Matthew Sigel, Head of Digital Assets Research at VanEck, has made a bold prediction about the future price of Bit, considering the upcoming election cycle.

Sigel estimates that Bit could reach $3 million, using VanEck's proprietary forecasting model.

Why Does VanEck Expect a Surge in Bit Price?

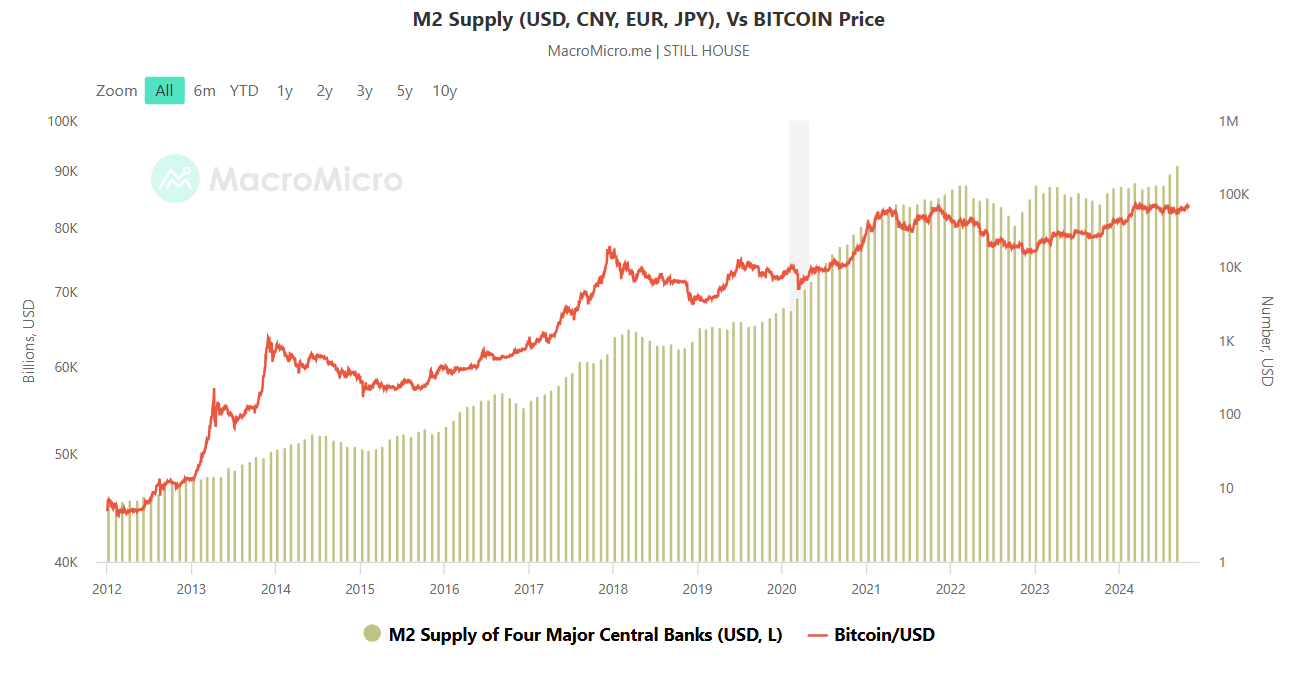

In a recent CNBC interview, Sigel explained the factors that could drive a surge in Bit price, emphasizing the negative correlation with the US dollar and the positive correlation with money supply (M2). He also suggested that the election results could impact Bit price, similar to the pattern observed after the 2020 election.

Sigel also mentioned that the recent large-scale Bit sales by governments, including Germany and the US, have helped to alleviate selling pressure in the market. Furthermore, the BRICS countries, particularly Russia, are introducing Bit-related initiatives, which could further drive the development of Bit.

"Russia has actually announced initiatives. Their sovereign wealth fund is going to invest in regional initiatives to build out Bit mining and AI infrastructure across the BRICS, which is the idea of settling global trade in Bit," Sigel said.

Read more: Crypto Regulation: What Are the Pros and Cons?

Sigel explains that VanEck's model predicts Bit could reach $3 million by 2050 if it becomes a global reserve asset, accounting for 2% of global reserves, and maintains an annual growth rate of around 16%.

"We have a model where we assume that by 2050, Bit is used in global trade and held as a reserve asset by global central banks in a very small 2% allocation. In that model, we've set a price target of $3 million for Bit. That sounds extreme, but it's a 16% annualized compounded growth rate over decades," Sigel explained.

Currently, Bit has a high correlation with risk assets like the Nasdaq, which may deter some investors. However, Sigel believes this trend could change as Bit evolves into a more independent asset.

At the time of writing, Bit is just 4% away from reaching an all-time high (ATH) of over $71,000, with less than a week until the US election.

Read more: How to Buy Bit (BTC) and Everything You Need to Know

VanEck is a US-based asset management firm with $107 billion in AUM, of which $1.8 billion is in digital assets. Three months ago, VanEck made an even bolder forecast, suggesting that Bit could reach $52.38 million by 2050 in a bull market scenario.