Current cryptocurrency investors are focusing on Bitcoin and meme coins, pouring capital into them. They have extremely different characteristics. One represents a reliable store of value, while the other symbolizes "high risk, high return".

This is a characteristic of the Babel strategy. Industry experts point to two main causes of this trend: first, short-termism, and second, the influence of social media.

Short-termism, distorting the cryptocurrency market

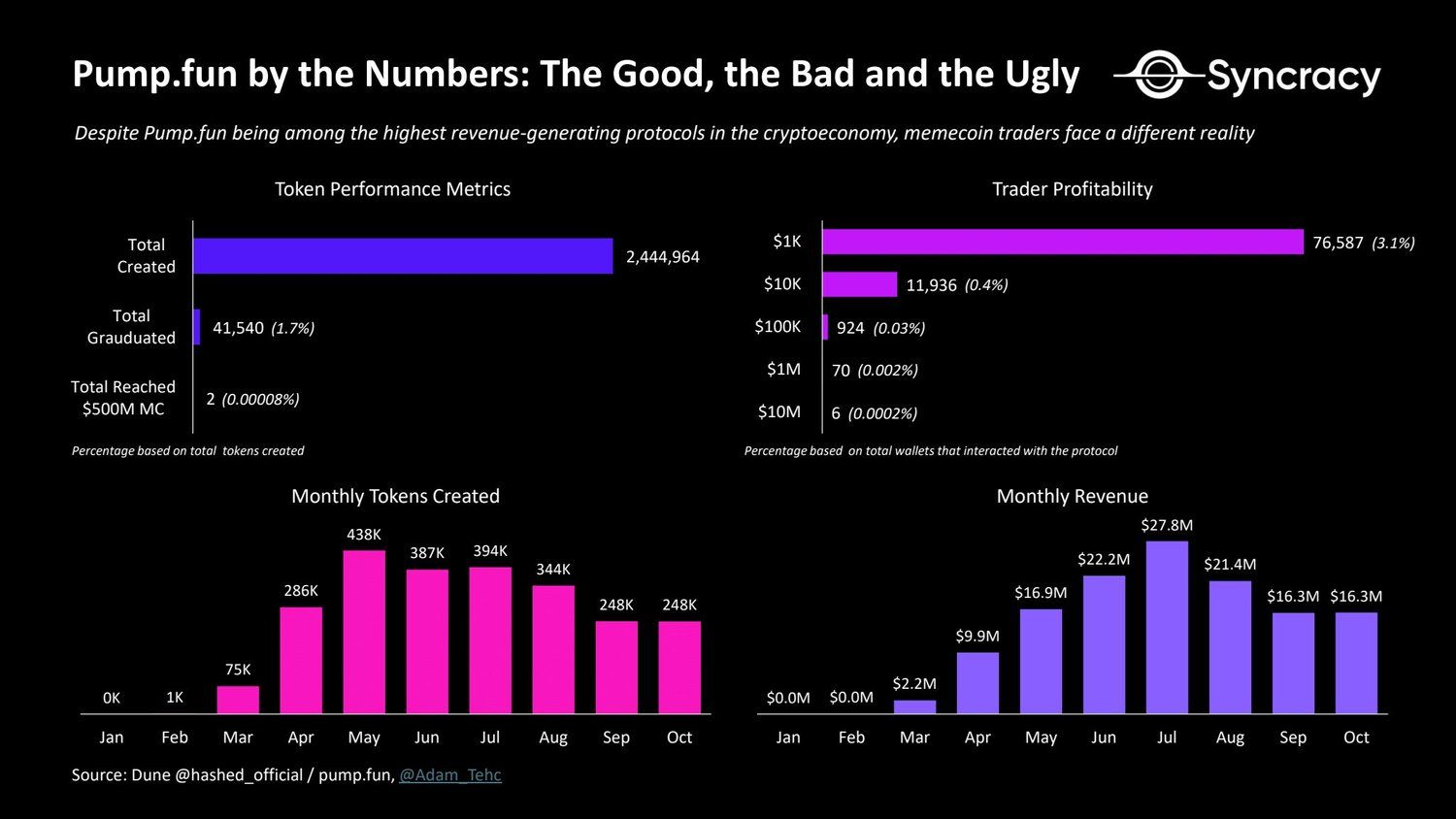

In a recent analysis, Ryan Watkins, co-founder of Syncracy Capital, used data from the Pump.fun platform to explain the performance of meme coin investments.

According to this data, out of the 2.44 million tokens generated on this platform, only 2 reached a market capitalization of $500 million. Only 3.1% of wallets achieved a profit of $1,000, and the percentage is even lower for higher profit thresholds. Despite these statistics, this platform releases over 248,000 tokens per month, generating over $16.3 million in revenue per month.

Read more: 7 Hot Meme Coins and Altcoins to Watch in 2024

Watkins describes the focus of investors on meme coins as a "speed trap", and short-termism dominates the market.

"This phenomenon is not surprising, as it reflects a broader shift in the global economy towards instantly delivered goods and services. Just as consumers expect food to be delivered to their doorsteps quickly, retail investors now expect immediate returns from mobile trading apps...Only a minority of market participants can look beyond 2 weeks, let alone 2 months or 2 years. For many, trading is becoming increasingly akin to the simple trappings of gambling." - Ryan Watkins opinion.

He also mentioned that today's market reflects the internet boom of the late 1990s. Bitcoin has moved beyond its volatile stage and established itself as a digital gold on the path to global adoption. However, the rest of the market is experiencing a similar speculative surge as in the late 1990s.

The influence of social media, driving market changes

Ryan also noted that token valuation is now entirely driven by public attention. Kiyoung Ju, CEO of CryptoQuant, attributes the current meme coin boom to the shift of social media from being centered on family and friends to being focused on shared interests. He predicts that altcoin season will continue as social media transitions to being driven by economic interests.

"Social media has evolved from being centered on relationships with friends and family to focusing on shared interests. The next step is social media driven by economic interests, which was the vision of Web3. Meme coins are a temporary harmony of economic and shared interests in this transition phase of social media. Soon, an era will come where social value creation and economic interests align on the internet, and that will be the true start of altcoin season." - Kiyoung Ju opinion.

Read more: 11 Cryptocurrencies to Add to Your Portfolio Before Altcoin Season

Community discussions still primarily revolve around Bitcoin and meme coins. Topics related to Bitcoin and meme coins always garner significant interest in community discussions.