From the assessment that Bitcoin is ready to surge to $100,000 to Ledger Live partnering with THORChain to launch cross-chain swap transactions, here are some notable news in the crypto market.

A trader who accurately predicted the 2023 breakout believes that BTC is now ready to surge to $100,000.

In a new update, anonymous analyst DonAlt told his 62,400 YouTube subscribers that BTC appears poised to end the prolonged consolidation phase that began in March.

However, DonAlt warned that BTC is likely to see a deep corrective move after the powerful breakout.

"The current prediction is that we'll see a breakout towards $80,000, $90,000, possibly even $100,000 and then it will come back down to around $60,000..."

The trader said he does not believe BTC will see a sustained uptrend after the initial breakout.

"It's highly likely that the market won't be able to sustain the momentum after the breakout. BTC will consolidate around $60,000 and then it may attempt another breakout."

But the trader noted that this stance could change depending on future market conditions.

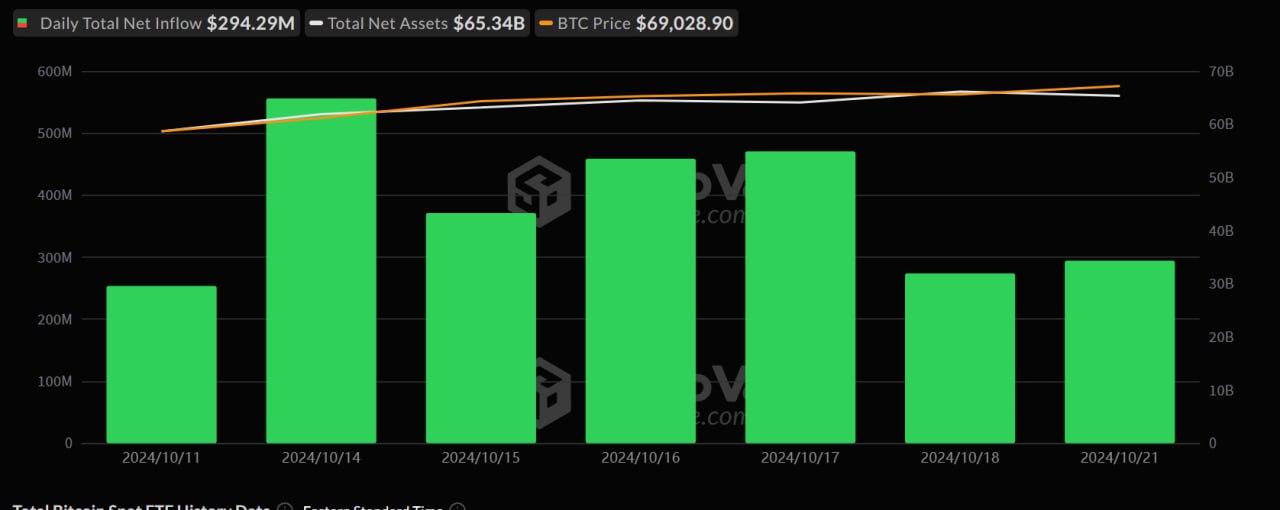

On October 21, spot BTC ETFs saw a net inflow of $294 million, continuing a 7-day streak of net inflows. BlackRock's IBIT ETF saw a $329 million inflow.

Meanwhile, spot ETH ETFs saw a net outflow of $20.7993 million.

Source: SoSoValue

The popular blockchain tracking tool Whale Alert reported on a massive XRP transaction carried out by Ripple. The transaction occurred as XRP reached a significant milestone in unique wallet addresses.

Yesterday, Ripple moved 200 million XRP worth $109,416,737 to an unidentified wallet.

The transaction has sparked curiosity among investors and attracted attention from the XRP community. Some joked that Ripple might be selling tokens to get the $125 million needed to pay the SEC fine. However, most comments see it as a bullish sign for both Ripple and XRP.

Ledger Live has partnered with the decentralized finance (DeFi) protocol THORChain to launch native cross-chain swap transactions on its platform. This will allow users to swap assets between blockchains directly from the Ledger Live app.

The hardware wallet manufacturer announced the new feature in a post on X on October 22, sharing that the partnership will enable users to swap assets from different blockchains, such as swapping BTC for ETH, more easily.

This is the first time Ledger has integrated a DeFi protocol to allow native token swaps between blockchains within the Ledger Live app.

According to Paul Grewal, the chief legal officer of Coinbase, the exchange has filed two Freedom of Information Act (FOIA) requests to US regulatory agencies, seeking information about the ongoing crypto crackdown among US banks.

The Federal Deposit Insurance Corporation (FDIC), the US bank deposit insurance agency, is reportedly requiring banks to limit deposits from crypto companies to 15% of total deposits.

"We've filed two new FOIA requests to get clarity on how regulators are approaching digital assets," Grewal said in an October 21 post on the X platform.

Chainlink has piloted an on-chain corporate actions database using artificial intelligence (AI) and decentralized oracle technology.

The pilot project aims to leverage "the combined advancements of AI, oracles, and blockchain technology to address the lack of real-time and standardized data around corporate actions," Chainlink said.

"We've found that by using data-rich oracles coupled with large language model AI, Chainlink can source the unverified, unstructured, and often inaccessible off-chain data and automatically transform that data into readily available, near real-time digital information."

The price of 1inch (1INCH) is testing key support levels on Tuesday after breaking above the downtrend line on Sunday. The technical outlook suggests an upside move and provides a potential buying opportunity for investors in the $0.261 to $0.273 range.

1INCH broke and closed above the downtrend line on Sunday and gained 7% that day. However, on Monday, it erased the gains and found support around the previously broken downtrend line. The breakout above $0.273, which roughly coincides with the 50-day EMA at $0.271, makes this an important reversal zone.

Sideline investors are looking for buying opportunities between the $0.261 and $0.273 support levels. Assuming 1INCH finds support and bounces from $0.271, it could rally 18% to test the daily resistance at $0.322.

The daily Relative Strength Index (RSI) is at 54, above the neutral level, indicating an uptrend.

1INCH/USDT Daily Chart | Source: TradingView

Based on IntoTheBlock's In/Out of the Money Around Price (IOMAP), around 1,110 addresses have accumulated 97.95 million 1INCH tokens at an average price of $0.273. These addresses bought the tokens in the range of $0.266 to $0.273, making it a crucial support zone.

The largest cryptocurrency exchange in South Korea, Upbit, has announced that they will list UNI on the KRW and USDT markets, with trading opening at 14:00 on October 22 (Vietnam time).

Previously, Upbit had listed the UNI/BTC trading pair. After this announcement, UNI has seen a short-term increase of nearly 5%, with the current price at $8.11 and a fully diluted market capitalization of $8.31 billion.

On October 22, the Avalanche Foundation announced the launch of the Avalanche Card on X, supporting payments in WAVAX, USDC, sAVAX and other tokens at Visa-accepting merchants.

It is understood that both physical and virtual cards will be available, and users will also have a custodial wallet with a new address. This card will initially be issued in Latin America and the Caribbean, with residents or citizens of Cuba, Venezuela, Nicaragua, Russia, North Korea, Syria, Iran, as well as the Crimea, Luhansk and Donetsk regions excluded.

Shibarium has stunned the community as layer-2 blockchain network transactions have skyrocketed over the weekend.

According to data from Shibariumscan, layer-2 transactions increased from 3,690 on October 17 to a peak of 324,590 on October 19.

Although down from the peak, the current daily transaction volume still reaches 128,050, marking a 3,370% increase in just a few days.

It is unclear what has driven this transaction surge. However, this indicates that Shibarium is designed to scale bandwidth based on increased community adoption.

The price of Sui (SUI) continued to decline on Tuesday after reaching a new all-time high of $2.36 on October 13. Technical analysis and on-chain data continue to show short-term downside, with the formation of a bearish divergence on the volume indicator and declining trading volume indicating weakening upward momentum.

SUI reached a new all-time high of $2.36 on October 13, then began declining more than 14% in the following days.

The Relative Strength Index (RSI) and Awesome Oscillator (AO) indicators suggest a bearish outlook on the daily chart.

If SUI continues to decline, it could lose 18% of its value compared to the current level to retest the 61.8% Fibonacci retracement level around $1.64.

SUI/USDT chart - 1 day | Source: TradingView

Northern Data Group is seeking to divest from its cryptocurrency mining subsidiary Peak Mining. Tether, the issuer of the stablecoin, is a major shareholder of Northern Data.

Northern Data, headquartered in Germany, announced on October 21 that it has "decided to commence negotiations with interested parties" regarding the divestment of Peak Mining. The parties were not named, and Northern Data warned that the divestment is not guaranteed and will depend on the cryptocurrency market and other factors.

The proceeds from the divestment of Peak Mining will be used to expand the capabilities and services of the AI product platform, acquire and develop data centers, and purchase additional AI graphics processing units (GPUs).

Karpatkey, a provider of online treasury management solutions for DAOs, has announced a $7 million funding round.

The new capital will be used to expand Karpatkey's service offerings to more DAOs and accelerate its reach into traditional financial institutions.

Investors in this round include AppWorks Ventures and Wintermute Ventures, along with a group of prominent angel investors such as Joe Lubin from ConsenSys, Stani Kuchelov from Avara, and Fernando Martinelli from Balancer Labs, among others.

Launched within GnosisDAO in 2021, Karpatkey became an independent entity earlier this year after a vote to spin out the online treasury management company.

Komainu, the crypto custodian backed by Nomura, is acquiring Propine Holdings Pte Ltd., a Singapore-based custodian, subject to approval from the Monetary Authority of Singapore (MAS).

In a statement on Tuesday, Komainu said the proposed acquisition is expected to strengthen the company's presence in Singapore.

"This platform not only provides robust security and bank-grade governance, but also meets the highest management standards, addressing the growing demand for secure, compliant and battle-tested custody solutions," the company said.

You can view coin prices here.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

Bitcoin Magazine