The price of ApeCoin (APE) has risen by almost 100% in the past 7 days following the announcement of Apechain and the APE staking program. However, whales are not accumulating more APE, indicating a lack of confidence in the sustainability of this price increase.

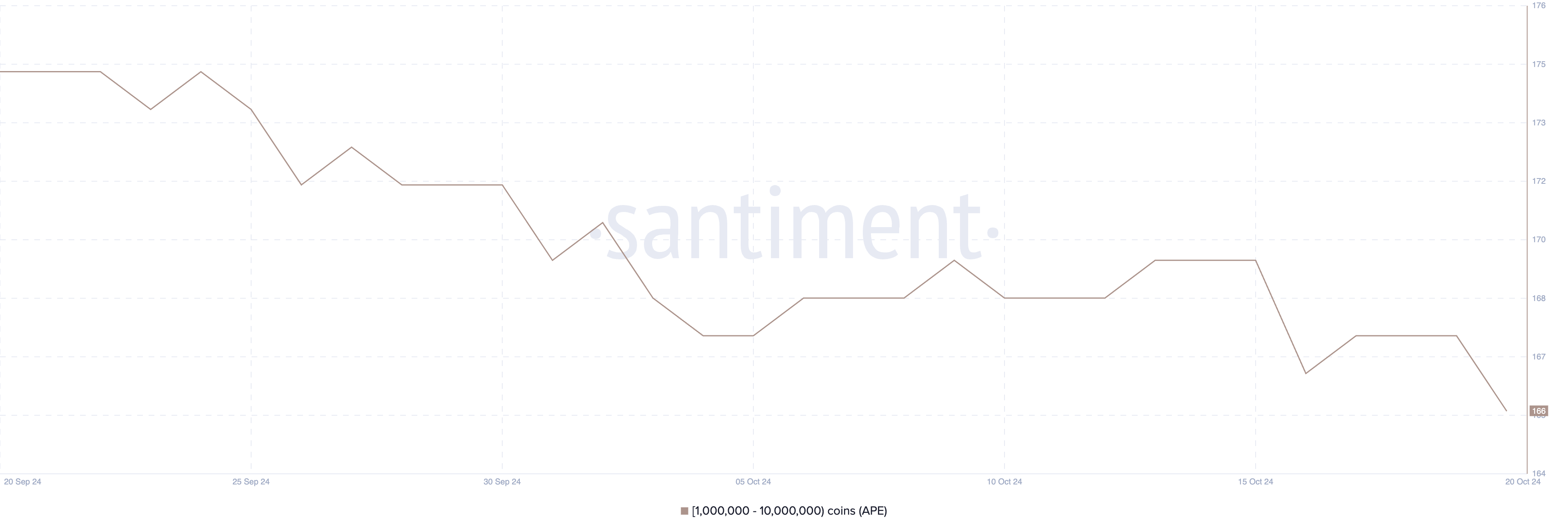

The number of wallets holding between 1 million and 10 million APE is actually decreasing, suggesting that the recent uptrend may be driven more by high interest than strong fundamentals. As APE reaches an overbought state, the possibility of a correction remains an important risk factor.

Whales are not accumulating APE

Despite the high interest in the Apechain launch, the number of wallets massively accumulating APE is not increasing. Specifically, the number of wallets holding between 1 million and 10 million APE has steadily decreased from 175 on September 20 to 166 on October 20.

This trend indicates that large investors, often referred to as 'whales', are not yet confident enough to significantly increase their positions.

Read more: ApeCoin (APE): Everything You Need to Know

This metric is important because whale activity often reflects the overall sentiment in the market. When large holders start accumulating, it generally indicates strong confidence in the asset's future growth potential.

Despite the recent surge in APE price, whales are taking a cautious approach, suggesting they may not believe this uptrend is sustainable. The price increase remains uncertain until these key players start accumulating.

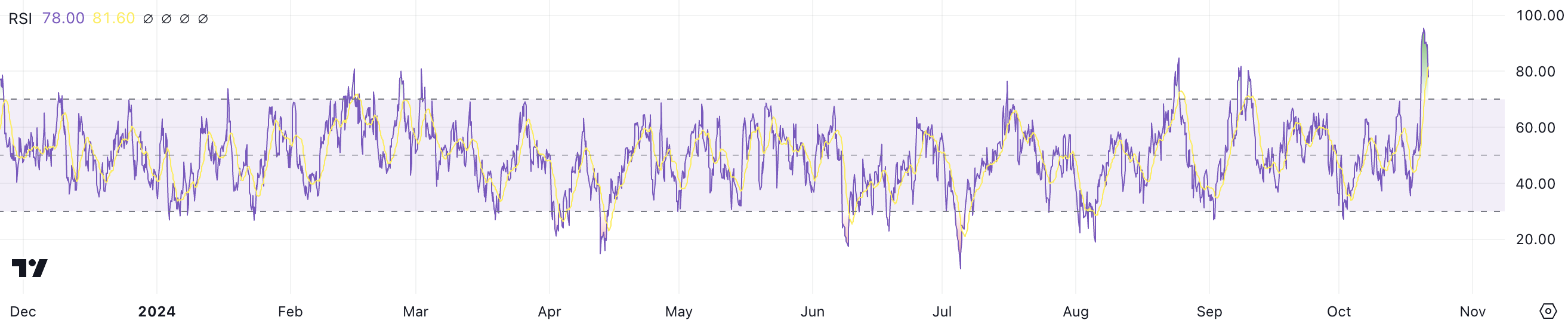

ApeCoin RSI shows an overbought state

The Relative Strength Index (RSI) of APE is currently at 78, up significantly from 35 a few days ago. This rapid RSI increase reflects the recent surge in buying activity and has pushed APE into the overbought territory.

When the RSI moves to such high levels, it suggests the asset may be overvalued in the short term, implying a correction could be on the horizon.

The RSI, or Relative Strength Index, is a metric used to evaluate whether an asset is in an overbought or oversold state. It ranges from 0 to 100, with levels above 70 generally indicating an overbought condition and levels below 30 indicating an oversold condition.

With APE's RSI well above 70, the lack of whale accumulation and uncertain fundamentals suggest the possibility of a price correction. If the recent uptrend has been driven solely by high interest, the likelihood of a correction becomes even higher.

APE price prediction: Will it return to April levels?

The APE price is approaching key resistance levels of $1.82 and $2.07 that it has not reached since the end of March and early April.

If APE manages to break above these resistance points, it could see a 38% price increase. However, sustained buying pressure driven by continued interest in Apechain would be required to overcome these levels.

Read more: ApeCoin (APE) Price Prediction 2024/2025/2030

On the other hand, if the current high interest in Apechain fades and buying power weakens, APE could experience a downtrend. The price could test the key support levels of $1.10 and $0.94.

If these supports fail, APE could potentially drop as low as $0.54, a 60% decline from current prices. How the market reacts to the upcoming developments will be crucial in determining whether APE maintains its uptrend or undergoes a significant correction.