Written by: BitpushNews

On Tuesday, gold continued to rise, while US stocks and the crypto market consolidated.

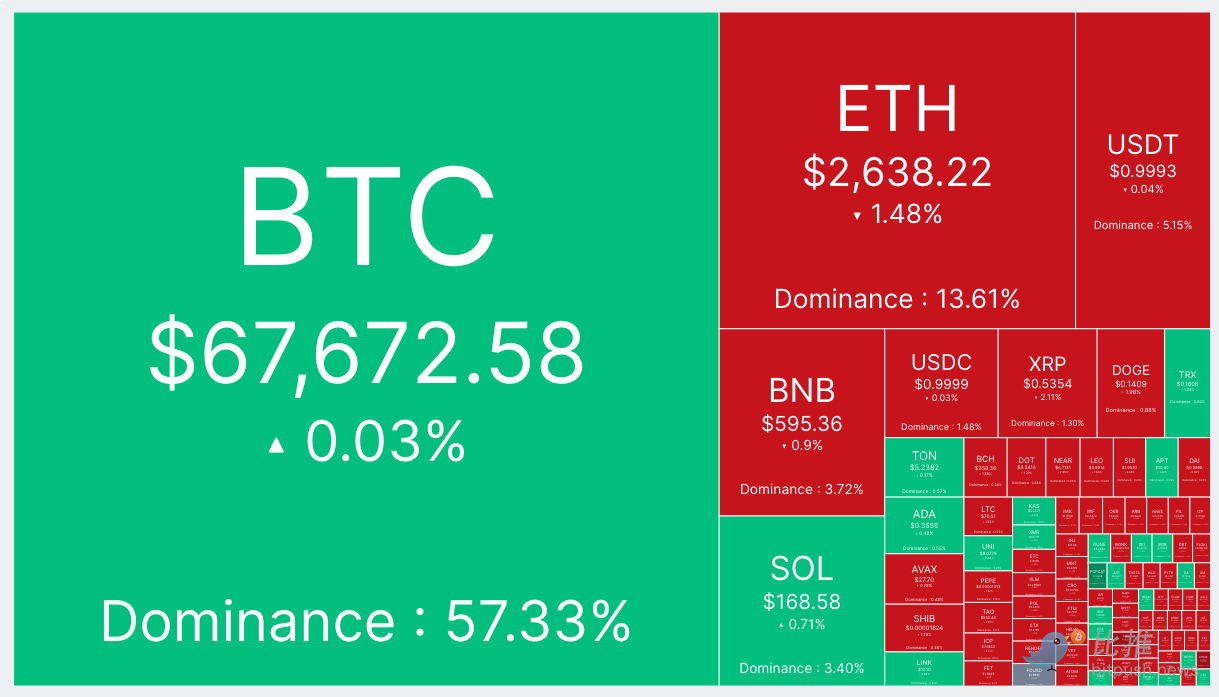

Bitpush data shows that Bitcoin bulls continue to be hindered by the resistance zone between $68,000 and $70,000, with the Bitcoin trading price at $67,672 as of the time of writing, with a 24-hour volatility of less than 1%.

Over the past 24 hours, Altcoins have lacked momentum, with the top 200 tokens by market cap seeing more declines than gains. The top gainers were Popcat (POPCAT), up 9.8%; Ponke (PONKE), up 9.4%; and Uniswap (UNI), up 4.7%. The biggest decliners were ApeCoin (APE), down 17.4%; Scroll (SCR), down 13.3%; and dYdX (DYDX), down 10%.

The overall crypto market capitalization is currently $2.33 trillion, with Bitcoin's market dominance at 57.3%.

In the US stock market, the S&P 500 and Dow Jones indices closed relatively flat, while the Nasdaq Composite closed 0.18% higher. Spot gold prices reached a new intraday high above $2,748 per ounce.

$80,000 Bitcoin Options OI Concentrated in November, $100,000 Just a Matter of Time

According to data from crypto exchange Deribit, the open interest (OI) of Bitcoin call options expiring at the end of November is concentrated around $80,000.

While many analysts have linked BTC's performance to the increasing probability of a Trump victory, FalconX research head David Lawant told Bloomberg that Bitcoin "could perform well regardless of the election outcome".

LMAX Group market strategist Joel Kruger stated in a report: "It feels inevitable that Bitcoin will break to new all-time highs, and we're getting closer to that point. The market has been performing very well in recent days, which is consistent with seasonal trend analysis that points to a strong October performance."

He added: "The next major hurdle is $70,000, which aligns with the July 2024 high and is close to the $73,835 all-time high set in March, where options and strikes have been working hard to cap the market so far. But the pressure to break above $70,000 seems to be building, and based on our technical analysis, this could set the stage for a push to new all-time highs."

Regarding Bitcoin's price around the election, Ledn chief investment officer John Glover noted that "the current support level is at $65,000, and I think in the days leading up to the election, BTC price will test the previous high of $73,000."

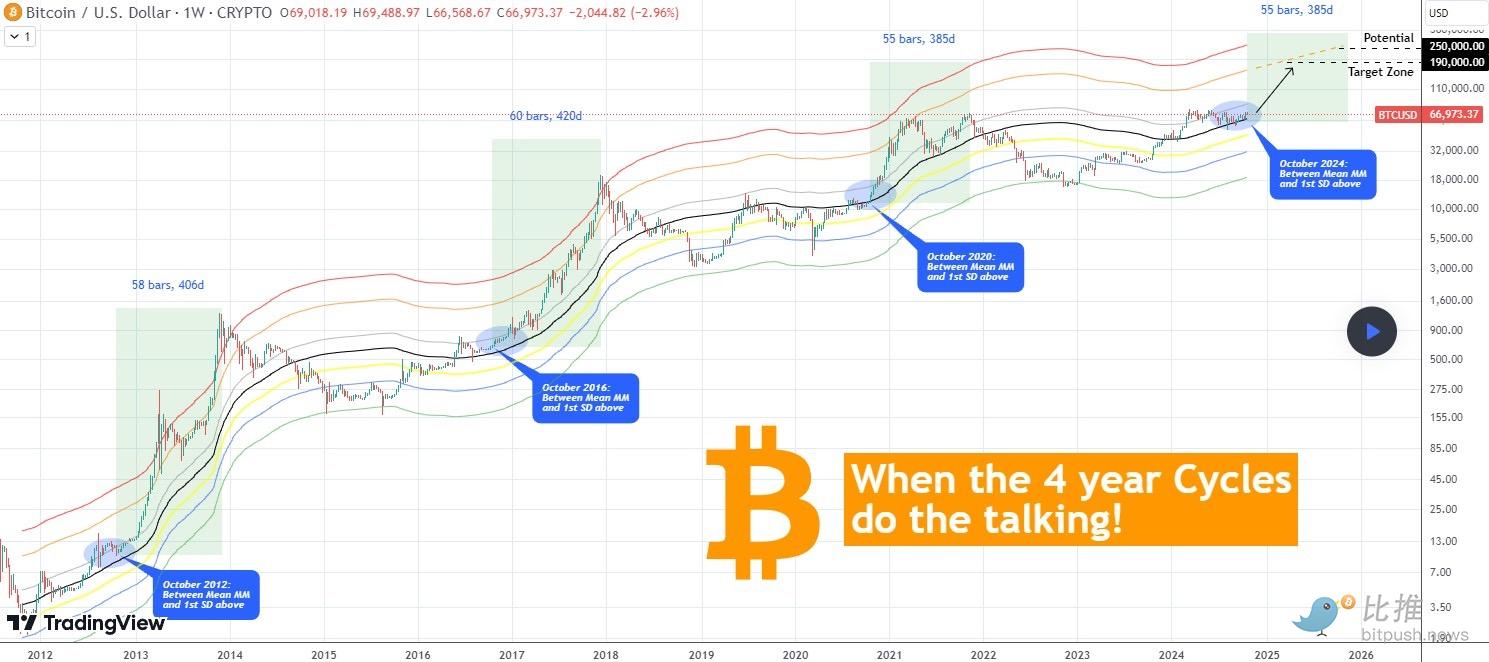

While analysts generally view the upcoming US election as the primary factor influencing the crypto market, TradingView analyst TradingShot argues that Bitcoin's four-year cycle will soon become the main driver of the crypto market.

In an update on Tuesday, he wrote: "It's been a while since we've used the Mayer Multiple Bands (MMB) to analyze Bitcoin, but now is the perfect time to release the latest update, with just two weeks until the US presidential election, and the market is about to enter a bullish breakout, this time, we'll be observing the price action around this date every 4 years."

TradingShot explained: "BTC's cycle is roughly 4 years, highly symmetrical, and the price action is likely to repeat itself each time. Currently, around late October (2024), the price is trading within the Average MM (black trend line) and the first SD (gray trend line) above. It has just started to rise from the Average MM."

He pointed out: "Based on the 4-year cycle theory, the price action in October 2020, October 2016, and October 2012 is within a highly similar range, with remarkable symmetry. This metric further confirms this. We can also see that around this time every 4 years, the price has started to rise from the Average MM, just like now. The green rectangles in the chart show the date range between these 4-year intervals and the peak of the bull market cycle. In October 2012, it took 58 weeks (406 days) to reach the peak, in October 2016 it was 60 weeks (420 days), and in October 2020 it was 55 days (385 days). So, from a timing perspective, the cycle tends to reach its peak around roughly the same period."

TradingShot believes: "Assuming the 'worst case' scenario is that it 'only' reaches the 2 SD trend line, we can set the target range at $190,000 - $250,000, depending on whether the price hits that range midway through the 55-week period or closer to the end. Nevertheless, Bitcoin appears to be embarking on an exciting rebound."