The problem with cryptocurrencies lies in the failure of diversification. When going out, there is no enemy outside, and the country will perish.

Author:Zuoye Waiboshan

The ancients did not deceive me, "When going out, there is no enemy outside, and the country will perish".

Vitalik has returned to the familiar Block world, with no desire for the throne, just an old legend. First, he wildly released MEME Coins, unwilling to be a good black hole address like Satoshi Nakamoto, then he pointed out that Based Rollup is a good L2, and finally he published several grand essays, pointing the way for the development of Ethereum, all of which can only be attributed to the internal proliferation caused by external pressure.

After brewing for a long time, let's seriously discuss whether a third public Chain/L2 other than BTC and ETH will appear in the market.

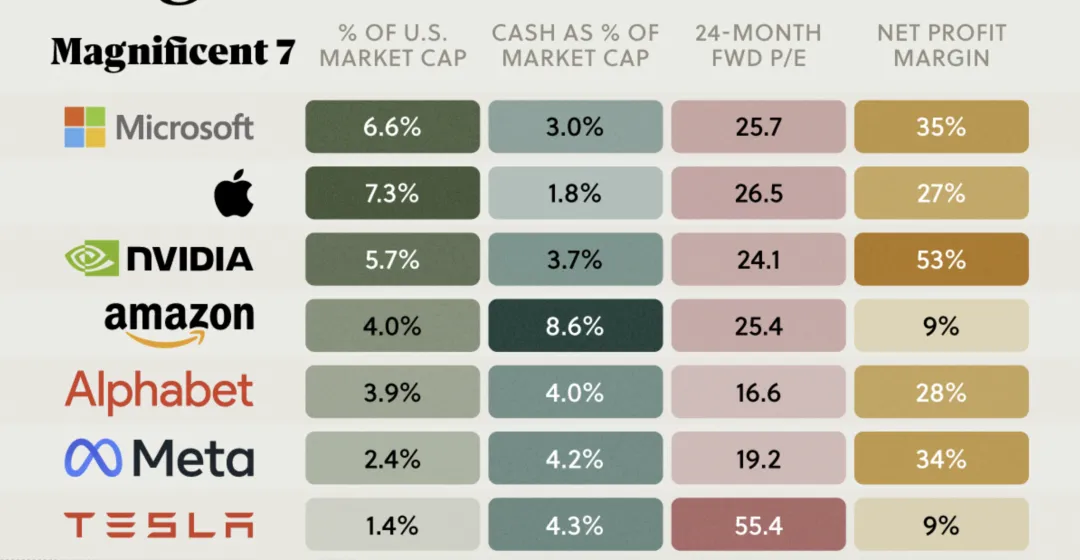

The Magnificent 7 in the US stock market, the 14K in the crypto world

The rise in the A-shares is just a flash back, it flashed once and then returned to the historical normal level, while the US stock market has walked out a long bull market, at the root of which is that the market capitalization of the tech giants in the US is accepted by the world, represented by Apple, Microsoft, Meta, Amazon, Alphabet (Google's parent company), Nvidia and Tesla, the Magnificent 7 in the US stock market have a market capitalization of trillions of dollars under the AI wave.

Source: https://www.visualcapitalist.com/stock-comparison-magnificent-7-vs-2000s-tech-bubble/

From the distribution of the Magnificent 7, they are involved in AI hardware and software, from models, algorithms to data, and there are companies like Apple that serve over a billion global consumers, while from the market performance of cryptocurrencies, the current biggest problem is the imbalance in weighting.

Source: CoinMarketCap

According to CMC data, the dominance of BTC is around 60%, and the global cryptocurrency market capitalization is only $2.34 trillion (including stablecoins), based on which I calculated the HHI index of cryptocurrencies (excluding stablecoins) to be around 0.35307.

Generally speaking, the HHI index is used to measure the concentration of market participants, according to the common principles of the market, the HHI index is usually calculated for the top fifty market participants, according to Coinglass data, the selected tokens are as follows: BTC, ETH, BNB, SOL, XRP, DOGE, TRX, TON, ADA, AVAX, SHIB, WBTC, LINK, BCH, DOT, NEAR, SUI, LEO, LTC, APT, UNI, PEPE, TAO, ICP, WBETH, FET, KAS, XMR, ETC, XLM, POL, STX, RNDR, IMX, WIF, OKB, AAVE, FIL, OP, ARB, INJ, CRO, MNT, FTM, HBAR, VET, ATOM, BONK, METH, RUNE.

Continuing to explore, according to the US Department of Justice's assessment standards, a market with an HHI less than 1500 is a competitive market, a market with an HHI between 1500 and 2500 is a moderately concentrated market, and a market with an HHI greater than or equal to 2500 is a highly concentrated market, we will amplify the cryptocurrency HHI index by 10,000 to get 3530.7, which has already exceeded the 2500 threshold, and combined with the dominance of BTC, the problem with cryptocurrencies lies in the failure of diversification.

We can even quantify the current state of diversification, according to the calculation method of the HHI index, only the top 14 cryptocurrencies out of the top 50 have a market share influence of more than 0.00001 (calculated to five decimal places), while the remaining millions of cryptocurrencies only serve as an atmosphere group.

From an optimistic perspective, if one believes in the future of cryptocurrencies, the concentration can be further concentrated, at least there is still room for contraction, the 2nd to 13th places all have the opportunity, from a pessimistic perspective, the total market capitalization of cryptocurrencies is really too low, Nvidia, Apple and Microsoft are all $3 trillion market cap players, if cryptocurrencies reach the top end of the rise, it will be difficult to change the current situation.

High-performance L1 or ETH L2?

The significance of the HHI index is to quantify the current situation, which will be more intuitive than data like TVL, after all, the trading volume of the top fifty coins is relatively stable and real, the current market is characterized by an excessively high dominance of BTC, while Ethereum is loosely powerless and gathering strength, Solana is rapidly rising on the back of MEME, in a sense, Solana has already gone through its TheDAO moment, and has regrouped the most basic faith pool and supporters after the FTX collapse.

But it's still not enough, for Ethereum to stand firm, it's not because of the greed of EOS's BM, but the asset issuance assistance of the DeFi Summer, smart contracts have found their best testing ground in DeFi, with a flick of the sleeve, it's a market capitalization of hundreds of billions.

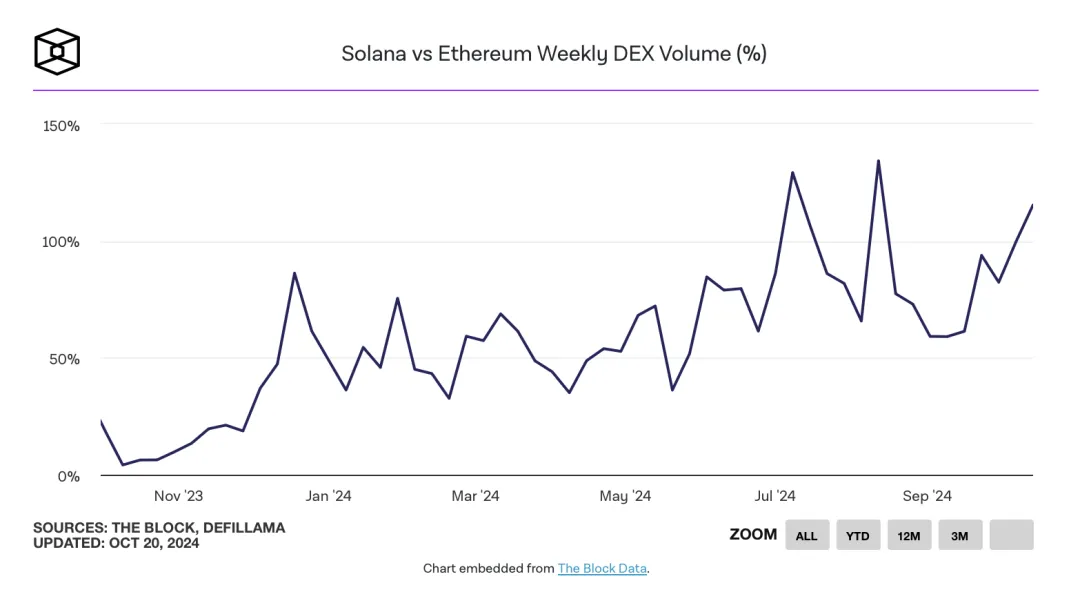

Here is the English translation of the text, with the content inside <> not translated:Now that Solana continues to engage in DeFi, it is obvious that it will not defeat Ethereum, even though Solana DEX has occasionally surpassed Ethereum. However, based on the experience of human economic history, the market share of monopolistic enterprises will gradually stabilize over time, such as the often-mentioned "dragon one and dragon two", while "dragon three" is basically ignored. Looking at the performance of traditional internet, it is more of a single dominant player, such as Didi in ride-hailing and Meituan in local life, although other new players may occasionally emerge, but the overall trend is unlikely to change.

What I want to express is that DeFi cannot help Solana become a new asset issuance platform. From the perspective of user path dependence, a complete migration from Ethereum to Solana is just a political dog whistle in the public opinion arena, rather than a fact that has already happened or is about to happen. This becomes even more evident with the market actions of public chains like Sui.

Another fact is that Memecoins have limited help as well. From the perspective of absolute market capitalization, the current market capitalization of Solana Memecoins is around $10 billion, while the entire Memecoin market capitalization is around $60 billion, with Doge alone having a market capitalization of over $20 billion.

Furthermore, the characteristic of Memecoins is that they have "no use value, but have economic value". Compared to the false empowerment of Token Utilization in VC coins, Memecoins directly acknowledge that no empowerment is needed, and everyone can speculate together. In terms of bursting the hypocrisy of VC coins, Memecoins have made great contributions, but they do not solve the problem of where to find use value. The market capitalization of Memecoins cannot continue to expand.

Any asset has its cycle of ups and downs. Even the seven sisters of the US stock market have experienced many years of major ups and downs. People are looking for use value not to support the high point, but to defend the low point, to retain the most basic real user group, and to recharge for the next speculation. But without use value, there is no recharging pool. The market can view Doge as the industry representative of Meme, but it cannot view Solana as a Meme Chain, as this would be too strange.

However, I am confident that the third chain is most likely not an L2. This is also the reason why I have not described it in detail. The problem with L2 is that it is superior to ETH, and Vitalik himself will come out to oppose it. If L2 is not powerful, then the meaning of developing L2 does not exist. This paradox is not a technical problem, but an economic one. The core of Ethereum is ETH and the DeFi ecosystem, not a certain scaling technology. If each L2 is forcibly required to empower ETH, then their own tokens basically have no value support, and we have already seen this in the token issuance and airdrop dramas of Eigen and SCR.

Conclusion

At a time when Chuanbo is running for the election, the United States can only have one president and two parties. Cryptocurrencies have entered the political agenda for the first time. Although Satoshi Nakamoto cannot be found, the president who supports cryptocurrencies is most likely to take office. The new industry ecosystem brought by compliance will bring new opportunities, and only those who can seize these opportunities will be the third chain, but its performance form is still uncertain.

Before the S3 performance, I hope we can all see the emergence of the third chain smoothly!

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal views of the authors and guests, and are not related to the position of Web3Caff. The information in the articles is for reference only and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of your country or region.

Welcome to join the official community of Web3Caff: X(Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram discussion group