The market is not as optimistic as many people want, but it is also not as pessimistic as some people think. No one could have foreseen that the crypto market would continue to decline for a full six months starting from March this year. It once fell to the point where some investors couldn't help but swear, cursing the sky, the earth, and the exchanges. It once fell to the point where a certain ancient OG predicted that one should be prepared for an 18-month protracted battle, and it once fell to the point where some whales tweeted to give up on the crypto circle and called for more people to go all-in on the A-shares.

Will there be an Altcoin season again? Whenever the market is in doubt, it is precisely the bottom area of the market. The answer from history always echoes: there will be.

History is also surprisingly similar. In 2023, the market also began to calm down in the middle of the year, until it took off again starting from October last year. This year is the same. Interestingly, some funds seem to be smart, as if they have smelled the scent and have quickly deployed in advance. As a result, the market saw an early and substantial rise at the end of September. After a brief pullback in early October, the "October bull run" self-fulfilling prophecy was realized again. The market has risen again from the short-term $52,000 level to $68,000, about $6,000 away from the historical high. Even the much-maligned Altcoins have also seen substantial gains, some even doubling or tripling from the bottom.

After waiting for half a year, has the bull market arrived?

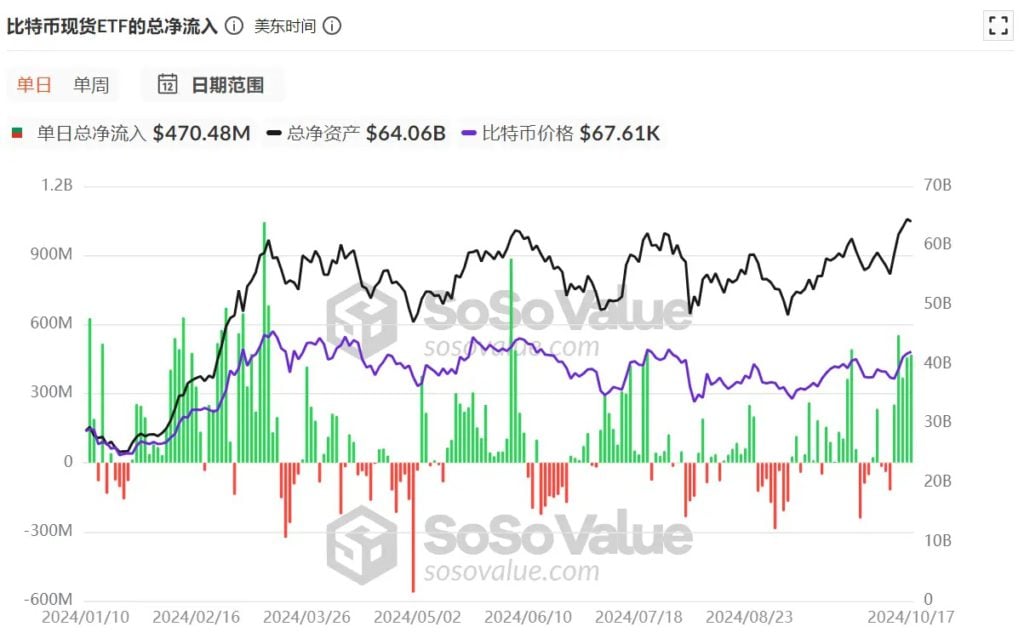

Continuous large inflows of BTC spot ETF data

The data of BTC spot ETFs represents the actual purchase volume of off-exchange funds. It is different from our personal trading, as it represents the willingness of some people to pay a commission to have someone else buy BTC for them. Looking at the historical chart, when the net inflow is large, the buying pressure is strong, and BTC prices tend to rise. When the net outflow is large, the price tends to fall.

Since the spot ETF officially went live, the total net inflow has reached $20.66 billion. It is worth noting that from October 1st to date, there have been 6 days of net outflows, but 7 days of net inflows, and the net inflow amounts are not small. On October 14th, the net inflow exceeded $555 million, on October 16th and 17th, the net inflow exceeded $450 million, and on October 15th, the net inflow exceeded $370 million.

Although in terms of the number of days, the net inflows and net outflows are roughly equal, the net outflow amounts are small, while the net inflow amounts are often several times the net outflow.

Even the unpopular Ethereum spot ETF has seen a rare single-day net inflow of $48.41 million since October.

The off-exchange purchasing power remains quite strong.

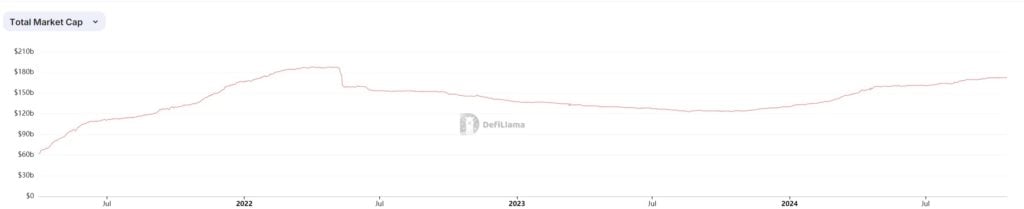

Stablecoin market cap is approaching historical highs

The change in the total stablecoin market cap represents the size of capital inflows and outflows. Although the market has fluctuated up and down over the past few years, with capital flowing in and out, when we zoom out our perspective, it is difficult to be pessimistic.

The total stablecoin market cap reached a historical high of $186.3 billion in mid-2022, and then continued to decline, but overall has remained above $120 billion. Fast forward to October 2023, capital inflows have been accelerating, and the current total stablecoin market cap has exceeded $172.3 billion, just a stone's throw away from the historical high.

Unrealized BTC net profit shows that most players are in profit

The BTC unrealized net profit/loss is a metric that mainly measures the profit/loss situation of players on the BTC chain. We can see that the color of the rows from top to bottom is red, orange, light yellow, gray-white, and light blue. The bottom blue represents that most people are in loss and have cut their losses, while the top red represents that most players are in profit.

When the line chart is in the light blue area, it is often the bottom range of the BTC price, because those who have suffered losses are constantly leaving the market to build a bottom, and when the line chart is in the yellow or red area, it is often the top range of the BTC price, most people will choose to take profits and leave the market after making a profit, resulting in the top of the cycle. The cycle goes on and on.

From the line chart, the market has climbed back from the light-colored area to the yellow area. According to data disclosed by IntoTheBlock, 95% of BTC addresses have now realized profits, and market sentiment has clearly improved.

Historically, this level often foreshadows a strong bullish trend, but it may also represent potential overexpansion.

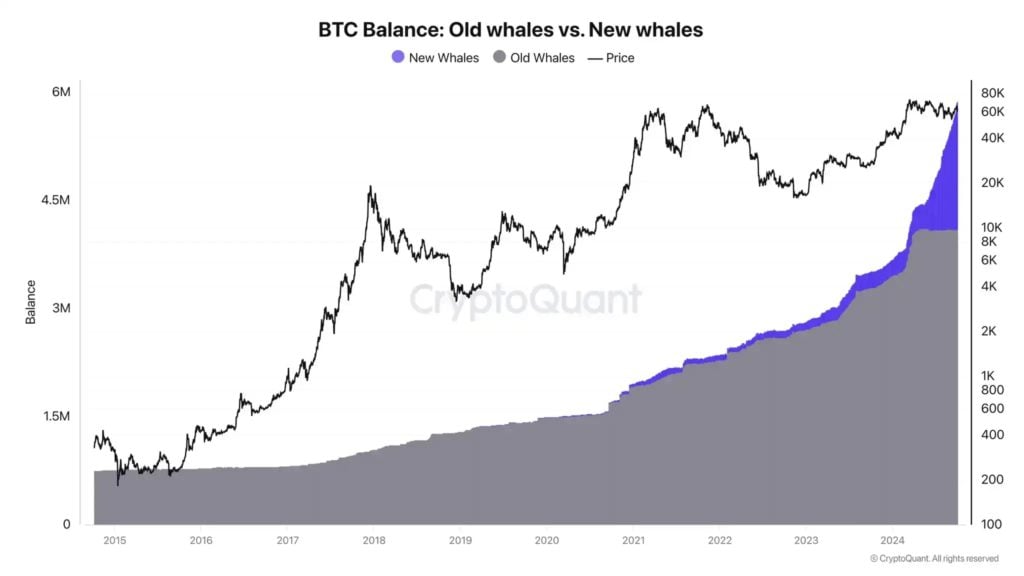

Long-term BTC Holders are Continuously Buying

The long-term holder volume mainly shows the total BTC supply held by long-term holders. The long-term holders here specifically refer to addresses that have held BTC for more than 155 days.

The chart shows that whenever the BTC price reaches a top, the number of addresses held by long-term BTC holders decreases. This is because smart money always chooses to take profits and leave the market when the price is at its peak. After the decline, they will accumulate BTC again, and when the price rises to a high point, they will sell again, repeating the cycle.

The chart shows that since the end of July this year, this group of long-term holders has re-entered the buying mode, and the right-side line chart appears quite steep. Apparently, these smart money are optimistic about the future market outlook.

It is worth mentioning that according to CryptoQuant data, new whale addresses are hoarding BTC in an almost crazy manner. The founder Ki Young Ju said that the BTC market has never seen such hoarding behavior. Some believe that the new whales are mainly due to the inflow of ETF, but the recent hoarding behavior shows that these new whale addresses have almost no correlation with ETF.

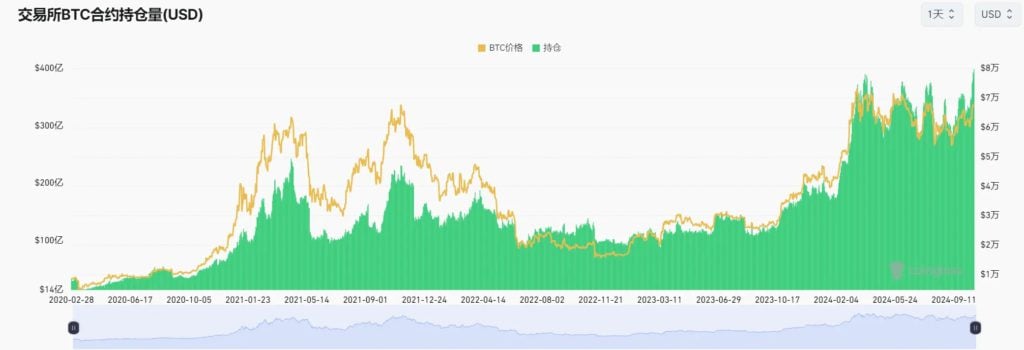

The Total Open Interest of BTC Contracts Reaches a New High

Today, according to Coinglass data, the total open interest of BTC contracts has risen to over $39.7 billion, setting a new record high.

Contract data often represents the market's view on the future trend. It often lags behind the performance of the BTC spot price, and because of this, when the market is extremely optimistic about the short-term trend, it is also easy to welcome a correction, washing chips and leverage.

It is worth noting that over the past half year, the open interest of BTC contracts has remained at a relatively high level. This new high data has broken the over $38 billion data at the beginning of this year for the first time. The market's optimistic sentiment has clearly risen.

Summary

From a macro perspective, the US Federal Reserve will cut interest rates in November and December, and some global liquidity will continue to flow into risk assets, making the crypto market more liquid. A series of on-chain indicators show that the market is constantly warming up and capital is flowing in.

"The market is always born in despair, grows in half-belief, matures in aspiration, and perishes in hope."

Perhaps, after nearly half a year of waiting, a new round of crypto market bull market is ready to take off.