October 21 update: According to TechCrunch founder Michael Arrington, "payment giant Stripe has acquired the stablecoin platform Bridge for $1.1 billion." The Block stated that "Bridge is Stripe's largest acquisition to date and the largest acquisition in Web3 history." In October, Stripe officially launched and supported USDC payments, accepting stablecoin payments from over 150 countries, with buyers able to pay USDC from the Ethereum, Solana, and Polygon chains.

This article was originally published on August 30, 2024, with the original title: "Raising $58 million, how does Bridge build the Web3 version of Stripe?"

Author: Karen, Foresight News

This week, Bridge announced the completion of a $58 million funding round, with support from investment institutions including Sequoia Capital, Ribbit Capital, Index Ventures, Haun Ventures, and 1confirmation.

In fact, Bridge has been building for more than two years. The two co-founders of Bridge have deep backgrounds in companies like Coinbase and other well-known fintech companies. CEO Zach Abrams was previously the Chief Product Officer at fintech company Brex, the Consumer Lead at Coinbase, and the General Manager at Square. CTO Sean Yu has served as a senior engineer or engineering manager at Airbnb, Coinbase, Doordash, and Square.

It is worth mentioning that, according to Techcrunch, these two founders co-founded the P2P payment platform Evenly in 2012, which was dedicated to simplifying the payment process between friends to split bills and other expenses. The following year, Evenly was acquired by Square, further validating their innovation and strength in the payment field.

Bridge - The Web3 Version of Stripe

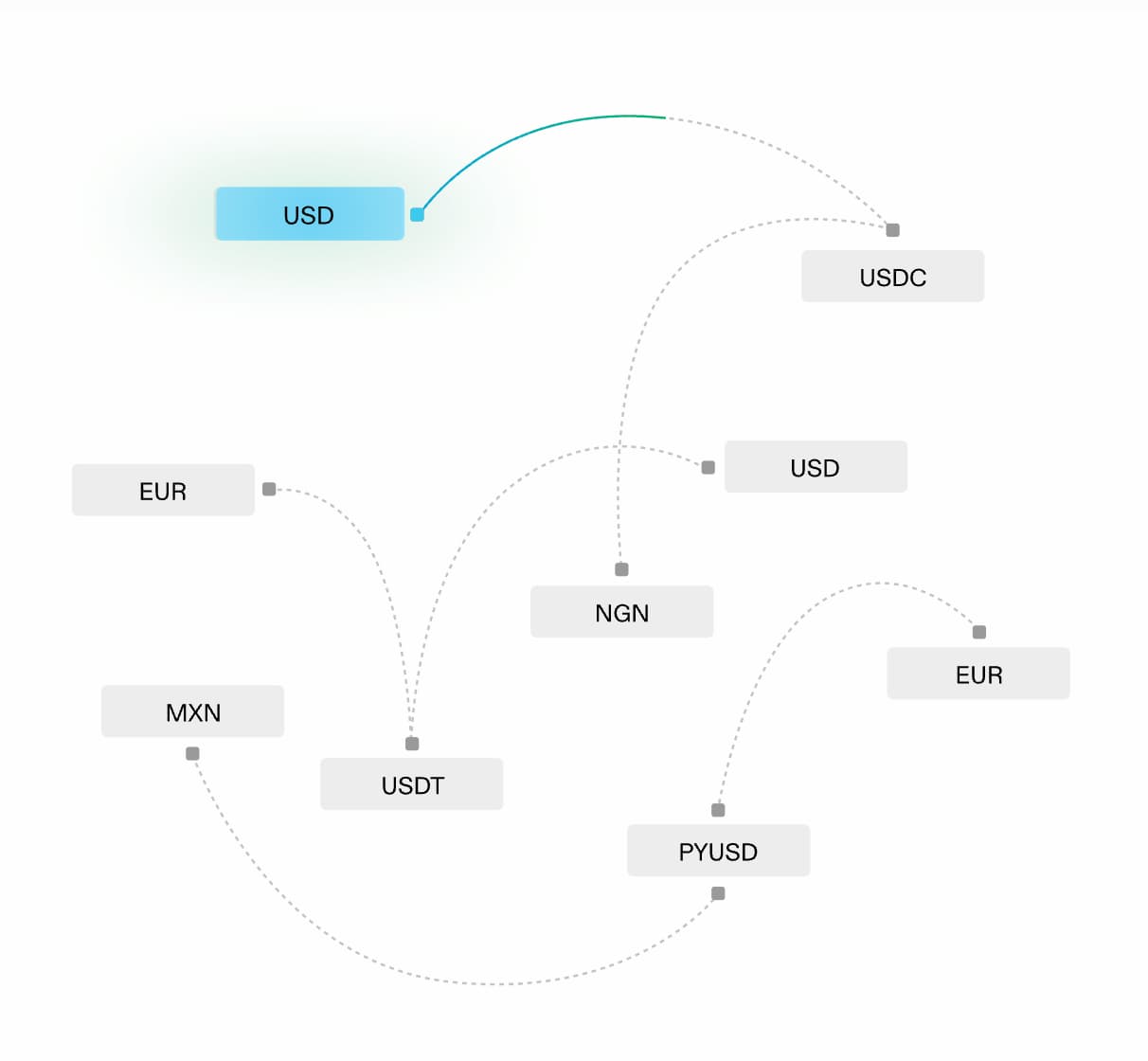

Bridge can be seen as the Web3 version of Stripe, using a simple and easy-to-use API interface to help businesses easily cross the threshold of stablecoin adoption, making stablecoin transfers and receipts more convenient and low-cost. Whether it's integrating stablecoin payments, helping businesses issue their own stablecoins, or achieving efficient cross-border fund transfers, Bridge provides comprehensive support and solutions.

Bridge's Orchestration API and Issuance API provide a relatively convenient experience for businesses and developers. The former helps businesses seamlessly integrate stablecoin payments, with Bridge handling all regulatory, compliance, and technical complexities; the latter allows businesses to quickly issue their own stablecoins in a matter of minutes, while accepting US dollars, euros, USDC, USDT, or any other stablecoin, and settling funds in the company's own stablecoin, with the reserve funds able to be invested in US Treasuries to earn returns.

Bridge states that using its API can transfer funds globally in a matter of minutes, seamlessly send stablecoin payments, convert local fiat currencies to stablecoins, and provide US dollar and euro accounts for global consumers and businesses, allowing customers to save and spend in US dollars and euros.

Bridge Has Processed Over $5 Billion in Annual Payments

Bridge has attracted numerous clients, including SpaceX. According to Fortune magazine, SpaceX uses Bridge to collect payments in different jurisdictions and different currencies, and then transfer them to its global treasury through stablecoins. Bridge has also established partnerships with crypto companies like the Stellar blockchain network and the Bitcoin payment app Strike, providing infrastructure for their own stablecoin payment features. Additionally, Coinbase has adopted Bridge's services to support transfers between Tether on Tron and USDC on Base. According to statistics, Bridge has processed over $5 billion in annual payments.

@TTx0x revealed that in the past few weeks, they have spoken with 25 to 30 crypto payment companies and found that these companies are generally using or planning to use Bridge's services.

In terms of compliance, Bridge has obtained operating licenses in multiple locations globally. Fortune magazine reported that Bridge currently holds licenses in 48 states and a VASP license in Poland, and is applying for further licenses in New York, Europe, and other regions. According to Conviction, in regions where Bridge is not yet compliant, they cover a wider range of services through partnerships, such as collaborating with Bitso for B2B payments in Latin America.

Looking ahead, whether Bridge can lead the transformation of the stablecoin payment sector and inject new vitality and possibilities for stable coin and fiat currency flows in global regions, including Africa, is something we will continue to closely follow and await.