Author: Revc, Jinse Finance

Preface

The 2024 US presidential election has entered the final sprint, and the election situation has reversed again. Trump has regained the lead in betting odds and polls in key swing states, making the election result even more difficult to predict. This political turmoil has already affected global financial markets, especially the performance of the cryptocurrency market. Bitcoin has attempted to break through the $70,000 mark several times in the past week, and although the volatility is high, investors remain cautious and wait for a clear direction in the US stock market, showing a more cautious investment atmosphere.

The Anxious Changes in the Election Situation

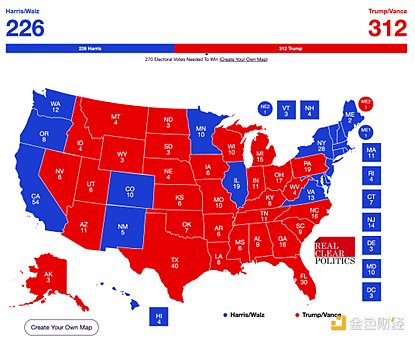

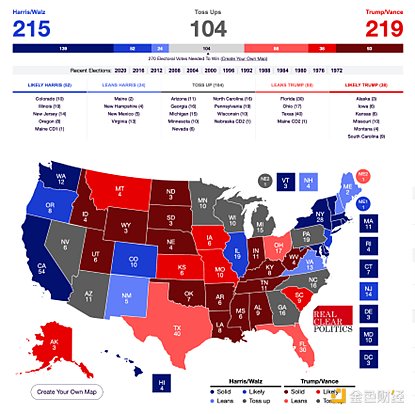

According to the latest forecast by The Economist, former President and Republican candidate Trump may win the election, which is the first time this forecast model has predicted Trump's victory since August. It is expected that Trump will win 276 electoral votes, while the Democratic candidate, current Vice President Harris, may win 262. Trump's probability of winning has risen to 54%, an increase of 6 percentage points from the previous week. According to RCP data, as of the 22nd, Trump is expected to win 312 electoral votes, enough to secure victory (270 votes are needed to win).

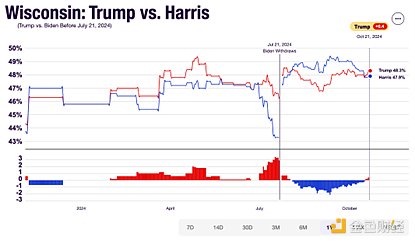

However, the election situation is changing rapidly. In the past 24 hours, the number of electoral votes that Trump may win has plummeted from 312 to 219, and as more election information is released, the key swing states have become difficult to predict again.

The latest Reuters/Ipsos poll shows that Harris leads Trump by a narrow margin of 46% to 43%. This six-day poll ended on Monday, and Harris' lead of 45% to 42% a week ago is basically unchanged, indicating that the election situation is unusually deadlocked.

Trump also has a slight lead in support in Wisconsin, Michigan, Pennsylvania, and Nevada.

Market Performance Analysis

The correlation between the US stock market and the cryptocurrency market means that the performance of the US stock market still plays an important guiding role in the sentiment of the cryptocurrency market. A report by Wells Fargo points out that regardless of the election result on November 5, the stock market may experience a "sell the fact" effect, where the stock price falls after the news is announced. Wells Fargo believes that the abnormal rise in the S&P 500 index before the election is inconsistent with historical trends, and the market is facing a situation of asymmetric risk and return.

The strategist at Wells Fargo pointed out that the S&P 500 index has risen 3% in the past month and 4.4% in the past two months. Based on historical experience, the stock market generally falls on election day during the past six presidential elections, and investors tend to be risk-averse. The report lists several possible "sell the fact" scenarios:

1. Election Dispute: If there is a dispute over the election result, the S&P 500 index may fall 2%-5% within 1-3 days, and the decline may be even greater if the uncertainty persists. The election dispute between Bush and Gore in 2000 led to an approximately 8% decline in the S&P 500 index in November.

2. Republican Sweep: If the Republicans win a landslide victory, Trump may push for more aggressive fiscal policies and tariffs, which could increase the cost of capital and put pressure on the stock market.

3. Interest Rate Hike: The yield on the 10-year US Treasury bond has recently risen, and if it continues to rise, the S&P 500 index may pull back to the 50-day moving average, falling about 3%.

4. Reduced Chances of Trump's Victory: If Trump's chances of winning decrease, or if Harris unexpectedly wins, the market may also face pressure. Wells Fargo pointed out that when Trump's re-election chances decreased in July, the S&P 500 index fell 2%-3%.

Bitcoin Market Heats Up

With the increase in Trump's probability of winning, the market's attention to the "Trump trade" has increased rapidly. Retail investors and investors have driven a new round of Bitcoin market sentiment, and traders are also closely watching the possibility of Bitcoin prices breaking through $80,000 during the election period.

Data shows that as of October 18, the open interest in Bitcoin futures on the Chicago Mercantile Exchange (CME) reached a new high of $12.26 billion, indicating that institutional investors have taken a more determined stance to hedge against Bitcoin volatility or price increases. In addition, the inflow of funds into US spot Bitcoin ETFs is also approaching a historical high, reflecting the strong demand for Bitcoin in the market. Analysts point out that option traders are increasingly focused on call options expiring in November, with a significant increase in demand for options with a strike price above $80,000, further enhancing the market's bullish sentiment.

Summary

In summary, from the perspective of trading opportunities brought by uncertainty, the current period is indeed the best trading time of the year. However, this also puts higher operational requirements on investors. Setting stop-loss orders is a prerequisite for participating in the current market game. The cryptocurrency market currently faces two major risks: one is that the election result is worse than expected (such as Trump's defeat), and the other is that capital will withdraw after the election hype. Cryptocurrency assets have the characteristics of absorbing risk and volatility, and the energy released by political events will provide the impetus for Bitcoin to break through. But this adventure is like sailing, although the returns are stimulating, it is also necessary to ensure a safe landing.