What is the Funding Rate? - The Price Maintenance Mechanism of Perpetual Contracts

The first key point: In the cryptocurrency world, the term "contract" refers to futures.

The second key point: Spot and futures are different trading markets, and there will be a phenomenon of incomplete synchronization of prices between these different trading markets, even though they are both Bit. The price difference between the spot market and the contract market will occur.

This is not only the case in the cryptocurrency market, but also in various financial markets. However, futures have an expiration date, such as the 30th of the month, and upon expiration, they will be settled according to the spot price. Due to the settlement mechanism, the price difference usually will not be too large, and if the price difference is large, there will be arbitrage opportunities, so the market will naturally have a continuous convergence force on the price difference.

But perpetual contracts have no expiration date and will not be settled. If there is no mechanism to connect the contract market and the spot market, and they are driven by their own market supply and demand, the price difference between them may become larger and larger, and they may eventually become two commodities that only share the same name but have no actual relationship.

In order to maintain the price linkage between the spot and contract markets and converge the price difference, the funding rate was designed.

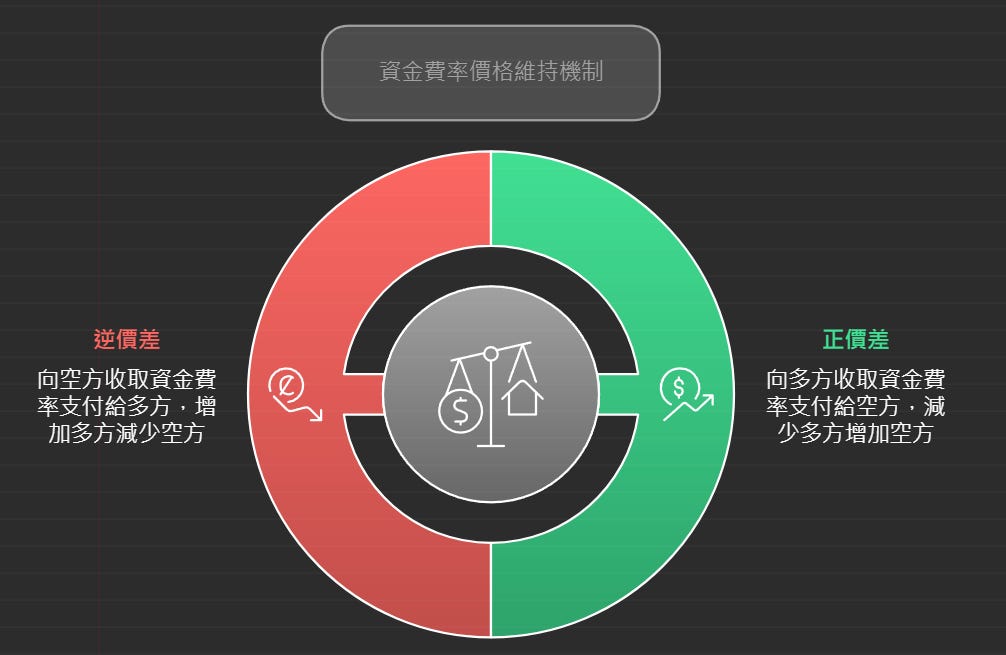

The Funding Rate Mechanism for Maintaining Prices

When there is a positive price difference, where the contract market price > the spot market price, the funding rate is positive

Collect the funding rate from the long side and pay it to the short side, making the long side smaller and the short side largerWhen there is an inverse price difference, where the contract market price < the spot market price, the funding rate is negative

Collect the funding rate from the short side and pay it to the long side, making the short side smaller and the long side larger

Components of the Funding Rate - Interest Rate + Premium Index

Interest Rate: The basic interest rate, reflecting the cost of capital, is relatively fixed, usually around 0.03% per day

Premium Index: As mentioned in the previous paragraph, it is determined by the positive or negative price difference in the market. The larger the price difference, the larger the premium index

If the spot and contract market prices are consistent and there is no significant price difference, the premium index will not come into play, and the funding rate will only have the interest rate component; when the market volatility is severe and causes a huge price difference, the premium index will come into play.

How to Calculate the Funding Rate

You can find the information about the funding rate on the perpetual contract trading interface of each exchange.

The formula for calculating the funding rate is very simple: Position Value x Funding Rate x Time

The funding rate interface already displays the numbers, and there are two key points here:

Calculation Time - Calculated every 8 hours, 3 times a day. With a 0.01% rate, it is equivalent to an annualized rate of about 10.95%

Note that the funding rate settlement time varies across different exchanges, with some being 4 hours and others 8 hours, etc.

Position Value - Not calculated based on the margin, but on the size of the established contract, considering that contract trading often involves leverage, using a small amount of margin to establish a large position, the funding rate will also be magnified by the leverage

Although perpetual contracts have no expiration and can be held long-term in theory, considering the funding rate, it is still recommended to focus on the spot market in practice. Perpetual contracts are only useful for participating in the price swings without having to worry about expiration and rollover, but as the holding time is extended, the funding rate will become an increasingly significant cost that must be carefully evaluated.

Example Calculation:

Assuming you have 1000 U of margin and use 3x leverage to long 3000 U of Bit, and hold for 10 days without any price increase or decrease before closing the position, how much funding rate will you be charged during this period?

Position Value 3000 U x Funding Rate 0.01% x 3 times per day x 10 days = 9 U

What is Funding Rate Arbitrage?

Warning: Arbitrage is an advanced and high-risk operation, and you must be very familiar with it before attempting it. This section only provides a simple explanation of the mechanism and logic.

Arbitrage can be simply understood as simultaneously executing two trades in opposite directions, not to profit from price movements, but to profit from the price difference between different markets, locking in profits in a risk-free or very low-risk manner.

In the case of funding rate arbitrage, the goal is to "earn the funding rate", and the general approach can be simplified into two types:

Spot-Futures Arbitrage, hedge in the perpetual contract and spot markets to earn the funding rate

For example, if the current funding rate is 0.01%, which is positive, meaning the long side pays the short side, in this case, you can short the perpetual contract market and long the equivalent position in the spot market. Since the two positions offset each other in terms of price movements, the profit would be the collected funding rate, which is around 10.95% annualized for a 0.01% funding rate.

Some exchanges provide this type of trading bot, usually called a spot-futures arbitrage bot or a funding rate arbitrage bot.

Arbitrage trading, hedging perpetual contracts across different exchanges, and earning the difference in funding rates

The funding rates across different exchanges may vary. For example, if the funding rate on Exchange A is 0.01% and the funding rate on Exchange B is 0.05%, by going long on Exchange A and short on Exchange B, the 0.04% difference in the rates would be the profit earned.

This approach is actually quite difficult, as you need to have assets that can be traded on multiple exchanges, and there may be slight price differences between the two exchanges, which may not be perfectly synchronized. Even a small difference can make it difficult to capture the profit.

Therefore, the so-called funding rate arbitrage usually refers to spot-futures arbitrage, which is relatively easier to execute, and can be combined with the use of trading bots provided by the exchanges.

Where can you check the funding rates of different exchanges

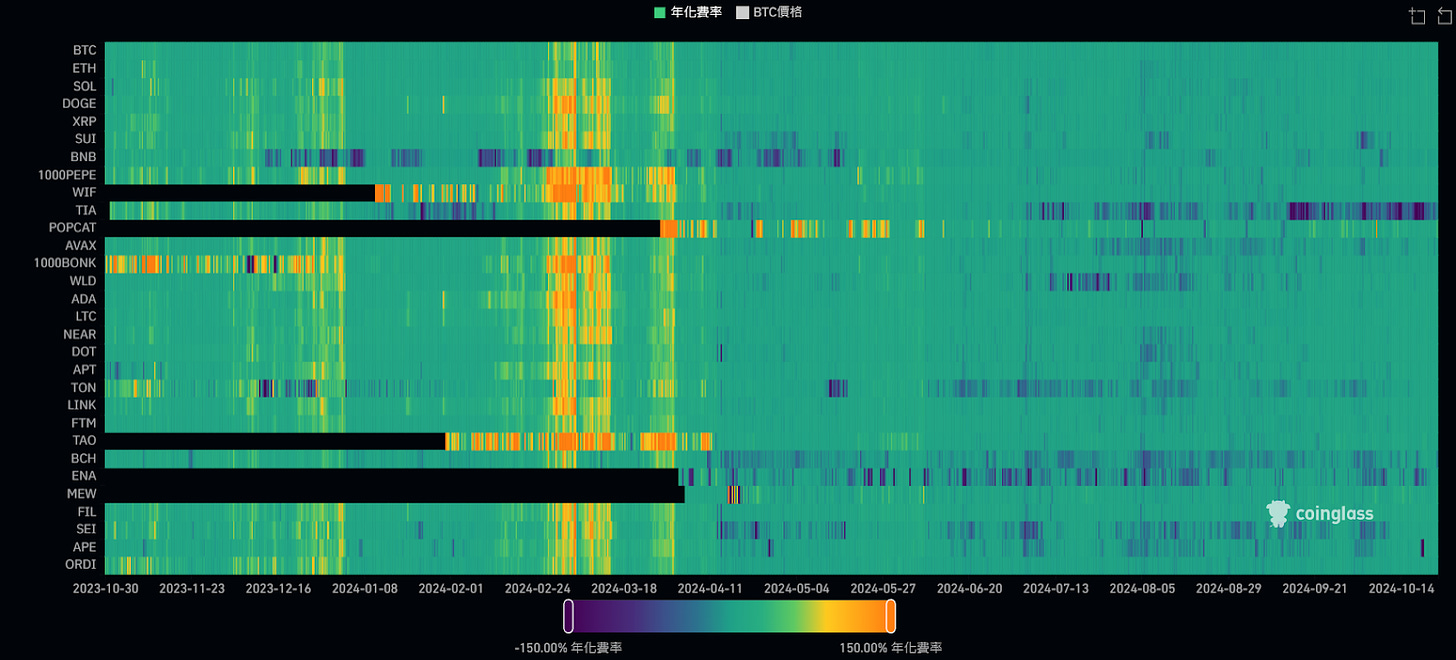

CoinGlass - Cryptocurrency derivatives information platform

When the funding rate is high, it also means that there is more leveraged capital in the market, and the market may face a risk of correction in the short term. Therefore, the funding rate is also a key indicator for traders to assess the current market sentiment.

You can directly check the current and historical rates of major cryptocurrencies on different exchanges, and they can also be presented in a heat map:

It also provides arbitrage detection and recommendations, which is a very useful information tool.

Reminder: Contract trading is a high-risk derivative market, which offers more opportunities to make profits, but also has a higher risk of losing everything. It is recommended to understand the contracts, leverage, and trading before attempting, and start with a small amount.