Author: Yash Agarwal Source: X, @yashhsm Translation: Shan Eoba, Jinse Finance

Stripe acquired Bridge for $1.1 billion, let me explain to you why this company you may have never heard of is so important.

Stripe Makes a Big Push into Stablecoins

Stripe co-founder demonstrated the acceptance of stablecoins using Solana's Phantom earlier this year. –– They have already launched crypto payment/payment, where any US merchant can accept stablecoins like USDC and settle in US dollars.

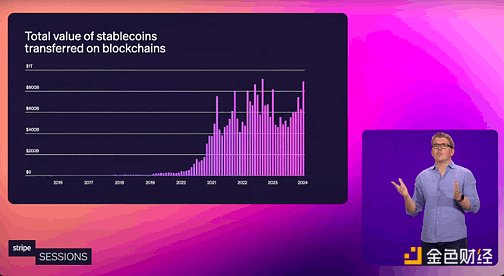

Although in the bear market, the trading volume of stablecoins continues to rise, coupled with the support of high-performance blockchains like Solana and Base, they are very optimistic about the market fit (PMF) of stablecoins.

These will become the most iconic lines in financial history: "Stablecoins are the room-temperature superconductors of financial services."

Why Does Stripe Need Stablecoins?

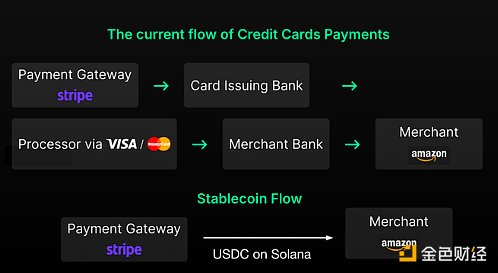

Stripe is currently just a payment gateway, having to rely on networks like Visa/Mastercard: –– Additional charge of about 1-3% –– Dependent on banks/local partners –– Low authorization rate Stablecoins can bypass all intermediaries, thereby owning the stack.

However, if Stripe wants to own the stablecoin stack, they have to build: –– On-ramp/off-ramp (fiat currency <> crypto currency conversion) –– Stablecoin issuance (e.g., Tether earns $10 billion a year) –– Complex stablecoin infrastructure (handling 20+ blockchains, 10+ stablecoins, etc.). They can spend years building it, or they can acquire it directly.

Bridge Company Emerges

Bridge was founded in 2022 by second-time founders (their previous company was acquired by Square). The founding team includes the former Chief Product Officer of Brex (@zcabrams) and former Airbnb engineer Sean.

Their vision is to build various "APIs" for stablecoins. They first started by supporting stablecoin payments and infrastructure (similar to how Stripe does for traditional financial services).

In 2023, they completed an undisclosed seed round (estimated around $18 million, led by Sequoia Capital). Over the past 2.5 years, they have built APIs for the following areas: –– Routing system (on-ramp/off-ramp channels, i.e., converting any form of US dollars to another. For example, converting USDC on Solana to US dollars) –– Issuance (minting stablecoins and managing reserve asset investments)

Their APIs have already supported over $5 billion in transaction volume, with customers including:

Stablecoin fintech apps, like @getdolarapp (virtual accounts provided by Leeds Bank)

Global treasury operations, like @SpaceX and the US government

Payments, like @scale_AI (for paying their contractors)

Bridge supports many on/off-ramps and crypto cards. Who are their competitors? Many!

@ZeroHashX (larger in scale, but less reputable)

@Brale_xyz and @Paxos (stablecoin issuers; Paxos helped issue PayPal's PYUSD)

@CoinflowLabs

And basically any on/off-ramp and stablecoin infrastructure provider.

Why Just Bridge?

–– API-first: Integrates with Stripe's tech stack –– Acquire future competitors (e.g., stablecoin fintech companies integrated with Bridge may disrupt Stripe's market) –– Complementary products (e.g., financial management services + stablecoin issuance, Banking-as-a-Service + BaaS + crypto payments) –– Common investors: Sequoia Capital + SF tech founders.

Why Pay $1.1 Billion?

The main reason is the strong team - the founders have led or worked with top startups (Airbnb/Brex/Coinbase/Square) - they are the best suited to lead the "Stripe crypto infrastructure".

Additionally, there are the licenses, products, market traction, and customer base. I guess the payment structure of this deal will be more equity-based rather than cash.

From a strategic perspective, acquiring Bridge helps:

–– Accelerate progress, compete with crypto-friendly giants like BlackRock, Revolut, and PayPal –– 24/7 global operations; break free from the constraints of localized payment systems (Stripe faces huge challenges in expanding to long-tail markets like Asia and Latin America)

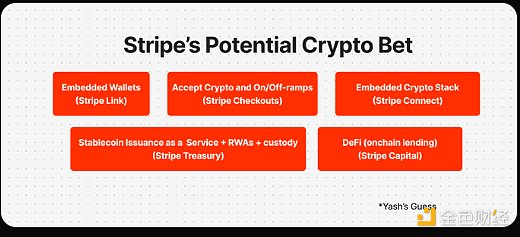

What's Next for Stripe? My Guesses

→ Continue to drive on-/off-ramps and the acceptance of crypto payments, and control Bridge's APIs→ Deepen the stablecoin infrastructure (enable global fintech companies to issue stablecoins, and even potentially launch their own stablecoin - STUSD, thereby vertically integrating the entire ecosystem?)→ Become a champion of stablecoin payments, making every street-side store able to accept stablecoin payments

As a stablecoin enthusiast, I think this is a positive signal for the crypto space:

This is the largest acquisition in the crypto space (and there are expected to be more M&A activities)

It's also Stripe's largest acquisition ever (demonstrating their foresight in the crypto space)

Will this become a historic acquisition like Instagram, and truly boost the GDP of the internet?