The $120 billion USDT market cap may spill over to Bitcoin and Ethereum, ending its 7-month downtrend and saving the "Uptober" narrative.

Tether's US dollar-pegged stablecoin market cap has hit a record high of over $120 billion, signaling a potential crypto rebound.

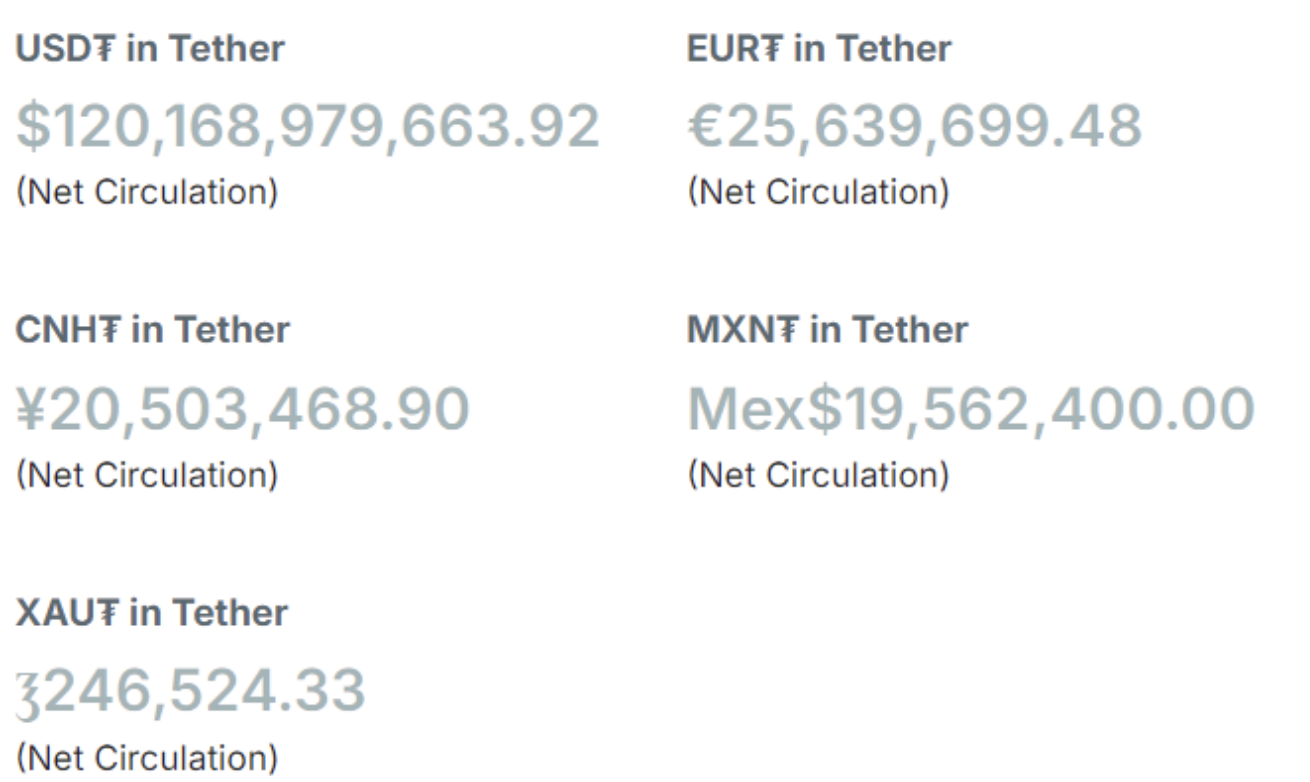

According to real-time updates on the company's website on the stablecoin supply, Tether's USDT, the world's largest stablecoin, surpassed the $120 billion market cap milestone on October 20.

Tether tokens in circulation. Source: Tether.to

Stablecoins are the primary gateway between fiat currency and digital assets. Increases in stablecoin supply are often used as a signal to predict an impending bullish rebound, as it indicates investors are heavily buying stablecoins before investing in cryptocurrencies.

The continuously growing USDT supply may help catalyze the next Bitcoin BTC price rebound. In August, after Bitcoin price fell to a 5-month low above $49,500 on August 5, Tether minted $1.3 billion USDT within 5 days.

By August 9, the $1.3 billion USDT helped Bitcoin rebound over 21% from the August 5 market bottom, trading at $60,271.

Can the $120 billion USDT catalyze a Bitcoin "Uptober" rebound?

Tether's growing stablecoin supply may catalyze the next "Uptober" rebound (crypto slang for October), as historically, this month has been favorable for Bitcoin prices.

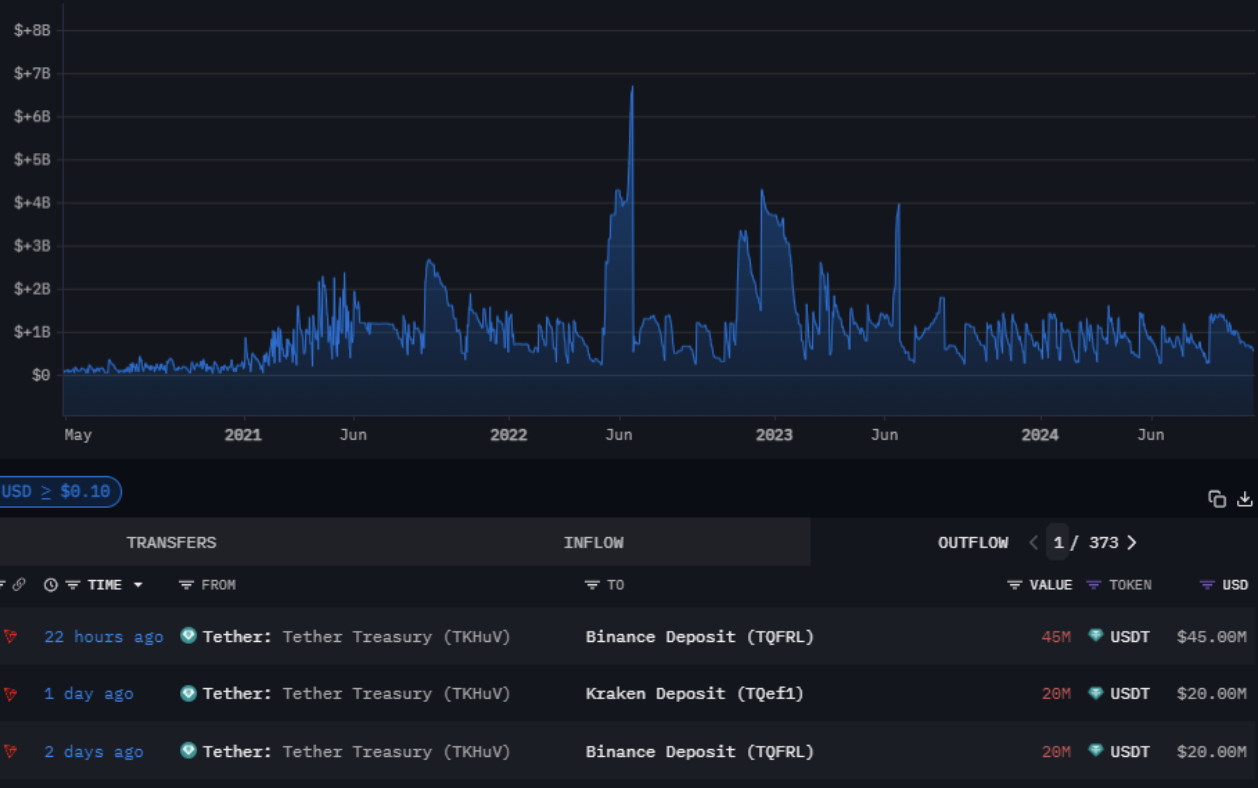

Looking at Tether's capital flows, a significant portion of funds have been sent to some of the largest centralized exchanges (CEXs), indicating buying pressure from investors is imminent.

Data from Arkham Intelligence shows that in the past 48 hours, Tether has sent over $66 million worth of stablecoins to Binance and over $20 million USDT to the Kraken exchange.

Tether capital outflows. Source: Arkham Intelligence

Conversely, insufficient stablecoin inflows typically lead to adjustments in the crypto market. On August 12, as institutions temporarily halted USDT purchases, Bitcoin price fell below the $60,000 psychological level, retracing nearly 4%.

Can Bitcoin break out before the end of October?

Based on historical chart patterns, some analysts expect Bitcoin to rebound to $92,000 within three months after experiencing the downtrend in September.

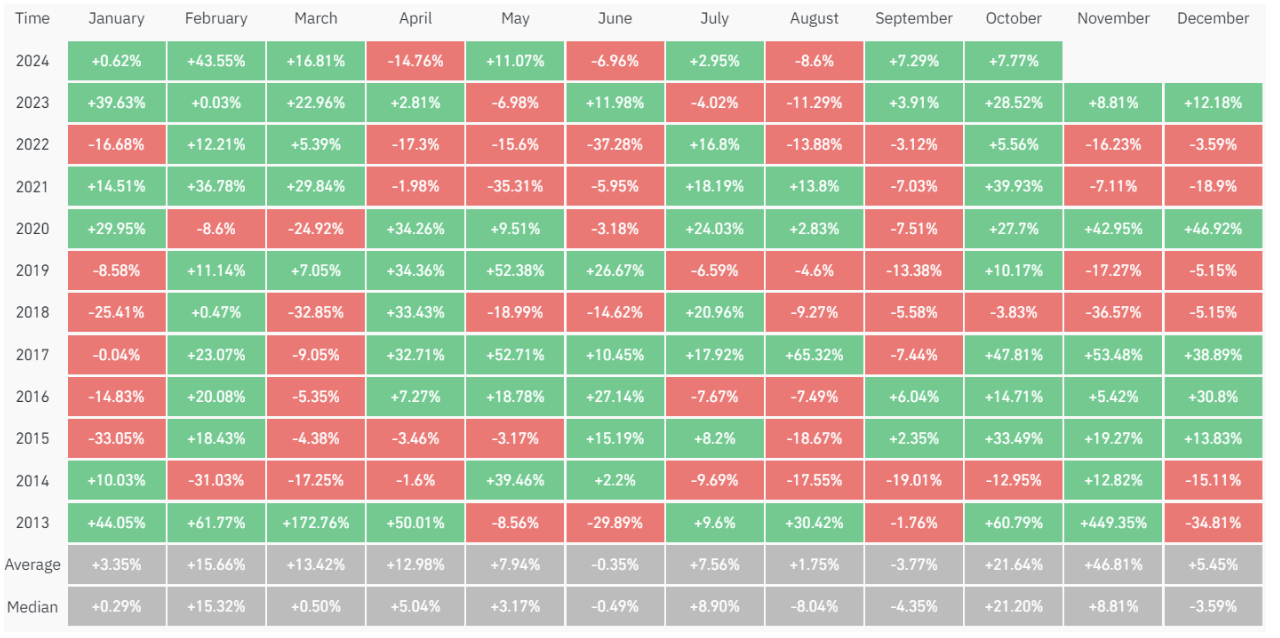

According to CoinGlass data, October is the second-best month historically for Bitcoin prices, with an average return of 21%, second only to November, which has an average monthly return of over 46%.

Bitcoin monthly returns. Source: CoinGlass

In the year leading up to Bitcoin's 2020 halving, Bitcoin prices rose over 27% in October and over 42% in November, with this rally lasting six months until March 2021.

According to renowned crypto analyst Rekt Capital, for Bitcoin to confirm a potential breakout from its current "crab walk", the weekly close needs to be above $68,700.

BTC/USD, 1 week chart. Source: Rekt Capital

The continuous growth in Bitcoin ETF inflows may also help facilitate Bitcoin's potential breakout. On October 17, the total net inflows to Bitcoin ETFs surpassed a record $20 billion, just 10 months after their launch.

In comparison, it took the gold ETF nearly 5 years to cross this $20 billion milestone.