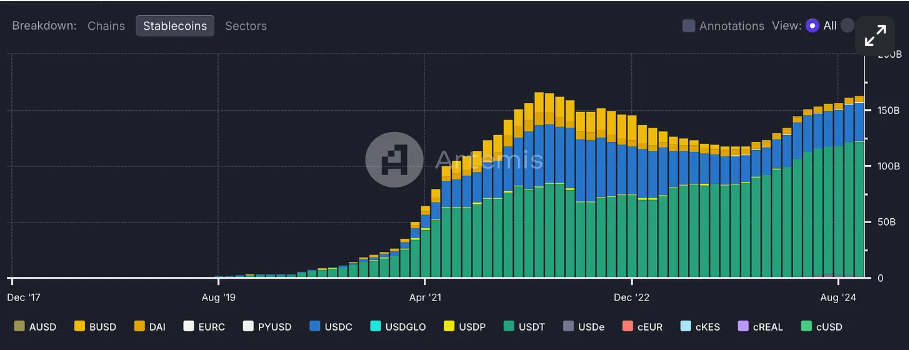

Source: Artemis

Viewed from a different angle, this market cap exceeds the GDP of more than 100 countries worldwide.

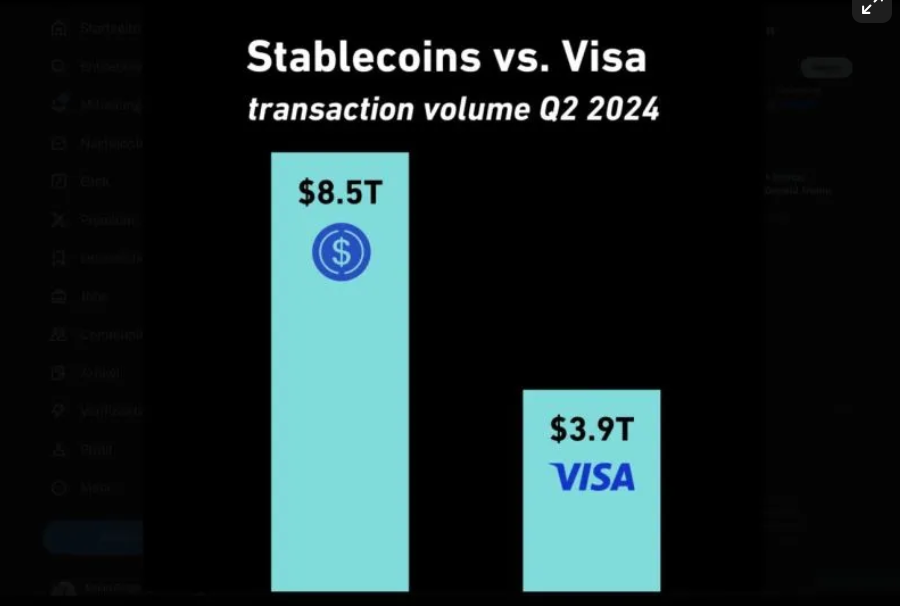

And these stablecoins are not idle. In just the second quarter of 2024, the trading volume of stablecoins was nearly double that of Visa, often exceeding tens of trillions of dollars per month.

Source: Artemis

Viewed from a different angle, this market cap exceeds the GDP of more than 100 countries worldwide.

And these stablecoins are not idle. In just the second quarter of 2024, the trading volume of stablecoins was nearly double that of Visa, often exceeding tens of trillions of dollars per month.

Data source: a16z Crypto State of the Industry Report 2024

For a technology invented just 6 years ago, this growth rate is astounding.

The Business Model of Stablecoins

Why are stablecoins a good business? How do they make money?

Stablecoins generate revenue by investing their reserve funds 1:1 in interest-bearing assets, such as government bonds and other short-term investment instruments. The interest earned on these investments provides a revenue stream for the stablecoin issuers.

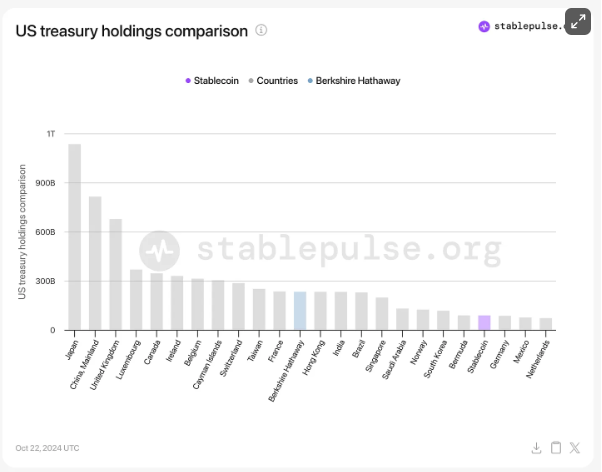

This innovative investment strategy has made stablecoin issuers one of the largest holders of US Treasuries, holding more than countries like Germany, Mexico, and the Netherlands.

Data source: a16z Crypto State of the Industry Report 2024

For a technology invented just 6 years ago, this growth rate is astounding.

The Business Model of Stablecoins

Why are stablecoins a good business? How do they make money?

Stablecoins generate revenue by investing their reserve funds 1:1 in interest-bearing assets, such as government bonds and other short-term investment instruments. The interest earned on these investments provides a revenue stream for the stablecoin issuers.

This innovative investment strategy has made stablecoin issuers one of the largest holders of US Treasuries, holding more than countries like Germany, Mexico, and the Netherlands.

Sources: https://www.stablepulse.org/ and Nic Carter

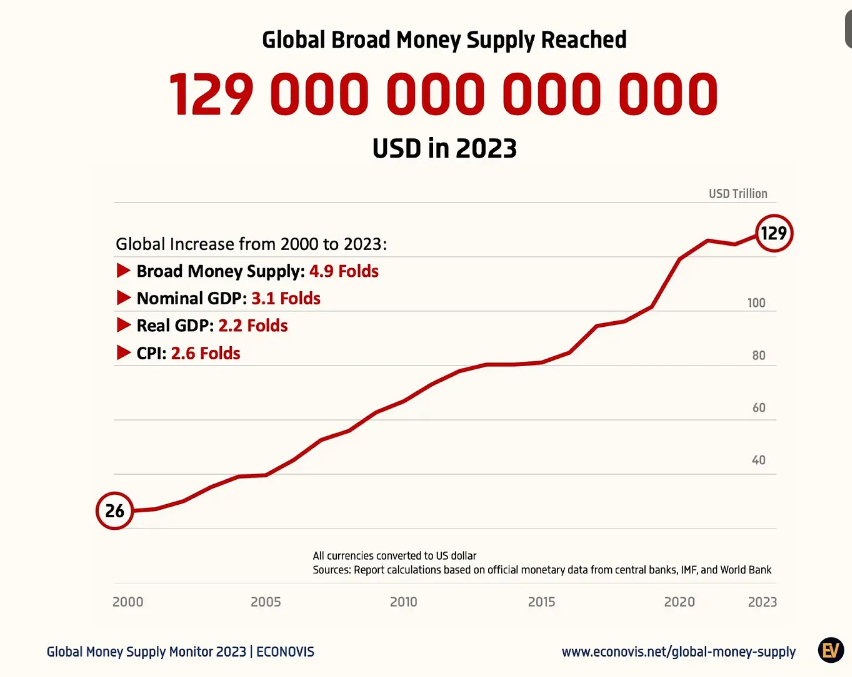

Consider this: the global money supply (M2) is estimated to be around $129 trillion.

Sources: https://www.stablepulse.org/ and Nic Carter

Consider this: the global money supply (M2) is estimated to be around $129 trillion.

Source: Voronoi

We have only just begun to update the surface of the financial system through stablecoins.

In addition to the M2 money supply, here are some other market sizes that stablecoins are poised to improve:

Foreign Exchange (Forex) Market: Approximately $80 trillion flows between different currencies daily. This is the largest market in the world, about 30 times the size of global daily GDP.

Once more currency-backed stablecoins gain deeper liquidity globally, the digital foreign exchange transacted through stablecoins will rapidly change the way money flows between currencies today.

Source: Voronoi

We have only just begun to update the surface of the financial system through stablecoins.

In addition to the M2 money supply, here are some other market sizes that stablecoins are poised to improve:

Foreign Exchange (Forex) Market: Approximately $80 trillion flows between different currencies daily. This is the largest market in the world, about 30 times the size of global daily GDP.

Once more currency-backed stablecoins gain deeper liquidity globally, the digital foreign exchange transacted through stablecoins will rapidly change the way money flows between currencies today.

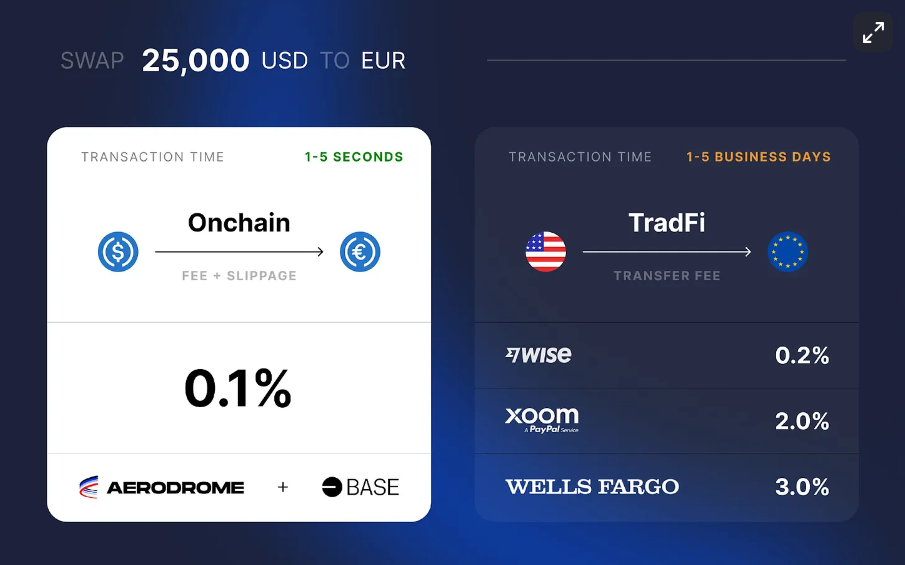

Source: Aerodrome

Global Remittances: Global remittance volumes are estimated to reach $883 billion in 2023 and are projected to reach $913 billion by 2025.

Stablecoins can make cross-border payments as simple as sending a text or email, by providing faster, cheaper, and more seamless transactions.

Source: Aerodrome

Global Remittances: Global remittance volumes are estimated to reach $883 billion in 2023 and are projected to reach $913 billion by 2025.

Stablecoins can make cross-border payments as simple as sending a text or email, by providing faster, cheaper, and more seamless transactions.

Source: Coinbase

Payments: As of 2023, the global payments market was valued at $2.64 trillion and is expected to grow to $4.78 trillion by 2029. Credit card processing fees vary by region, payment method, and transaction type, typically ranging from 1.5% to 3.5% of the transaction amount. The global average credit card transaction processing fee in 2024 was around 2.4% of the transaction value.

Stablecoins have the technological capabilities to simplify the payment process and significantly improve payment efficiency.

Source: Coinbase

Payments: As of 2023, the global payments market was valued at $2.64 trillion and is expected to grow to $4.78 trillion by 2029. Credit card processing fees vary by region, payment method, and transaction type, typically ranging from 1.5% to 3.5% of the transaction amount. The global average credit card transaction processing fee in 2024 was around 2.4% of the transaction value.

Stablecoins have the technological capabilities to simplify the payment process and significantly improve payment efficiency.

Source: Alana Levin on X

If stablecoins can capture even a small portion of these legacy markets, trillions of dollars will flow into digital currencies, fundamentally improving the financial system.

The Miracle of Money

Why are internet-based currencies so important?

Like water, money permeates our society, nourishing economic activity.

It seeks the path of least resistance, just as water flows downhill. And just as water is a necessity of life, money is the lifeblood of commerce, facilitating transactions and storing value.

Source: Alana Levin on X

If stablecoins can capture even a small portion of these legacy markets, trillions of dollars will flow into digital currencies, fundamentally improving the financial system.

The Miracle of Money

Why are internet-based currencies so important?

Like water, money permeates our society, nourishing economic activity.

It seeks the path of least resistance, just as water flows downhill. And just as water is a necessity of life, money is the lifeblood of commerce, facilitating transactions and storing value.

Understanding the basic functions of money is crucial to understanding the value of stablecoins.

The essence of money lies in solving a fundamental problem: how to efficiently exchange value in a complex society. Economists have long recognized the three main functions that define money:

1. Store of value

2. Medium of exchange

3. Unit of account

These functions form the foundation of any monetary system, enabling individuals and societies to save, transact, and measure economic value over time.

Stablecoins are designed to fulfill these same core functions, but in the digital realm, they offer improvements over traditional fiat currencies.

Understanding the basic functions of money is crucial to understanding the value of stablecoins.

The essence of money lies in solving a fundamental problem: how to efficiently exchange value in a complex society. Economists have long recognized the three main functions that define money:

1. Store of value

2. Medium of exchange

3. Unit of account

These functions form the foundation of any monetary system, enabling individuals and societies to save, transact, and measure economic value over time.

Stablecoins are designed to fulfill these same core functions, but in the digital realm, they offer improvements over traditional fiat currencies.

Store of Value

One of the most direct and obvious uses of stablecoins is as a store of value, especially in countries with unstable currencies or limited access to the global financial system. For those living in high-inflation or strictly capital-controlled countries, holding stablecoins pegged to the US dollar or euro can be a lifeline to protect their hard-earned capital.

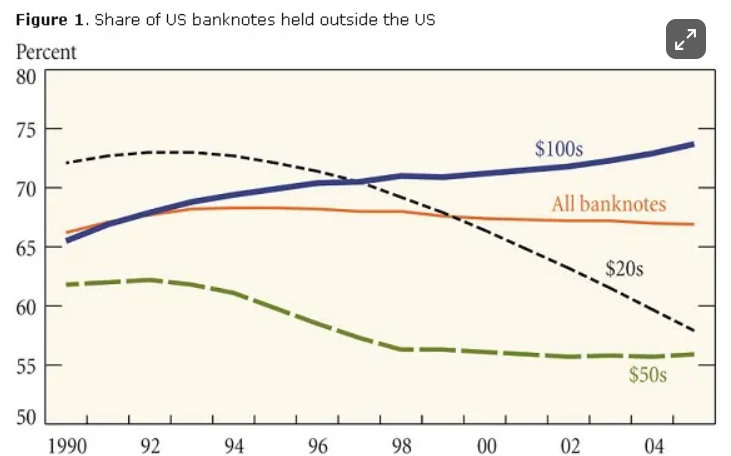

Nearly 75% of $100 bills are held overseas, with a total value exceeding $1.5 trillion. Now, people can access any amount of US dollars or other currencies in digital form through stablecoins, anytime and anywhere.

Store of Value

One of the most direct and obvious uses of stablecoins is as a store of value, especially in countries with unstable currencies or limited access to the global financial system. For those living in high-inflation or strictly capital-controlled countries, holding stablecoins pegged to the US dollar or euro can be a lifeline to protect their hard-earned capital.

Nearly 75% of $100 bills are held overseas, with a total value exceeding $1.5 trillion. Now, people can access any amount of US dollars or other currencies in digital form through stablecoins, anytime and anywhere.

Source: Macro Musings

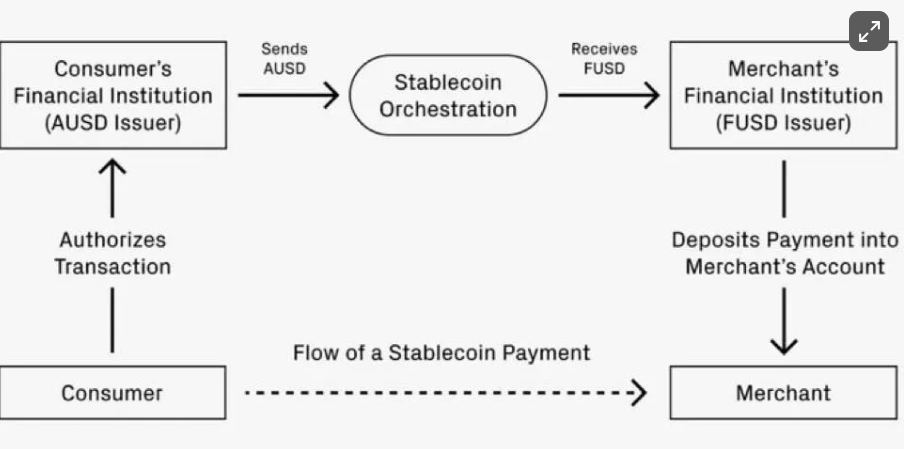

Medium of Exchange

As a medium of exchange, stablecoins have the opportunity to replace existing money flows through their efficiency and programmability. In every workflow where intermediaries facilitate and participate in transactions, stablecoins have the opportunity to abstract and simplify the payment process.

According to McKinsey, in 2023, the global payments industry processed 340 billion transactions, worth $1.8 quadrillion, creating a $2.4 trillion revenue pool. By simplifying these payments, stablecoins can cut into that $2.4 trillion global payments "tax," making payments more efficient for everyone.

Source: Macro Musings

Medium of Exchange

As a medium of exchange, stablecoins have the opportunity to replace existing money flows through their efficiency and programmability. In every workflow where intermediaries facilitate and participate in transactions, stablecoins have the opportunity to abstract and simplify the payment process.

According to McKinsey, in 2023, the global payments industry processed 340 billion transactions, worth $1.8 quadrillion, creating a $2.4 trillion revenue pool. By simplifying these payments, stablecoins can cut into that $2.4 trillion global payments "tax," making payments more efficient for everyone.

Source: Jesse Walden on X

Stablecoins have already surpassed the trading volume of most cryptocurrencies and will soon do the same in other industries.

Unit of Account

While stablecoins have already served as a store of value and medium of exchange, their potential as a unit of account remains largely untapped. As more businesses and individuals gain confidence in stablecoins, we may see them used for pricing goods and services, especially in international environments.

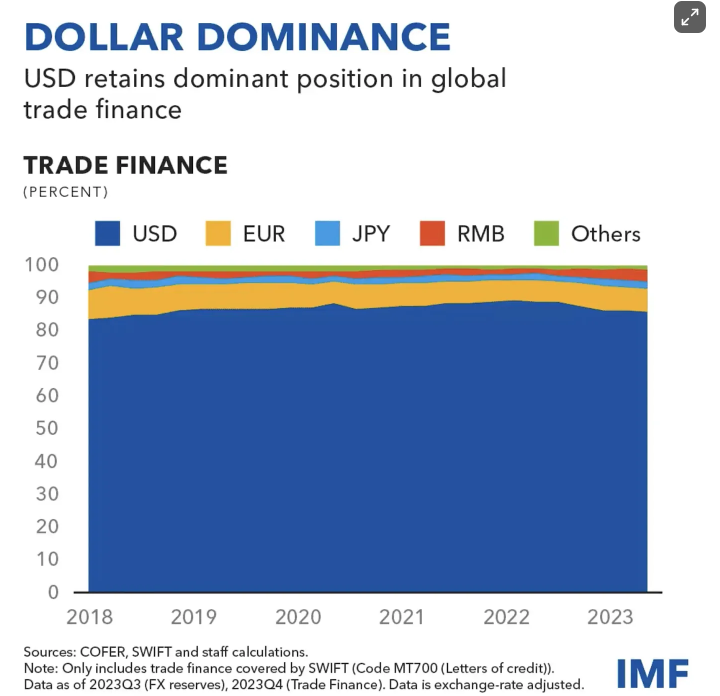

According to SWIFT data, the US dollar accounts for over 80% of trade finance, as most commodity trade is still invoiced and settled in dollars.

Source: Voronoi

The global trade finance market was valued at $10.5 trillion in 2023 and is expected to reach $13.6 trillion by the end of 2032. The CAGR from 2024 to 2032 is close to 2.94%, providing a massive opportunity for stablecoin settlement.

In short, stablecoins are still in their early stages.

Internet Monies Superior

Apps like Venmo and Cash App have revolutionized peer-to-peer payments in the US, making it simple to split dinner bills or pay rent.

However, these solutions are primarily domestic. There is currently no "global Venmo" that can quickly, easily, and cheaply facilitate international transfers.

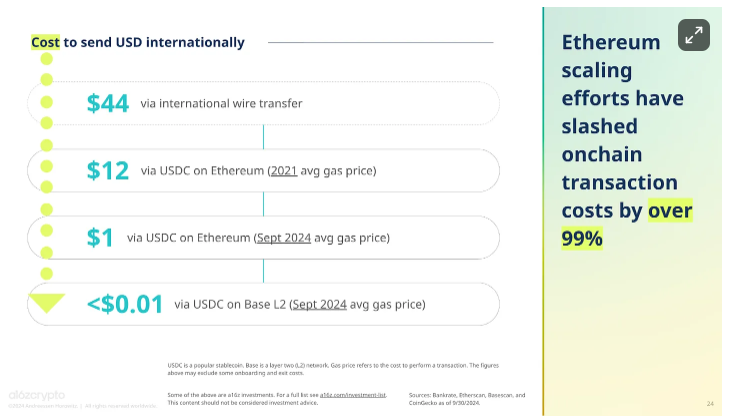

This is where stablecoins shine. They provide an inherent global solution, operating 24/7, unconstrained by borders or banking hours. Using stablecoins like USDC, sending funds anywhere in the world becomes as simple as sending a text message, often costing a fraction of traditional international wire transfers.

After Ethereum's Dencun upgrade in March 2024, average costs on L2s like Base will drop below $0.01. This process is nearly instant and usable globally.

Source: a16z

Coinbase CEO Brian Armstrong recently said at a Goldman Sachs conference:

"I'm very pleased to report that we now have transactions taking less than a second anywhere in the world, with transaction fees of just $0.01.

I believe this makes crypto the best payment rail in the world to date. There are some payment rails in traditional finance that are very fast, like credit cards, but they have fees as high as 2%. And there are some that are very low cost, like ACH, but they're very slow, taking two to three business days, right?

And then there are some that are very fast and cheap, like WeChat Pay, but they're only available in China. Whereas crypto, especially these L2 crypto rails like Base, is the only system I'm aware of that checks all three boxes - it's fast, it's cheap, and it's global.

And that's part of why I think we're seeing 200% to 300% year-over-year growth in stablecoin transaction volume. So it's incredibly powerful. It's not just unlocking payments, it's starting to unlock a whole new class of applications.

For example, if you have fast, cheap, and global payments, what might that enable people to do? Maybe on social media, people could click a "like" button or tip some content. You know, why can't that be a micro-transaction? In the US, people get paid every two weeks. Why can't it be every hour?

Maybe the whole concept of payday lending could go away. Or every minute. If the world has a fast, cheap, decentralized global financial system that's not controlled by any one country, I think a lot of frictions will disappear, and the economy will see massive growth. Even a small reduction in frictions can lead to huge adoption growth. For example, SMS used to cost $0.25.

At peak, there were about 25 billion SMS messages per year. Now, with free services like WhatsApp and iMessage, it's hundreds of billions per day. So just by eliminating a small amount of friction, the volume can increase by an order of magnitude. That's happened in messaging, and it's going to happen in payments."

More specifically, stablecoins like USDC have become the world's most efficient payment rails on L2s.

Let's ponder this...

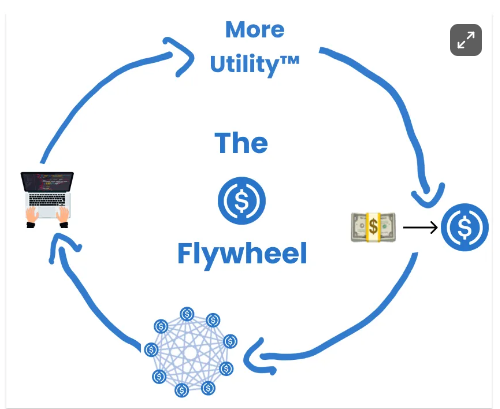

As more apps integrate stablecoin functionality, we're likely to see network effects. Each new app that adopts stablecoins increases the utility of the entire ecosystem, incentivizing further adoption and innovation.

Network effects refer to the phenomenon where the value of a product or service increases as more people use it. Think of social networks like Facebook or messaging apps like WhatsApp - their value grows exponentially with each new user.

Stablecoins have the potential to generate powerful network effects.

Source: Not Boring

As more people start using stablecoins, more businesses will accept them; and as more businesses accept them, more people will be willing to use them.

This virtuous cycle could lead to rapid and widespread adoption.

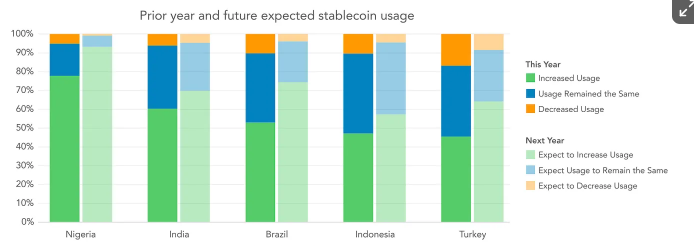

Source - Stablecoins: The Emerging Market Story

Out with the Old, In with the New

When examining the prospects of stablecoins, people often draw comparisons to the early days of the internet. Back then, many struggled to grasp the transformative potential of the technology.

Our current situation with stablecoins is similar.

On Jeremy Allaire's "The Money Movement" show, Chris Dixon stated:

"All new technologies tend to do two things. They tend to do the old things better, and they tend to do new things that were never possible before. Blockchain is actually a new way of building internet services that don't have gatekeepers or toll collectors."

Stablecoins present tremendous opportunities for entrepreneurs, developers, and innovators. The companies and protocols that successfully navigate this space may become the financial giants of the future.

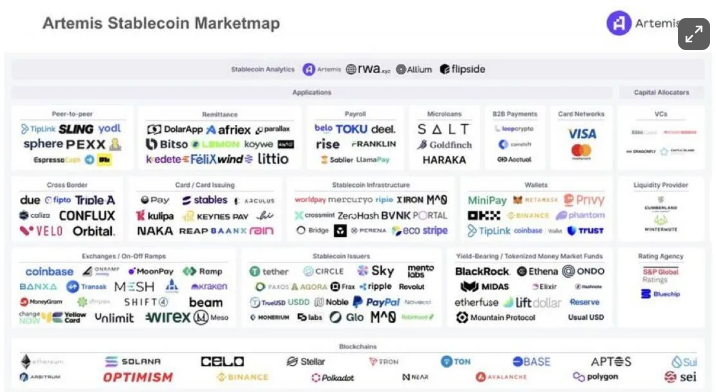

Here are some of the companies innovating in today's stablecoin ecosystem:

Source: Stablecoin Market Map

Immense Potential

Stablecoins have the ability to reshape the financial system in a more open, efficient, and inclusive way.

They may be the key to achieving global financial inclusion, enabling new business models, and creating a more interconnected global economy.

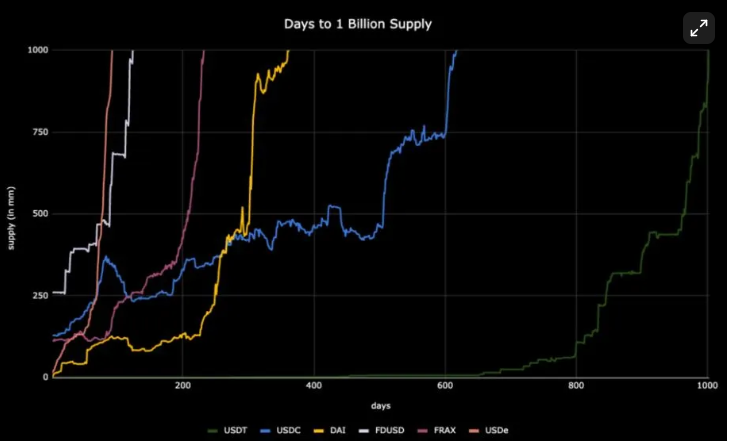

Don't blink, as this growth is happening rapidly, with multiple stablecoins surpassing $1 billion in supply in less than a year.

Source: Ethena

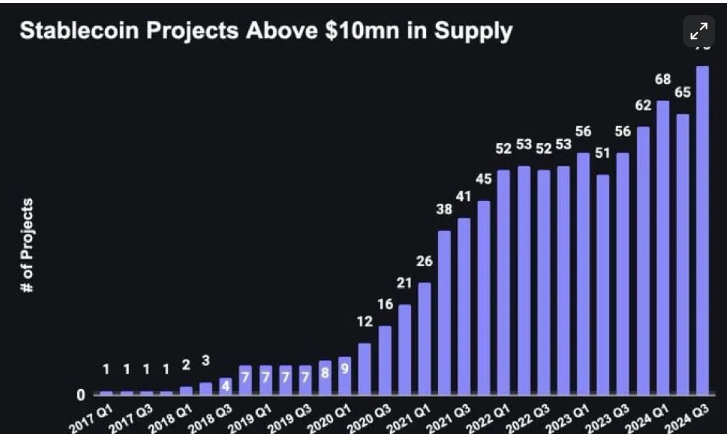

There are now over 76 stablecoin projects with a supply of over $10 million.

Source: Artemis on X

The growth potential is not only massive; it is transformative at the global economic level. And we are still just getting started.

We are on the threshold of a new financial era. The stablecoin revolution has just begun, and I can't wait to see where it takes us.

Source: Mike Dudas on X

Until our next adventure.