong client interest we've seen so far represents a victory for ETF wrappers," Tang said.

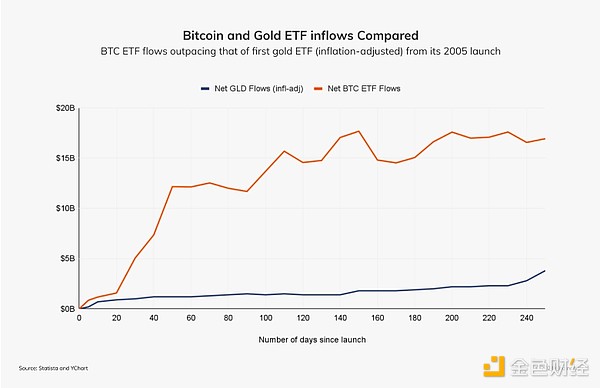

In the first 200 days after launch, the inflows into the US Bitcoin ETF even far exceeded those of the most popular gold ETF in history, making it the most popular ETP category in history.

This rapid adoption confirms the strong potential demand for regulated, institutional-grade products that provide access to BTC.

The impact of the US Bitcoin ETP is not just a US phenomenon, as it has far-reaching implications and lays the groundwork for a broader wave of international adoption. Tang noted that the product has attracted investors from Asia, Europe, and Latin America. "The global impact of these ETPs is undeniable." Tang further emphasized that Bitcoin is increasingly seen as a global currency alternative and a unique diversification tool for investment portfolios, particularly as a potential hedge against inflation or geopolitical instability - a point also echoed in BlackRock's recent white paper on the unique value proposition Bitcoin offers investors.

The growing acceptance of BTC and ETH as assets worthy of serious investment is paving the way for broader institutional adoption. Tang noted that many investors are now engaging in deeper discussions about the role of BTC and other crypto assets in their portfolios. "They're asking how Bitcoin can fit into their portfolios alongside other traditional investments," he said, and pointed out that the launch of ETPs has opened the door to broader crypto access. "ETPs have shifted the conversation to the investment merits and value proposition of BTC and ETH, rather than just the logistical challenges of accessing them," Tang explained.

For many institutions, Bitcoin ETPs are the first step in deeper engagement with the crypto asset market. This exposure may ultimately lead to broader investments in blockchain technology and decentralized finance (DeFi), far beyond the risk of BTC and ETH price exposure. "For now, we're focused on BTC and ETH because we see clear demand and regulatory clarity," he explained. "As the market evolves, we remain committed to meeting client needs."

Through ongoing efforts to educate investors and build trust in the space, traditional financial institutions (FIs) like BlackRock are playing a crucial role in reshaping the way institutions handle crypto, laying the groundwork for future, wider adoption. As Tang said, "We are firmly convinced that blockchain technology, particularly the potential of tokenization, could disrupt traditional finance."

Stablecoin Growth Stagnates in the US Market

Despite record-breaking activity, the US market has also faced some challenges over the past year, including a noticeable divergence of stablecoin activity from the US regulatory landscape. This trend may reflect the barriers posed by the slow progress of stablecoin and broader digital asset regulation.

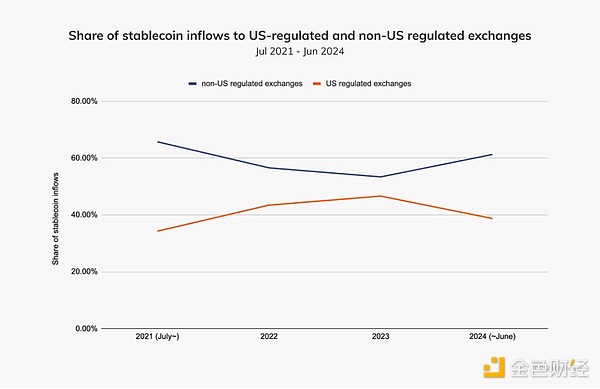

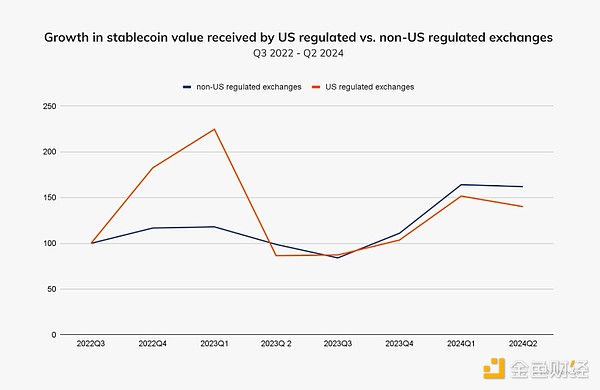

Up until 2023, the share of stablecoin trading on US-regulated exchanges has been steadily growing, in line with the increase in global stablecoin adoption. However, by 2024, this trend begins to reverse, as shown below.

Given the surge in stablecoin adoption in emerging markets and global markets, this shift may reflect a relative, rather than absolute, decline in stablecoin usage within the US market. Now, an increasing share of stablecoin trading is occurring on exchanges not regulated by the US, indicating that the pace of global stablecoin adoption is outpacing growth in the US. Below, we can see the US-regulated and non-US-regulated. Regulated exchanges are growing, but non-US exchange stablecoin activity is growing faster.

As mentioned, this shift does not necessarily indicate a sharp decline in US market participation, but rather reflects the rapid expansion of the role of stablecoins in emerging markets and non-US markets.

To further understand the evolving stablecoin market, we interviewed the issuer of USDC (a US dollar-pegged stablecoin), Circle. Circle emphasized that the global demand for US dollar-backed assets is growing, particularly among populations outside the traditional banking system, as they have limited opportunities to access stable currencies.

A Circle spokesperson explained, "One way to think about USDC's recent opportunities is to focus on the global demand for fiat US dollar cash." "The Federal Reserve estimates that nearly $1 trillion in US paper currency (45% of all circulating paper currency) is held outside the US, with two-thirds of the $100 bills circulating abroad. While people outside the US face difficulties in accessing US dollars through local banking systems, this demand persists."

The growth in stablecoin usage outside the US reflects a broader trend of international markets facing currency volatility turning to US dollar-denominated stablecoins to preserve value and facilitate faster, cheaper transactions. Stablecoins like USDC and Tether offer an attractive solution to obtain the stability of the US dollar without the traditional banking channels, which are often more difficult to access outside the US.

However, regulatory uncertainty in the US is threatening the country's leadership position in the stablecoin space. Circle pointed out that in the absence of clear regulatory guidelines in the US, other financial hubs like the EU, UAE, Singapore, and Hong Kong are able to attract stablecoin projects with more favorable regulatory frameworks. The spokesperson noted, "Europe has successfully achieved what the US has yet to accomplish: providing legal and regulatory clarity for the entire digital asset market through the MiCA framework." The Crypto Asset Markets (MiCA) regulation, which will take effect in June 2024, has laid the regulatory foundation for stablecoins in the EU.

The regulatory clarity in regions outside the US is driving the growth of global stablecoins, while the US risks falling behind. The Circle spokesperson warned, "The lack of a regulatory framework for US dollar stablecoins in the US poses a threat to US interests." "This vacuum has incentivized the growth of stablecoins outside the US, as the demand for the US dollar is greater in those regions." The opportunity cost for the US is not just missing out on the economic activity associated with stablecoins, but also the risk of losing influence and authority over the future role of the US dollar in on-chain commerce. This is not unlike the historical precedent of the Eurodollar, which initially received little attention from US policymakers due to its smaller market size. However, the Eurodollar grew rapidly and helped cement the international status of the US dollar - a fortunate outcome for legislators. If the US continues to lag in providing transparency, the stablecoin story may not be so fortunate.

Although there are regulatory delays, Circle remains optimistic about the potential of USDC in the United States. They added, "The United States is the home of the dollar and Circle's home market, and we are optimistic about the potential of USDC here." However, as more countries develop regulatory frameworks to encourage the adoption of stablecoins, particularly in regions where inflation and instability are driving demand, US policymakers are facing increasing pressure to take action. They stated, "A key question now is whether the US will ultimately develop its own stablecoin rules or maintain the status quo of uncertainty, which policymakers in both parties have said is unacceptable." The US is not entirely without progress on stablecoins. Circle mentioned the stablecoin bill proposed by the House Financial Services Committee in July 2023, which could provide the regulatory clarity needed for the US market to remain competitive. They urged, "Congress should pass this bill on a bipartisan basis." Establishing clear anti-money laundering/counter-terrorism financing and sanctions obligations for stablecoin issuers is crucial to ensuring that US stablecoins maintain their global influence.The Canadian Market Follows the US

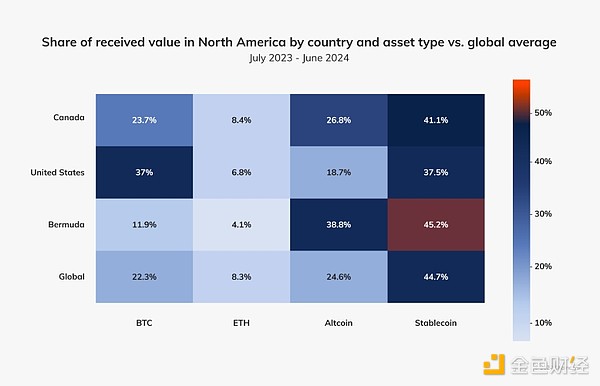

While the Canadian market is smaller than the US market, it is still a major participant in the North American market, generating around $119 billion in value during the period from July 2023 to June 2024. Although the Canadian market follows US trends, volatility is often lower, with more moderate gains during bull markets and milder declines during bear markets. Canada's asset distribution and trading volume are closely aligned with global averages.

Canada's asset distribution and trading volume are closely aligned with global averages.

To understand the actual landscape of the Canadian cryptocurrency market, we interviewed Kunal Bhasin, Partner and Co-Head of Advisory Services at KPMG's Digital Asset Centre of Excellence. Bhasin provided insights into the adoption of cryptocurrencies in Canada and some of the challenges facing the industry.

After the regulatory reforms implemented last year (which introduced stricter rules on custody, leverage, and stablecoins), several major cryptocurrency companies in Canada have temporarily suspended their operations in the country, with Gemini joining the ranks of Binance and OKX as the latest exchange to exit the market. However, Bhasin stated that this trend is not solely due to regulatory challenges. He explained, "The Canadian regulators have introduced the concept of crypto contracts, which provides more clarity and transparency for crypto exchanges compared to other North American jurisdictions, clarifying the applicability of securities regulations to crypto platforms." He believes that the exits of these exchanges may be due to broader business decisions rather than an unworkable framework. Nevertheless, Bhasin emphasized that Canadians still have "many regulated venues where they can meaningfully participate in cryptocurrencies."

While Canada's regulatory framework for trading platforms and investment funds helps maintain a certain level of confidence, gaps still exist, particularly in the regulation of stablecoins and DeFi. "Canada's approach to stablecoins is somewhat different from the more forward-looking jurisdictions like the EU, UAE, Hong Kong, and Singapore," Bhasin explained. "There is no clear regulatory framework for stablecoins. As a result, you may see stablecoin issuers leaving Canada, and related crypto innovations also moving outside of Canada."

Despite these hurdles, Bhasin also mentioned some promising developments. The Canadian Investment Regulatory Organization (CIRO) is a pan-Canadian self-regulatory organization currently responsible for regulating all investment dealers, mutual fund dealers, and trading activity in the Canadian debt and equity markets. Under this framework, cryptocurrency exchanges must become CIRO members, subjecting them to stricter disclosure, internal controls, and regulatory reporting requirements. Bhasin stated, "This is a sign of the maturing regulatory environment for crypto companies in Canada."

Another challenge to cryptocurrency adoption in Canada is the reluctance of major financial institutions to meaningfully participate in cryptocurrencies. "While global banks have taken appropriate measures to understand the unique risks of crypto companies under banking regulations and have incorporated enhanced due diligence programs related to crypto business, which has become a new source of deposits for these banks, we have not seen similar measures taken by Canadian banks," Bhasin explained. "This makes it difficult for crypto companies to obtain banking services, leading to some innovation moving outside of Canada." Furthermore, he noted that while Canada's large banks have crypto teams and have conducted various pilot projects and proof-of-concepts, "when it comes to going beyond these pilots, the leadership often retreats," which he attributed to risk aversion and a tendency to maintain existing business models rather than disrupt them through new, potentially risky crypto ventures.

A key driver of global cryptocurrency adoption is the proactive stance of governments, such as Singapore and the UAE, which have incorporated cryptocurrencies as part of their economic strategies. Bhasin stated that increased government engagement can stimulate growth and investment. "There needs to be more engagement at the federal level to make digital assets a priority industry for Canada," he said.

While the Canadian cryptocurrency market faces challenges, Bhasin remains optimistic about the future, particularly considering the ongoing efforts of both the public and private sectors. Bhasin stated, "Canada still has a strong regulatory environment for certain cryptocurrency activities, such as investment funds." He noted that Canada was the first country to launch a staked ETH ETF. He added, "There is potential to further develop this by providing a clear roadmap for the primary and secondary markets for tokenized real-world assets." "If the government makes cryptocurrencies a priority and we continue to make progress in the regulatory space, there is no reason why Canada cannot be a global leader in cryptocurrency adoption."

To understand the actual landscape of the Canadian cryptocurrency market, we interviewed Kunal Bhasin, Partner and Co-Head of Advisory Services at KPMG's Digital Asset Centre of Excellence. Bhasin provided insights into the adoption of cryptocurrencies in Canada and some of the challenges facing the industry.

After the regulatory reforms implemented last year (which introduced stricter rules on custody, leverage, and stablecoins), several major cryptocurrency companies in Canada have temporarily suspended their operations in the country, with Gemini joining the ranks of Binance and OKX as the latest exchange to exit the market. However, Bhasin stated that this trend is not solely due to regulatory challenges. He explained, "The Canadian regulators have introduced the concept of crypto contracts, which provides more clarity and transparency for crypto exchanges compared to other North American jurisdictions, clarifying the applicability of securities regulations to crypto platforms." He believes that the exits of these exchanges may be due to broader business decisions rather than an unworkable framework. Nevertheless, Bhasin emphasized that Canadians still have "many regulated venues where they can meaningfully participate in cryptocurrencies."

While Canada's regulatory framework for trading platforms and investment funds helps maintain a certain level of confidence, gaps still exist, particularly in the regulation of stablecoins and DeFi. "Canada's approach to stablecoins is somewhat different from the more forward-looking jurisdictions like the EU, UAE, Hong Kong, and Singapore," Bhasin explained. "There is no clear regulatory framework for stablecoins. As a result, you may see stablecoin issuers leaving Canada, and related crypto innovations also moving outside of Canada."

Despite these hurdles, Bhasin also mentioned some promising developments. The Canadian Investment Regulatory Organization (CIRO) is a pan-Canadian self-regulatory organization currently responsible for regulating all investment dealers, mutual fund dealers, and trading activity in the Canadian debt and equity markets. Under this framework, cryptocurrency exchanges must become CIRO members, subjecting them to stricter disclosure, internal controls, and regulatory reporting requirements. Bhasin stated, "This is a sign of the maturing regulatory environment for crypto companies in Canada."

Another challenge to cryptocurrency adoption in Canada is the reluctance of major financial institutions to meaningfully participate in cryptocurrencies. "While global banks have taken appropriate measures to understand the unique risks of crypto companies under banking regulations and have incorporated enhanced due diligence programs related to crypto business, which has become a new source of deposits for these banks, we have not seen similar measures taken by Canadian banks," Bhasin explained. "This makes it difficult for crypto companies to obtain banking services, leading to some innovation moving outside of Canada." Furthermore, he noted that while Canada's large banks have crypto teams and have conducted various pilot projects and proof-of-concepts, "when it comes to going beyond these pilots, the leadership often retreats," which he attributed to risk aversion and a tendency to maintain existing business models rather than disrupt them through new, potentially risky crypto ventures.

A key driver of global cryptocurrency adoption is the proactive stance of governments, such as Singapore and the UAE, which have incorporated cryptocurrencies as part of their economic strategies. Bhasin stated that increased government engagement can stimulate growth and investment. "There needs to be more engagement at the federal level to make digital assets a priority industry for Canada," he said.

While the Canadian cryptocurrency market faces challenges, Bhasin remains optimistic about the future, particularly considering the ongoing efforts of both the public and private sectors. Bhasin stated, "Canada still has a strong regulatory environment for certain cryptocurrency activities, such as investment funds." He noted that Canada was the first country to launch a staked ETH ETF. He added, "There is potential to further develop this by providing a clear roadmap for the primary and secondary markets for tokenized real-world assets." "If the government makes cryptocurrencies a priority and we continue to make progress in the regulatory space, there is no reason why Canada cannot be a global leader in cryptocurrency adoption."