The cryptocurrency exchange Bitfinex stated in a report released on Monday that the uncertainty surrounding the US election, the "Trump trade" narrative, and seasonal factors in the fourth quarter have created a "perfect storm" for Bit, setting the market up for potential turbulence. Analysts believe that given the steady growth in Bit call options and favorable seasonal factors in the fourth quarter, Bit could break its historical high of $73,666 after the US election.

Bit to See Significant Volatility

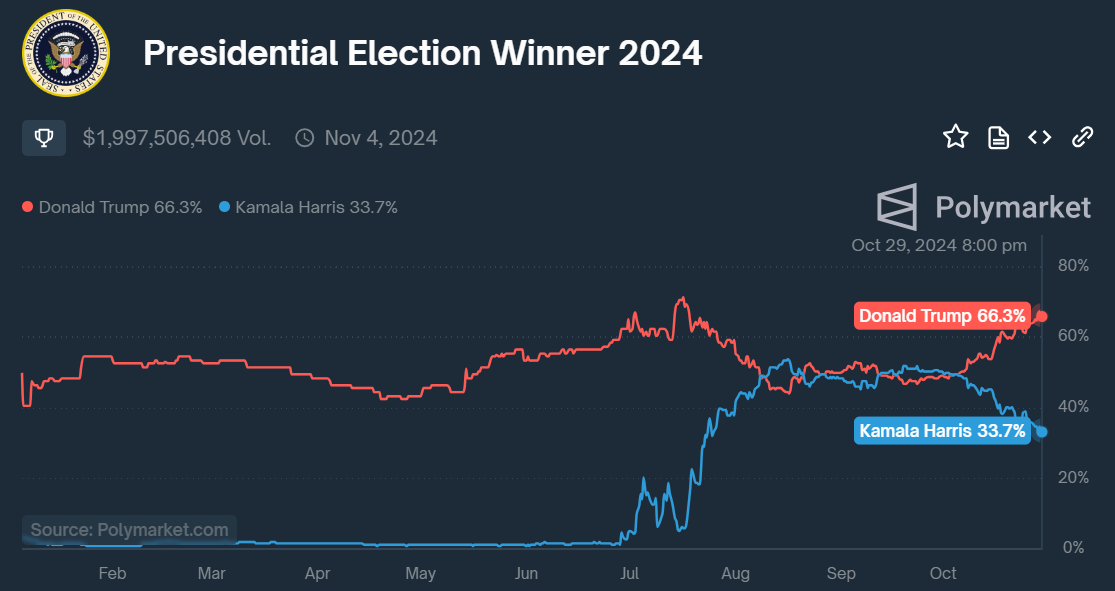

Bitfinex's report indicates that Bit volatility has intensified due to geopolitical uncertainty, macroeconomic factors, and the increasingly strong "Trump trade" narrative. Last week, Bit experienced a significant 6.2% drop before rebounding, highlighting the growing influence of the upcoming US presidential election on recent price movements. The market generally believes that a Republican victory would be positive for risk assets like Bit, and the correlation between Trump's chances of winning and the upward trend in Bit has strengthened.

On the decentralized prediction market platform Polymarket, users believe the likelihood of a Trump victory has risen to 66.3%, while Kamala Harris has fallen to 33.7%.

Bitfinex analysts then discussed the trading activity in the Bit options market, noting that the high implied volatility suggests that market volatility could increase over the next two weeks.

"The anticipation surrounding the election has fueled a surge in options activity, with options expiring around key election dates being traded at higher premiums, and implied volatility expected to peak at 100% daily volatility on November 8th (the day after the election) - indicating that the market is bracing for potential turbulence."

The analysts stated that regardless of the outcome of the US election, Bit's short-term volatility is expected to be higher than usual, while in the long term, Bitfinex remains bullish on Bit.

Bullish Seasonal Factors

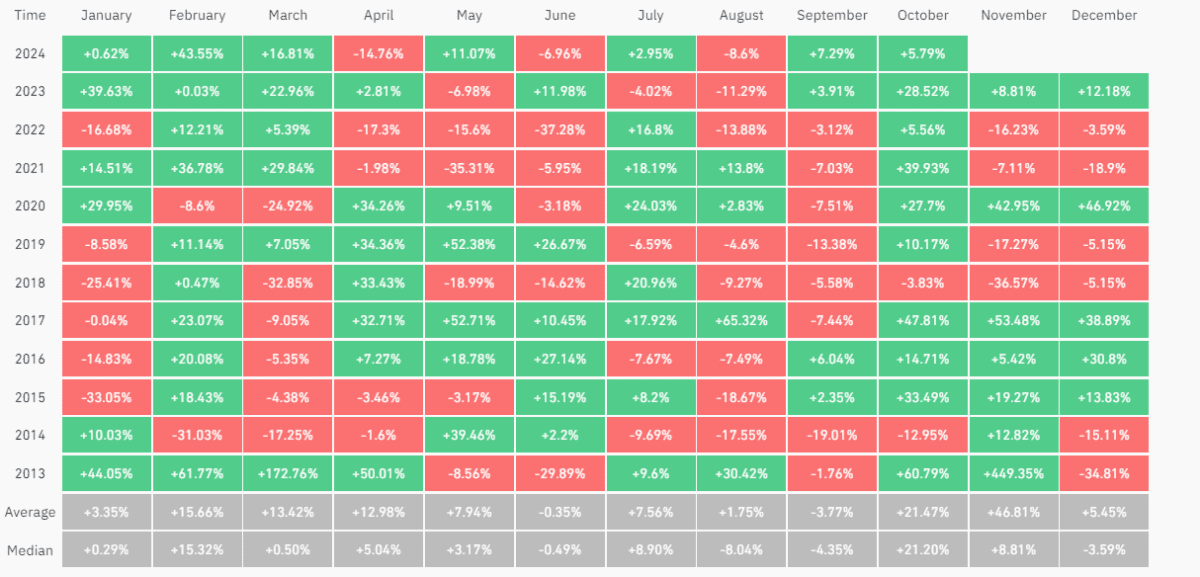

Bitfinex's report also highlighted the seasonal factors that are favorable for Bit. Based on historical data, Bit typically performs strongly in the fourth quarter of a halving year, with a median quarterly return of 31.34%. The analysts stated that this strong seasonal effect, combined with record-high open interest in options and futures, suggests that market participants are optimistic about the year-end phase, which could drive Bit to a new all-time high.

The report states: "Fueling this optimism is the steady growth in call options expiring on December 27th, particularly concentrated at the $80,000 strike price. As open interest in options contracts reaches new highs, the market is showing signs of positioning for a post-election surge, which could propel Bit towards, or even beyond, its $73,666 all-time high."