The sharp rise in Solana network activity and the outstanding performance of memecoins have driven SOL to $180.

Solana's native token SOL has risen 12.1% from October 11 to October 18, with data showing that the upward momentum is partly driven by demand for memecoins. The increased demand means increased network capacity, fees, and total locked value (TVL).

Traders are currently debating whether the memecoin frenzy is sustainable and how SOL's price can continue to benefit from the surge in network activity.

While the surge in memecoin demand has no fundamental reason, influential social media accounts have clearly drawn traders' attention to the tokens. Take this post by pwnlord69 on October 12 as an example.

Driven by rumors of an upcoming AI bot, the meme coin Goatseus Maximus (GOAT) has soared to a market cap of $400 million in a week. In fact, the bot only promoted the GOAT token, which was launched using Pump.fun, a decentralized application for managing the technical aspects and liquidity supply of Solana tokens on the Raydium exchange.

Several other memecoins on the Solana network have also seen significant price increases in October, with SPX6900 (SPX) up 379%, Apu Apustaja (APU) up 170%, and FWOG up 134%. According to data from Cryptorank.io, PUPS and MAGA (TRUMP) also recorded notable gains of over 90%. As the value of these memecoins has risen, they have attracted more attention from social networks and media, creating a positive feedback loop.

Solana network activity supports higher SOL prices

However, the key question is whether this initiative will have a significant impact on SOL's price and how the network's performance compares to its competitors. A key indicator in this analysis is the total locked value (TVL), which measures the total funds deposited in the network's smart contracts.

Solana's total deposits have recently soared to their highest level in two years, approaching 41 million SOL, up 13% quarter-on-quarter. In contrast, Ethereum's TVL has remained stable at 17.7 million ETH, while BNB Chain's TVL has also stagnated at 7.9 million BNB. Highlights on the Solana network include Raydium (deposits up 70% in the past 30 days) and Sanctum (TVL up 32%).

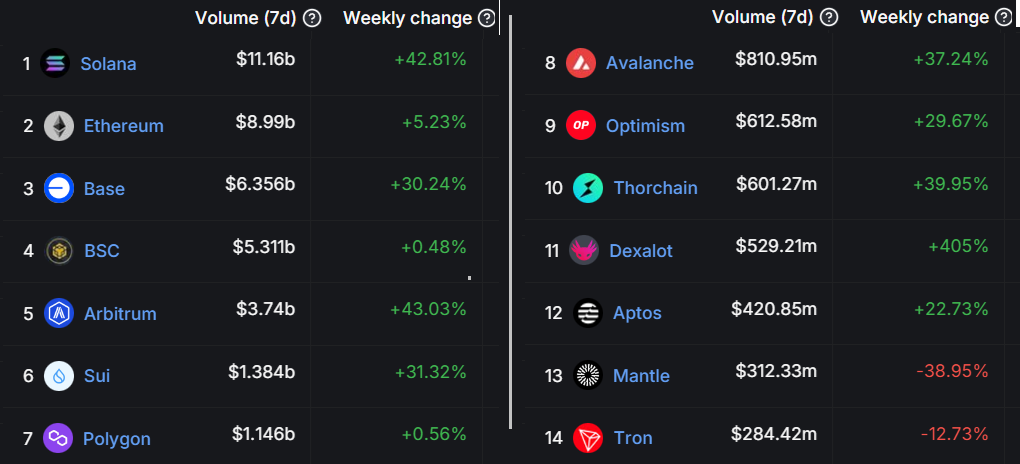

Measuring deposits is important, but to truly measure demand for SOL, on-chain activity must be analyzed. For example, decentralized exchanges (DEXs) can record high trading volumes without having a significant TVL. In this context, Solana's impressive network activity has recently consolidated its leading position, surpassing Ethereum in the past week.

Solana's DEX trading volume has grown 43% week-over-week, outperforming its direct competitors. Notably, even Ethereum's Layer 2 solutions, which benefit from lower transaction fees, cannot match Solana's performance. For example, Arbitrum's weekly trading volume of $37.4 billion is still 64% lower than Solana's $111.6 billion.

While it is difficult to predict whether the memecoin surge will continue, the data suggests that given the network's competitive advantage of high validator capacity, a SOL price of $180 is reasonable. Ultimately, Solana appears to be in a favorable position to grow in areas such as AI infrastructure, Web3 applications, gaming, and prediction markets.