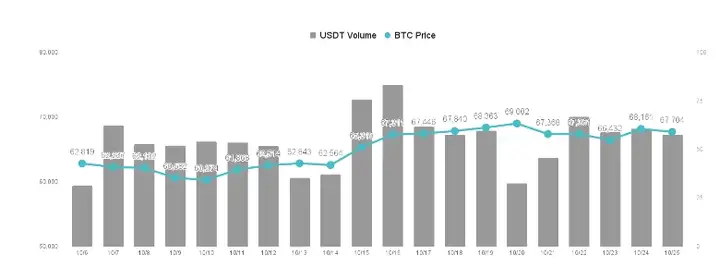

Over the past week, the price of Bitcoin has been trading between $69,000 and $65,000, and although it once tried to break through $70,000, it fell back to $67,000 under the pressure of rising bond yields last Monday. Overall, Bitcoin is currently the most stable cryptocurrency in the entire market, with a weekly decline of only 1.5%, much better than the 4.5% weekly decline of Ethereum, which has fallen to the $2,500 range, the main difference being the Trump trading characteristics of Bitcoin.

VX: TTZS6308

Due to Trump's strong support for the cryptocurrency industry, Bitcoin has been dubbed the "Trump concept commodity", and if Trump wins the U.S. presidential election in November, the possibility of a sharp rise in Bitcoin is relatively high.

The election issue continues to ferment, and the market further imagines that the scripts for the election of the two-party candidates will unanimously continue to boost the U.S. economy through fiscal policy, inevitably at the cost of a huge fiscal deficit. The Biden administration is now constantly borrowing to stimulate the job market, using various subsidy policies to enable the poor in America to travel, which has provided the tourism industry with a huge employment opportunity, which is the main reason for the recent good employment situation in the United States, while the government deficit is also constantly expanding.

Bonds are rising in yield due to oversupply, and in the long run, the deterioration of U.S. fiscal conditions will lead to a decline in investor confidence in the U.S. dollar, or force the U.S. to embark on another round of rate cuts to dilute debt, either of which will push up the price of Bitcoin in the long run.

Currently, retail investors are selling, and the main driving force for the price is institutional investors, and in such cases, the price of Bitcoin is likely to rebound.

Bitcoin is the new focus

Considering that Trump's chances of winning are generally higher, however, the fiscal situation will be more severe if Trump takes office, because according to the U.S. Constitution, he can only serve for another four years, he will undoubtedly increase government spending to make America great again, which means that regardless of who is elected, the script will only go in the direction of "rate cuts", "fiscal easing" and "soaring government deficits", causing institutional investors to focus on the "U.S. fiscal problem" again, believing that the U.S. debt problem will be a potential risk in the future.

In addition to the continued expansion of the fiscal black hole, the U.S. government's public debt auctions have recently reached a peak, and institutional investors are unable to digest such a large supply of public debt in the short term, with demand clearly sluggish, leading to a continued decline in the price of U.S. Treasuries and a rise in bond yields. Institutional investors are beginning to realize that the supply of U.S. Treasuries is much higher than expected, and the government's funds are like a bottomless pit that the market cannot digest, and if this continues, it will not be a problem of the benchmark interest rate, but rather that the bonds cannot be sold out, and the yield is likely to rise all the way up.

Assuming this is the case, the U.S. government's borrowing costs will further rise, and as spending increases, more public debt will have to be issued, forming a long-term vicious cycle, and the only option left for the U.S. government will be "quantitative easing", diluting the value of debt through money printing. In this way, the U.S. dollar will depreciate greatly in the long run, and the credibility of the U.S. dollar may eventually collapse, although this is unlikely given the current U.S. dollar hegemony, but the original intention of the invention of Bitcoin was to fight against this U.S. dollar-centric system.

Against this backdrop, as yields will continue to rise, Bitcoin will inevitably fall in the short term due to the rise in U.S. Treasury yields, as funds will be attracted to the higher-yielding U.S. Treasuries. However, once confidence in U.S. Treasuries collapses, funds will flow into Bitcoin, and the cryptocurrency will see a huge bull market, and the U.S. will eventually be forced to return to the old path of quantitative easing: through rate cuts to rescue the economy, which will further accelerate the rise in Bitcoin.

There has been a huge net inflow of funds into Bitcoin spot ETFs, which is behind the institutional investors' reallocation of assets, and Bitcoin has therefore gained a higher weighting. On the other hand, the disappearance of the Kimchi premium and the Coinbase premium also indicates that retail investors are selling to realize their profits, presenting a situation of "institutions buying, retail selling". Institutional investors have indeed seen opportunities that retail investors cannot see, and with the stock market already high and the bond market gloomy, commodity markets such as gold and Bitcoin are returning to the embrace of investors.

Bitcoin currently has themes such as the "Trump trade", the "U.S. fiscal crisis", "confidence in the U.S. dollar" and the "rate cut cycle", and the long-term price trend is optimistic, with a short-term trend of short-term shorts and long-term longs. In the short term, the rise in bond yields will lead to a decline in the price of Bitcoin, while in the long term, the collapse of confidence or the rate cut cycle will turn Bitcoin bullish.