Editor | Colin Wu

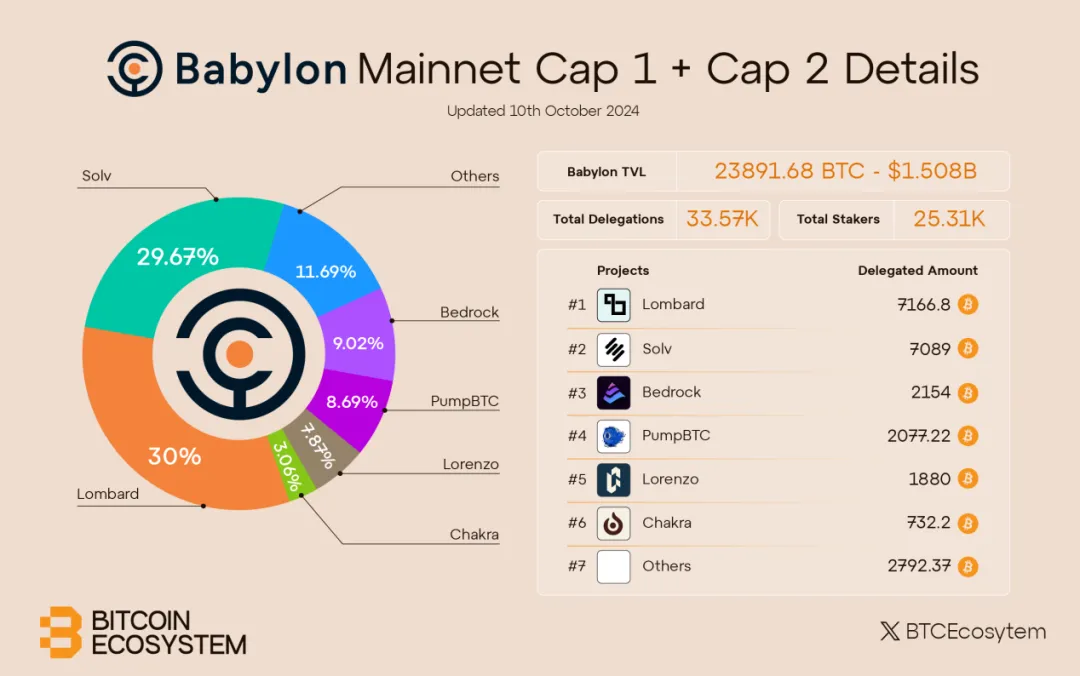

In the middle of this year, the reStaking track represented by projects such as EigenLayer, Karak, Symbiotic, and Solayer has exceeded $20 billion in locked-up volume. As the counterpart of Ethereum, Babylon, the most important project in the BTC Staking narrative, has been closely watched by the market since the launch of its testnet. After two openings of the staking quota, Babylon's direct deposit address has exceeded 25,000, and the amount of BTC deposited has also exceeded 23,000.

Babylon BTC Staking narrative drives BTC LST growth

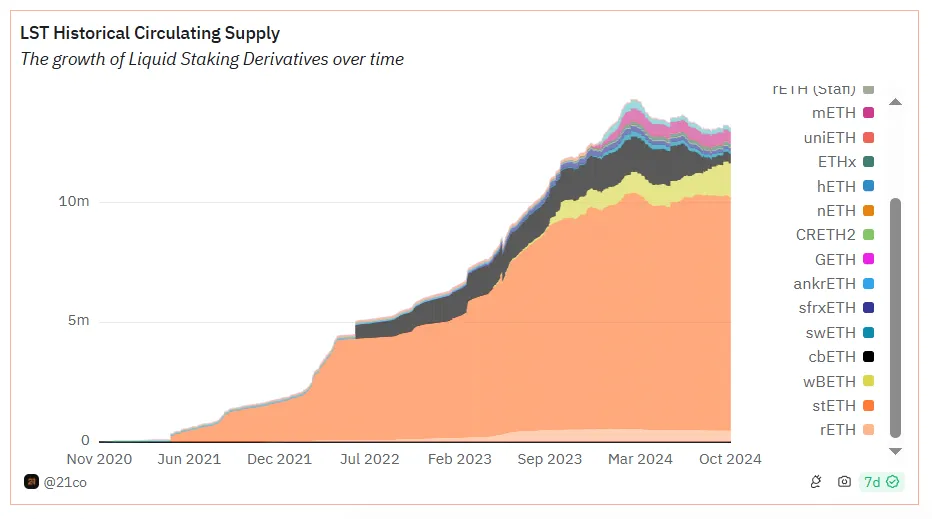

From last year to the beginning of this year, the Ethereum ecosystem has increased its overall ETH staking rate with the help of the "big mountain" of reStaking - EigenLayer, and has also driven the LST deposit volume to hit new highs for a long period, which is still maintained at a high level.

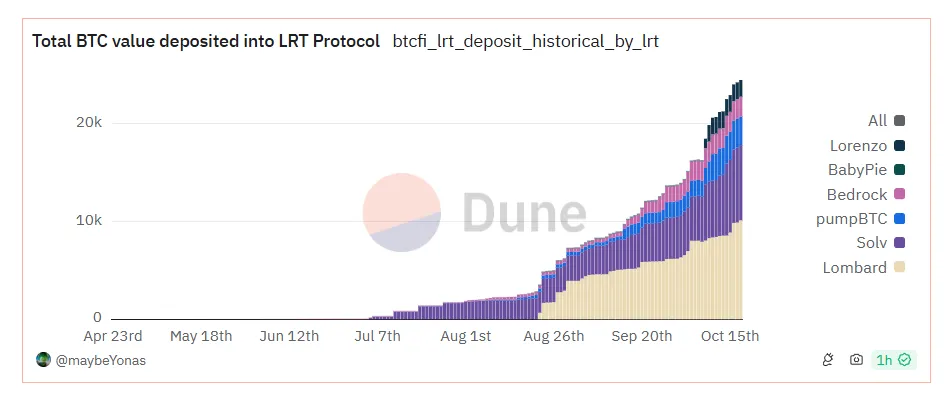

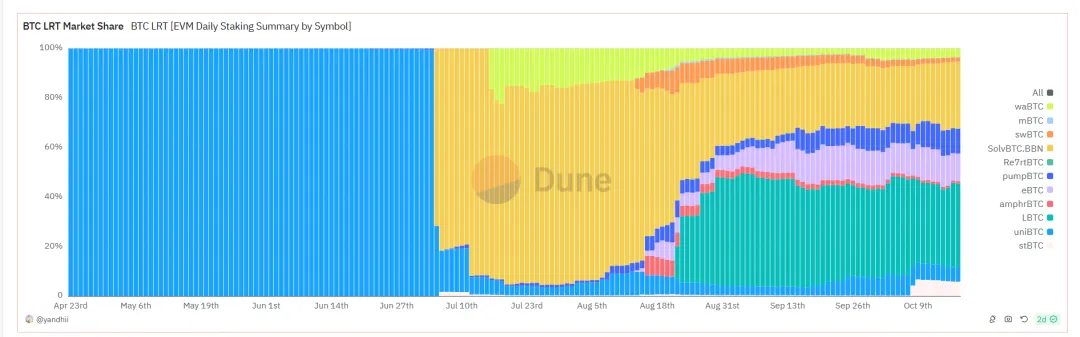

When the heat of Babylon brings the spring breeze of Staking to the BTC ecosystem, it also promotes the LST construction in its ecosystem. Driven by the pre-staking activities of Babylon, the deposit volume of various BTC LSTs has been continuously increasing, and there are currently more than 20,000 BTC participating in BTC LST deposits. Compared to the over $3.5 billion in ETH LST, the approximately $1 billion in BTC LST deposits is still in the initial stage.

After the two staking openings of Babylon, Bedrock, Lorenzo, PumpBTC, Solv, and Lombard currently occupy nearly 85% of the Babylon staking pool.

Babylon LST PPC

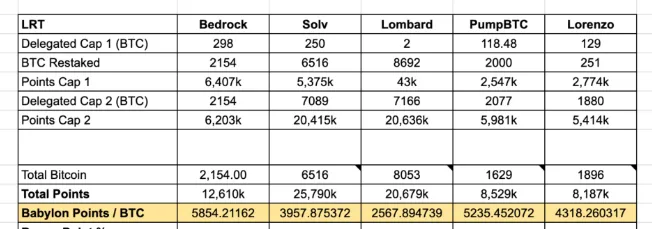

Since Babylon set a time-limited quota when opening staking in the early stage, LST protocols need to self-stake and process points, so the pre-staked BTC amount is not equal to the final actual staked BTC amount. Here, the concept of PPC (Points Per Coin) needs to be introduced. When users stake through different LSTs, although the staked BTC amount is the same, the points obtained may be different, and the actual returns may also vary accordingly. For example, the first Babylon limited each LST protocol to only deposit 250 BTC, but at that time Solv pre-staked more than 250 BTC, so Solv needed to handle the point distribution.

The PPC of Babylon LST protocols can be simply understood as the staking success rate of Babylon. According to the on-chain analyst @lstmaximalist, the PPC ranking of the top 5 Babylon LSTs is:

Bedrock: 5,854

PumpBTC: 5,235

Lorenzo: 4,318

Solv: 3,957

Lombard: 2,567

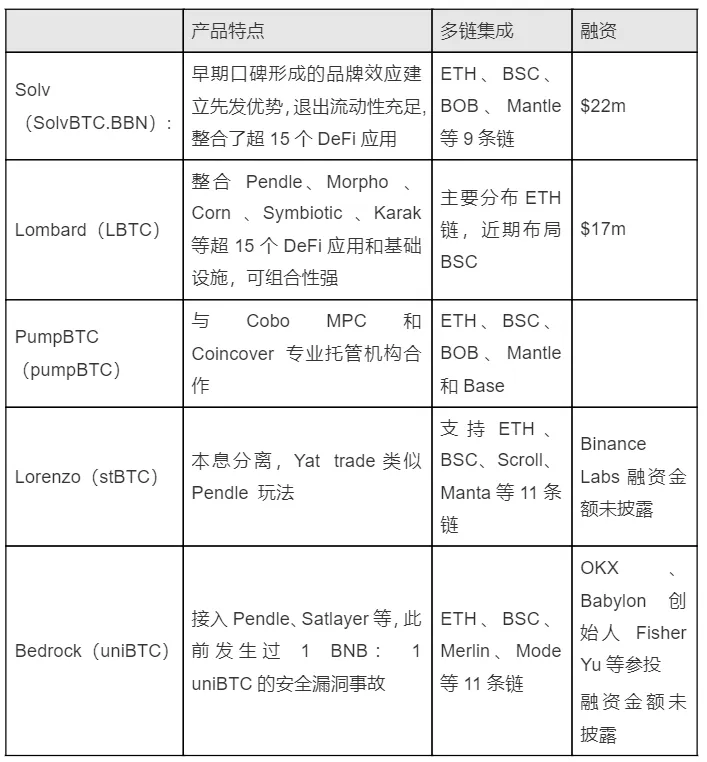

Babylon LST product situation

Currently, most BTC LST projects are mainly concentrated in the EVM ecosystem. On the one hand, this is because the infrastructure and ecosystem environment of EVM is more mature compared to the BTC ecosystem, which allows BTC LST to better match DeFi applications in the EVM ecosystem, and has stronger composability and more diverse gameplay, thus more easily achieving a similar capital utilization rate to ETH LST; on the other hand, deploying in the EVM ecosystem also lowers the user's usage threshold, and the use and wallet management on EVM chains is more convenient compared to operations on the Bitcoin chain.

Providing Babylon points is a basic requirement for BTC LST products. Due to the existence of Babylon PPC, BTC LSTs use airdrop platforms to subsidize users' losses on Babylon points, and attract users through a combination strategy of "platform points + DeFi returns". For the community, in addition to paying attention to the financing background of LST projects, the composability of star DeFi products is also an important evaluation indicator.

Babylon's BTC LST/LRT War

Relying on the first-mover advantage, uniBTC and Solv quickly occupied a large market share in the early stage, while Lombard, with the support of institutional staking, surpassed Solv later. Currently, the BTC LST/LRT market is mainly dominated by Ether Fi, Bedrock, PumpBTC, Lorenzo, Solv, and Lombard.

After the two staking openings, Babylon has obtained more than 20,000 deposit addresses and more than 23,000 BTC deposits, with its TVL close to Symbiotic, second only to EigenLayer. It is worth noting that since August, Symbiotic has started to accept the pledge of BTC LST assets such as LBTC and tBTC, which has diverted part of the market share of BTC LST.

With the entry of Pell network and Satlayer into the BTC staking track, the middle-tier projects will also seek opportunities to face Babylon in the future.

Lessons from the ETH LRT path

For most BTC LST/LRT projects relying on Babylon, although they have not been fully accepted due to a late start, the experience of ETH LRT is still worth learning from.

EigenLayer has spawned LRT projects such as EtherFi, Puffer, and Renzo. These projects not only promoted the TVL and popularity of EigenLayer, but the market capitalization and TVL of LRT Tokens have always been difficult to surpass the "big brother", and their own value ceiling also depends on EigenLayer. Before the EIGEN TGE, LRT Tokens can maintain their valuation with the help of the heat and expectations of EigenLayer, but after the launch of EigenLayer, they need to find their own way.

Some ETH LRT projects have already tried various methods to maintain their heat and "extend their life cycle":

● Extending the life cycle by multi-season airdrops of leading reStaking projects, such as EigenLayer dividing the airdrop into three quarters to maintain the heat.

● Joining other reStaking projects, such as Symbiotic and Karak, for example, Stakestone's STONE can be deposited in both EigenLayer and Symbiotic reStaking projects, and Ether Fi provides users with the choice of EigenLayer, Symbiotic, and Karak vaults to earn points.

● Empowering LRT protocol Tokens, cooperating with reStaking protocols to enhance their utility, for example, the ETHFI platform Token of Ether Fi can be used as a staking target for Symbiotic and Karak, while EigenLayer also allows the REZ Token of the Renzo platform to be staked.