Recently, the Bit coin spot ETF in the United States has attracted a large influx of funds, but some analysts have begun to worry that this may lay hidden dangers for a potential decline.

According to a report by Cointelegraph, Shubh Varma, CEO and co-founder of Hyblock Capital, said in an analysis report on October 23:

"Historically, such activities are usually followed by a bearish price trend, and we may be seeing the beginning of a price decline."

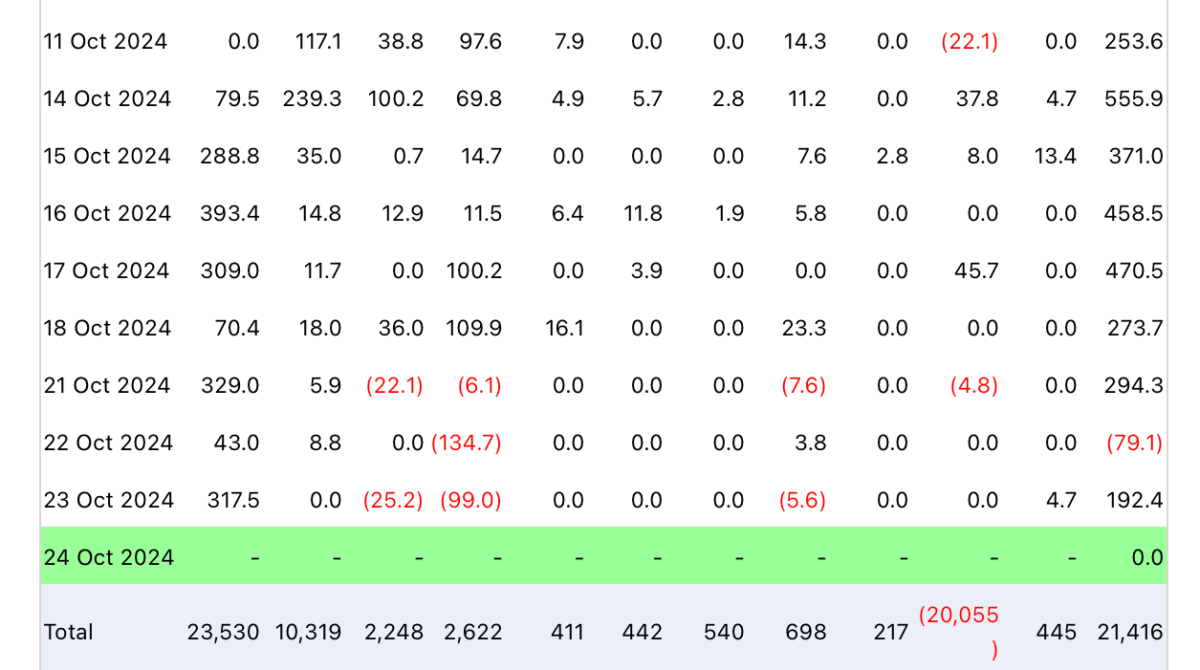

According to data from Farside, from October 11 to 21, the Bit coin spot ETF saw a net inflow of about $2.68 billion over seven consecutive days, until a $79 million outflow on October 22, but on October 23 it began to record a net inflow again, with a total inflow of $192.4 million that day.

However, Shubh Varma said that the last time the Bit coin spot ETF saw an unusually large influx of funds, Bit coin's price fell 13% about three weeks later.

On June 4 and 5, the Bit coin spot ETF saw inflows of $886.6 million and $488.1 million respectively, and at that time Bit coin was fluctuating between $68,800 and $70,000. By June 25, just 20 days later, Bit coin's price had fallen to $60,266.

Varma claimed that if history repeats itself, with Bit coin declining, analysts would expect to see "massive outflows" from the Bit coin spot ETF:

"This could create a higher low, setting the stage for Bit coin to surge to new highs."

However, other analysts believe that the large influx of funds may indicate an impending supply shock. Pentoshi, Chief Investment Officer of North Node Capital, posted on the X platform on October 23:

"The volume of Bit coin ETF purchases far exceeds the daily Bit coin mining output, and this has been particularly evident over the past 12 days. When will the supply shock occur? When will the sellers run out of Bit coin?"

Meanwhile, according to a previous report by Zombit, data from the derivatives trading platform Deribit shows that options traders have begun to increase their bets on Bit coin reaching new highs by the end of November. In particular, the $80,000 strike price for call options expiring on November 29 is the most closely watched, while the $70,000 price has also attracted a lot of attention. The options expiring on December 27 are concentrated between $100,000 and $80,000.