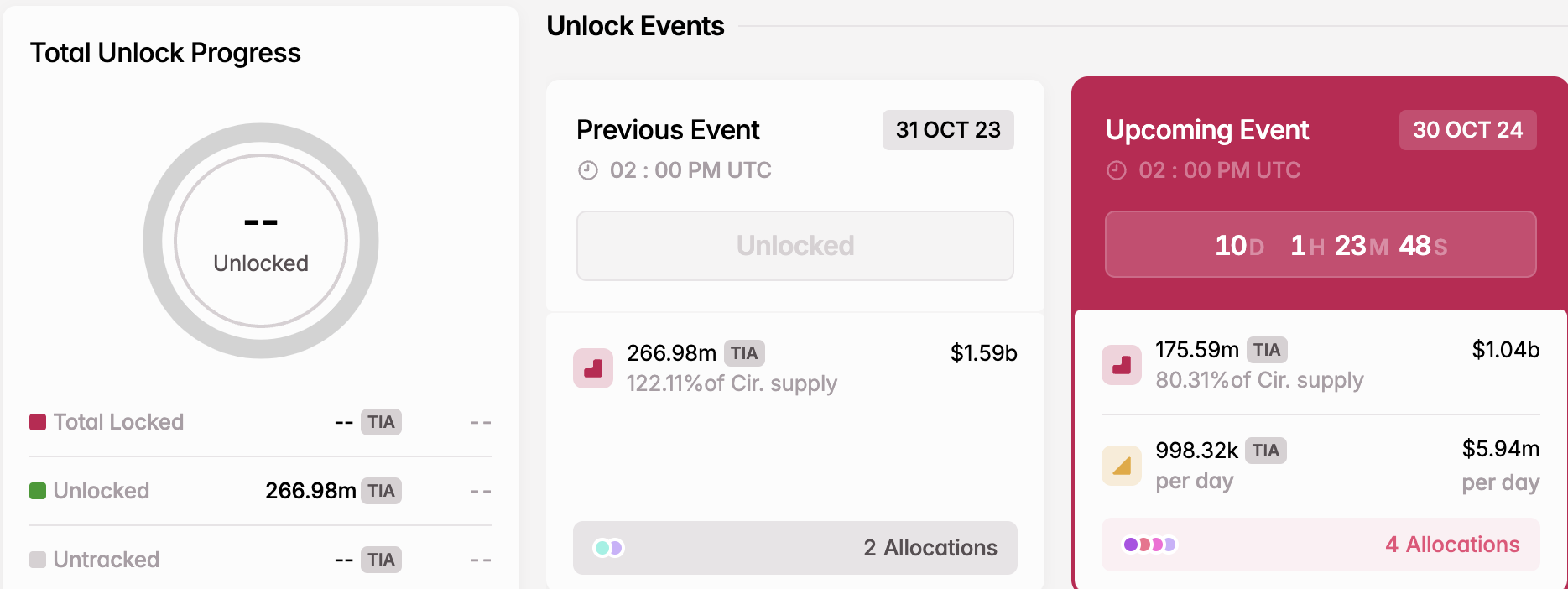

In 10 days, the modular blockchain project Celestia (TIA) is expected to release 80.77% of its circulating supply, valued at $1.05 billion. This token release could trigger selling pressure and impact TIA's price.

BeInCrypto explores how this altcoin, which has seen significant price volatility in recent days, might perform ahead of the event.

TIA Faces Selling Pressure as Massive Token Unlock Approaches

For Celestia, this token release represents one of the largest since the project's inception. Consequently, TIA's price is expected to experience substantial volatility leading up to the event.

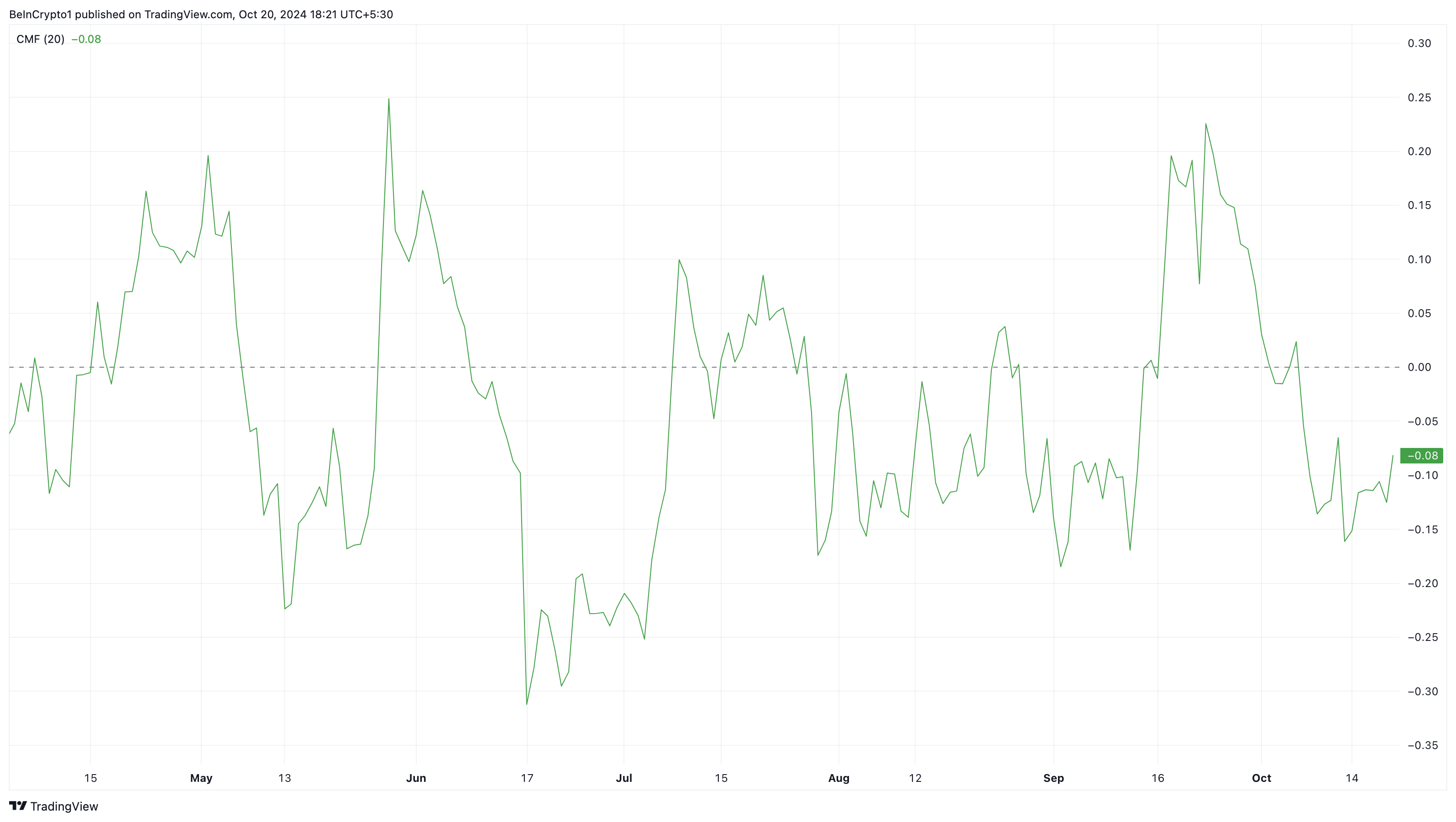

Currently, Celestia's price is $5.95, and it has maintained this range for a certain period. However, according to the Chaikin Money Flow (CMF) signal, the price of this altcoin could drop below $5.

Read more: Top 5 Blockchain Security Protocols

CMF is a volume-weighted indicator that tracks the flow of funds into and out of a cryptocurrency over a certain period. It is generally used to identify trends, detect potential reversals, and assess overbought or oversold conditions.

Additionally, this indicator oscillates above and below 0, with positive values indicating an uptrend and negative values indicating a downtrend. As shown below, the CMF value is in the negative territory, suggesting that TIA's price could soon experience a significant decline.

TIA Price Prediction: Selling Pressure to Drive Price Below $4

From a technical perspective, the TIA/USD chart displays the formation of a head and shoulders pattern. This pattern, where the cryptocurrency's price movement creates a chart formation resembling a head and shoulders, signals a potential trend reversal from bullish to bearish.

Generally, if the asset's price falls below the pattern's neckline, a significant correction is expected. Conversely, if it rises above the neckline, this prediction would be invalidated. According to the chart below, Celestia's price is likely to drop below the $4.73 neckline.

If this occurs, the token's value could decline to $3.87. However, if the bulls manage to defend the drop below $4.73, this decline may not materialize.

Read more: Top 10 Altcoin Exchanges in 2024

In that case, TIA could rise to $7.30, and if buying pressure increases after the supply shock, the altcoin could reach $10.40.