The second-largest cryptocurrency in the world by market capitalization, Ethereum (ETH), appears to be bullish, and it is expected to see a significant upward rebound due to its bullish price trend and favorable on-chain indicators. In addition, whales and investors have moved a large amount of ETH from exchanges in the past week.

Join the discussion group →→VX: ZLH1156

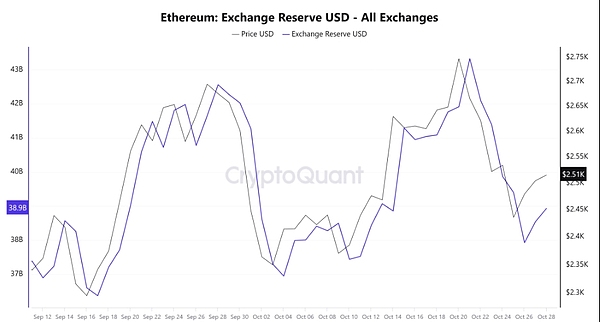

Ethereum Exchange Reserves Decline

According to data from on-chain analysis firm CryptoQuant, Ethereum's exchange reserves have declined from $42 billion to around $38.5 billion, a decrease of about $3.5 billion. The significant drop in exchange reserves suggests potential signs of whales or investors accumulating or acquiring.

Furthermore, the decline in exchange reserves occurred near the strong support area where ETH is currently trading.

Ethereum Technical Analysis and Upcoming Levels

ETH appears to be bullish and is moving within a rising channel, forming higher highs and higher lows. Currently, ETH is at the lower boundary of this pattern, forming a higher low.

Based on historical data and price adjustments, the asset is likely to rise by 12% in the coming days, reaching a resistance level of $2,800. In fact, this level not only serves as a resistance but also aligns with the 200-day Exponential Moving Average (EMA) and the upper limit of the bullish pattern.

This bullish thesis will only hold if ETH maintains above the $2,400 level; otherwise, it may fail.

Bullish On-Chain Indicators

The positive outlook for ETH is further supported by on-chain indicators. According to data from on-chain analytics firm Coinglass, the long/short ratio for ETH is currently 1.36 in the past four hours, indicating a strong bullish sentiment among traders. During the same period, 57.76% of top traders have opened long positions, while 42.24% have opened short positions.

ETH's open interest has increased by 4.9% in the past 24 hours and 3.1% in the past 4 hours. The increase in open interest suggests that traders' interest in the asset is continuously growing, forming new positions.

When examining the bullish on-chain indicators through technical analysis, the bulls appear to currently dominate the asset and may continue to support it in the upcoming rebound.

Current Price Momentum

As of the time of writing, ETH is trading at the $2,584 level, with a 3.50% increase in the past 24 hours. During the same period, its trading volume has surged by 90%, indicating higher participation from traders and investors in the potential upward rebound.

That's the end of the article. Follow the public account: Web3团子 for more great articles~

If you want to learn more about the crypto world and get the latest news, feel free to consult me. We have the most professional community, and we publish daily market analysis and recommendations for potential coins. No threshold to join the group, welcome everyone to discuss together!

Join the discussion group →→VX: ZLH1156