Author: Alvis, Mars Finance

In the past month, the cryptocurrency market has seen a dramatic turnaround, with Bitcoin breaking through $69,000 and VC-backed coins staging a remarkable comeback. Major projects have been updating frequently, as if holding a trump card and ready to reveal it, and the market's reaction has been - wow, the surge is even more intense than expected! From the mainnet launch of Worldcoin, to the Layer 2 expansion chain Unichain of Uniswap, and the launch of ApeChain and cross-chain bridge by ApeCoin, value-driven coins have been delivering hardcore actions one after another. In just a few weeks, the market has seen a meteoric rise, even crazier than most MEME coins.

The drama of this market trend lies in the fact that everyone originally thought MEME coins would still be the protagonists, relying on hype and short-term explosive growth to dominate the market. However, the "slow-heating" value-driven projects have managed to turn the tables through solid technology and ecosystem implementation, with VC-backed coins staging a counterattack and experiencing a frenzy of price increases. This operation, from technical "foundation-laying" to price takeoff, is almost like a silent counterattack by VC projects against MEME coins.

The glory of MEME coins is still fleeting, like a soulless feast, fading into the mundane after a show of bravado. Meanwhile, value-driven coins are gradually taking the lead in the market, relying on the expansion of multi-chain ecosystems, the substantive functions of DeFi, and the further improvement of infrastructure. Compared to emotional speculation, they rely on hard power. In the end, is it a short-term frenzy or long-term dominance? It now appears that value-driven coins are gradually reclaiming the "throne" of the market.

Why were VC coins previously FUD'd?

The reason why VC coins have been subject to FUD in the past is mainly due to the following deficiencies:

Slow delivery: Many VC-backed projects, including complex infrastructure construction, have long development cycles. This has resulted in many projects, despite early financing, being unable to launch usable products or services in the short term, severely lagging behind the market's high expectations.

Unclear business model: Even for technologically advanced projects, many VC coins still lack a clear business model. Project parties often fail to timely launch products and services that can generate sustainable profits, resulting in unclear token value representation. For example, the token design of some VC projects cannot provide long-term value capture mechanisms for investors.

Weak token economic model: The tokens of many VC-backed projects only serve as transaction fees within the ecosystem, without participating in governance or reward mechanisms. Due to limited demand, the market performance of such tokens is unable to support high valuations, causing investors to gradually lose confidence.

Reigniting VC Coins: Practicality and Long-term Value

Although VC coins face many challenges, it does not mean they have no value. On the contrary, many VC-backed projects, with clear technical foundations, strong ecosystem support, and real application scenarios, have shown long-term potential. The following are some aspects worth noting:

Practicality and technical support: Many value-driven coins are accompanied by strong technological innovations. For example, Uniswap's technological innovations (such as the automated market maker mechanism) in the DeFi field have driven the development of decentralized finance. Sui, through the unique design of the Move language, has improved transaction speed and security, attracting developers in the DeFi and Non-Fungible Token fields.

Extensive ecosystem: The application scenarios of many value-driven coins are broad, such as the multiple decentralized lending platforms in the Sui network, such as Suilend, demonstrating its ecosystem expansion capabilities in DeFi. Similarly, ApeCoin has built a multi-chain ecosystem by launching cross-chain bridges and DeFi functions.

Long-term development potential: The true advantage of value-driven coins lies in their long-term sustainability. For example, Uniswap's Layer 2 expansion chain Unichain is committed to solving the scalability issues of the Ethereum network and enhancing network security through staking mechanisms. As these projects are gradually implemented, the long-term value of VC coins will be released.

Relatively stable market: Value-driven coins have lower volatility compared to MEME coins, making them suitable for long-term investors. Although MEME coins can bring huge returns in the short term, their market fluctuations are severe and easily affected by sentiment and market manipulation. In contrast, value-driven coins, with their real application scenarios and technical support, have smaller price fluctuations and better anti-downside capabilities.

The Rise of Value-Driven Coins: Analysis of 8 Projects

As the market gradually returns to rationality, some technologically advanced projects are showing great potential. The following are 8 recent value-driven coin projects worth noting, whose technical foundations, ecosystem expansion, and market performance demonstrate the potential of value-driven coins:

1. ApeCoin (APE): From MEME Coin to DeFi Bridge

Introduction: ApeCoin is a token launched by the Bored Ape Yacht Club (BAYC), aimed at supporting the BAYC community and its related DeFi and Non-Fungible Token ecosystem. With the launch of ApeChain and the cross-chain bridge, APE is gradually transforming into a key player in the multi-chain ecosystem. As the native Gas token of ApeChain, APE is providing critical support for cross-chain transactions.

Current Circulation: The total supply of ApeCoin is 1 billion, with approximately 753 million tokens currently circulating in the market. The token unlocking speed is gradually slowing down.

Price Change: Over the past month, the price of ApeCoin has risen from $0.74 to $1.68, an increase of over 127%.

Future Potential Analysis: ApeCoin's initial popularity was due to its cultural connection with the Bored Ape Yacht Club, but in the long run, relying solely on culture and community hype is unlikely to support a steady increase in the token price.

On October 20th, ApeChain and its official cross-chain bridge were announced to be live, and according to market information, the launch of its ecosystem's first MEME coins has led to a price surge. The ApeCoin team stated that stablecoins bridged to ApeChain will be converted to DAI and deposited into sDAI, earning interest based on the MakerDAO savings rate. Meanwhile, LayerZero also announced that it has gone live on the ApeChain mainnet and become the standard interoperability provider.

The launch of ApeChain and the cross-chain bridge have provided ApeCoin with substantive application scenarios, especially in its role as the Gas token in the multi-chain DeFi ecosystem, which gives it certain growth potential. Additionally, LayerZero's cross-chain technology allows APE to be seamlessly transferred between multiple blockchains, enhancing the token's utility and liquidity. Overall, the future upside of ApeCoin depends on the development of its cross-chain ecosystem and its ability to continuously launch valuable application scenarios. If the ApeChain ecosystem can continue to grow and attract more developers and projects, APE has significant upside potential.

2. Uniswap (UNI): The Core Engine of Decentralized Finance

Introduction: Uniswap is a leading project in the DeFi field, using an Automated Market Maker (AMM) model to greatly simplify the decentralized trading process. Uniswap's technological innovations, such as the liquidity aggregator and Layer 2 solutions, have driven the development of DeFi.

Current Circulation: The total supply of UNI is 1 billion, with a current market circulation of 600 million tokens. The remaining tokens will be gradually released through a linear unlocking mechanism.

Price Change: UNI has risen from $5.5 to $7.6 in the past month, an increase of about 38%, mainly benefiting from the launch of the Unichain testnet.

Future Potential Analysis: It has already become the leading project in the DeFi field, with its market capitalization and trading volume consistently ranking high.

On October 10th, Uniswap Labs announced the launch of Unichain, stating that after years of building and expanding DeFi products, they have seen areas for improvement in DeFi and the conditions needed to continue pushing the Ethereum expansion roadmap. Unichain is a fast, decentralized Optimism super-chain Layer 2 aimed at becoming the chain for cross-chain DeFi and liquidity.

The launch of Unichain as a Layer 2 expansion chain marks Uniswap's accelerated pace of technological innovation, aimed at addressing the scalability issues of the Ethereum network. This provides technical support for the future upward trend of UNI. In addition, Uniswap is continuously expanding its liquidity aggregator and cross-chain trading functions. In the future, with the widespread adoption of Layer 2, the reduction in transaction costs and the improvement in processing speed will further enhance its competitiveness. Due to Uniswap's dominant position in DeFi and its continuous technological innovation, UNI has the potential for long-term appreciation, but short-term volatility still exists.

3. Sui (SUI): High-Performance Blockchain and DeFi Innovator

Introduction: Sui is a high-performance blockchain built on the Move language, focused on providing support for DeFi and Non-Fungible Tokens (NFTs). Its innovative design and powerful technical performance have enabled it to rise rapidly in the decentralized application domain.

Current Circulation: Sui has a total supply of 10 billion, with approximately 2.7 billion tokens currently in circulation. The token unlocking pace is stable, avoiding excessive market selling pressure.

Price Changes: The SUI price has increased from $1.80 to $2.10 over the past month, a gain of 16.7%, primarily benefiting from the support of major institutions, the integration of USDC, and the launch of decentralized lending platforms.

Future Potential Analysis: Sui's technical advantage lies in its Move language-based architecture, which gives it extremely high scalability and security, particularly in the DeFi and NFT markets.

On September 12, Grayscale announced that its Sui Trust is now open to qualified investors seeking exposure to SUI.

On September 17, SUI collaborated with Circle to introduce native USDC, further enhancing its potential for decentralized finance applications.

Furthermore, the launch of decentralized lending platforms such as Suilend has significantly increased DeFi activity within the Sui ecosystem, with the Total Value Locked (TVL) continuously growing, demonstrating its strong development momentum. Sui's innovative technology and the expanding DeFi ecosystem give it long-term appreciation potential, but its future success will depend on its ability to attract more developers and users.

4. Jupiter (JUP): Liquidity Provider in the Solana Ecosystem

Introduction: Jupiter is a decentralized trading aggregator within the Solana ecosystem, serving as a liquidity bridge by providing users with the optimal trading paths and low-slippage trading experiences. Jupiter integrates multiple liquidity sources within the Solana ecosystem, helping users complete transactions at the best prices, and has also launched a mobile application to further enhance the user experience.

Current Circulation: Jupiter has a total supply of 10 billion tokens, with approximately 1.35 billion currently in circulation. As Jupiter's liquidity management function continues to improve, the demand for its tokens has also increased, and the gradual unlocking of team and community staking rewards has increased the token's liquidity.

Price Changes: Over the past month, the JUP token price has increased from $0.7 to $1.00, a gain of approximately 42%. The primary drivers of the price increase are the expansion of the Solana ecosystem and the improvements in Jupiter's liquidity aggregation capabilities.

Future Potential Analysis: On September 20, the Solana ecosystem's DEX aggregator Jupiter released several updates, and in October, it plans to launch a mobile application, an email newsletter, and a DAO website to further enhance the user experience.

Jupiter's future performance is largely dependent on the development of the Solana ecosystem. If the technical issues of Solana are effectively resolved, JUP may have new growth opportunities. If the Solana ecosystem continues to expand, the JUP token may appreciate accordingly, but the technical and market risks of the Solana network need to be monitored.

5. Bittensor (TAO): Founder of the Decentralized Computing Network

Introduction: Bittensor is a decentralized machine learning network aimed at driving the development of Web3 and AI by providing decentralized computing resources. Bittensor offers a GPU-based computing rental platform, where users can rent computing resources by paying TAO tokens, and the participating computing nodes in the Bittensor network can earn TAO tokens by sharing their computing power.

Current Circulation: The total supply of TAO tokens is 21 million, with approximately 7.38 million currently in circulation. The remaining tokens are gradually entering the market circulation and are used for the payment of computing resource rentals. Since the liquidity of TAO is primarily dependent on the computing demand in the network, the growth of the Bittensor project will directly affect the demand for TAO tokens.

Price Changes: The price of TAO has increased from $250 to $575 over the past month, a gain of 130%. The primary reasons for the price increase are the launch of the Bittensor Trust Fund by Grayscale and the growing demand for decentralized computing resources, which has increased the market demand for TAO.

Future Potential Analysis: Bittensor's innovative model combines blockchain and decentralized computing resources, particularly in the Web3 domain, where the rise of computing-intensive applications will drive the demand for the Bittensor network. As the payment tool in the Bittensor ecosystem, the demand for TAO tokens is expected to continue growing with the expansion of the network. The launch of the Bittensor Trust Fund by Grayscale has further strengthened market confidence in TAO. With the ongoing development of the Web3 ecosystem, TAO tokens have significant upside potential, especially in the context of increasing demand for decentralized computing resources.

6. dYdX (DYDX): The Giant of the Decentralized Derivatives Market

Introduction: dYdX is the leader in the decentralized derivatives market, focused on providing users with decentralized perpetual contracts and leveraged trading services. Its permissionless architecture and efficient order book system provide users with a highly transparent trading environment, attracting a large number of institutions and high-frequency traders.

Current Circulation: The total supply of DYDX tokens is 400 million, with approximately 220 million currently in circulation. The team and investors' tokens are subject to a gradual unlocking mechanism, ensuring that the market will not experience violent fluctuations due to a large influx of tokens.

Price Changes: Over the past month, the price of DYDX has increased from $0.8 to $1.25, a gain of over 56%. The return of founder Antonio Juliano has boosted market confidence in dYdX, and the expansion of platform functionalities and the growth in trading volume have further driven the token price.

Future Potential Analysis: dYdX's leading position in the decentralized derivatives trading market is unshakable. Its technical architecture and product features are highly regarded by institutions and large-volume traders. With the return of founder Antonio Juliano, dYdX's strategic direction is clearer, and it is expected to continue strengthening its derivatives trading capabilities in the future.

On October 20, the CEO of the dYdX Foundation, Charles d'Haussy, posted on social media that "at tomorrow's dYdX Day event, speakers will reveal secrets about moats, Trojan horses, and flywheels."

Furthermore, the transparency and trustless nature of decentralized exchanges give them long-term growth potential, and as the leader in the decentralized derivatives trading platform, dYdX has significant growth potential, especially in the context of the continued expansion of the derivatives market.

7. SushiSwap (SUSHI): The Innovative Force in the DeFi Domain

Introduction: SushiSwap is a pioneer in the DeFi domain, initially a fork of Uniswap, but through technological innovation and expansion, it has gradually established an independent position in the DeFi field. SushiSwap offers features such as liquidity mining and leveraged trading, and its unique product design has formed a broad user base.

Current Circulation: The total supply of SUSHI is 250 million, with approximately 140 million currently in circulation. The token lock-up periods for the team and early investors are gradually unlocking, and the token demand has been further increased through staking rewards and liquidity mining.

Price change: In the past month, the price of SUSHI has risen from $0.52 to $0.8, an increase of about 53%. This increase is mainly due to the expected technical upgrade of SushiSwap and the strategic acquisition plan.

Future potential analysis: On October 21, Jared Grey, CEO of Sushi Labs, posted on X stating that Sushi surpasses the major aggregators on the competing networks in terms of price, gas, and latency, and the aggregation volume is also steadily increasing month by month. Sushi is about to announce a strategic acquisition that will allow it to introduce embedded, invisible DeFi primitives into the AMM and perps vertical.

Its latest technical upgrades and strategic acquisition plans demonstrate the ambition of the SushiSwap team in the future DeFi track. The future performance of the SUSHI token will largely depend on whether these innovations can be successfully translated into practical applications and liquidity growth. Through technological innovation and expansion, SushiSwap is continuously enhancing its competitiveness in the DeFi market, and in the long run, the SUSHI token has the potential to rise.

8. Worldcoin (WLD): Attempt at Identity Verification and Web3 Infrastructure

Introduction: Worldcoin is a global identity verification and Web3 infrastructure project supported by Open AI founder Sam Altman. Worldcoin provides global digital identity verification through World ID, using a decentralized identity system to provide users with real identity verification services. Its Layer 2 network World Chain is built on Optimism, supporting cross-chain transactions, and has partnered with several well-known projects (such as Uniswap, Etherscan, etc.).

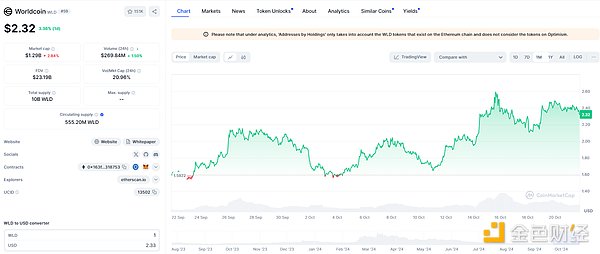

Current circulation: The total supply of WLD tokens is 10 billion, and the current market circulation is about 550 million. As the number of identity verification users increases, more tokens will be gradually unlocked and enter the market circulation.

Price change: The price of WLD has risen from $1.3 to $2.3 in the past month, an increase of 76%. The factors driving the price increase include the launch of the World Chain mainnet, the cooperation with dune analytics to improve on-chain transparency, and Uniswap's support for transactions on the World Chain.

Future potential analysis: Worldcoin's application scenarios cover identity verification, financial transactions, and Web3 applications, aiming to provide users with an ecosystem based on real human identity. The driving force for the price increase comes from the launch of the World Chain mainnet and the cooperation with dune analytics to improve on-chain transparency.

In addition, Uniswap has officially launched on the World Chain, significantly increasing its trading volume, making Worldcoin one of the largest applications on the OP Mainnet. If Worldcoin's identity verification protocol can continue to expand its application scope and maintain the growth of its global users, the demand for its tokens will steadily increase. Furthermore, as the usage of its Layer 2 network World Chain grows and more developers build applications on its platform, the utility and demand for the WLD token will increase significantly.

Conclusion: The Rise of Value Tokens in the Long Run

Although meme coins have dominated the market in the past year, as the market matures, value tokens, with their technical support, ecosystem expansion, and long-term development potential, are regaining the attention of investors. These 8 projects demonstrate the potential of value tokens in the future market. In the future, as these projects are further implemented, value tokens are expected to lead a new round of bull market.