Author: Chandler, ForesightNews

On October 24, market data showed that the price of Bitcoin fell below $66,000 at its lowest. Since October 21, the upward momentum of Bitcoin has shown signs of weakness, falling from a high of $69,500 to a low of $65,260. The trend of Ethereum is synchronized with that of BTC, falling from a high of $2,770 to a low of $2,440. According to data from Coinglass, the market liquidation amount reached $279 million in the past 24 hours, of which long positions accounted for $202 million.

Has the market reached a cyclical top again? Perhaps we can find some clues from on-chain data.

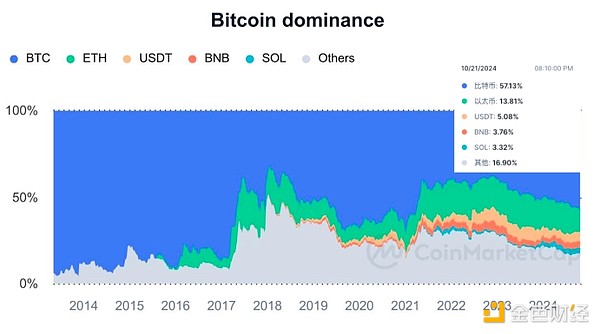

Bitcoin Dominance Index Rises to a Three-Year High

The Bitcoin Dominance Index (BTC.D) represents the current market share of Bitcoin in the cryptocurrency market. Since around September 2022, the market share of BTC has been on an overall upward trend. According to Coinmarketcap data, BTC's market share has recently approached 58%, up more than 8% year-to-date, reaching a high since April 2021.

According to historical data, the early stage of a bull market is usually accompanied by a rise in Bitcoin's market share, while when the market enters the "Altcoin Season", Bitcoin's market share usually declines. At the same time, when Bitcoin's market share reaches a high point, the market often enters a sideways consolidation or correction phase. In theory, this is a manifestation of the critical point of market liquidity and investment sentiment, as a natural result of profit-taking after Bitcoin attracts a large influx of funds and the price reaches a relatively high level.

The Inflow of Bitcoin Spot ETFs Becomes a Key Factor

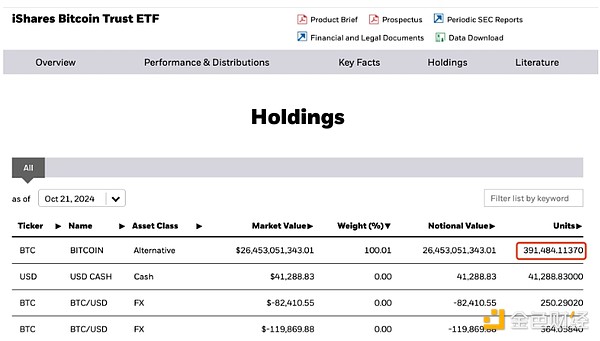

It is worth noting that the rise in Bitcoin's market share in this round of the market is mainly driven by the large-scale inflow of funds into Bitcoin spot ETFs, especially the participation of institutional investors. According to data disclosed by Ki Young Ju, CEO of CryptoQuant, institutional holdings account for about 20% of US Bitcoin spot ETFs. Asset management companies hold about 193,000 Bitcoins. Benefiting from spot ETFs, 1,179 institutions have joined the investment in Bitcoin this year.

From the data, from October 14 to October 21, Bitcoin spot ETFs have seen a net inflow for 7 consecutive days, especially the BlackRock ETF IBIT, which has seen a net inflow of over $1.5 billion, increasing its current BTC holdings to 391,484 (worth about $264.5 billion). The price of Bitcoin has also risen from $62,300 to over $69,000.

With the first net outflow of $79.09 million from Bitcoin spot ETFs after the 7-day net inflow on October 22 Eastern Time, the price trend of Bitcoin has also begun to show stagnation and oscillation accompanied by a decline. This phenomenon can be interpreted as the market failing to break through an important technical support level, and investors' confidence in the short-term market outlook has declined. When institutional funds begin to decrease or flow out, the price will subsequently decline. If Bitcoin fails to effectively break through, the price trend may face further consolidation and volatility.

From another perspective, the market's reaction shows that the rise of Bitcoin has attracted a large amount of liquidity, which is particularly evident in the current market stage. At the same time, Bitcoin is gradually absorbing the liquidity of other Altcoins during the oscillation period, further forming a obvious "blood-sucking" effect. During the process of Bitcoin's rise, the prices of other crypto assets often do not follow suit, leading to a further tilt of market liquidity towards Bitcoin. If Bitcoin fails to break through key resistance levels, the market may experience a short-term correction, and liquidity will further withdraw from the Altcoin market, leading to increased price volatility. Typically, when Bitcoin reaches a new high, some liquidity may spill over into the Altcoin market, which may then see a larger-scale price increase.

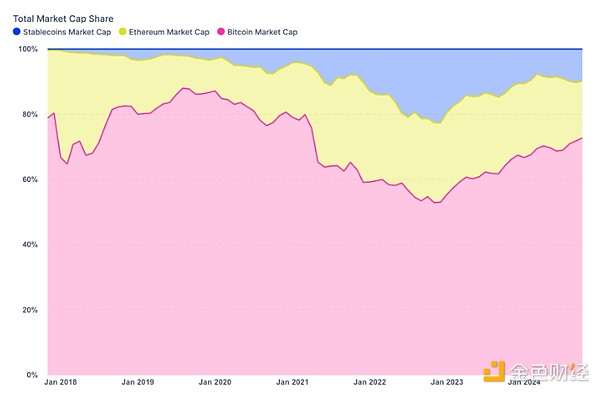

USDT Market Cap Hits a New High, USDT.D Touches Support

The total market capitalization of stablecoins has increased its market share by taking away a portion of Ethereum's share. Excluding the impact of other Altcoins, its share of the total market value of BTC, ETH, and stablecoins has grown from 7% in 2024 to 10%. According to data from defillama, the total market capitalization of stablecoins is currently $172.78 billion, a new high since May 2022.

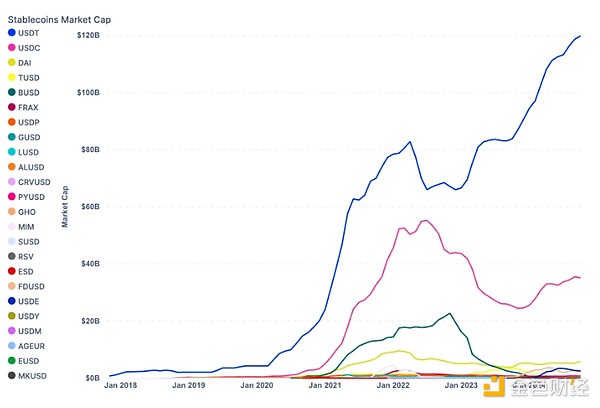

Among them, the market capitalization of USDT has reached a historical high of $120 billion, accounting for 69.49% of the total stablecoin market value. This has also been the main driving force for stablecoins to seize market share from ETH over the past six months.

The collapse of Silicon Valley Bank (SVB) in March 2023 was a turning point in the stablecoin competition, leading to a significant contraction in USDC's market share, while the supply of USDT increased. To a certain extent, the rise of the USDT Dominance Index (USDT.D) is not a good sign for the market. USDT.D can serve as a barometer of market sentiment and effectively predict the price tops and bottoms of Bitcoin in different cycles.

As shown in the figure below, in this year's market, whenever USDT.D approaches or retests its long-term upward support line, Bitcoin often experiences a local price peak. This is because investors tend to transfer funds to stablecoins like USDT to hedge risks during market volatility periods. Therefore, the rise in USDT.D usually implies the withdrawal of market funds, which is also the location of the recent high point of Bitcoin prices.

Weakening Demand

From a medium to long-term perspective, the absolute realized profits and losses in the Bitcoin market are currently showing a significant downward trend. Since Bitcoin reached a historical high of $73,000 in March 2024, the speed of new capital inflows into the market has slowed significantly. According to data provided by glassnode, the current daily capital inflow into the market is about $730 million, although this figure is still not small, it has decreased significantly compared to the peak of $2.97 billion in March.

This indicates that the momentum of market demand has weakened significantly. Although funds are still flowing into the market, the scale is not sufficient to drive a long-term stable rise or fall in Bitcoin prices, but is more likely to experience violent fluctuations with relatively small capital changes. This lack of liquidity makes Bitcoin likely to continue to experience significant price volatility in the short term, and the overall market lacks a clear direction, leading to a more cautious sentiment among large investors.

Overall, Bitcoin is currently in a market situation where high volatility and uncertainty coexist, and the price trend over the past half year has been more like repeated "ups and downs" within the existing range. Without a real large-scale capital inflow or outflow, it will be difficult for Bitcoin's price to break out of the current oscillation pattern.

Overall, Bitcoin is currently in a market situation where high volatility and uncertainty coexist, and the price trend over the past half year has been more like repeated "ups and downs" within the existing range. Without a real large-scale capital inflow or outflow, it will be difficult for Bitcoin's price to break out of the current oscillation pattern.

This market phenomenon is closely related to the fluctuations in the sentiment of market participants. The sentiment of large investors is relatively cautious, and many institutional investors choose to wait for clearer market signals, such as further clarification of macroeconomic policies or adjustments to the Federal Reserve's future monetary policy, as well as the upcoming US presidential election. At the current stage, market sentiment is fragile, and any macroeconomic changes could become a catalyst for market volatility.