Author: Zixi.eth

I have held ETH/SOL for 3 years, the market won't lie, and in a year and a half, users have voted with their feet to give the answer. In summary:

Ethereum's overall capital and developers are still > Solana;

Ethereum mainnet users have already migrated to L2, but L1's capture of L2 value is still relatively weak, while Solana's user base is far larger than Ethereum L1;

There are fewer assets priced in Ethereum than in Sol;

Ethereum's Ecosystem direction is skewed.

In the past, the standards we used to judge a public chain were: 1. Capital TVL; 2. Number of developers; 3. Users; 4. Ecosystem; (5. Whether there is a big player). We will continue to analyze the current Ethereum (L1+L2) and Solana ecosystem from these 5 perspectives.

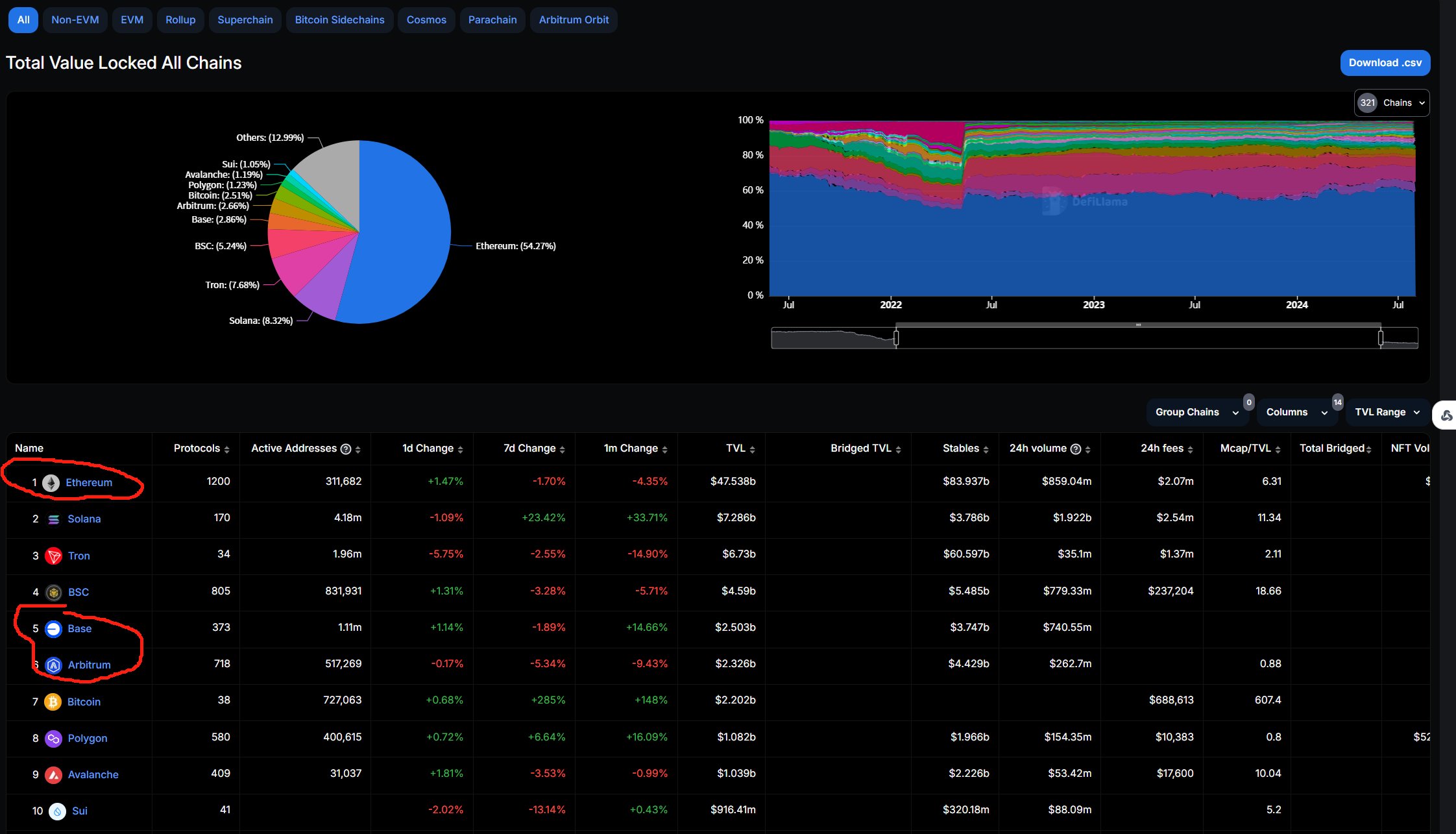

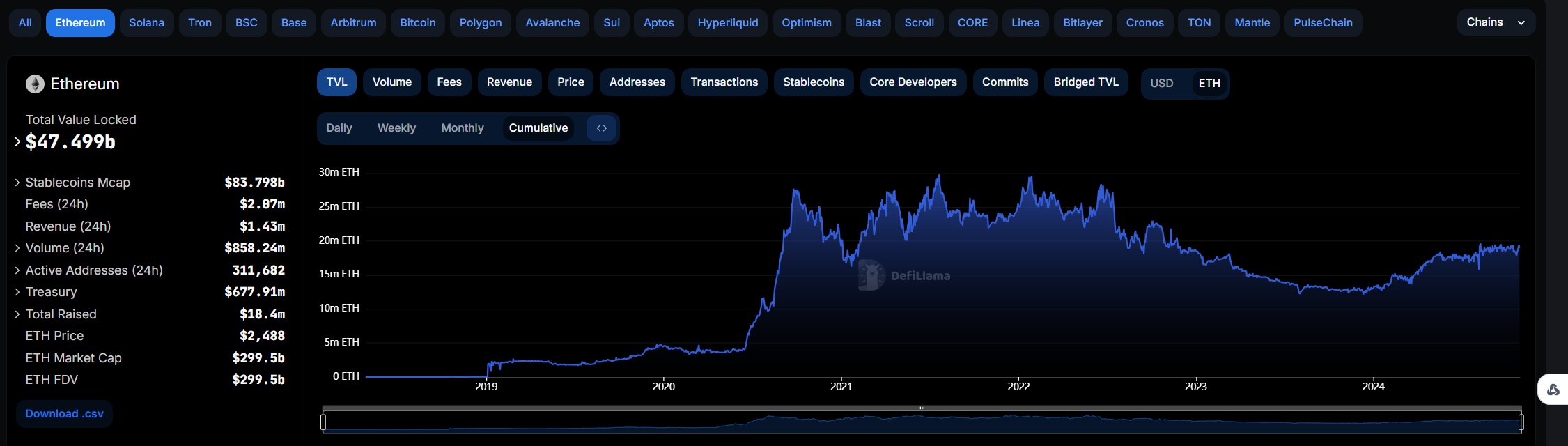

1. From the perspective of capital

Ethereum mainnet is far ahead of Solana. The trend has not changed in 3 years, since 2021, Ethereum TVL has always been 50%-60%. Although Ethereum TVL Dominance has recently declined, including the TVL of Base/Arbitrum, the overall Dominance is still around 60%, at the same level as the 2021 bull market. But it is worth noting that Solana TVL has now grown to 8%, a significant increase from 1%-3% in 2021.

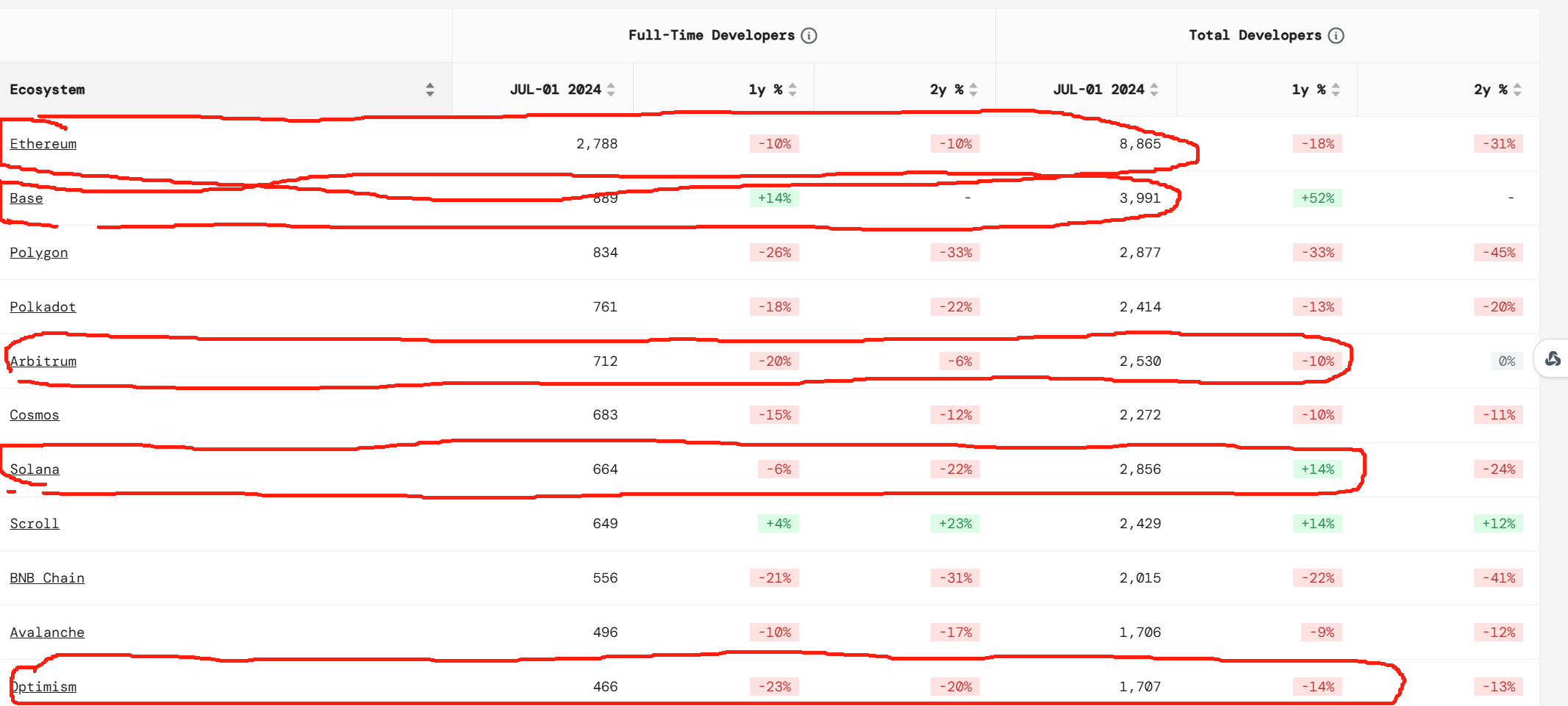

2. From the perspective of developers

The total number of developers in the Ethereum ecosystem is still far ahead. Ethereum mainnet developers have declined somewhat in the past year, possibly as some have gradually migrated to L2, such as Base. In 2022-2023, Ethereum's "builders" took "halal" as the supreme glory, and Ethereum's investors took "halal" as the core of their investment. During that period, I heard project parties talk about how various zk were changing everything, painfully, but I have to admit that zk is gradually being implemented.

But in the past year, I have personally felt the rise of Solana ecosystem developers. Especially at this year's Breakpoint, I haven't seen a major public chain able to organize ecosystem events so well in a long time. And the Solana Foundation is constantly holding hackathons, and many teams around me are turning to Solana, which is corroborated by the 20% growth in Solana dev numbers in the past year.

3. Users

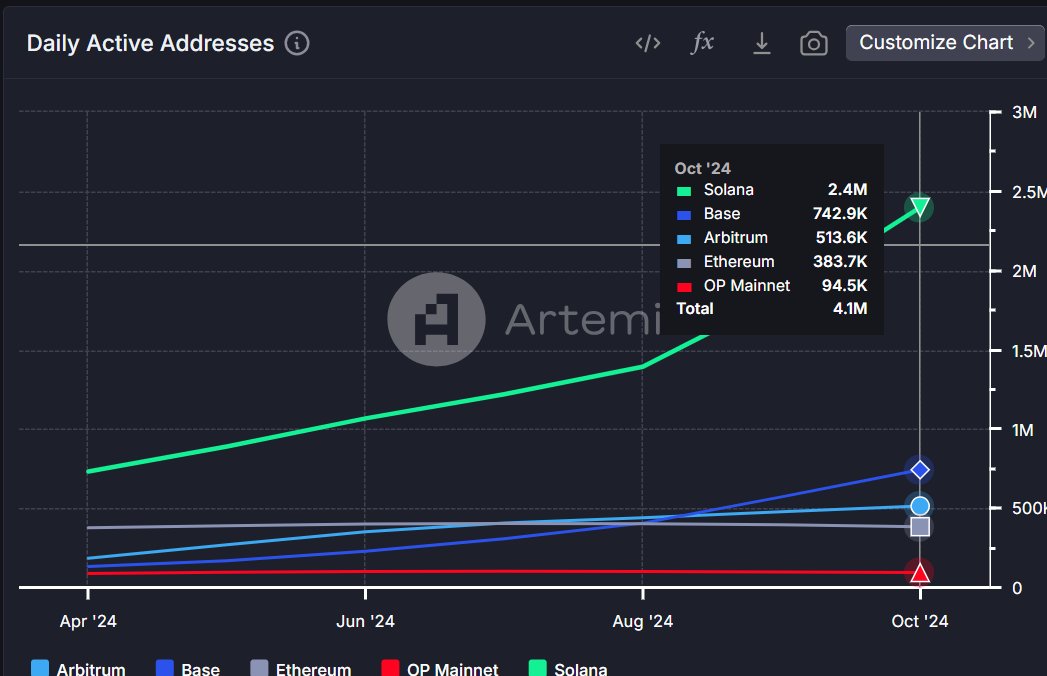

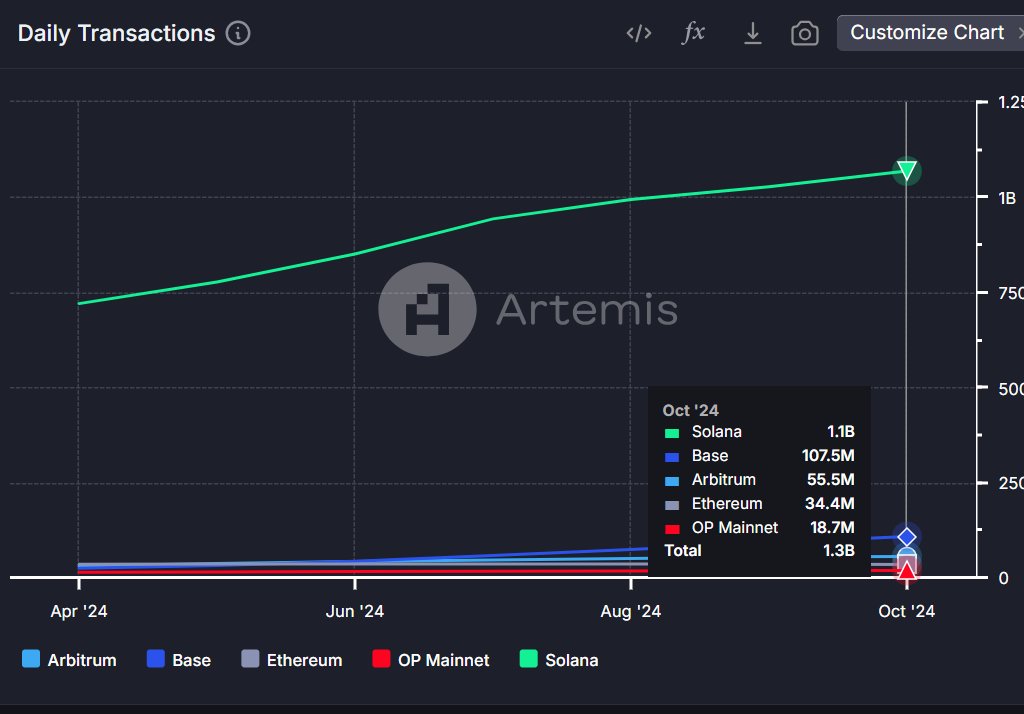

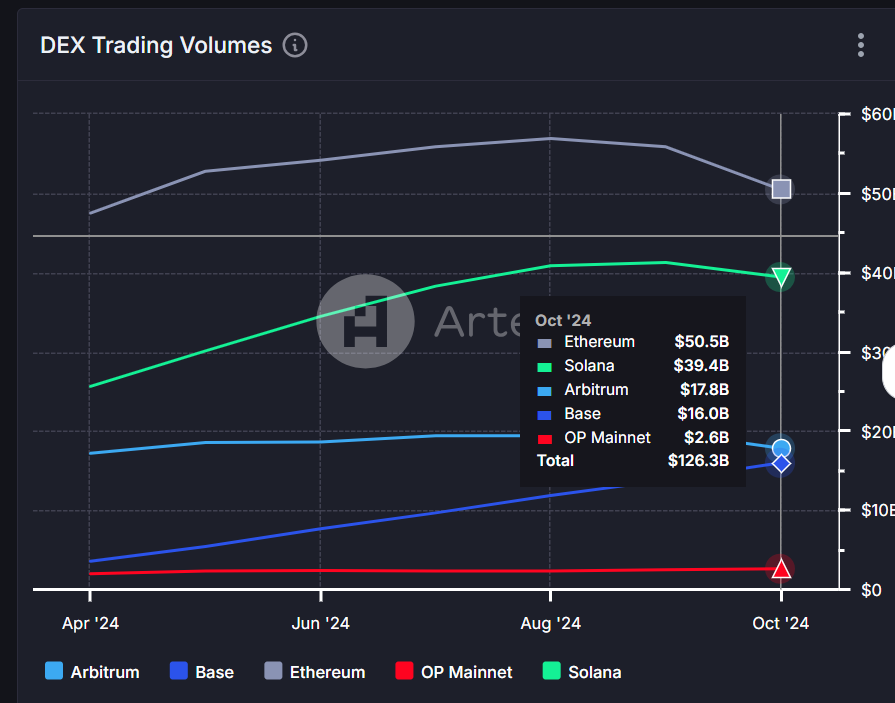

Solana is far ahead. Solana's daily active users (58%) are more than Ethereum and L2 combined (42%), and Solana's transaction volume (84%) is far ahead of the Ethereum ecosystem (16%). However, the trading volume of core assets is still concentrated on Ethereum and L2. This is related to Solana's current ecosystem positioning as a meme token launch platform. In addition, you can pay attention to Base, which is rising rapidly.

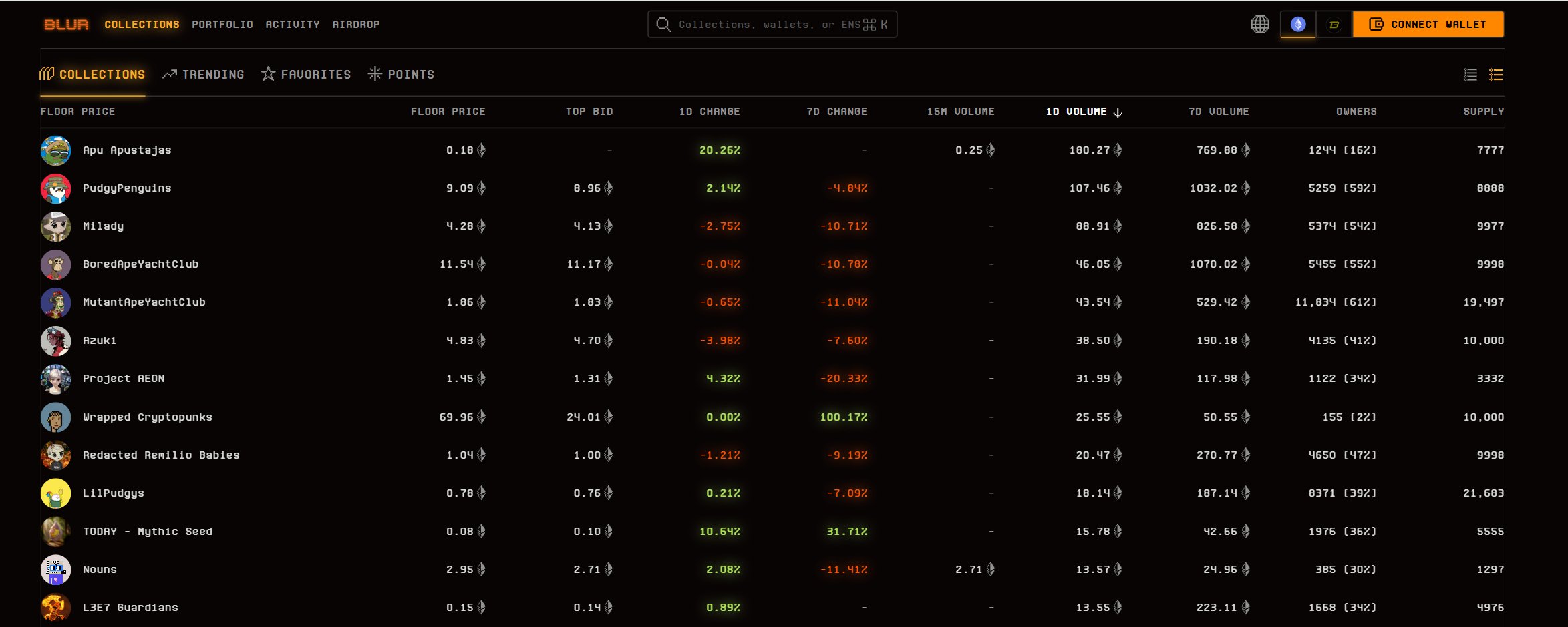

4. Pricing of on-chain meme assets in the ecosystem

The pricing of on-chain meme assets is actually the result of the good or bad development of the public chain ecosystem. In 2020-2021, Ethereum relied on the two ecosystems of DeFi/Non-Fungible Token, making all DeFi assets and Non-Fungible Token assets priced in ETH. People would say that DeFi TVL is in the thousands or tens of thousands of ETH, and the price of Non-Fungible Tokens is in the ETH. Whether from the real buying power or the virtual psychological pricing, the coin-based position will be used as the ultimate pricing standard, although these coins will eventually be sold off in a pump and dump fashion:)

Looking back at the GameFi on BSC in 2021, users also used the BNB-based position to price ecosystem assets, leading to the surge of BNB during the GameFi period.

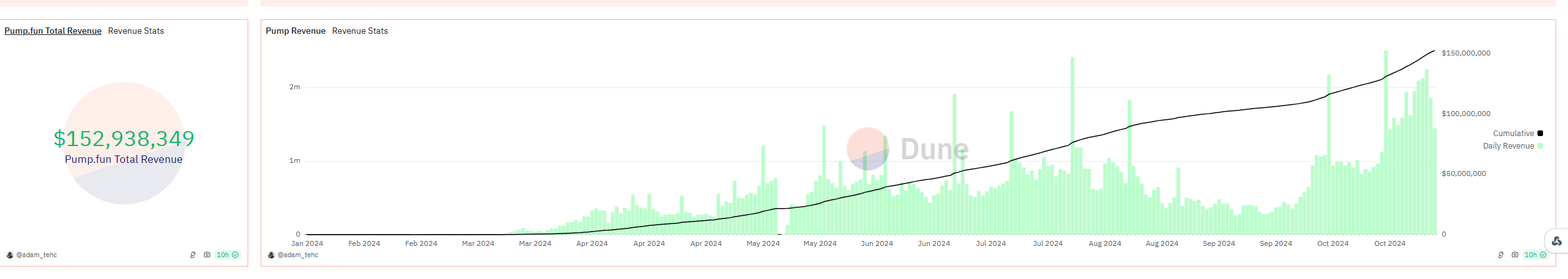

Recently, I think Solana has done the most right thing, which is that @pumpdotfun has been constantly using the three-plate theory to split the plate and the myth of wealth creation for a small number of users to attract a large amount of buying power to the entire market. Over time, users will form a mindset of pricing on-chain meme assets in SOL. BTW, http://pump.fun is the third most perfect product I've seen in the last 3 years (the first and second will be discussed later).

5. Has the Ethereum ecosystem not developed well in the last two or three years?

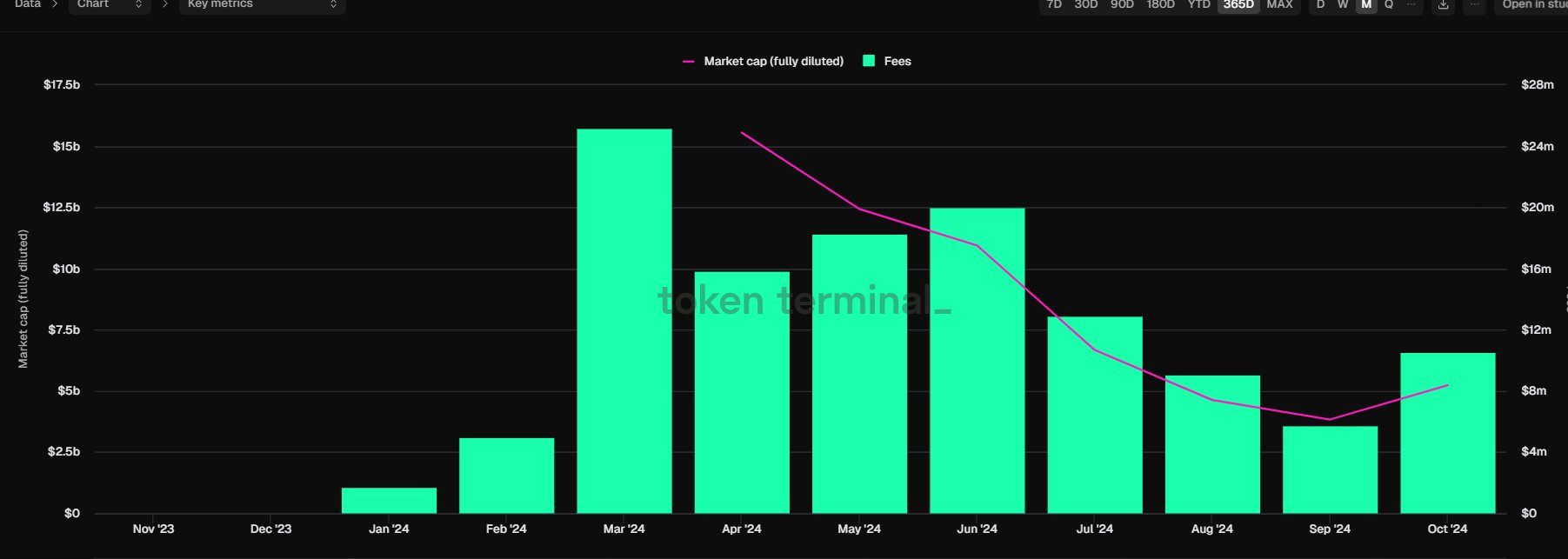

On the contrary, I think it has developed very well. In the past 3 years, I think the most perfect top 1/2 products are @ethena_labs and @Polymarket. Ethena has sold the interest rate arbitrage that only a few people could do in the past to decentralized retail investors, with a 251-day protocol revenue of $100 million, a win-win-win for the project party/investors/users, but the design of the token utility is indeed problematic.

Polymarket has put prediction markets on-chain, using blockchain to circumvent the payment and regulatory issues of traditional prediction markets, and has grasped the opportunity of the general election, and now media platforms around the world refer to Polymarket's election data to look at the polls.

Ethena has brought real yield scenarios to users with financial management needs, and Polymarket has used blockchain to solve the practical problems of web2 prediction markets and successfully broken through. Ethena and Polymarket have written new success stories for the Ethereum ecosystem, but what have they brought to Ethereum's price? It is difficult for Ethena and Polymarket, two successful big brothers, to replicate the glory of using Ethereum to price the ecosystem as DeFi/Non-Fungible Token did.

6. Future Ecosystem Outlook

I think the future ecosystem needs to be viewed from two aspects. On the one hand, there are real use cases, such as @ethena_labs and @Polymarket that require Ethereum, and more and more PayFi on Solana, which is the real direction of blockchain development. At the same time, there also need to be projects like @pumpdotfun that split the plate, to pump the price of the core assets. Both are indispensable.