Recently, Christopher Waller, the Governor of the Federal Reserve of the United States, emphasized that effectively managed stablecoins can bring many benefits to the current financial system.

"Stablecoins can reduce the need for payment intermediaries, thereby lowering global payment costs."

However, he also warned that "the safety of stablecoins is not a given."

"If appropriate safeguards can be established to minimize risks, including preventing their use for illicit financial purposes, stablecoins could become a useful tool in the payments realm and serve as a safe asset on many new trading platforms."

Waller also believes that decentralized finance can form a symbiotic relationship with traditional finance, rather than completely replacing it. This view has been expressed by some U.S. lawmakers, who believe that DeFi and dollar-pegged stablecoins could prolong the dominance of the U.S. dollar for decades to come.

On June 14, former U.S. House Speaker Paul Ryan published an article in The Wall Street Journal, highlighting how stablecoins can help mitigate the looming debt crisis.

Ryan pointed out that stablecoins can create demand for U.S. Treasury bonds and the U.S. dollar, helping the dollar maintain its competitiveness against the Chinese renminbi and protect its status as a global reserve currency.

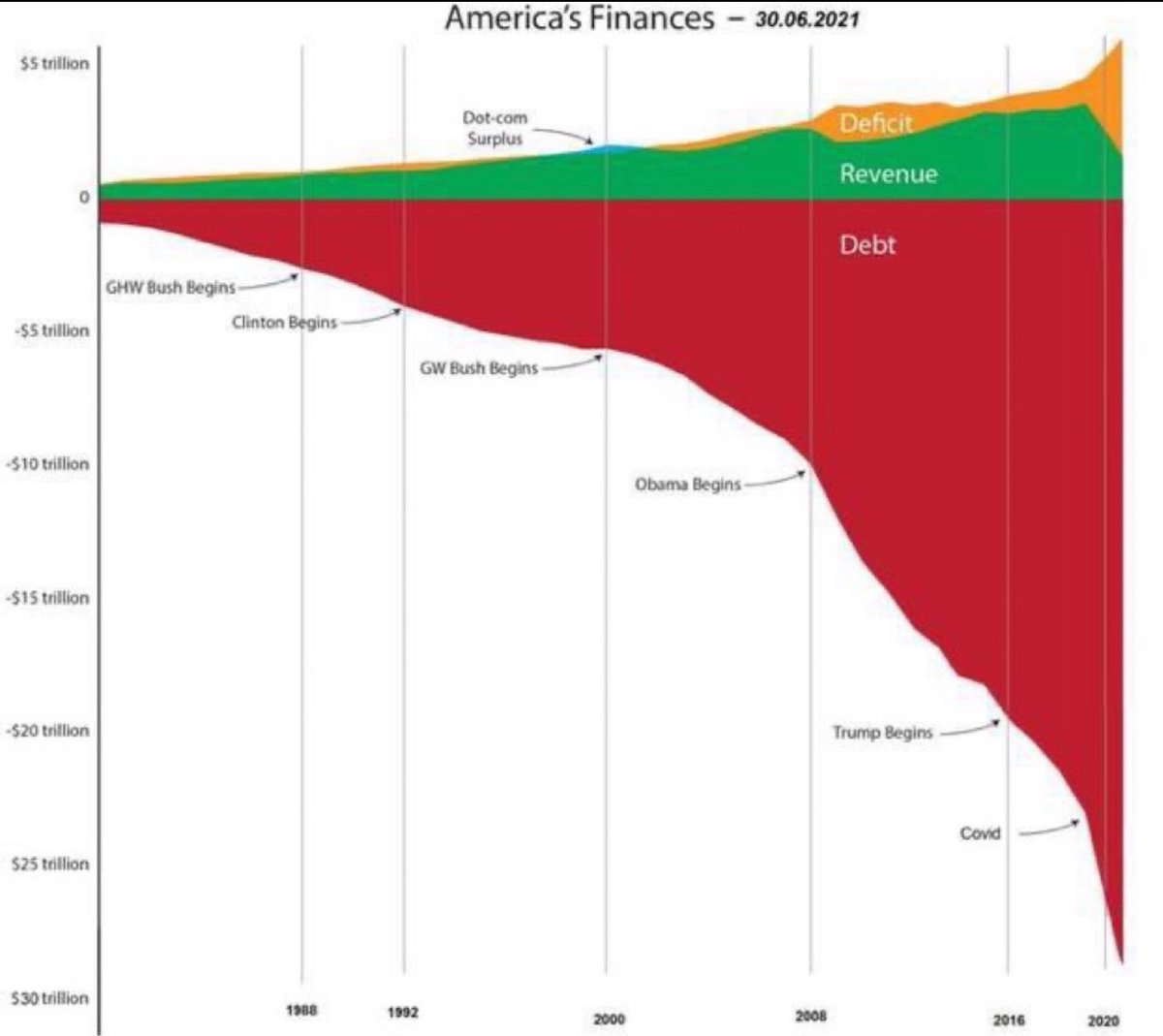

U.S. government debt is on the rise. Source: Toby Cunningham

Recently, in October, U.S. Senator Bill Hagerty introduced the Stablecoin Transparency Act, based on Representative Patrick McHenry's 2023 stablecoin bill. Notable changes in the bill include provisions for state-level stablecoin regulation and the removal of a clause from the 2023 version that defined stablecoins as securities.

Despite these efforts, a recent report from Chainalysis shows that the U.S. is lagging in stablecoin adoption. According to Chainalysis, the market share of stablecoin transactions on U.S.-regulated exchanges has dropped below 40% in 2024, while the share of stablecoin transactions through foreign exchanges has risen to 60% this year.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Itadori

According to Cointelegraph