$Sui Quick Facts

Token Name | $Sui |

Maximum Supply | 10 billion |

Total Supply | 10 billion |

Current Circulating Supply | 2.76 billion |

Current Market Cap | $5.34 billion |

Market Cap Rank | 26 |

Token Price | $1.92 |

Token Utility | Participate in staking, governance, and as Gas |

Sui and the Move Programming Language Blockchain

Sui is a Layer 1 blockchain built using the Move programming language. However, Sui has developed a unique Move-based architecture, introducing the novel "Object" concept, which overturns the traditional shared ledger approach and is more aligned with real-world asset transactions.

The advantages of using the Move language include the ability to eliminate many blockchain vulnerabilities (such as replay attacks, double spend attacks, and compiler issues) at the language logic level, as well as the ability to run parallel processing to improve performance. This gives the Move-based blockchain ecosystem, represented by Sui and Aptos, a significant advantage. Other competitive Move-based blockchains include the previously introduced Movement.

Recommended Reading:

Team Background: Top Developers from Meta

Sui was developed by the Mysten Labs team, whose members are mostly former members of Meta's blockchain projects (Novi and Diem). The co-founders include:

Evan Cheng

Evan Cheng serves as the team's CEO. Evan spent 10 years at Apple developing core technologies and was one of the primary innovators of LLVM, a technology that has brought a major revolution to the tech industry. Evan later joined Meta, leading a team to develop and research blockchain and Ethereum, making him a world-class computer scientist.

Sam Blackshear

Sam Blackshear serves as the team's Chief Technology Officer, also coming from Meta's Novi team. Sam Blackshear has a high level of expertise in programming, and he developed the Move language.

Adeniyi Abiodun

Adeniyi serves as the team's Product Director. Prior to joining the Meta team, he worked on blockchain teams at Oracle and VMware, helping enterprises develop blockchain solutions. He also founded the blockchain company Peernova and the Bitcoin cloud mining company CloudHashing.

George Danezis

George is the team's expert in blockchain consensus and security. Meta actually acquired his company Chainspace to assist with the Libra (Diem) project. George is currently a professor of Security and Privacy Engineering at the University of London and an advisor to the data security software company Privitar.

Kostas Kryptos Chalkias

Kostas is a cryptographer who also previously led the cryptography research for the Novi team. Many of the cryptographic algorithms used in the popular social software WhatsApp were developed by him. He is currently responsible for the team's cryptography and encryption-related technologies.

Sui Technical Architecture: Security x Performance x User Experience

Since the founders of the Sui team came from Meta's Novi and Diem projects, their goal is not just to build a high-performance public blockchain, but to create a global user intent coordination layer. In other words, Sui must be easy to develop for and able to execute different tasks in parallel.

In traditional Web2, sending messages and data is quite mature, but sending funds is not as proficient. Sui must excel at both, which is why the team places such emphasis on security, speed, and user experience.

The "Object" Concept

The core of Sui's technical architecture revolves around the "Object" concept. An Object is the basic storage unit in the Sui blockchain, with each Object having a unique 32-byte ID. To make it easier to understand, you can think of an Object as a bundle of assets or items.

There are several types of Objects:

Owner Object

An Owner Object represents an Object owned by a specific address. It could be 10, 100 $Sui tokens, or an Non-Fungible Token (NFT). An Owner Object can only be read, written, or deleted by the owner, similar to only being able to see or modify the items (Objects) you own.

Immutable Object

An Immutable Object is public but cannot be modified, and it does not belong to anyone, but everyone can read it.

Shared Object

A Shared Object is public and can be modified. Everyone can read and write to a Shared Object, similar to a bank where each deposit or withdrawal changes the bank's state, and everyone can see the related status. In the ecosystem, a Shared Object could be an application or an asset.

Wrapped Object

An Object can be wrapped inside another Object, and the ID of the wrapped Object will not be visible until someone unwraps it.

Some Objects can be split or merged, such as an Object holding 100 $Sui tokens, which can be divided and transferred, providing great flexibility for asset transfers.

This system may sound simple, but what are the advantages?

First, this concept means that your assets are "truly" owned, rather than just recorded in a shared ledger. Each transaction involves the transformation of multiple Objects, and due to the integrity of the mechanism, it is almost impossible to carry out contract attacks. Additionally, the parallel processing advantage allows Sui to handle unrelated Objects without conflicts, improving throughput (TPS) while providing an excellent transaction experience.

Consensus Mechanism: Introducing Mysticeti to Reduce Latency by 80%

Narwhal-Bullshark

Sui's original core architecture was built on the two pillars of Narwhal and Bullshark. Narwhal optimizes transactions, while Bullshark ensures blockchain security. This Proof-of-Stake (PoS) consensus mechanism is quite powerful and can scale with the addition of validator nodes, maintaining low gas fees while ensuring decentralization.

Mysticeti

This year, Sui has introduced a new consensus mechanism called Mysticeti. Mysticeti is an optimized Byzantine Fault Tolerant (BFT) consensus mechanism. According to data from the testnet, Mysticeti has reduced the consensus time by 80%, achieving a latency of around 390 milliseconds, making Sui the speed king of the consensus layer.

In July this year, the new consensus mechanism Sui mainnet went online. As it stands now, the transaction speed of Sui has already matched or even surpassed the web2 applications we normally use, and in terms of transaction speed, Sui is indeed several steps ahead of other blockchains.

Sui performance summary

Transaction confirmation time < 700 milliseconds

Theoretical TPS can reach 297,000 and can be multiplied according to the number of hardware

According to Coingecko data, the actual TPS is 854, second only to Solana's 1,053

zkLogin + Sponsored Transactions

Recently, Sui co-founder Adeniyi Abiodun mentioned in an interview with Grayscale that he believes the web3 wallet is a product with a very poor user experience. When users want to enter the web3 world, they are required to first download an application and learn how to use it, and then perform complex transfer and transaction operations. By the time the successful transaction is completed, they have already lost interest.

In response to this situation, the Sui ecosystem has introduced the zkLogin feature, allowing users to create wallets using Google, Facebook and other accounts, and integrate sponsored transactions to allow new users to avoid the complex concept of Gas, as if they are browsing in the web2 world, thereby reducing the entry threshold for users and then optimizing the transaction experience to the extreme.

From the above points, it is not difficult to see that Sui has a greater technical advantage among many blockchains, which is also what the Sui ecosystem is pursuing. Therefore, Sui's vision is focused on games and social networking, and currently there are about 75 game developers developing on the Sui ecosystem, including the three major Korean game companies NetMarble, Nexon and NCSoft. The Sui Playser X One game console launched this year also integrates the Playron operating system to enhance the gaming experience.

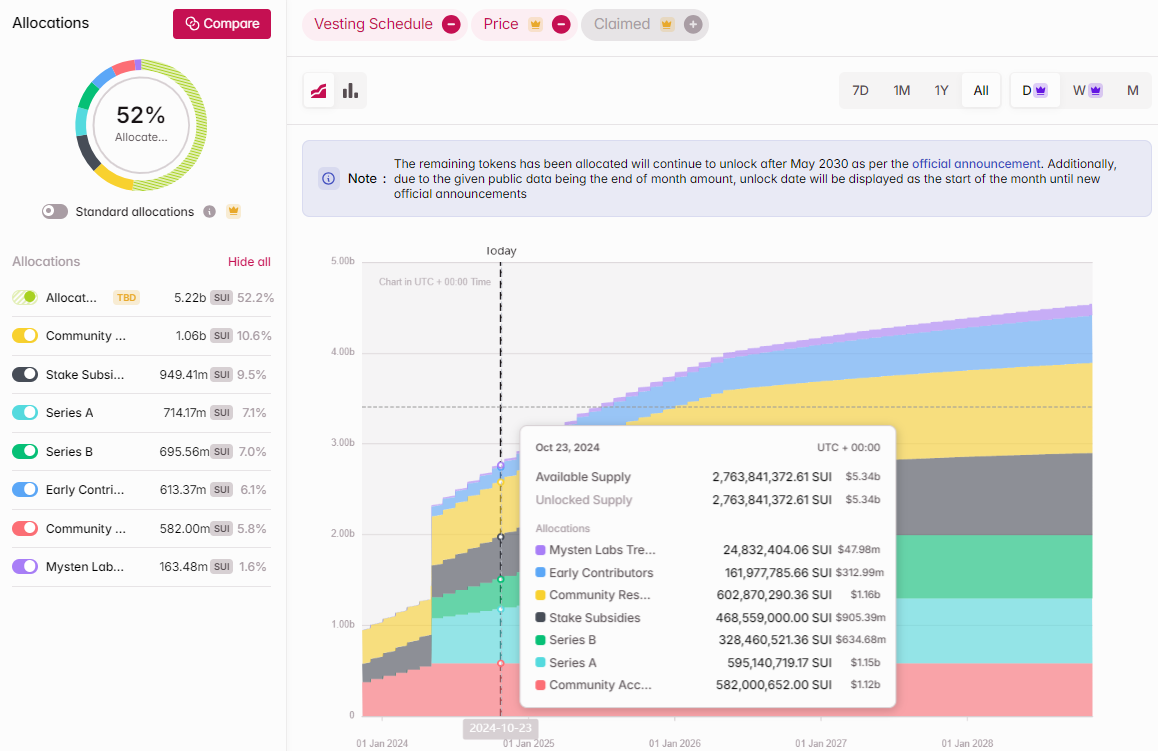

$Sui Token Economics and Unlocking Situation

The ecosystem native token $Sui currently has 27.6% of the tokens in circulation, another 20% of the tokens are locked, and 52% of the tokens are unallocated. However, on-chain data shows that there are currently 7.7 billion $Sui tokens locked, most of which are owned by the Sui Foundation.

Since more than half of the tokens are in the hands of the Sui Foundation, their voice is quite large. Many people believe that these uncertain tokens will flow into the market in different ways, thereby diluting the token value and causing retail investors to lose everything. In May this year, the founder of CyberCapital also pointed out this problem in a tweet.

In addition, the impact of the market not buying VC tokens in this bull market cycle has not yet dissipated, and $Sui is also on the list. Sui has raised a total of $336 million in 2 rounds of financing, with the latest round of financing in September 2022 led by FTX, with participation from well-known institutions such as a16z, JumpCrypto, and Binance Labs. FTX's tokens have been bought back by the Sui Foundation. Although Sui is indeed technically very strong, whether it is worth investing in still needs to be carefully evaluated by investors.

Discussion: Can Sui Become the Next Solana?

Let's do a key data comparison:

Sui | Solana | |

Actual TPS | 854 | 1,053 |

Theoretical TPS | 297,000 | 65,000 |

Final transaction confirmation time | < 1 second | < 13 seconds |

Average daily transaction volume | About 10 million | About 40 million |

Daily active addresses | 1.76 million | Over 4 million |

Active applications on-chain | 86 | Over 300 |

On-chain TVL | $1 billion | $6.6 billion |

From the data, the number of on-chain applications and TVL can reflect the development progress and market acceptance, and in this regard, Solana has an absolute advantage. The daily transaction volume and active addresses can also truly reflect the on-chain heat, and Solana with pump.fun also has an advantage, but Sui has indeed surpassed Solana's performance in 2021, but they cannot be compared on the same day, after all, the current blockchain users are more.

At the current stage, Sui has achieved what Solana achieved in the past, and in terms of technology, Sui has indeed surpassed many competitors. But in 2021, Solana was not only ahead in technology, but also a leader in capital and innovation. In terms of capital, it had the strong support of FTX, and in terms of innovation, it had platforms like MagicEden and Raydium, and through these chain reactions, it successfully created the wealth effect of Tokens and Non-Fungible Tokens, thereby attracting many developers and users to jointly prosper the Solana ecosystem.

At present, Sui has a powerful performance advantage and is continuing to move towards the game track. If it can bring more innovation and wealth effect from this starting point, and attract more people to join the ecosystem to build together, it may indeed create another Solana.

Summary

The advantages of the Sui ecosystem are obvious. The high-efficiency performance provides users with an excellent experience, and the strong security is an absolute advantage. However, in the web3 world, the heat of the ecosystem, the wealth effect, and the meme fever cannot be lacking. Although the team has not paid much attention to this, the recent meme fever has indeed spread to the Sui ecosystem, bringing a lot of attention. On the other hand, creating a sense of trust in the market for the ecosystem is also very important. This point still needs to be strengthened in the token distribution, and it is hoped that more innovation and planning for the Sui ecosystem can be seen in the future.