Author: Liu Jielian

Recently, BTC has broken out of the downward channel, surging from around $60,000 to $67-69,000, showing signs of an upward breakthrough. Meanwhile, ETH has been oscillating sideways since August. That sideways consolidation has been remarkably horizontal.

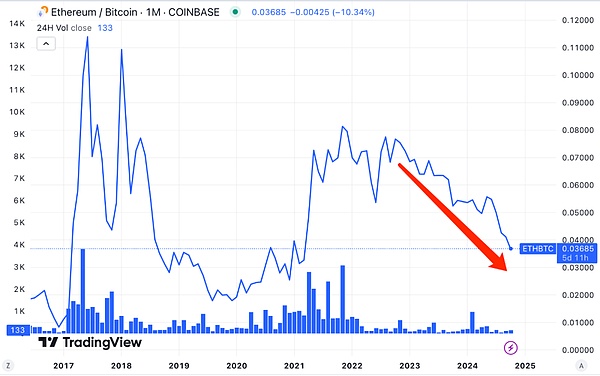

Jielian wrote an article called 《The Life Dilemma of Ethereum》 on August 27, 2024, which included a chart of the ETH/BTC exchange rate trend. At that time, it had already fallen below the 0.05 critical psychological level, but was still above 0.04. Now it has effectively fallen below 0.04, reaching the "3-digit" range.

Since the bear market bottom at the end of 2022, ETH/BTC has been declining all the way, from nearly 0.08 (which was actually close to the 2021 bull market peak), to the current level below 0.04, a near-halving.

This means that if you didn't take the opportunity to switch to BTC when ETH was relatively strong against BTC during the altcoin frenzy at the end of the 2021 bull market or the BTC oversold period at the end of the 2022 bear market, holding ETH until now can only get you back half the amount of BTC. That is, measured in BTC terms, holding ETH has lost half its value.

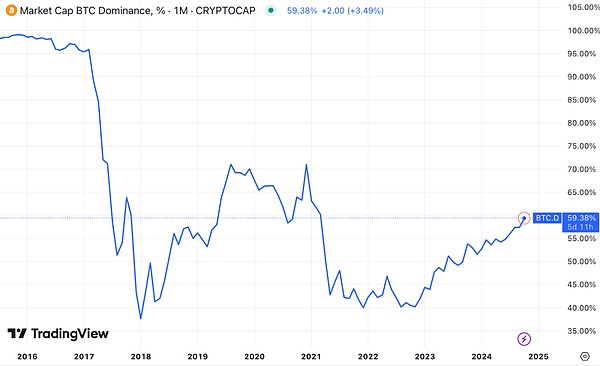

BTC's market cap share is already close to 60%. And it seems to be getting closer and closer to a sudden market rally. It's hard to say whether ETH/BTC will hit a new low one day when BTC suddenly surges and sucks the blood of altcoins, as it once reached 0.02 in 2019.

But this doesn't mean that switching now is wise. The reason is simple: everyone knows that making money is about buying low and selling high, and losing money is about buying high and selling low. Cutting losses now is definitely not selling high.

The disastrous performance of ETH has actually been "cursed" since the end of 2023. Looking back at the 《12.20 Internal Reference: Messari Bearish on Ethereum, ETH/BTC Hits New Low》 in 2023, Messari's boss Ryan Selkis openly bearish on Ethereum and bullish on Solana in his year-end report.

Earlier, in 2021, the article 《Ethereum Besieged from Both Sides》 by Jielian on November 24, 2021 had already written about the huge challenges facing Ethereum: "Besieged in front, pursued from behind, Ethereum is besieged from both sides."

From the perspective of market cap competition, it can be said that ETH has a strong competitor in BTC in the position of value storage; while it is being chased by sidechains (new public chains) represented by Solana, which have taken away a large market share - the "coin speculation" market.

After 15 years of development, the blockchain or crypto industry has only verified two real demands: one is BTC's value storage, and the other is coin speculation. These two are the real PMF (Product-Market Fit) that have been verified. All other so-called blockchain application demands have not been proven to have real commercial value so far.

"Coin speculation" can be broken down into three major parts: token issuance, trading, and derivatives. Corresponding to on-chain applications, they are ICO, DEX, and various DeFi (such as lending). "Coins" include fungible tokens and Non-Fungible Tokens (NFTs).

Stripping away the flowery rhetoric, it all boils down to one word - "speculation". What is "speculation"? It is not value creation, but wealth transfer. "Speculation" is a game of taking money out of the pockets of the masses and putting it into the pockets of the few.

"Coins" are tools, "speculation" is the purpose.

Seeing through this essence, it becomes clear that:

In the 2017 ICO craze, Ethereum was used to issue tokens, and the ETH/BTC ratio reached an all-time high of over 0.11.

In the 2020 DeFi summer, the DEX leader Uniswap pioneered on-chain meme coin speculation, and by the first half of 2021, SHIB broke out, with "new inexperienced investors only knowing SHIB and not BTC", and NFTs waving the "art" flag to attract impoverished artists into the circle to "harvest" them, all of which fell on the Ethereum chain, making it overcrowded and fees skyrocketing, earning it the nickname "aristocratic chain". ETH/BTC also once rebounded to 0.08.

When a restaurant is overcrowded, smart people will seize the opportunity to open a new restaurant next door and share the traffic dividend. So in 2021, the new public chain track exploded. Various so-called new public chains (such as Solana) emerged, taking over the overflow traffic from Ethereum, and thriving.

Everyone knows deep down that these "restaurant" branded stores have a constant stream of customers, but not a single one is there to eat, they are all there to gamble (speculate).

So these new restaurants are doing even better, even stripping off the fig leaf. Don't talk about crypto visions, decentralization, or value propositions, customers come to our store just to speculate on coins. Token issuance tools, go! Churn out meme coins by the hundreds or thousands a day. Trading tools, go! Low fees, smooth and slick. One coin, one meme, one plate. Plates open, plates collapse, not a short time of three to five days, not a long time of ten days or half a month. Rush in, go all out, accomplish it in one fell swoop, and disperse in a frenzy. Those who run slow can't even catch up with the hot ones.

The fat meat of the coin speculation track, this market, has been "snatched from the tiger's mouth" by the new public chains from Ethereum.

Yesterday's 《10.25 Internal Reference: The Four Stages of BTC Transfusing and Sucking Blood from Altcoins》 mentioned that the 7-day trading volume of the Solana DEX is already close to double that of Ethereum.

When all the coin speculation traffic has gone to Solana or elsewhere to play, what's left for Ethereum?

2024 will be the year of the crypto industry's value disillusionment.

Those who believe in crypto value only believe in BTC. Those who don't believe in crypto value only speculate on meme coins.

These two types of people will no longer step into Ethereum's door.

When the customers leave, the tea gets cold. User loss, market loss, this is the main reason why ETH has become more and more dilapidated in the past two years.

Why won't BTC users churn? Because the demand for value storage has strong user stickiness. "Security" is a truly scarce product.

But the "coin speculation" demand is completely different. For these users, where can't they speculate, where can't they gamble? So they have almost no stickiness. Wherever the speculation is more exciting, the dreams of getting rich quick are more, they will flock there.

Ethereum's technology is advanced, and its architecture is more decentralized, but users are often indifferent to technology, they only care about the perceptible experience, whether the operation is simple and smooth, whether the speculation is thrilling, whether the adrenaline can be stimulated, whether there are new tricks to play every day, just like the rich and colorful experience of Macau or Las Vegas.

Now ETH's performance has forced the community to start rumoring that Vitalik Buterin has broken up with his girlfriend and is ready to focus on Ethereum. But with Vitalik's lofty and idealistic talk about technology and high-end application scenarios all day long, he is completely unable to win back those users who have fled to Solana and other places to speculate on meme coins.

So Ethereum still has to figure out clearly, it's no longer possible to do value storage better than BTC, and it's been "snatched" by Solana in coin speculation, so what is its positioning, and what market should it occupy next, and who should pay the bill?

If you don't pay the bill, I don't pay the bill, and he doesn't pay the bill either, then the coins that the Ethereum Foundation sells every day can only be bought by the inexperienced investors in the secondary market.