Author: Jonah Roberts, Bankless author/researcher; Translated by: Jinse Finance xiaozou

The Ethereum L2 space has always been a chaotic battlefield. For years, the top L2s have been fiercely competing to attract developers to build their applications within their respective interconnected ecosystems.

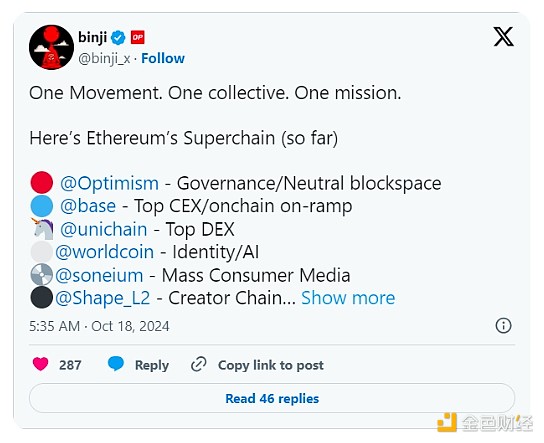

As the dust settles, the top development teams continue to choose the Optimism Superchain.

This article will analyze the major projects being built on the OP Stack, and why the Superchain has been able to win over developers.

1. Optimism Superchain's Market Positioning

In the highly competitive blockchain space, many blockchains offer similar services, and securing market share requires not only good technology, but also innovative use cases and strategic growth. Optimism has done well in this regard, adopting a top-tier business development model to transform the Superchain from a bold name into a true market leader.

While the total value locked (TVL) on the Optimism mainnet still lags behind competitors like Arbitrum and Polygon, the Superchain has still performed remarkably, largely thanks to Base. According to defillama data, its TVL has recently surpassed that of Arbitrum.

While Arbitrum and other L2s have tried to expand the interconnected blockchain ecosystem, their success has been relatively limited compared to Optimism.

This is because the Superchain has an incredible network effect and seems to have truly won the meme war, becoming the golden land for on-chain development.

However, this does not completely diminish the importance of other L2s, as they will continue to play a crucial role in Ethereum scaling, but it is clear that the OP Stack has become the de facto development ground for the industry's biggest players.

2. Superchain Projects to Watch

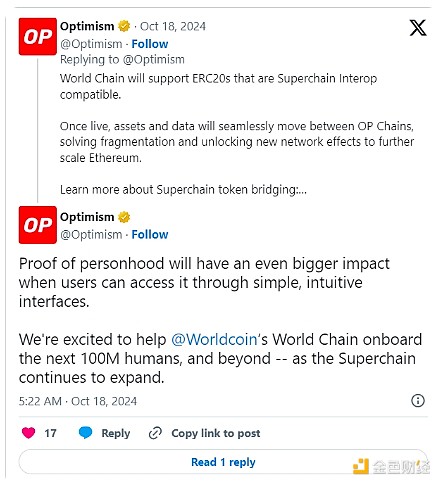

Optimism's modular design has enabled some of the industry's biggest players to create impactful products under the Superchain's umbrella. A recent example is World Chain, launched by the Web3 vision of World (formerly Worldcoin) led by OpenAI CEO Sam Altman.

World Chain is designed as a verifiable human network. It may be the most advanced identity system in Web3 to date. World Chain already has 7 million unique address users, enough to validate this. As of August, the number of unique address wallets holding 20 USDC was lower than the number holding 20 WLD tokens across all Ethereum networks.

Another heavyweight company that has recently joined the Superchain is Uniswap, which has launched Unichain - a dedicated rollup aimed at becoming the liquidity hub of the Superchain. As the largest DEX in the crypto space, Uniswap has processed trillions of dollars in trading volume for millions of users. By integrating liquidity within the Superchain, Unichain aims to eliminate the inefficiencies caused by fragmented liquidity across different chains, indicating that the Uniswap Foundation believes the Superchain will be the hub for most user activity.

Another is Coinbase's ambitious on-chain project, Base. Base is known for lightning-fast transactions and fees of less than $1, and has quickly become the preferred choice for dApps and developers. Base's exponential growth has greatly driven the adoption of the Superchain, demonstrating the power of network effects. This exponential growth of the network is one of the most important crypto narratives of the year and is expected to continue playing a core role in the future.

Finally, Kraken has just this week announced the launch of their own brand new L2, called Ink. Ink appears to be a direct competitor to Base, but in the long run, both will benefit the overall Superchain ecosystem.

3. Optimism's Vision and Principles

Optimism's mission is described as "forking capitalism", aiming to achieve a financial vision that emphasizes better value alignment and accounting accountability. This principle is reflected in the network's design and governance, which is led by the Optimism community. The network's inclusive architecture and open-source principles support a decentralized economy, with rules co-created by participants. This vision challenges the traditional centralized, profit-driven model by providing a model that prioritizes community ownership and inclusivity.

Additionally, the economic model of the Superchain is designed to create shared incentives across all chains on the OP Stack. Optimism and its OP token directly benefit from a revenue-sharing model, where a portion of the fees generated by activity on individual chains like Base or Ink will flow back to the mainnet. This optional framework ensures that the growth of some Superchain rollups contributes to the vitality of the entire ecosystem, turning potential competition into collaboration.

This revenue-sharing model not only expands Ethereum's technology, but also aligns with the network's principles of decentralization and sustainable growth. By having each chain contribute to the economic vibrancy of the ecosystem, Optimism is positioned to grow together with the evolving network.

4. Future Outlook

Undoubtedly, the Optimism Superchain is currently the leader of the L2 scaling army, but we are still in the early stages of rollups. Major non-Web3 players are still in the early stages of exploring on-chain possibilities, leaving room for other players to capture market share and challenge this narrative in the coming years.

As the Superchain's network effects continue to expand, it will become increasingly difficult for other players to attract new activity elsewhere - especially as the next wave of user acquisition unifies the Superchain user experience. Optimism's current growth lays the foundation for Ethereum's ecosystem to maintain long-term dominance.