Author: route2fi Source: The Black Swan Translation: Shan Ouba, Jinse Finance

Introduction

Centralized stablecoin issuers, such as Tether and Circle, occupy around 90% of the stablecoin market and have become heavyweight players in the cryptocurrency field, with valuations and profits far exceeding traditional financial giants like JPMorgan Chase and BlackRock. Their business model is simple: leveraging the liquidity behind stablecoins to support various risky assets.

With rising interest rates, these entities have transformed into lucrative "cash machines." Tether and Circle generated over $10 billion in revenue in 2023, with valuations exceeding $200 billion. The wealth they create is not shared with the users who have contributed to their success. Usual aims to make users the owners of the protocol infrastructure, capital, and governance. By redistributing 100% of the value and control through its governance token, Usual ensures its community holds the dominant power.

The Usual protocol distributes its governance tokens to users and third parties who contribute value, realigning financial incentives and returning power to the participants within the ecosystem.

Usual is revolutionizing the stablecoin world by introducing the functionality of decentralized RWA stablecoins. By depositing yield-generating assets (initially USYC), users can earn speculative returns linked to the success of the Usual Governance token ($USUAL). This return is intended to exceed the risk-free yield of the underlying asset. Its mission is to transform stablecoin holders into profit owners.

Transforming Users into Owners

TLDR:

While traditional stablecoins like Tether prevent users from participating in profits and growth, and yield-bearing assets only provide yields without growth, Usual combines the best of both. With Usual, you can enjoy both yields and growth potential.

The ownership-sharing mechanism creates a positive feedback loop, ensuring a tight coupling between early contributors and the protocol, enabling Usual to capture a significant market share. By widely distributing ownership, the protocol rewards early participants and aligns the interests of all stakeholders.

Stablecoins like Tether collect users' cash, earn interest, and yet users neither receive the profits nor the issuer's growth. In exchange, users receive a token for DeFi, but no share of the profits.

What if users could benefit uncompromisingly from interest, growth, and utility?

This is where Usual steps in: a decentralized stablecoin issuer where users are the owners.

There are currently three types of stablecoin issuers in the market:

Tether retains all the revenue and allocates it entirely to Tether's shareholders. Users have a DeFi-compatible stablecoin, but miss out on the opportunity for yields and protocol growth.

Yield stablecoins issued by tokenizers like Ondo or Mountain mark a significant shift in the stablecoin space, as they redistribute the underlying yields to users through permissioned stablecoins. Users can earn yields, but are not impacted by protocol growth: whether the USDM TVL is $100 million or $100 billion, users still "only" get 5%.

Usual goes a step further, redistributing value through the $USUAL token, granting users protocol ownership. Unlike the yield-sharing model, Usual concentrates all the value created into its treasury, of which 90% is distributed to the community through the governance token. Users can benefit from both: utility, yields, and growth.

This is how Usual transforms users into direct owners, giving them control over the protocol's infrastructure, finances, and future cash flows.

Usual Token Infrastructure

The protocol is built around three tokens:

USD0

USD0 is Usual's dollar-pegged stablecoin, intended to serve as the protocol's medium of exchange, counterparty, and collateral token. It provides a better alternative to USDC and USDT, while complying with US and EU regulations. This institutional-grade stablecoin is available for retail investors and DeFi users.

USD0 aggregates US Treasury token collateral, creating a secure asset detached from bankruptcy, unrelated to traditional bank deposits. It is fully transferable and permissionless, seamlessly integrating into the DeFi ecosystem.

USD0 Yield Bonds (USD0++)

If USD0 holders want to earn a yield on their stablecoin, they must stake it to receive the high-yielding LST of the RWA. USD0++ is the liquid staking representation of staked USD0. By locking up capital, users have a daily opportunity to claim $USUAL. If they haven't claimed $USUAL yet, they can exercise a risk-free yield right every six months. USD0++ is fully composable in DeFi, similar to USD0.

Therefore, USD0++ is an enhanced US Treasury bond that entitles you to:

Speculative returns in the form of the Usual governance token $USUAL. The returns fluctuate based on the secondary market price of $USUAL.

At least the risk-free yield rate based on the underlying Treasury bonds, proportionally increased by the floating supply of non-productive USD0.

$USUAL - Governance Token - Capturing the Benefits of USD0

USUAL rewards the growth, adoption, and utilization of USD0 within the ecosystem. This token represents the increasing adoption of USD0 and aligns incentives with users who contribute to the protocol's expansion and utilization.

The $USUAL token is the governance token of the Usual ecosystem, representing the protocol's earnings and empowering users to participate in decisions related to protocol operations and capital management.

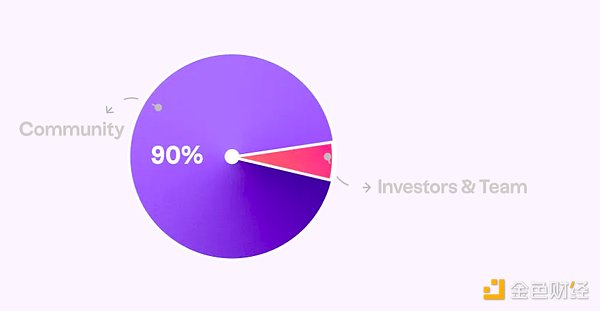

USUAL is designed for long-term value growth, with its issuance rate intentionally kept below the protocol's revenue growth, to increase its intrinsic value over time. Consistent with its community-first ethos, 90% of the tokens are allocated to the community, with only 10% reserved for the team and investors.

Growth

Usual has exhibited the highest TVL growth rate among stablecoins in the summer of 2024, joining the top five fiat-backed stablecoins:

Usual has experienced rapid growth, reaching a Total Value Locked (TVL) of $330 million within just three months. This impressive expansion has made it one of the best-performing projects on Ethereum in the summer of 2024.

Usual has over 40,000 users from various integrated platforms, becoming a top participant in the stablecoin space, ranking as the 13th largest stablecoin issuer. Additionally, it is among the top five mining pools on Curve and holds a leading position in the TVL of Morpho and Pendle.

The protocol is expected to generate $15 million in annual revenue, further solidifying its position within the DeFi ecosystem.

Team

Pierre Person, CEO, Presidential Advisor, Former French MP, Deputy Chairman of the President's Party, started working on creating a stablecoin protocol that incorporates cryptocurrency and true decentralized value two years ago. During his time as a member of parliament, he was dedicated to the development of the French cryptocurrency regulatory framework.

Hugo Sallé de Chou, Chief Operating Officer, as a fintech entrepreneur, Hugo founded a Venmo-like payment startup Pumpkin in 2014, challenging the traditional banking system and reaching a peak of 2 million active users.

Adli Takkal Bataille, DEO

A true cryptocurrency OG, he entered block #271376 in 2013 and created a French cryptocurrency organization called Le Cercle du Coin, serving as an advisor to multiple projects since 2018.

In 2020, he founded a cryptocurrency-native venture capital fund called Shift Capital in Luxembourg, currently only making market-neutral investments. Twitter | LinkedIn

Pierre Cumenal, Chief Financial Officer

Pete holds dual master's degrees in applied mathematics and quantitative finance, having previously worked at Natixis and Amundi before relocating to London and serving as a quantitative analyst at BNP Paribas. There, he developed pricing models for exotic derivatives across different markets. Recently, he has developed a fully decentralized options protocol.

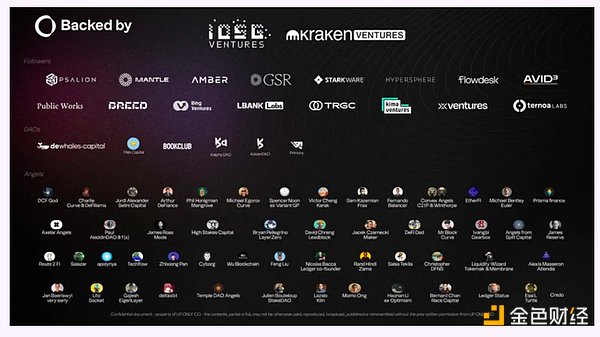

Backers

Usual has raised $7 million across three rounds, currently supported by 170 investors: venture capital, angel investors, protocols, and DAOs.

Investors include Dewhales, IOSG, Kraken Ventures, GSR, Psalion, Hypersphere, LBank Labs, Public Works (Gitcoin co-founder), Kima Ventures, and Breed (former Circle executive).

These 120 angel investors include Sam from Frax, Charlie and Michael from Curve, Defi Dad, DCF God, Chud, Lux Temple, Amber Group, Ivan from Gearbox, Convex founders, and Zoomer Oracle.

USUAL Token Economics

Today, many governance token designs are flawed. They often follow an unoptimized copy-paste model, struggling to balance short-term traders and long-term buyers, leading to sell pressure without sustained demand or utility growth. Additionally, the correlation between the token's value, governance, and revenue potential is poor, focusing on speculative trading rather than long-term utility, leading to hype-driven price inflation. Incentives are often misaligned, with founders and insiders holding large token allocations while the value-creating users are underserved and face token devaluation from inflation.

Usual contrasts this by aligning the interests of users, contributors, and investors to drive long-term sustainable value growth and real utility.

The USUAL token is the primary governance tool within the Usual framework. Upon launch, USUAL tokens provide economic benefits and governance capabilities to holders. Rewards are distributed in the form of $USUAL tokens, whose value stems from their economic rights and the actual yields generated by the stablecoin collateral.

No VC Dominance: 90% of USUAL tokens are allocated to those who contribute value and revenue to the protocol, primarily through USD0 TVL distribution. Investors, the team, and advisors collectively hold less than 10% of the total supply, protecting users from excessive dilution.

Cash Flow-Linked Issuance: The issuance of USUAL is directly tied to the future cash flows generated by the stablecoin collateral. USUAL is minted each time $0 is staked, and the token supply grows as the protocol's revenue increases.

Controlling Dilution: Usual's issuance model aims to achieve deflation, similar to Bitcoin. The inflation rate is calibrated to remain below the protocol's revenue growth, ensuring the token issuance rate does not exceed the economic expansion of the protocol.

Fiscal Management: USUAL holders will also have the ability to decide how to manage the treasury and protocol revenue, through future mechanisms such as token burns or revenue distribution.

Weighted Voting: USUAL holders guide the protocol's liquidity and influence key decisions, ensuring they play an active role in the protocol's development and success.

Staking Rewards: Token holders can earn revenue by staking their USUAL tokens. When USUAL tokens are staked, they become USUAL+, and holding $USUAL+ can earn the holder up to 10% of newly minted $USUAL tokens, with the exact proportion calculated according to the specified issuance rules.

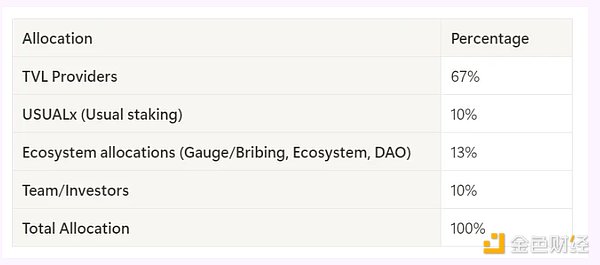

USUAL Token Distribution

The majority of $USUAL tokens are distributed to users who actively contribute to the protocol's development and value creation. This model aims to protect the community from any dilution caused by the team or investors, ensuring the incentives are aligned with those driving the protocol's success.

Detailed Distribution

The emissions are divided into various distribution channels that can be modified through governance voting, each with different purposes:

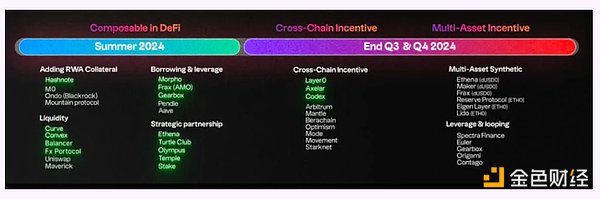

Partnerships

Integration is a key factor for Usual to expand its Total Value Locked (TVL), increase user stickiness, and build a moat. To better understand Usual's partner ecosystem, the following lists the integrated or ongoing partners, categorized by type:

Lending: Morpho, Euler, Term Finance, Sturdy, Arkis, PWD, Llamalend

Cross-Chain: Chainlink, LayerZero, Axelar, Socket (in discussion)

Yield: Etherfi, Pendle, Origami, Spectra, Equilibria, Penpie, StakeDAO

Re-staking: Karak

L2 Networks: Arbitrum, Base, BNB, Mantle, Starknet, Mode, Berachain, Monad, Movement, Sui

DEXes/Liquidity: Curve, PancakeSwap, Balancer/Gyro, Maverick, Uniswap

Fiat On/Off-Ramps: Banxa, Holyheld

Upcoming Integrations:

Morpho, EtherFi, Pendle, Symbiotic, EigenLayer, GainsTrade, Reserve, dTrinity, Polynomial, Bubbly, Hourglass, Superform, Brahma, Abracadabra, TimeSwap, Gearbox, Contango, DYAD, Idle, Notional, Exponential.fi, Curvance, Fluid, Thetanuts, Mach, GMX, Vertex, Bunni, vDEX.

Participate in the Pre-Launch

The pre-launch is Usual's airdrop program, running from July 10th until mid-November.

7.5% of the USUAL supply will be airdropped and distributed based on points earned during the pre-launch period. The system rewards daily points for holding Usual products. Additionally, minting USD0++ instantly grants points.

The points system works as follows:

Daily Points:

USD0++ holders earn 3 points per token per day.

USD0/USD0++ Curve LP holders earn 3 points per USDO staked per day.

USD0/USDC Curve LP holders earn 1 point per USDO or USDC staked per day.

There are many other opportunities, such as Pendle, Morpho, and more.

Visit the Usual dApps to learn about the various participation methods, especially through Pendle, Etherfi, Morpho, Curve, Equilibria, Karak, and others.