Written by: IOSG Ventures

Abstract

BOB is a new type of L2: a Hybrid L2. BOB is secured by the most secure L1, BTC L1, and uses this security to create a trustless bridge that connects BTC, ETH, and other L1 blockchains. Therefore, the Hybrid L2 does not rely on third-party bridging tools to achieve interoperability, and also solves the problem of fragmented BTC multi-chain liquidity.

1. Introduction

BTC was created as a decentralized, transparent, and censorship-resistant payment system. Ten years later, smart contract chains have driven the creation of DeFi applications and other innovative products, such as Non-Fungible Tokens, tokenized social media and gaming, as well as DAOs and other trustless governance structures. In this context, although the BTC L1 remains the core of global cryptocurrency adoption, it has fallen behind in terms of innovation and developer activity.

Although the BTC L1 is slow to develop and lacks flexibility, it still has a much larger market capitalization, transaction volume, and active user base than all other cryptocurrencies combined. As of October 2024, BTC has 300 million users, a $10 trillion market cap, and unparalleled brand recognition and dominance. However, the DeFi activity on the BTC L1 is the lowest among all cryptocurrencies: the DeFi TVL to market cap ratio of Ethereum is 30%, while for BTC it is only 0.1%, a 300-fold difference.

In the past few years, there have been many attempts to introduce smart contracts and DeFi on the BTC L1 through protocol changes and forks, but these attempts have all failed. The BTC L1 opposes any protocol upgrades that could significantly change its functionality or increase its complexity. Therefore, the BTC L1 will not have native programmability like Ethereum for a long time to come, and ultimately BTC L2 will become the best solution for DeFi in the BTC ecosystem.

1.1 Hybrid L2

Hybrid L2 is a BTC L2 solution that aims to solve the main challenges of scaling DeFi on the BTC L1. This type of L2 often has three key attributes:

BTC L1 security: Using BitVM2 to leverage OP verification and error proofs on the BTC L1.

Trustless BTC bridging: Using an improved BitVM bridging design, where as long as the BTC L1 is secure and there is at least one honest node in the network to execute on-chain disputes, users can deposit and withdraw BTC. This new security model is called "existence is trust" (1-of-n), as it relies on minimized assumptions and is much more secure than existing BTC multi-sig bridges.

Trustless Ethereum bridging: BOB uses the security of the BTC L1, combined with the L1/L2 Ethereum OP rollups bridging design, to encode the correctness of Ethereum L2 withdrawals as part of L1 smart contracts. This design can be extended to most L1 chains with smart contracts.

As the first Hybrid L2, BOB provides a practical trustless cross-chain interoperability solution: first, the BTC L1 as the most secure decentralized network can secure both the L2 and all cross-chain bridges. On top of this, BOB further solves the problem of fragmented BTC cross-chain liquidity - users can use the native BTC liquidity and the BTC L1 secure withdrawal mechanism through the BOB network to deposit assets on various chains. Ultimately, BOB sustains the security and sustainability of the BTC L1 by paying fees to the BTC L1.

2. The State of BTC L2: Blessings and Curses

BTC L2 has the potential to bring innovation to the BTC L1 while maintaining its core principles. It can unlock the prospect of DeFi use cases, empowering trading, lending, and staking without the need to rely on centralized exchanges. This is a huge opportunity to unlock the trillion-dollar BTC market. Currently, dozens of chains have claimed to be "BTC L2".

However, building a BTC L2 is a daunting task, and previous attempts have not achieved the level of success seen in Ethereum. We believe there are three major challenges to successfully launching a BTC L2:

BTC security and trustless BTC bridging: This is the key feature that sets BTC L2 apart from all others. The security of the BTC L1 allows users to deposit and withdraw BTC without relying on third parties. To date, almost all BTC bridges have relied on multi-signatures. BOB is the first team in history to realize this blueprint through BitVM2.

Building a competitive ecosystem: L2 can only succeed if its dApp ecosystem thrives. The key to creating successful products is to provide the best developer tools and DeFi infrastructure, such as wallets, institutional custody, and oracles. This means the L2 team has to keep up with the pace of development, such as ms-level transaction speeds and abstracted gas fees. If they cannot provide a competitive developer environment, BTC L1 applications will struggle to compete with Ethereum and other network competitors.

Introducing blue-chip liquidity (cold start problem): In a DeFi ecosystem, introducing stablecoins, fiat on/off-ramps, and bridges to other networks is crucial. For developers, network effects are a decisive factor in the success of new products, so building projects in isolation on a chain poses a major challenge.

3. BOB's Background: Bridges, Light Clients, and BitVM

BOB's innovation is primarily embodied in three core technical concepts: cross-chain bridging, light clients, and BitVM. These technologies collectively constitute BOB's value proposition, so it is necessary to delve into these three aspects.

3.1 Light Clients

The BTC L1's "Simplified Payment Verification" (SPV) light client protocol allows nodes to perform payment verification without downloading the entire blockchain data. This method only requires the light client to verify consensus finality through block headers, and can then verify based on the selected transactions.

The BTC L1 light clients have verifiable security and can be verified by other blockchains with smart contract capabilities. For example, Threshold has been running such light clients on Ethereum for years. However, Ethereum does not have a secure light client, as it needs to store and track the public keys of over a million validators, increasing system complexity.

3.2 Cross-Chain Bridges

We have proven the two properties of "bridging" or "wrapping" assets to different blockchains:

a) It can allow both chains to function correctly;

b) It is difficult to achieve without a trusted third party.

In practice, we can reduce the reliance on third parties by allowing any network participant to take on the verification role. Through the so-called "light client bridge", Chain A and Chain B can verify each other's consensus protocols through their respective smart contracts. When we deposit asset a into the bridge on Chain A, the smart contract on Chain B will verify that the transaction has reached consensus on Chain A, and only then will it mint the wrapped token b(a). Vice versa, when we burn b(a) on Chain B, we must first verify that the transaction has reached consensus on Chain A. This design has had very few successful implementation cases due to the complexity of light clients.

3.3 BitVM

BitVM is a mechanism that executes arbitration programs on the BTC L1 in an OP-based manner. Its execution happens off-chain, with on-chain dispute resolution in case of failure. Its two main use cases are OP aggregation on the BTC L1 (similar to Arbitrum) and trustless bridging. In both cases, BitVM allows users to deposit and withdraw BTC from L2, as long as there is at least one honest node in the network to execute the on-chain disputes.

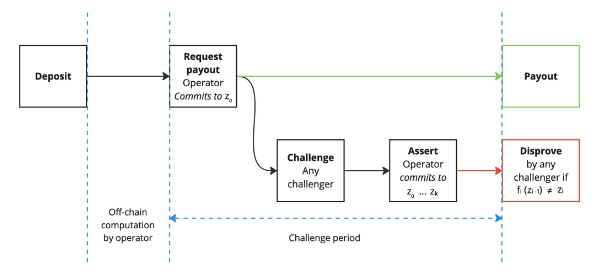

The current most widely used version of BitVM is BitVM2. Its design summary is as follows:

Compress the program into a SNARK verifier and implement it in the BTC L1 script.

Divide the verifier into sub-program blocks of less than 4MB to execute in BTC L1 transactions.

BitVM2 operators submit the program and pre-sign the transactions during the setup phase via the Taproot tree.

Users deposit funds into BitVM2 (e.g. bridge deposits).

When attempting to withdraw from BitVM2, anyone can challenge the operator.

If challenged, the operator must reveal the results of all intermediate sub-programs and show the final computation result.

If the operator cheats, some of the revealed sub-program results will be incorrect, and anyone can prove the operator's cheating by executing the specific sub-program.

Operators who cheat will be expelled and will no longer be able to access deposits.

Source: bitvm.org

Our latest paper will provide a detailed overview of BitVM2.

4. BOB Hybrid L2

The innovative design of BOB's Hybrid L2 is based on the concept of decentralized network trust in BTC L1 and its simplicity in consensus verification.

4.1 BTC L1 Security

BOB's Hybrid L2 will utilize BTC L1 for settlement and security assurance. The currently recognized ideal BTC L2 design is based on zk-rollups: all state changes are computed off-chain, and then verified and recorded on-chain through zk proof. However, to date, BTC L1 scripts cannot support zk-rollups due to the need for additional opcodes to avoid consensus forgery. Therefore, BOB achieves security through the OP verification of BitVM2. This method generates a validity proof for each state transition and publishes it along with the state difference to BTC L1. When paired with BitVM2, any network participant can initiate a fault proof challenge within 7 days to overturn failed operations and ensure security.

This means that through BitVM2, we can allow any node in the network to participate in the fault proof mechanism, so that they can raise a challenge when an error is detected. This design makes the security almost equivalent to BTC L1 itself: as long as there is one online and honest node in the network, it can trigger the fault proof.

4.2 Trust-minimized BTC L1 Bridging

The BitVM2 fault proof also allows BOB to create a trust-minimized BTC L1 bridge. Specifically, this is a light client bridge, where BTC L1 is supported by a light client running in BitVM2. This bridge allows users to deposit BTC into the BOB network and withdraw back to the BTC L1 network with guaranteed security. This new design relies on the "existential honesty" security model, requiring only a 1-of-n honest assumption to ensure correct operation, which is more stringent than the existing multi-signature bridge solutions.

In existing BTC bridges, most rely on multi-signature schemes and require honesty of the majority of signers. However, in the BitVM2 design, even if all bridge operators are dishonest, as long as there is one online participant in the network, the funds cannot be stolen. This design solves the security vulnerabilities in multi-signature schemes and constitutes the most secure BTC bridge solution in history.

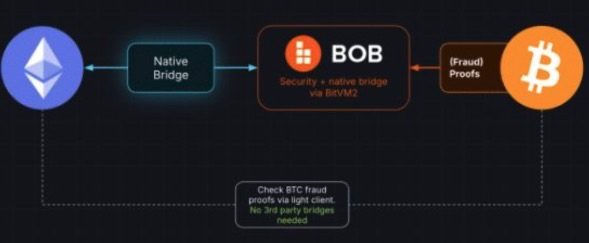

4.3 Trust-minimized Ethereum Bridging

BOB's Hybrid design also supports secure access to ETH and ERC20, similar to the Optimism design. When users wish to withdraw assets from L2 to Ethereum, they must wait for a 7-day challenge period to ensure there are no fault proofs. This mechanism provides security assurance for asset bridging between Ethereum and BTC L1 networks, solving the inherent risks of cross-chain bridging.

In BOB's Hybrid L2 design, the ETH bridge smart contract will wait for BOB to complete final confirmation on the BTC L1 network, ensuring all proofs are correct. This functionality is part of the bridge smart contract, which can verify the BTC L1 blockchain and achieve this through a BTC L1 light client. Therefore, any user who deposits ETH and ERC20 tokens into BOB can retrieve these assets to Ethereum as long as the BTC L1 network is secure and there is at least one online node that can trigger an error proof.

Source: BoB

5. Outlook: BOB as the Center of DeFi

The uniqueness of the Hybrid L2 will propel BOB to become the largest DeFi ecosystem in the industry. Currently, BOB is leveraging the network effects of BTC L1 and ETH, and will expand to other chains in the future.

5.1 Self-Reliance through Ethereum

dApps built on BOB can benefit from Ethereum's best-in-class infrastructure and development tools, while tapping into the core DeFi user base and establishing connections with all exchange and institutional players. It is worth noting that almost all Ethereum users hold BTC, and most BTC users also use ETH DeFi.

5.2 Growth Driven by BTC L1

Over time, the additional security provided by the trust-minimized BitVM2 bridge and access to BTC will unlock more untapped BTC liquidity pools and allow dApps on BOB to not only catch up with their Ethereum competitors, but also surpass them. This effect will be further amplified by the global adoption and diverse user base of BTC L1: in contrast to ETH L2 competing for the same user base, BOB's dApps can leverage the over 300 million BTC user base and thousands of real-world enterprises.

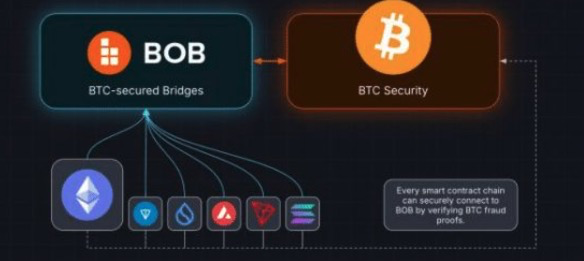

5.3 BTC L1 as the Multi-Chain DeFi Hub

BTC L1, ETH, and stablecoins occupy 90% of the market. However, just like the existing banks, we believe that hundreds of chains will emerge in the future, each focusing on different applications or geographic locations. All of these chains will need secure access to BTC L1, and a way to exchange assets between them.

Currently, centralized exchanges play this role: they connect all chains, allow users to deposit and withdraw assets, and convert assets to the corresponding L1. However, centralized exchanges have also caused major problems in the past, and will continue to do so until we fully transition to DeFi.

Instead, BOB's mission is to establish BTC L1 as the foundation of a secure and transparent DeFi ecosystem. As a Hybrid L2, BOB will securely bridge assets to any smart contract chain that can verify the BTC L1 blockchain through BTC. This means that the modern 90% of L1 and L2 chains, including Solana, TRON, Sui, Aptos, Monad, Avalanche, Cosmos, and Polkadot, can securely deposit and withdraw assets through BOB. All of this is done through trust-minimized operations on BTC L1, without relying on third-party bridges.

Source: BoB

Using BTC L1 as a trust anchor to create an interoperable DeFi ecosystem is the core advantage of the Hybrid L2 design. Rather than fragmenting BTC L1 liquidity across dozens of chains, BOB will concentrate liquidity around BTC, providing a truly viable alternative to centralized exchanges and placing BTC at the center of DeFi.

6. Conclusion

The BOB Hybrid L2 solves some of the most pressing challenges in building a decentralized financial system on top of BTC L1. By creating a BTC bridge that inherits the security of BTC L1 and maintains trust minimization, it provides the necessary infrastructure for the masses to join the BTC L1 ecosystem without relying on centralized service providers. At the same time, BOB's trust-minimized bridging to Ethereum and other smart contract L1 chains prevents the fragmentation of BTC liquidity and provides a practical, BTC L1 security-based solution to the long-standing issue of cross-chain interoperability, making BTC the core of DeFi.