Table of Contents

ToggleMarket Analysis – BTC Challenges New Historical High, US Election to Trigger Violent Fluctuations

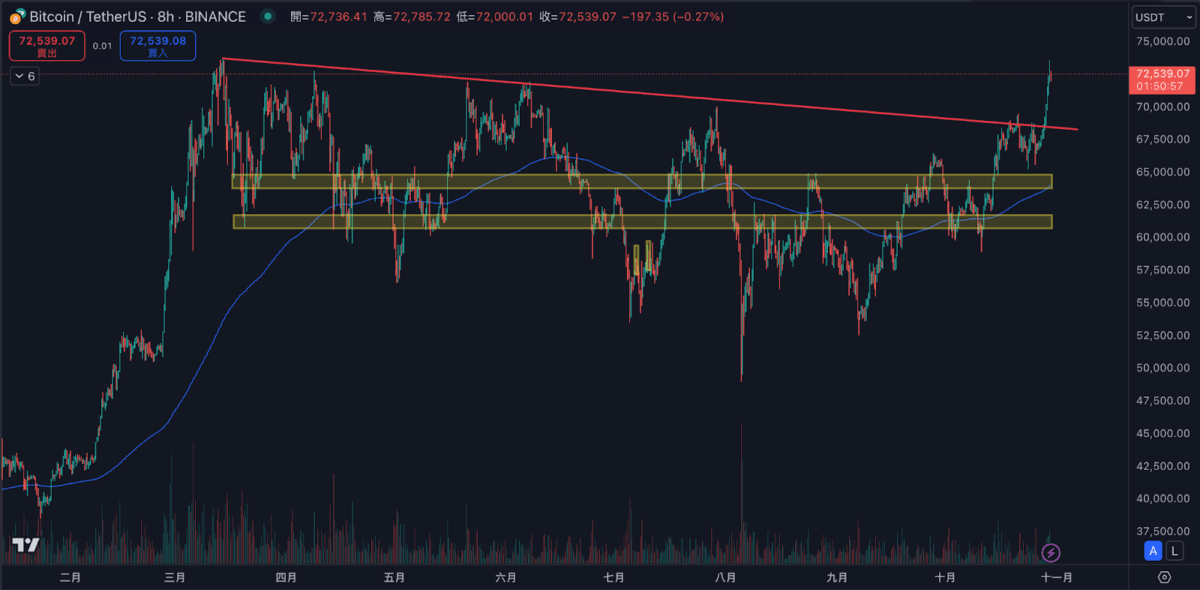

BTC successfully broke through the $70,000 mark on 10/29 yesterday, reaching a high of $73,620, just one step away from the historical high of $73,777 set in March this year.

Reviewing the past six months, BTC has reached the $70,000 range five times, but has not been able to break through successfully, even forming a long-term downward trend line above for half a year, accumulating a large amount of selling pressure. Finally, after experiencing half a year of washing and fluctuations, it broke through multiple resistance levels directly challenging the new high, with the price trend almost presenting a 90-degree upward trend, so the possibility of BTC successfully breaking through the historical high in the near future is very high. Once it breaks through, both inside and outside capital will rush in, and a full-scale bull market may then begin.

In addition to BTC, Doge has also performed very outstandingly in the past week. Doge is also the largest market cap meme coin, so its popularity both inside and outside the circle is quite high. The current surge is largely due to the recent bullish momentum of Trump and Musk. Investors have already linked Doge to the relationship between Musk and Trump, and Musk has been strongly supporting Trump recently, even starting to analyze politics this week. So it is easy to imagine that if Trump is elected, with Musk benefiting from it, Doge will not lack topics for hype in the future, and even payment-related applications can be promoted. Therefore, if Trump is indeed elected, a celebratory market for Doge can be expected.

At the same time, Sol also broke through $180 yesterday, and related ecosystem tokens such as Ray and Jup also showed very strong momentum. In comparison, ETH has appeared very weak during this period. It can be seen that BTC has been the strongest and most resistant to declines in the past six months, and the Sol/BTC trend has been basically flat over the past six months, indicating that Sol is also very strong compared to BTC. In contrast, the ETH/BTC ratio has been constantly hitting new lows, and after BTC's big surge yesterday, this ratio has returned to the 2021 level of 0.036 BTC per 1 BTC. From the beginning of the year to now, BTC has risen about 60%, while ETH has only risen about 10%.

In summary, the current market sentiment is bullish, and holding BTC has become a consensus. Breaking the historical high is just a matter of time. In the October 16th weekly report, it was also suggested to hold more than 40% of BTC. The current BTC strategy is in a full position, and the fluctuations in the prices of different coins during this bull market are very polarized. Even though BTC is about to hit a new high, most Altcoins are still at relatively low levels, and even the old public chains are in a slump. The selection of coins will be very important in this bull market, and we will also replace the coins in the copy trading portfolio to adapt to the upcoming possible bull market. However, the most important thing is still risk management. The election is next week, and the polls are close, so it is difficult to predict the outcome. Therefore, more conservative investors can appropriately reduce their positions and wait for the election results to be finalized before re-entering the market.

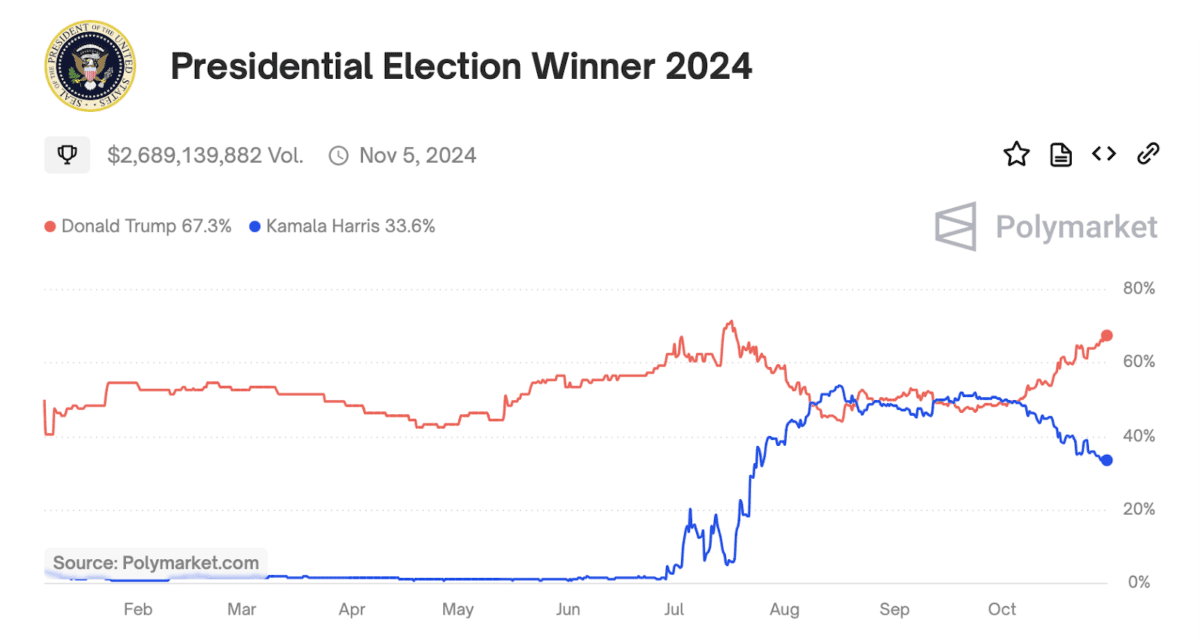

Polls and Forecasts

The biggest issue affecting the market in the coming week is the US election. According to the current poll results, Trump and Harris' support is still very close, with the current poll gap in 7 key swing states not exceeding 2 percentage points, making it difficult to determine who will ultimately win. However, there are significant differences in the prediction markets, with traders currently betting that Trump has a 67.3% chance of winning, while Harris has fallen to 33.6%.

Historical Election Data

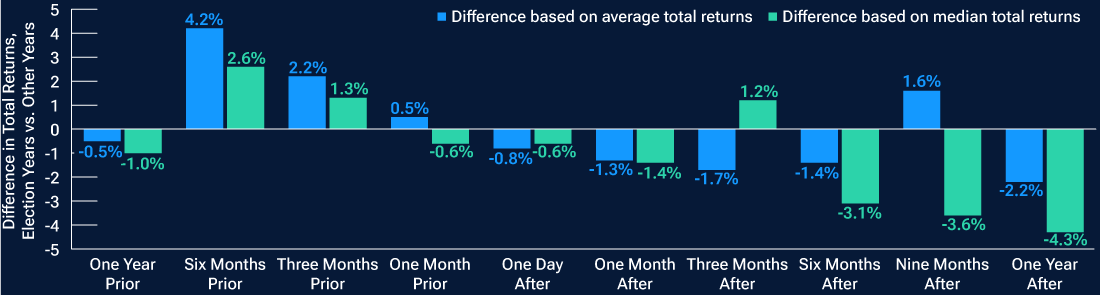

How Does the Election Affect the Market?

According to a statistical report compiled by T. Rowe Price based on historical data from 1927 to the present, the average return of the S&P 500 is generally higher than non-election years before the election day, but the market's returns in the 1 month, 6 months and 12 months after the election day are significantly lower than the same period in non-election years.

Higher Probability of Recession in Election Years

The probability of recession is higher. In more than half (54%) of the 24 presidential elections in the past, the US economy entered a recession within a year after the election (according to the definition of the National Bureau of Economic Research). This proportion is significantly higher than the average recession rate in other years of the president's term: specifically, there is a 29% chance of recession in the second year of the president's term, 17% in the third year, and 25% in the election year.

In other words, the likelihood of the US economy falling into recession within 12 months after the end of the presidential election year is relatively high. This may be because the market has already anticipated that the economy will weaken after the election year, so the stock market may reflect this expectation at the end of the election year.

Impact of Re-election on Volatility

On the other hand, the data also shows that when the incumbent party fails to retain the White House, the volatility of the S&P 500 tends to be higher on average in the months before and after the election (see Figure 5), which may reflect the uncertainty brought about by policy changes. In this case, volatility is highest in the month before the vote. Two other trends are worth noting:

- When the incumbent party is re-elected, volatility on average declines before the election and rises slightly after the election.

- When the incumbent party is defeated, volatility increases significantly before the vote and then declines.

How Will the Cryptocurrency Market Change

The Market Has Divergent Views on the Post-Election Direction

Currently, the market has significant divergence on the performance of the cryptocurrency market after the election. The general market view is that if Trump wins, the market may expect a more relaxed regulatory environment, which would be good news for the cryptocurrency market. Compared to the Democratic Party's recent strict law enforcement actions, the Republican government has had a more relaxed attitude towards cryptocurrency regulation in the past, which may promote innovation and investor confidence.

The recent rebound in Bitcoin is likely due to bets on a Trump victory, as Edouard Hindi, Chief Investment Officer of Tyr Capital, told The Block in an interview that traders may sell to lock in profits after the election, which could push down Bitcoin prices.

However, Geoff Kendrick, Head of Global Digital Assets Research at Standard Chartered Bank, believes that the performance of the cryptocurrency market will depend on the election results. If the Republican Party sweeps Congress (i.e. the Republican Party wins both the House and Senate), Bitcoin's year-end target price could rise to $125,000, while if Vice President Kamala Harris wins, Bitcoin could plummet.

In a report released on Monday, Bitfinex pointed out that the uncertainty of the US election, the "Trump trade" narrative, and seasonal factors in the fourth quarter have created a "perfect storm" for Bitcoin. Analysts believe that given the steady growth of Bitcoin call options and favorable seasonal factors in the fourth quarter, Bitcoin could break through its historical high of $73,666 after the US election.

On the other hand, according to a 2024 return analysis study by an Italian bank, if Trump wins in 2024, it is more likely to be accompanied by bond market volatility, rising stock prices, lower volatility, and falling oil prices.

In addition to the presidential election, control of the House and Senate is also closely watched. According to current polls, the Republicans appear poised to win the Senate, while the Democrats are expected to win the House, which could lead to political gridlock and make it more difficult to implement policy agendas. Interestingly, however, an analysis by Darrow Wealth Management found that political gridlock when the presidency, Senate and House are controlled by different parties is the best outcome for the market, as the market prefers an environment with less policy change.

Overall, it is currently difficult to determine which direction the cryptocurrency market will take in the short term after the election, but it is certain that the cryptocurrency market will see significant volatility next week under the dual events of the US presidential election and the Federal Reserve's interest rate decision, and investors should reduce their positions appropriately to avoid taking on too much risk.

Binance Copy Trading Analysis

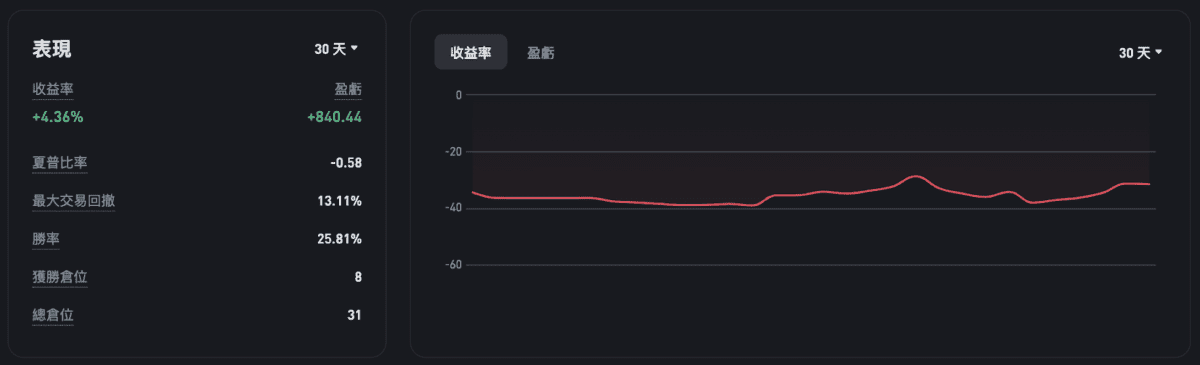

GTRadar – BULL

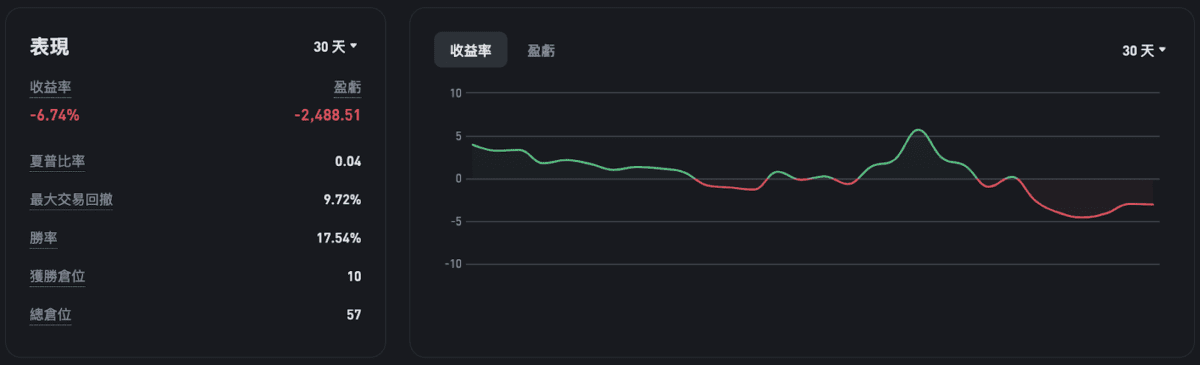

GTRadar – Balanced

GTRadar – Potential Public Chain OKX

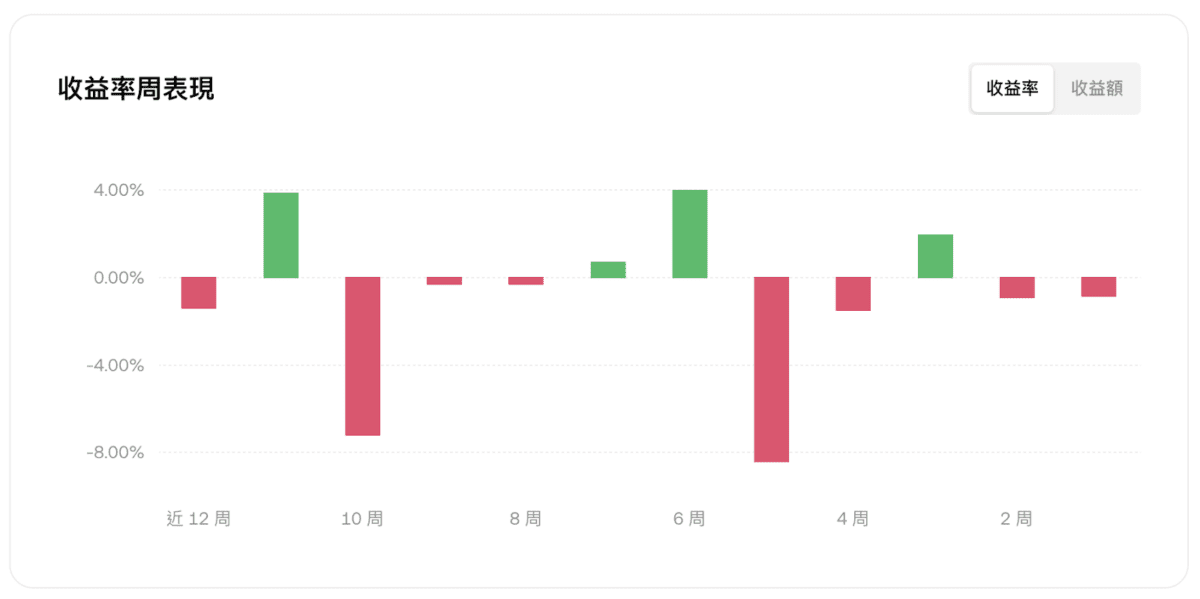

- The 7-day returns of 『 GTRadar – BULL 』, 『 GTRadar – Balanced 』 and 『 GTRadar – Potential Public Chain OKX 』 are +4.02%, -3.07% and -0.85% respectively, and the 30-day returns are +4.36%, -6.74% and -1.32% respectively.

- Currently, 『 GTRadar – BULL 』 holds a net long position of 80%, mainly in BTC and ETH.

- Currently, 『 GTRadar – Balanced 』 holds a net long position of about 50%, mainly in SOL and ETH.

- Currently, 『 GTRadar – Potential Public Chain 』 holds a net long position of about 40%, mainly in SOL and ETH.

- Copy traders who frequently change their investment portfolios tend to have lower long-term returns than those who consistently follow a single portfolio. Do not easily terminate copy trading due to short-term drawdowns, as the drawdowns shown in the curve charts may actually be a good time to start copy trading, and frequent in-and-out trading can significantly reduce the rate of return.

Headline News

Tesla Q3 2024 Earnings: Revenue Increased, No Bitcoin Sold

According to Tesla's Q3 financial report released on October 23, the company did not sell any of its $184 million digital asset investments this quarter, and has not sold any of its held cryptocurrencies for five consecutive quarters.

Bitcoin Whale Addresses Reach Highest Level Since January 2021

According to data tracked by blockchain data analytics firm Glassnode and Bitwise Europe research lead André Dragosch, the number of Bitcoin whales (wallet addresses holding at least 1,000 BTC) surged to 1,678 at the beginning of this week, reaching the highest level since January 2021.

US Government Wallet Hacked, $20 Million in Crypto Assets Stolen

A US government wallet saw unusual activity on the 24th, with around $20 million worth of cryptocurrencies transferred to external addresses. These funds were related to the Bitfinex hack, coming from 9 different US government seizure addresses. The assets included nearly $14 million worth of AUSDC stablecoins, $5.4 million in USDC, $1.1 million in USDT, and nearly $500,000 in ETH. However, the attackers later returned most of the funds for unknown reasons.

Microsoft Considers Bitcoin Investment, Board Recommends Against

According to documents filed with the US Securities and Exchange Commission (SEC) on Thursday, tech giant Microsoft appears to be considering investing in Bitcoin. The company has included the issue as a "voting item" on the agenda for its next shareholder meeting scheduled for December 10, titled "Evaluation of Bitcoin Investment".

Kraken Launches Ink, an Ethereum Layer 2 Network Built on Optimism

Cryptocurrency exchange Kraken announced on the 24th that it will launch Ink, an Ethereum Layer 2 network built on top of Optimism's Superchain. The blockchain will focus on creating the best decentralized finance (DeFi) experience, providing seamless access and interoperability for users.

Yesterday, Financial Supervisory Commission Chairman Peng Chin-long confirmed in a legislative committee hearing that the implementation date of the VASP registration rules will be brought forward by one month from the original January 2025 to December 2024. Legislator Ke Jue-jun questioned that the administrative department's change of the regulatory implementation schedule under pressure from the Executive Yuan will put tremendous pressure on the operators, and the hasty implementation may also lead to defects in the registration procedures for the operators.

FTX and Bybit Exchange Reach $228 Million Settlement, Claim Day Approaching?

The FTX bankruptcy estate manager and Bybit exchange have reached a $228 million settlement agreement, according to legal documents dated October 24. This settlement stems from a lawsuit filed by the 2023 FTX estate manager to recover funds to repay past customers and creditors.

Tether CEO Refutes Wall Street Journal Allegations, Discloses USDT Reserves

Tether CEO Paolo Ardoino recently publicly introduced the reserve asset portfolio supporting the company's Tether-USD stablecoin (USDT) and responded to the Wall Street Journal's reporting on Tether being under investigation by the US Department of Justice and Treasury Department. Ardoino strongly denied these allegations and accused the report of "merely rehashing old news".

Vitalik Proposes Methods to Reduce Ethereum Protocol Bloat in "Purge" Upgrade Roadmap

Ethereum co-founder Vitalik Buterin outlined a potential "Purge" upgrade roadmap in his latest article, aimed at gradually addressing the complexity and "bloat" issues of Layer 1.

According to the latest research report released by Coinbase Institutional, Solana (SOL) network activity typically peaks during US time zones, but compared to Bitcoin and Ethereum, Solana's activity seems to be more skewed towards the US West Coast time zone. The report indicates that Solana's transaction fee spending is consistent with other low-fee networks, with the top 0.13% of users contributing 90% of non-voting transaction fees, most of which come from DEX trading activity.

Ethena Accused of "Black Box": Using Locked Tokens to Mine, Ignoring Questioning

Recently, user Nomad disclosed on a social media platform that the Ethena team, a decentralized finance protocol, was accused of using 180 million ENA tokens, equivalent to 25% of the SENA supply, in the SENA Season 3 airdrop event. This operation diluted the earnings of other participants, causing widespread holders to have serious concerns about the team's ethics and transparency. However, the Ethena team later denied the allegations of using locked tokens for mining.

Accused of Supplying Chips to Huawei, Bitmain: The Incident Has No Relation to the Company

According to Reuters on the 26th, citing two informed sources, TSMC suspended shipments to Chinese chip developer Sophgo after finding that Huawei's AI processor used its produced chips. According to the report, Sophgo is affiliated with the large mining machine manufacturer Bitmain. However, Bitmain stated in a statement issued today that Bitmain is focused on the cryptocurrency mining machine business and has no association with the aforementioned supply investigation.

According to the official announcement, Binance Exchange has launched a solution called "Binance Wealth" specifically designed for high-net-worth clients, which allows clients to flexibly manage their own investments or allow wealth managers to recommend investment targets. Reportedly, wealth management personnel will be responsible for the client's onboarding process and provide a user experience with a traditional wealth management framework.

Bitcoin Price Approaches Historic High, BlackRock IBIT Fund Trading Volume Hits 6-Month High

Bitcoin (BTC) rose above $73,000 on Wednesday morning Taiwan time, reaching as high as $73,600, just 0.3% away from the historic high set in March this year. As of the time of writing, the Bitcoin price has retreated to $72,300. Meanwhile, as Bitcoin approaches its historic high, the US Bitcoin spot ETF has attracted about $3.6 billion in net inflows so far this month.

The above content does not constitute any financial investment advice, and all data comes from official GT Radar announcements. Each user may have slight differences due to different entry and exit prices, and past performance does not guarantee future results!