Author: Karen, Foresight News

Last weekend, in addition to the BAN platform of Sotheby's Vice President Michael Bouhanna, a16z also attracted a lot of attention with its outstanding performance, with a market value once approaching $100 million, and currently falling back to around $46 million.

Someone bought 47.54 million ai16z tokens for only 20 SOL (about $3,500) three days ago, which are now worth $2.3 million, a return of 650 times.

So what is ai16z? How does its launch platform daos.fun work? What are its features and risks?

What is daos.fun and how does it work?

daos.fun is a platform founded by @baoskee and supported by Alliance DAO. The main function of this platform is to help fund managers and creators raise funds so that they can establish their own DAO and invest in MEME on behalf of token holders.

Currently, daos.fun is still in the invitation-only stage, and only creators who have received an official or @baoskee invitation code can participate.

Once you become a creator on daos.fun, you need to set the fundraising target amount, the fund expiration date, and the management fee, and then you will have one week to raise the required SOL amount. The tokens of each DAO will be issued in a fair manner, ensuring that everyone can obtain the tokens at the same price at the beginning. If the fundraising fails, the buyers have the right to redeem the SOL, and a 10% loss will be incurred for early redemption.

After the fundraising reaches the preset hard cap, the creator will invest the collected SOL in their favorite Solana protocols or MEME, and the DAO token will also be traded publicly through the virtual AMM market. In this way, the market value and price of the DAO token will fluctuate with the trading activities and performance of the fund, and the market attention will also account for a very large proportion.

In principle, the upside potential of the DAO token price is unlimited, but the downside is limited by the fundraising market value. As long as the token's market value exceeds the original fundraising amount, the holders can sell the DAO token at any time.

The expiration time of all DAOs is between 3 months and 1 year. After the fund expires, the DAO wallet will be frozen, and the SOL profits will be distributed proportionally to the creators and investors. Token holders can choose to burn the DAO tokens to redeem the underlying assets, or directly sell them on the market (provided that the market value is higher than the fundraising amount).

Ai16z: The top-ranked AI DAO on daos.fun

As mentioned above, the most successful DAO fund on the daos.fun platform is undoubtedly the ai16z fund created by @pmairca (i.e., Marc Andreessen). ai16z started with an initial fundraising of 420.69 SOL, and with the help of two mentions by a16z founder Marc Andreessen on the official Twitter, its market value has become the top-ranked, once approaching $100 million, and currently remains stable at around $45 million.

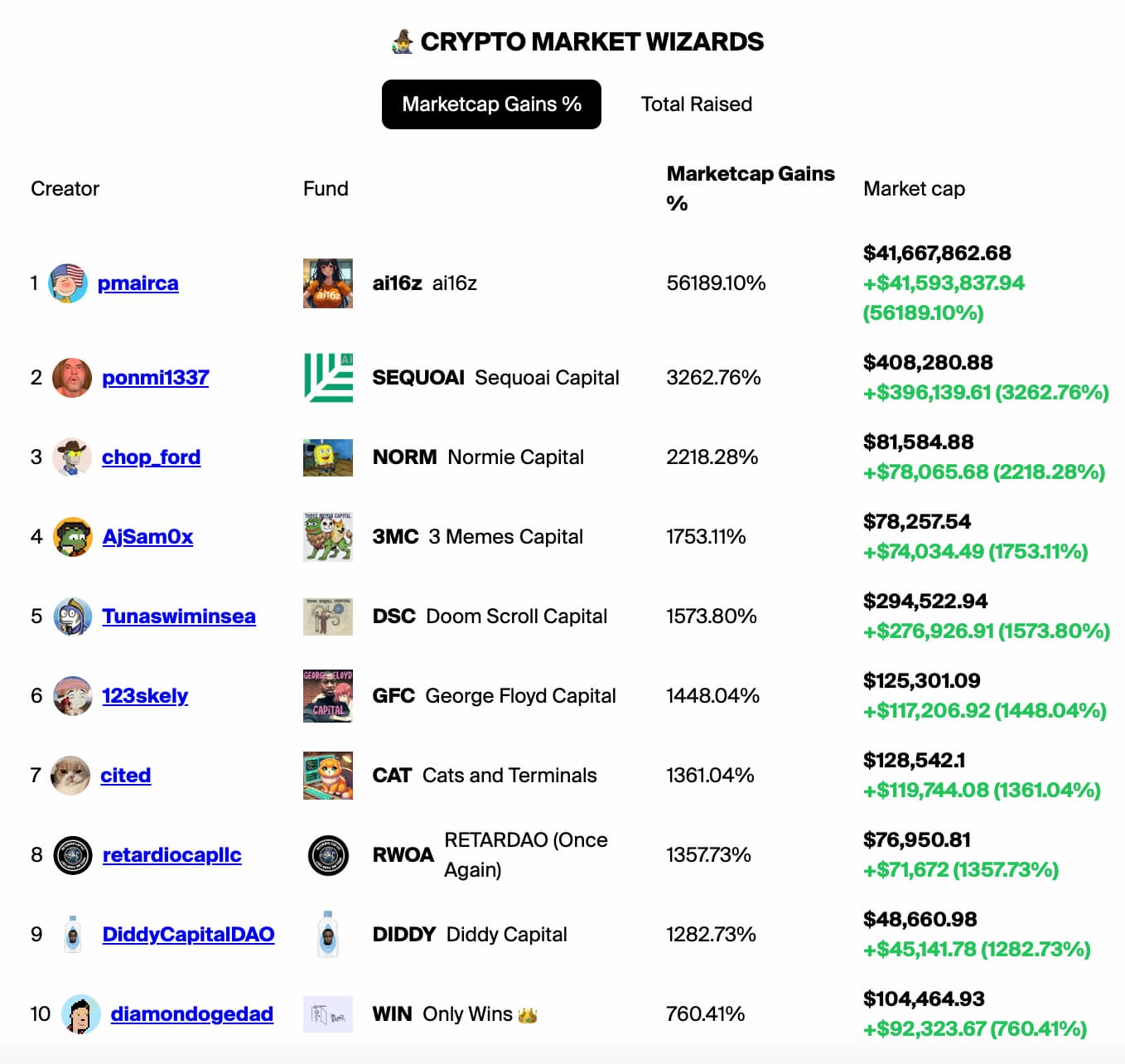

Top 10 DAOs by market value on daos.fun

Marc Andreessen once pointed out that "we are in the midst of a revolutionary transformation, where the deep integration of AI and blockchain technology will reshape the landscape of finance and innovation. In this transition process, the pioneering AI DAO ai16z is playing a leading role, depicting a future vision where AI agents are the core drivers of value creation and growth. In the early stage, ai16z will operate in a highly autonomous manner under the collective wisdom of stakeholders. Its long-term goal is to achieve full on-chain deployment, placing the AI entity under the strict protection of a trusted execution environment (TEE) to ensure unprecedented transparency, security, and integrity."

ai16z not only actively listens to the insights and suggestions of the community, but also strives to learn and grow from them. DAO holders have the opportunity to provide opinions on investment decisions in Discord, and the AI system will closely track the implementation effects of these suggestions. Individuals who continuously contribute reliable insights will earn the trust and confidence of the AI, while those with poor suggestion effects will gradually lose their influence. To maintain a balanced distribution of power, each member's input weight will be proportional to their share holding in the DAO, effectively preventing malicious actors from posing potential threats to the system. In the future envisioned by ai16z, all those who empower the network and add value will be fairly rewarded.

The ai16z official page also shows that ai16z will invest in seed-stage AI companies in areas such as robotics, bio + healthcare automation, consumer manipulation, crypto anarchism, enterprise obsolescence, fintech disruption, game theory development, and infrastructure hijacking. The technical roadmap of ai16z has been open-sourced on Github.

It is worth mentioning that kotopia is the DAO that has raised the most funds on daos.fun, raising nearly 4,207 SOL (worth $740,000), with a current market value of $810,000.

What are the features and risks of daos.fun?

So, what are the features and potential risks of daos.fun?

daos.fun has lowered the threshold for operating MEME funds. If daos.fun opens up creator registration in the future, in theory, anyone can initiate a MEME DAO or MEME VC, and some KOLs and institutions may also be able to issue tokens through daos.fun. Against the current backdrop of extremely high heat in AI MEME, but most retail investors struggling to keep up with the pace, daos.fun undoubtedly opens up new possibilities for retail investors.

Openness and transparency are also major features of daos.fun. First, the asset management status of each DAO is publicly displayed on the daos.fun page, and the profit-sharing mechanism is also relatively transparent. In addition, all DAO creators are associated with their own Twitter accounts, which usually means they will pay attention to their reputation. But who knows?

The profitability of daos.fun mainly lies in the performance of DAO tokens and fund investments. However, this profitability model also comes with undeniable risks, especially the potential misconduct of fund managers, such as insider trading. More importantly, the serious disconnect between the fund's market value and its net asset value has become another major potential risk.

Taking the largest token ai16z on daos.fun as an example, its market value to net asset value ratio is as high as 58. The second-largest token SEQUOAI (market value $455,000) has a ratio of 40, while the third-largest token NORM has a ratio of 29. The high ratios of these funds reveal the strong atmosphere of speculation and hype in the current market, as well as investors' extremely high expectations for the future performance of these funds. However, this also reminds us that while pursuing high returns, we must be vigilant about potential market volatility and risks.

As early as 2022, the concept and implementation of Ventures DAO had emerged in the Web3 field, but at the time it did not make significant progress. This time, with the rise of the MEME craze, whether MEME DAO funds, AI DAO funds, and the like can ignite a new wave, Foresight News will continue to follow up.