Author: Yashu Gola, CoinTelegraph; Translator: Bai Shui, Jinse Finance

As of 2024, the price of BTC has risen 55%, with a 12.50% increase in October. Better-than-expected Wall Street earnings have driven an overall improvement in risk sentiment, fueling the recent rally in the stock.

BTC/USD daily price chart. Source: TradingView

Additionally, investors are increasingly considering the possibility of a Federal Reserve rate cut in November, and the rising likelihood of Donald Trump, who is supportive of cryptocurrencies, winning the 2024 presidential election, further boosting optimism.

Fundamentally, Bitcoin appears to be in a favorable position to enter a bull market cycle for the remainder of 2024 and beyond. At the same time, certain technical and on-chain indicators also point to a similar upward outlook.

Bitcoin Price to Reach $100,000 by 2025

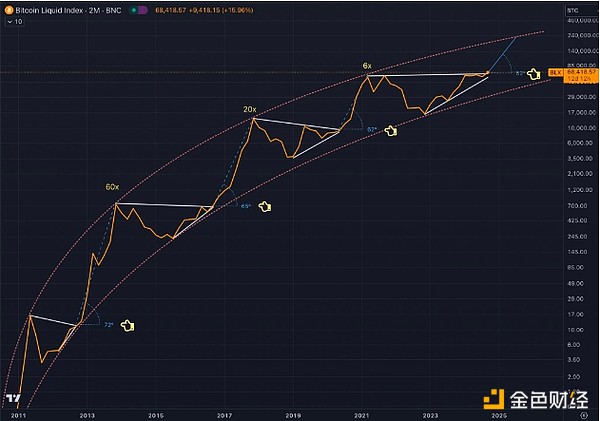

The first sign of Bitcoin entering a new bull market cycle comes from its two-month logarithmic chart, shared by independent market analyst Coosh Alemzadeh on X.

The chart marks the historical bullish phases of Bitcoin, such as a 60-fold increase around 2011, a 20-fold increase in 2017, and a 6-fold increase during the 2020-2021 bull market.

These phases follow a pattern: Bitcoin's price first consolidates, then experiences a significant, almost vertical surge.

BTC/USD two-month price chart. Source: Coosh Alemzadeh

As of October 2024, Bitcoin is showing signs of breaking out of its long-term consolidation phase, which typically marks the beginning of a bull market within the parabolic channel denoted by the two red dotted lines.

Market analyst Ted Pillows echoes this view, highlighting a similar breakout of Bitcoin's consolidation channel.

Bitcoin/USD weekly price chart. Source: Ted Pillows

He believes that Bitcoin's "parabolic phase" has begun, consistent with the historical pattern of rapid price acceleration.

Alemzadeh's analysis predicts that Bitcoin will rise above $100,000 by 2025 and reach $250,000 in the long term.

Bitcoin Whale Data Signals Bullish Rebound

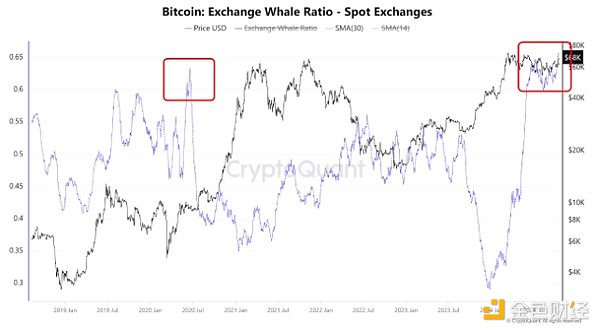

Another bullish signal for Bitcoin comes from on-chain data tracking the activity of whales on spot exchanges.

The "Exchange Whale Ratio" represented by the 30-day moving average currently reflects the pattern last observed after the 2020 crash. In this case, whales have been actively accumulating Bitcoin, followed by a large-scale bull market that pushed Bitcoin to new all-time highs by the end of 2021.

Bitcoin Exchange Whale Ratio. Source: CryptoQuant

As of October 2024, a similar whale accumulation pattern suggests that large holders are preparing for a potential price increase, as CryptoQuant analyst Woominkyu points out:

"They (whales) may benefit from the potential long-term price increase after the next Bitcoin halving."

Stablecoin Dominance Declining

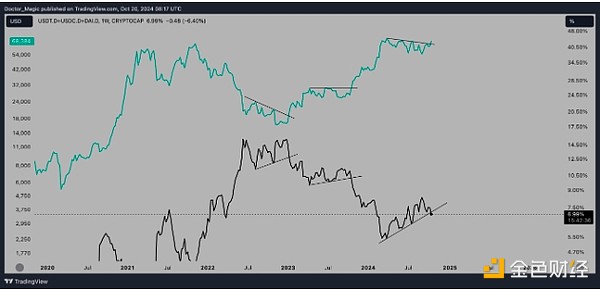

The third indicator focuses on the declining dominance of stablecoins. Market analyst Doctor Magic notes that the dominance of stablecoins such as USDT, USDC, and Dai has been steadily declining since mid-2024.

Historically, when capital starts to flow out of stablecoins, it is a precursor to a significant price increase in top cryptocurrencies, including Bitcoin, as shown below.

Stablecoin market cap (black) vs. BTC/USD (green) weekly chart. Source: Doctor Magic

In other words, the decline in stablecoin dominance suggests that investors expect Bitcoin's value to appreciate relative to the US dollar. The strengthening of the US dollar reflects an increasing risk appetite and confidence in the market.

If this trend continues, it could strongly indicate that Bitcoin's parabolic phase has begun, as more liquidity flows back into Bitcoin, driving its price higher.