Author:Eli Nuss

Compiled by: TechFlow

Who is performing the best in the crypto venture capital space?

We referenced the fundraising data provided by @tokenterminal and the market data from @artemis__xyz to answer this question.

Please refer to this for our full analysis.

Summary

It's important to note that we rely on the accuracy of this data. There are often undisclosed funding rounds or missing key data in other announcements. However, even with these limitations, we can still glean some interesting insights from the available data.

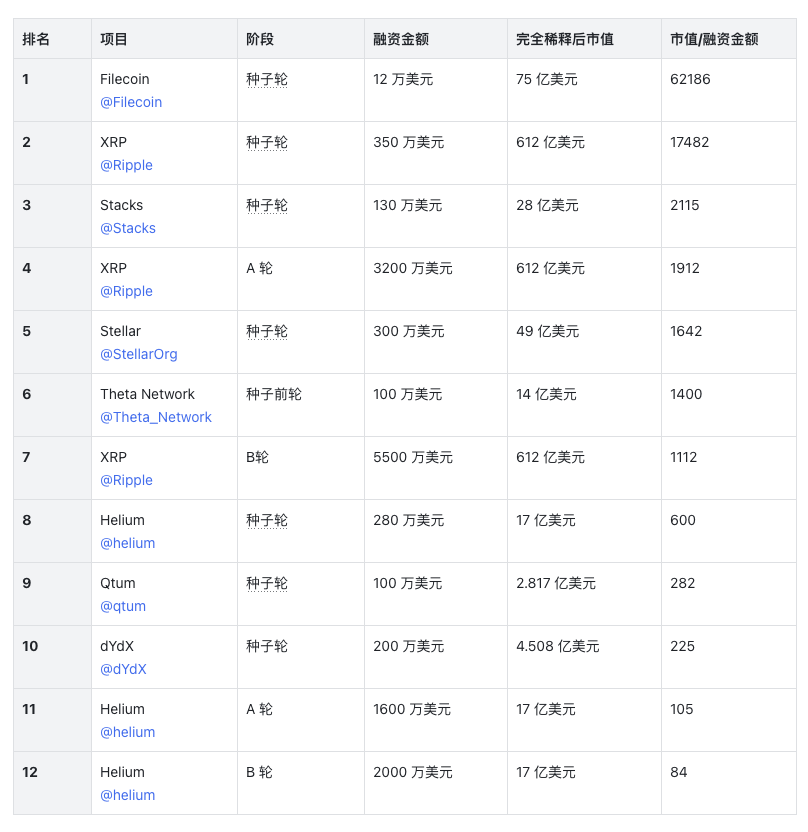

First, let's review the most successful crypto investments historically.

We ranked them by calculating the ratio of the fully diluted market capitalization (FDMC) at the end of Q3 2024 to the funding amount.

We then categorized them by funding cycle to identify the best performers in each year.

Here are the top investments from 2015 to 2017:

Infographic compiled by TechFlow

Notes:

"FDMC" refers to the fully diluted market capitalization.

"FDMC/Funding" represents the ratio of market value to funding amount.

Here are the top investments from 2018 to 2021:

Infographic compiled by TechFlow

Here are the top investments from 2022 to 2024:

Infographic compiled by TechFlow

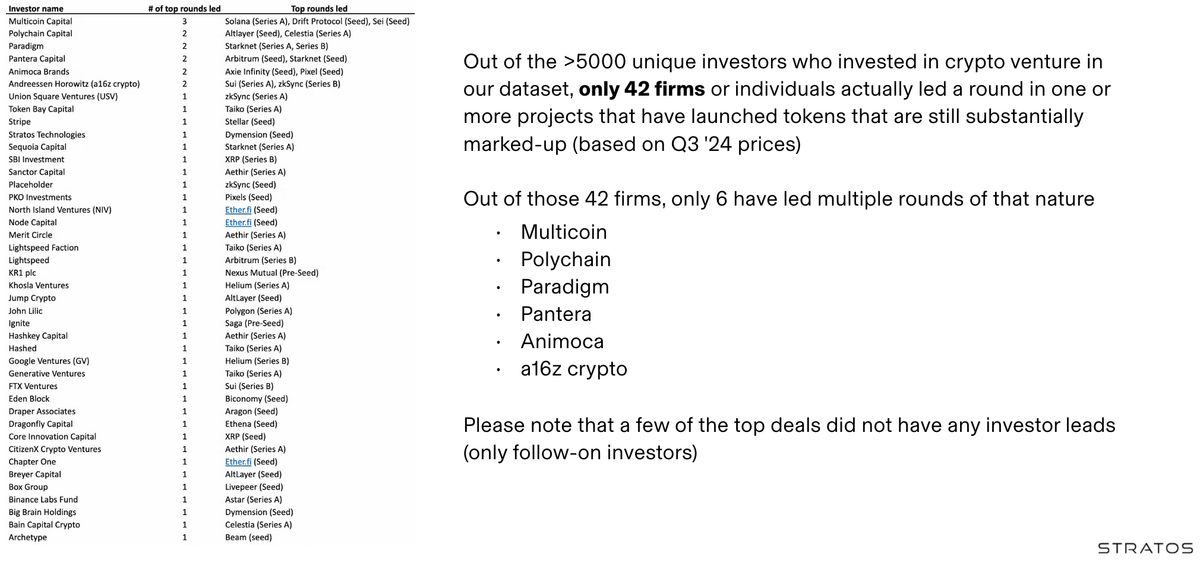

After identifying the highest-returning investments, we next look at which funds participated in these funding rounds.

We distinguish between lead investors and co-investors. Here is the list of investors that have led or co-led these high-return rounds:

Notably, @animocabrands and @a16zcrypto stand out as the only companies that have repeatedly led these high-return transactions.

Out of over 5,000 unique investors in our dataset, only 42 companies or individuals have actually led one or more projects that have seen significant appreciation in token prices based on Q3 2024 valuations.

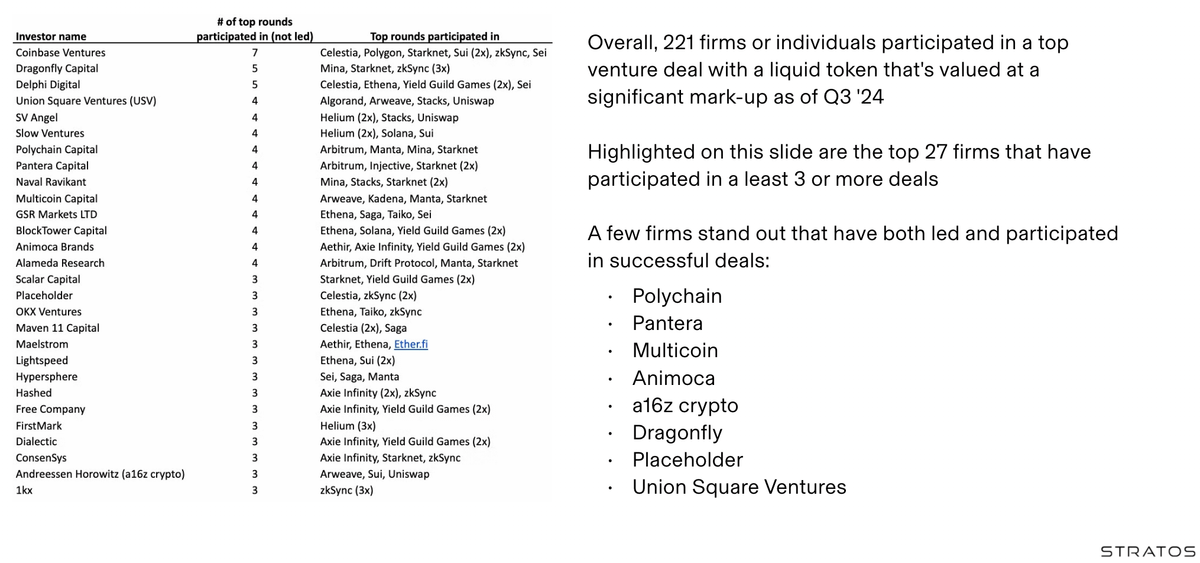

Here are the funds that have most frequently participated in these rounds:

In total, 221 companies or individuals have participated in a top-performing venture transaction, with their liquid tokens appreciating significantly in value by Q3 2024.

This chart highlights the top 27 companies that have participated in 3 or more of these transactions.

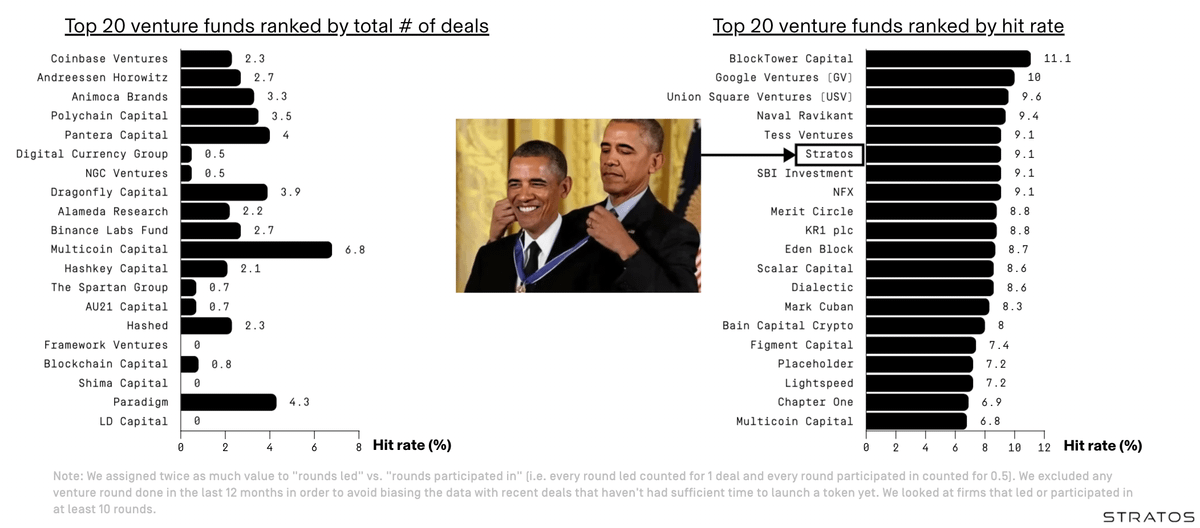

Considering that some investors are more active than others, it's also important to look at the hit rate. We not only used the previous data, but also considered the total number of transactions each investor has participated in to identify the ones with the highest hit rates. It's worth noting that @BlockTower stands out in this regard!

Based on the information above, we have constructed a matrix in the hope of providing an overview for funds in this space.

This matrix is dynamic, as a single major success can propel a fund into a new quadrant.

We hope that one day all funds will be in the top right corner of the matrix.

We hope this analysis is as interesting to you as it has been to us.

We welcome any feedback or suggestions to help us improve the analysis in the future. We plan to update these data regularly, so we aim to be as accurate as possible.