Want to make quick money in the crypto market? New coins are often the most hyped wealth codes, but don't get too excited too soon, what falls from the sky may not be a pie, but a trap. Especially now, the performance of new coins listed on the top five exchanges is enough to calm down every investor eager to get rich.

We have carefully analyzed the earnings performance of new coins listed on Binance, OKX, Upbit, Bybit, and Coinbase exchanges from September 19 to October 18 at 4 pm,the conclusion is: playing new coins, most people are paying for the escape of early investors. Don't think that just because they are listed on the exchange, they are stable. Behind the data, some projects have terrifying valuations and huge selling pressure, while others are quietly stockpiling in the market sentiment. Whether it's a lucky windfall or being cut as a leek, it all depends on your choice.

This article will take you deep into the real performance of these new coin projects, compare the steady growth of Bitcoin and Ethereum, and reveal the traps and opportunities hidden behind the liquidity depletion of altcoins. To stand firm in this turbulent market, you not only need luck, but also wisdom.

New Coin Market: High Risk, High Volatility, Who is Holding On?

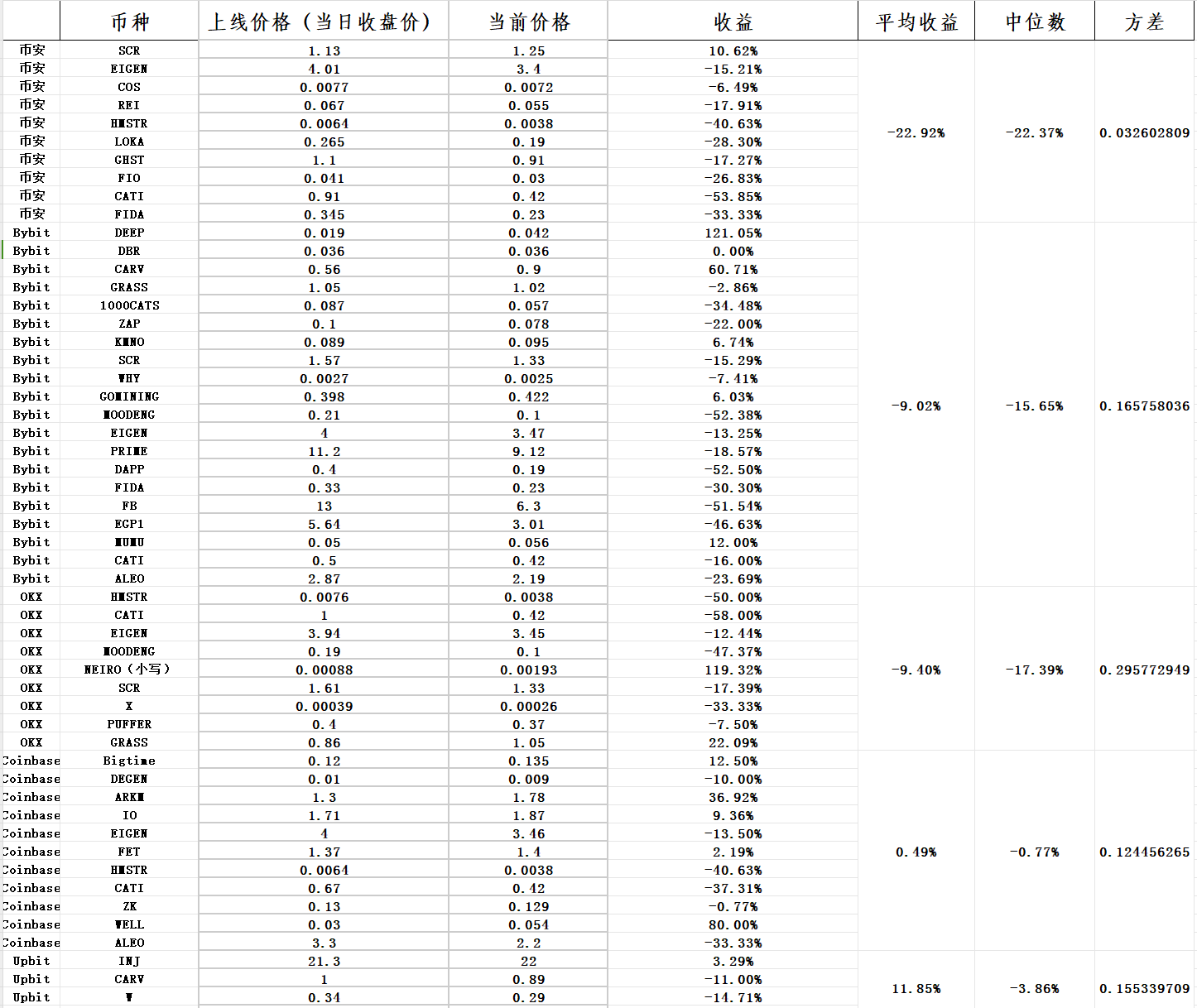

First, let's look at the performance of new coins listed on various exchanges in the past month. In short, the new coin market shows relatively high volatility, and the earnings performance is uneven. Although some platforms like Upbit and Coinbase are relatively stable, the performance of most new coins is not satisfactory, and even the industry giant Binance is struggling.

- Bybit: 20 new coins were listed, with an average return of -0.09, a median of -0.156, and a variance of 0.165. The volatility is relatively large, indicating that the market sentiment is extremely unstable. Bybit's new coins overall have a negative performance, but there are still short-term opportunities in the volatility. The market seems to have given Bybit's projects a certain amount of hype space, but this high volatility is often accompanied by high risk.

- Coinbase: 11 new coins were listed, with an average return of 0.0049, a median of -0.0077, and a variance of 0.124. Although the performance is average, the earnings are close to zero, reflecting that investors are relatively conservative about the confidence in the projects listed on the Coinbase platform. Although Coinbase has high regulatory compliance, the market seems to have low expectations for its short-term earnings potential.

- OKX: 9 new coins were listed, with an average return of -0.094, a median of -0.174, and a variance of 0.296. OKX's performance is similar to Bybit, with high project volatility, and investors' sentiment seems to be more driven by market speculation. Although short-term opportunities are frequent, the overall downward pressure is huge.

- Upbit: 4 new coins were listed, with an average return of 0.118, a median of -0.039, and a variance of 0.155. Upbit's performance is relatively stable. Although the sample size is small, its token performance is better, worthy of investors' attention. Compared to other platforms, Upbit's token volatility exists, but the drawdown is relatively small.

- Binance: 10 new coins were listed, with an average return of -0.229, a median of -0.224, and a variance of 0.033. This result is shocking, Binance's new coins have almost all failed, with persistently poor performance, lack of market enthusiasm, and even low volatility, reflecting investors' lack of confidence in Binance's projects.

The data shows that the choice of exchange has a crucial impact on investor returns.

Take Bybit and OKX as examples, although these two platforms have listed a large number of tokens, the average return is negative, and the market risk is obvious.

As a retail investor, if you invest the same amount of capital in each coin,your investment on Bybit and OKX will lose nearly 10%.

In comparison, Coinbase and Upbit's performance is more stable.

Coinbase's earnings are less than 1%, but the performance is relatively stable.

AndUpbit's earnings are as high as 20%, which may be related to its stricter project screening standards.

But the most surprising thing is that if you bought these new coins onBinance, theaverage loss is as high as 22.9%.

Altcoin Market: Liquidity Dilemma

If the mainstream coins are the pillars of the crypto world, altcoins have always played the role of "adventure paradise". However, the liquidity dilemma in the altcoin market has recently sparked a lot of discussion.The data shows that the market share of BTC has recently hit a new high, with BTC sucking up the gains, while the liquidity of altcoins is still depleted. The performance of most new coins after listing is weak, with high volatility but insufficient trading volume and depth. This reflects the outflow of funds from the market.

High leverage and high volatility seem to have become the "selling point" of altcoins, but the problem is that there is less and less incremental capital willing to enter the market. Insufficient liquidity has led to an increase in the bid-ask spread in the token market, making it difficult for some projects to form sufficient market depth and price stability in the short term. Especially in the new coin market, although there are short-term trading opportunities, the majority of tokens are not well supported on the exchanges, and their performance is more like a "fleeting moment".

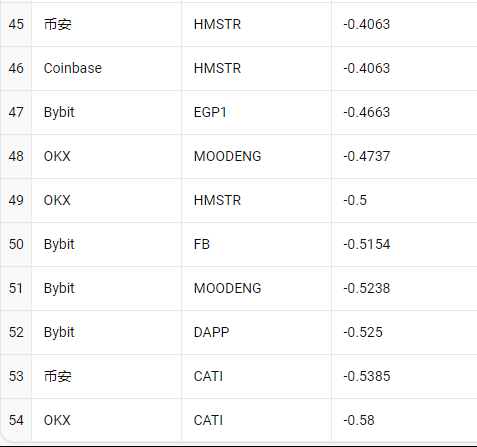

Comparing the top-performing five coins, we can find that the valuations of these projects are generally low,with their FDV (fully diluted valuation) mostly below $200 million.These tokens are mainly MEME coins, reflecting the high risk preference of current market investors. More funds have flowed into high-risk, highly speculative projects. Investors are obviously attracted to the high returns that these small-cap projects may bring when the market sentiment is high, especially in short-term speculation, low-valuation projects are more likely to attract capital for a rapid rise.

In contrast, the projects with the lowest returns generally have higher valuations, with an FDV typically over $2 billion at the time of listing.However, their circulating ratios are extremely low, leading to poor liquidity in the secondary market, and the tokens face huge selling pressure. Due to the fact that most tokens are in a locked-up state or have extremely low circulation, the buy-side in the secondary market is simply unable to absorb the selling pressure from early investors.This directly leads to a severe price drop of these tokens after listing, and investors often become the victims of the secondary market.

In addition, we noticed thatsome projects adopted the strategy of "listing futures first, then spot"when they went public. This operation model makes one question whether it is to provide a more convenient profit channel for early investors. Through this strategy, early holders can first use leverage to profit in the futures market, and then quickly cash out in the spot market after it goes live, further increasing the selling pressure in the secondary market. This unhealthy market behavior exacerbates the price decline of the tokens, especially in the case of extremely low circulation ratios, the risk borne by ordinary investors increases significantly.

The underlying reason for this phenomenon is the complex interplay between market mechanisms and investor psychology.Low-valuation projects attract a large number of short-term speculators who are more willing to take high risks to pursue short-term super profits. While high-valuation projects have become a "game of the big players", where early investors raise funds through high valuations, leaving the secondary market with tokens full of bubbles and endless selling pressure.

The valuation and circulation mechanism of the project cannot be ignored in the market. Low circulation ratio allows early investors to have absolute advantage, and they can almost completely control the price trend without sufficient liquidity support. When choosing a project, investors should not only focus on the potential and development direction of the project, but also carefully examine its FDV and circulation supply ratio to avoid the predicament of insufficient liquidity.

Mainstream Coins vs. Altcoins: Why are Bitcoin and Ethereum as Stable as Mount Tai?

Let's compare the performance of Bitcoin and Ethereum. In the past month, Bitcoin has risen 15% from its lowest point to its highest point, and if you choose to buy Bitcoin at any time point in the past month, the average increase is nearly 8%, which is in stark contrast to the dismal performance of most new coins. The reason is that market funds seem to be more inclined to flock to mature mainstream coins, especially in a risk-heightened market environment, investors are more willing to choose Bitcoin as a hedge asset.

In a market sentiment that tends to be conservative, the stability of Bitcoin and Ethereum becomes their biggest advantage. Unlike altcoins, the liquidity and market depth of mainstream coins are better guaranteed, which is why even when the overall market performance is sluggish, funds still flow in large quantities into Bitcoin and Ethereum, rather than new coins.

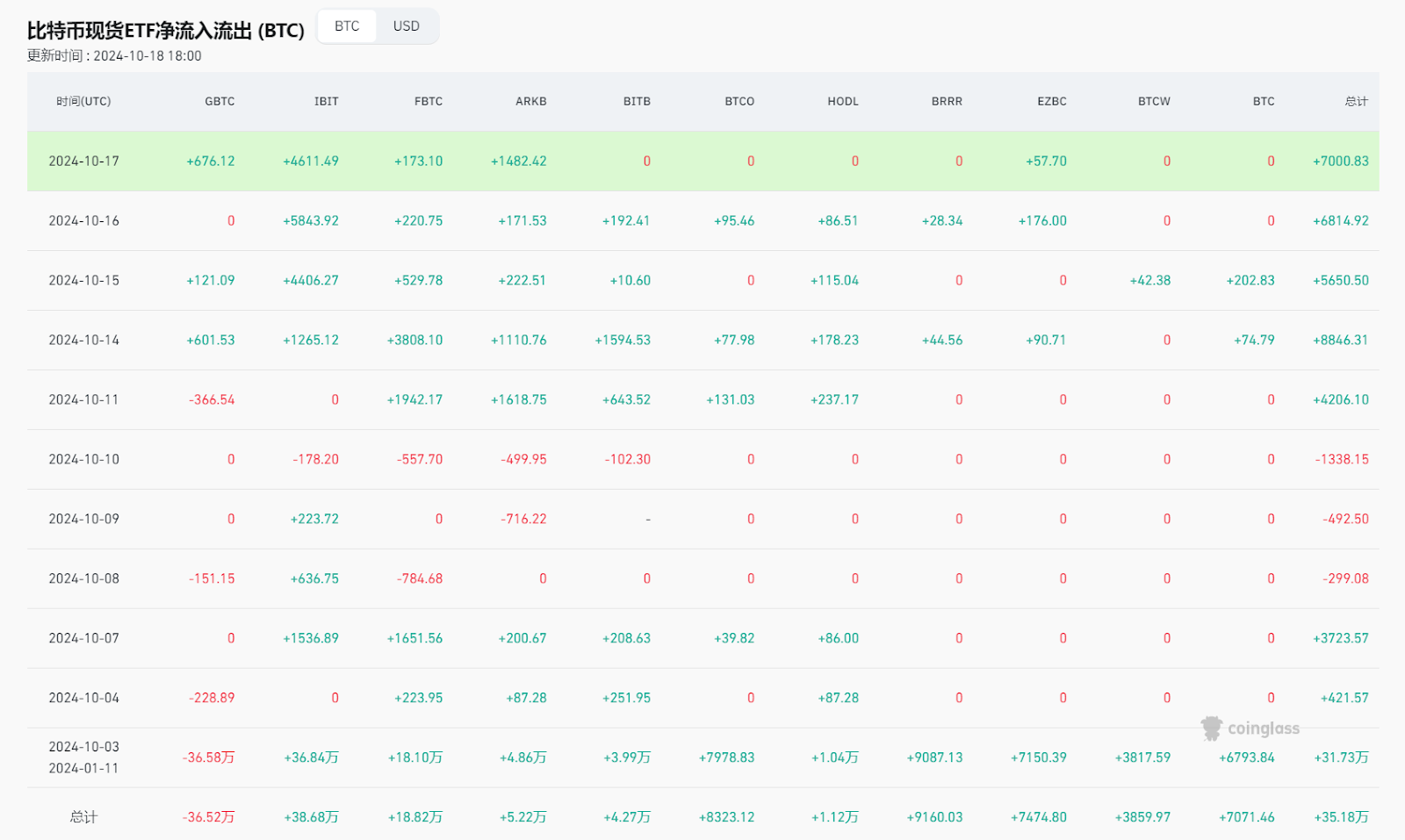

Recently, Bitcoin has broken through $68,000, driven by multiple factors, especially the strong growth in spot demand and the continuous inflow of ETF funds. Bitcoin ETFs have achieved net inflows for four consecutive days, reflecting the high recognition of institutional investors in cryptocurrencies, indicating that funds are pouring into the market on a large scale.

According to data from Coinglass, the total open interest of Bitcoin contracts on the network has reached a historical high of $39.785 billion, indicating that the market sentiment for Bitcoin is very bullish. This influx of funds also suggests that Bitcoin may once again challenge the historical high of $73,790.

In addition, the upcoming U.S. election may become the next important catalyst for Bitcoin and cryptocurrencies. The continued rise of Bitcoin is not only due to its large market capitalization and mature market, but also because of its "digital gold" status, making it the preferred choice for institutional investors. Ethereum, on the other hand, continues to consolidate its position in the market with its DeFi and Layer 2 innovative ecosystem.

Summary

It must be said that at this moment, I must be deeply saddened, because what most retail investors hold are often those altcoins that have been heavily promoted by various institutions. On the one hand, there is the institution's push, and on the other hand, there is the ruthless market correction, and altcoins have become the place where many retail investors' dreams are shattered.

From the data analysis, the performance of new coins on the five major exchanges is generally lower than expected, and the market sentiment for investing in altcoins has clearly cooled down. In stark contrast, mainstream assets like Bitcoin and Ethereum have shown strong risk-resistance capabilities, remaining as solid as a rock in the market turmoil.

In the long run, the healthy development of the market cannot be separated from a transparent and fair issuance mechanism. Investors not only need to focus on the fundamentals of the project, but also need to deeply understand the token economics of the project, in order to stand firm in this uncertain cryptocurrency market. Avoiding those opaque token distribution mechanisms and being wary of projects with low circulation rates, these are the basic rules for investors to survive in this complex market.

This market will never show mercy to those blindly chasing the trend speculators. Only by thinking deeply and carefully selecting, can one truly be at ease in this volatile cryptocurrency world.