Written by Carlton, TaxDAO

1. Introduction to Colorado

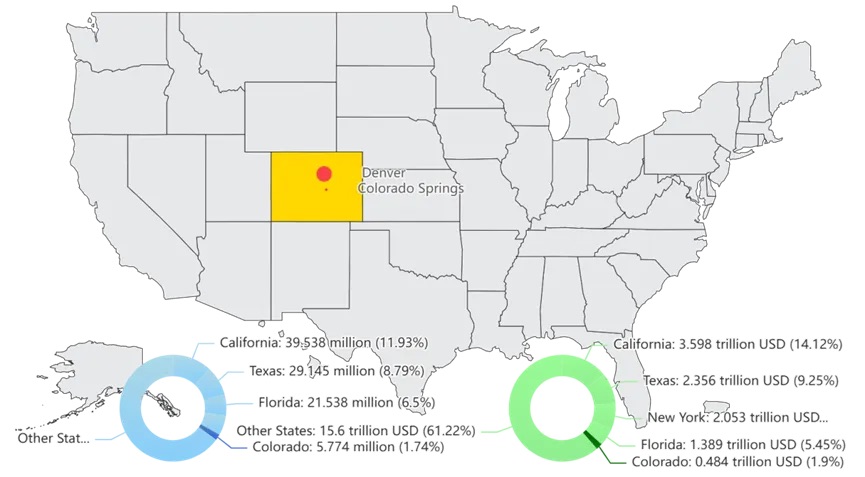

Colorado is located in the western United States, straddling the eastern Rocky Mountains. It has an area of about 268,000 square kilometers and a population of about 5.77 million (2020), ranking 8th in area and 21st in population among the 50 states in the United States. The state capital is Denver, which is also the largest city in the state. Due to its rich natural resources and diversified economic structure, Colorado occupies an important position in the United States.

(Chart is self-made, data source: Wikipedia Colorado)

In 2022, Colorado's economy will be approximately $484 billion, accounting for 1.9% of the U.S. GDP. Colorado's economic development is highly diverse, mainly including six pillar industries: aviation, aerospace, biotechnology, energy, financial services, and information technology software. The state's high-tech industry is very developed, especially in cities such as Denver and Boulder, which have gathered a large number of technological innovation companies such as Oracle, Bloomberg, and Newmont Mining. Colorado is also an important agricultural state in the United States, and its main agricultural products include beef, wheat, and corn. In addition, with its famous natural landscapes such as the Rocky Mountains, Colorado has become a world-renowned tourist destination, attracting millions of tourists every year.

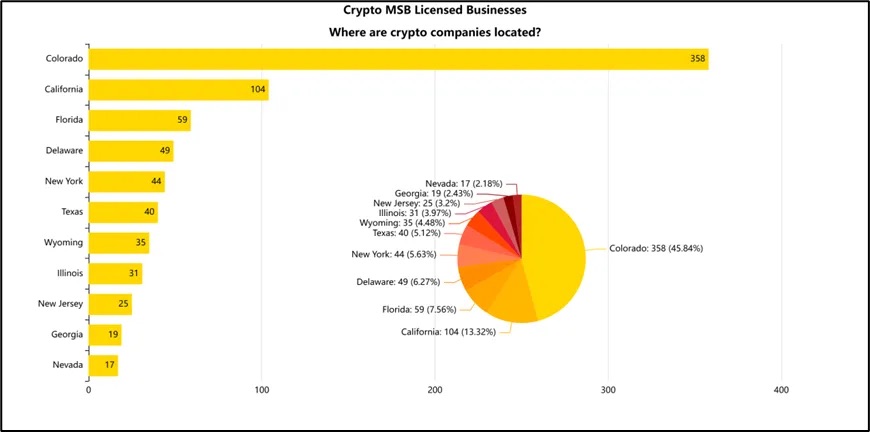

(Chart created by myself, data source: FinCEN Cryptocurrency Business Registration)

Colorado is a relatively small state in the United States in terms of area, population, and economic output, but it plays an extremely important role in cryptocurrency activities. According to data from the Financial Crimes Enforcement Network (FinCEN), Colorado accounts for about 33% of all cryptocurrency companies registered in the United States. This phenomenon is mainly due to Colorado's active policy support, relaxed regulatory environment, and advantages in energy and industry, and the help of key figures is also indispensable. Next, we will analyze in detail Colorado's specific performance in these aspects and how it has promoted the state to become an important center for the cryptocurrency industry.

2. Colorado's Basic Tax System

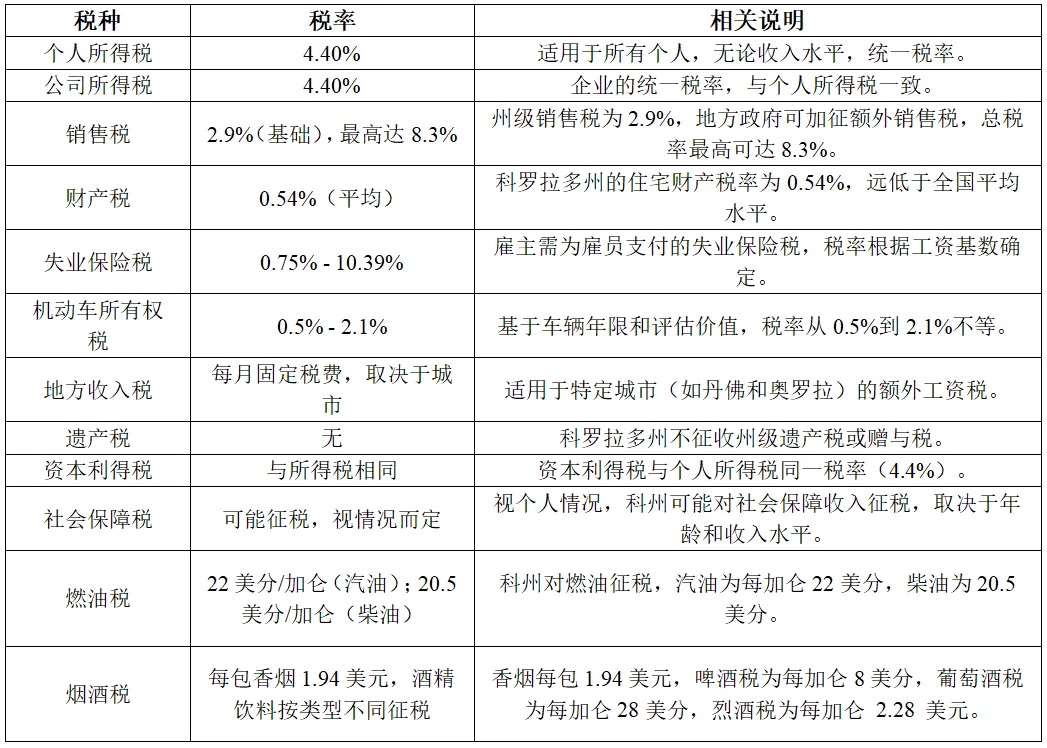

Colorado's tax system is characterized by simplicity and uniformity. Compared with the complex progressive tax systems of some states, Colorado adopts a single tax rate, which is consistent for both individuals and businesses, making Colorado's tax system simple and transparent. Overall, Colorado's tax burden is at a medium-low level, especially in terms of income tax and sales tax rates, which are competitive nationwide.

2.1 Tax types and tax rates

There are currently 11 major tax categories on the Colorado official website, such as income tax, land tax, sales and use tax, etc. Some tax categories and tax rates are summarized as follows:

2.2 Taxpayers

Under Colorado's tax system, taxpayers include individuals, corporations and other legal entities, and the tax burden is reflected in many aspects.

Individuals in Colorado are subject to a 4.4% state income tax, which is a uniform rate for the state and applies to individuals of all income levels. In addition, individuals are subject to a state sales tax of 2.9% on the purchase of goods and certain services, and local governments may impose additional surcharges, bringing the total sales tax rate to 7.78% in some areas. If an individual owns real estate (such as a residential or commercial property), they are subject to property taxes levied by local governments. In 2023, the average property tax rate in Colorado was approximately 0.54%, which is relatively low compared to the national level.

For businesses, Colorado imposes the same 4.4% flat income tax as individuals, and this rate applies to businesses regardless of size or revenue. In addition, businesses are required to collect and remit sales tax on the sale of goods and services, which applies to most physical goods and some digital goods (such as software, online services, etc.). Colorado also imposes a motor vehicle ownership tax on the vehicles of businesses, with the tax rate adjusted based on the age and assessed value of the vehicle. Although Colorado does not have a franchise tax or similar corporate tax other than the corporate income tax, businesses are still required to report their income and sales taxes to ensure compliance with the law.

2.3 Taxable Objects

Colorado's taxable items cover goods, services, capital gains, and specific industries, with a wide range of tax types. Individual and corporate income, commodity sales, real estate, movable property, specific services, etc. are all included in the tax system, forming a relatively comprehensive tax collection framework. In this system, local taxes are combined with state taxes to ensure that taxes are reasonably distributed across different economic activities and industries, and that the tax burden on companies and individuals is relatively balanced.

Goods: Colorado imposes a sales tax on most tangible goods, with a state-level tax rate of 2.9%, one of the lowest base tax rates in the country. Goods taxed include common goods such as daily consumer goods and clothing. In addition, local governments can impose additional taxes, bringing the total sales tax rate to 7.78% in some areas. Colorado's property tax is imposed on real estate of individuals and businesses, including residential, commercial properties and vacant land. The average property tax rate in 2023 is about 0.54%.

Services: While many services are not taxable in Colorado, some services are still taxable. Taxable services include repair services, digital services (such as software subscriptions, streaming services), entertainment services, and cable TV services. In addition, as the digital economy expands, Colorado is also taxing more and more virtual goods and services, such as cloud computing services and other online platform services. For businesses that provide taxable services, they must collect and remit sales tax on behalf of the service provider to ensure compliance with state regulations.

Capital Gains: Colorado taxes individual and corporate income and capital gains at a uniform rate of 4.4%. Wages, salaries, interest income, and dividends earned by individuals, as well as business income, are taxed as capital gains. Capital gains (such as gains from the sale of stocks, real estate, and other assets) are also taxed at the same rate as personal income taxes.

Personal Property and Transportation: Colorado imposes a motor vehicle title tax on vehicles owned by individuals and businesses.

Certain consumer goods: Colorado imposes special excise taxes on certain consumer goods, such as fuel, tobacco, and alcohol.

2.4 Tax Incentives

According to the official website, Colorado has a lot of tax incentives, totaling 24 categories. As a state with a low tax burden, Colorado uses a series of incentives to attract investors and residents and create a favorable operating environment for enterprises. These include advanced industry investment tax credits, employee stock ownership tax credits, enterprise zone contribution tax credits, personal benefit tax credits, etc.

2.4.1 Tax incentives for enterprises

Colorado offers many incentives for businesses, covering capital investment, R&D innovation, and industry-specific tax credits. First, Colorado's Enterprise Zone Program provides important tax incentives for businesses investing in economically underdeveloped areas. Businesses can enjoy sales tax rebates, equipment purchase exemptions, and other investment tax credits by expanding capital investment and hiring new employees in these areas.

Colorado also has significant tax incentives for renewable energy projects and R&D activities. If companies invest in renewable energy such as wind and solar energy, they can enjoy tax breaks for equipment purchase and installation, greatly reducing initial costs. For R&D companies, the state government provides R&D tax credits to support companies' investment in technological innovation and high-tech fields. These tax credits encourage companies to set up R&D centers in Colorado and promote the development of green energy and high-tech industries.

To further support technological innovation, Colorado has also established the Advanced Industries Accelerator Program, which provides direct financial support and tax incentives to companies in the fields of aerospace, medical equipment, energy technology, etc. Through this fund, companies can obtain R&D funds and enjoy tax breaks, especially in promoting cutting-edge technologies and innovative product development.

In addition, Colorado offers capital investment incentives for capital-intensive investments. Companies that make long-term capital investments in the state, such as building a new plant or expanding a production line, can receive corresponding investment tax credits.

2.4.2 Tax benefits for individuals

Colorado also offers a variety of tax benefits to individuals. First, Colorado's flat income tax rate is 4.4%, which is relatively low and simple. It applies to residents and non-residents of all income levels, reducing the tax burden on individuals. In addition, Colorado provides partial exemptions for social security income. Individuals aged 55 to 65 can be exempted from $20,000 in social security income, and individuals aged 65 and over can enjoy complete tax exemption. This policy is particularly attractive to retirees and elderly residents, reducing their tax pressure.

Colorado also offers property tax relief to certain groups, especially seniors and people with disabilities. Qualified residents can apply for a property tax rebate to help them ease the financial burden of owning property.

3. Crypto-asset taxation and regulatory systems

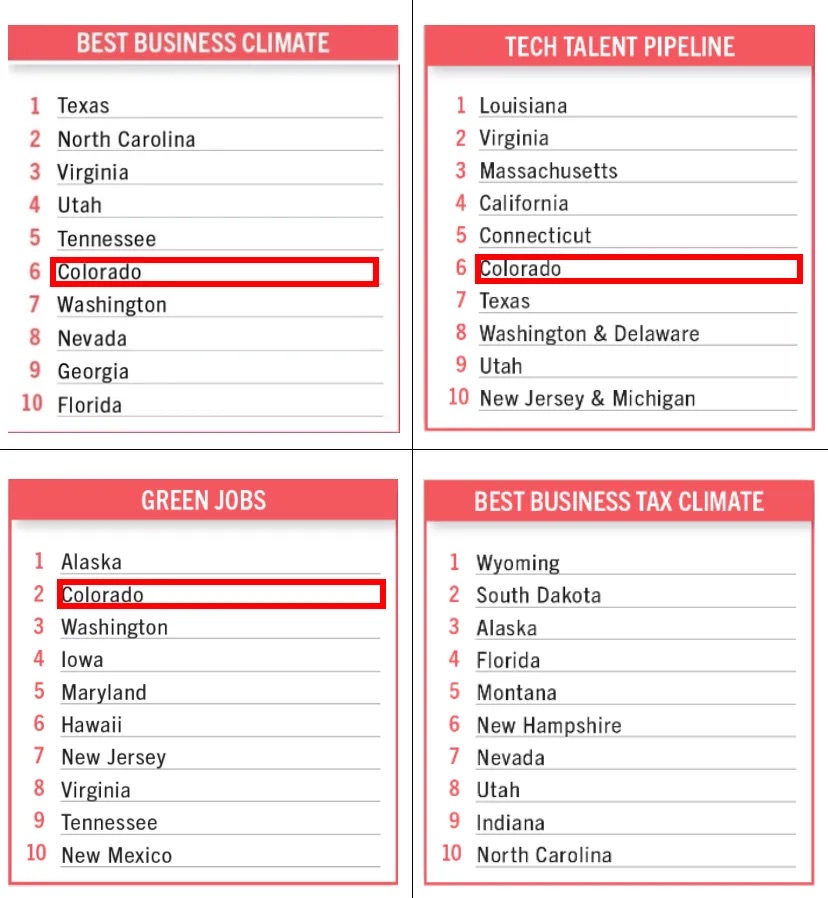

According to a 2023 Business Facility report on business location selection, Colorado ranked second in "Green Jobs", and only sixth in "Best Business Environment" and "Technical Talent". In addition, "Best Business Tax Environment" and "Professional Workforce Training" were not even on the list. From the overall tax environment, Colorado does not seem to have a low tax rate like Texas. Why is the state so attractive to registered money service businesses (MSBs)?

Colorado has been a leader in creating a crypto-friendly legal framework, which may explain the state's appeal to MSBs. The state introduced the Digital Token Act, which provides certain state securities law exemptions for cryptocurrencies, which may make it easier for blockchain and cryptocurrency-focused businesses to operate. Below we will take a closer look at the state's taxation and regulation of the crypto industry.

(Chart source: Business Facilities' 19th Annual Rankings Report: State Rankings)

Before introducing Colorado's cryptocurrency taxation and regulatory framework, we must first mention Governor Jared Polis. He was elected Governor of Colorado in November 2018 and was officially sworn in in January 2019, and has been re-elected to date. He is an important example of a technology entrepreneur entering politics. Polis has shown a strong interest in cryptocurrency and blockchain technology during his tenure as a member of Congress, and became a co-founder of the Congressional Blockchain Caucus. He is committed to making Colorado a center of blockchain innovation. As early as during the campaign, he publicly and clearly put forward five policy goals, including: promoting the widespread use of blockchain in business and government, developing blockchain infrastructure for election security, simplifying government services, and providing legal and financial framework support for crypto companies. Among them, the Digital Token Act, which he insisted on, further provided a broader entrepreneurial environment for cryptocurrency companies by relaxing securities law regulations for certain tokens.

He is also committed to making Colorado the first state in the United States to accept cryptocurrency for state taxes. His goal is not limited to this, and he also suggests allowing the use of cryptocurrency to pay for driver's licenses, hunting and other services. We have reason to believe that Colorado can quickly become the forefront of blockchain innovation in the United States, which is inseparable from his election and promotion.

3.1 Taxation of Crypto Assets

3.1.1 Definition

Colorado does not have a special tax on cryptocurrencies. Consistent with the U.S. federal government's policy, Colorado treats cryptocurrencies as property, subject to similar tax rules as capital assets such as stocks and real estate. Therefore, when it comes to cryptocurrency trading or sales, individuals and businesses must declare capital gains tax or capital losses instead of declaring them under other taxes. Capital gains tax on cryptocurrencies is divided into long-term capital gains and short-term capital gains based on their holding period, and different tax rates apply to each, with higher short-term tax rates and relatively lower long-term tax rates.

3.1.2 Taxes and tax rates related to crypto assets

The lack of a special tax specifically for crypto assets means that Colorado’s taxation of crypto assets is based on the basic tax system.

Capital Gains Tax: If cryptocurrency is held for less than one year, the gains are considered short-term capital gains and are taxed at the individual or corporate ordinary income tax rate. Colorado's ordinary income tax rate for individuals is 4.4%, and the federal tax rate is tiered based on individual income, up to 37%. If cryptocurrency is held for more than one year, long-term capital gains tax applies. The long-term capital gains tax rate at the federal level is 0%, 15%, or 20%, also depending on the taxpayer's income level. Long-term capital gains tax rates are generally lower than short-term capital gains tax rates, which encourages investors to hold cryptocurrencies for the long term.

Sales Tax: In Colorado, when cryptocurrency is used to trade goods or services, the payment behavior of cryptocurrency is no different from legal tender. After accepting cryptocurrency payment, merchants must declare the transaction amount at the equivalent exchange rate in US dollars and pay the corresponding sales tax. The basic state sales tax rate is 2.9%, but with the increase of local taxes (such as municipal taxes and county taxes), the actual total tax rate can reach 7% to 11%. Therefore, using cryptocurrency to purchase goods or services in daily consumption does not exempt you from the obligation to pay sales tax. Similarly, buying and selling cryptocurrencies as commodities is also subject to sales tax.

Paying taxes: Colorado is the first state in the United States to allow residents and businesses to pay state taxes with cryptocurrencies. Starting in 2022, individuals and businesses can use cryptocurrencies such as Bitcoin and Ethereum to pay personal income tax, corporate tax and other taxes through third-party platforms. These cryptocurrencies will be instantly converted to US dollars through payment processors, and the state government will not directly hold cryptocurrencies. This policy reduces transaction costs while providing more payment options for cryptocurrency users.

Sales tax: When a company conducts cryptocurrency-related business in Colorado, its profits are subject to state and federal sales tax policies. For corporate income, Colorado's corporate income tax rate is 4.4%, which is consistent with the tax rate applicable to ordinary companies. Whether a company makes profits through cryptocurrency exchanges, mining, or other related businesses, it will eventually pay sales tax based on the corresponding corporate income.

For individual miners or independent cryptocurrency service providers, Colorado requires reporting income and paying taxes according to various tax regulations. First, the cryptocurrency income obtained by individuals through mining will be considered taxable income, which is estimated according to the market value of the cryptocurrency at the time of mining. This part of income is subject to Colorado's personal income tax at a rate of 4.4%. At the federal level, this part of income is also subject to federal income tax based on the size of the income. In addition, if an individual sells or trades the cryptocurrency obtained from mining, the capital gains will be subject to capital gains tax.

In addition, individual miners or self-employed cryptocurrency practitioners are also subject to self-employment taxes, which include social security and Medicare taxes, with a total tax rate of 15.3%. This tax burden is particularly important for those who earn income through mining or blockchain services. If individual miners or independent practitioners operate on a large scale and employ employees, they also need to consider payroll taxes, including social security and Medicare taxes at the federal and state levels, as well as personal income tax withheld.

For cryptocurrency mining companies or blockchain service companies, tax responsibilities are more diverse. The company's profits are subject to Colorado corporate income tax, and the company's profits from the sale of cryptocurrency after generating income through mining or blockchain services are also subject to capital gains tax. Similarly, if the company uses imported equipment or equipment purchased from other states to mine or provide services without paying local sales tax, the company will need to pay excise tax. The rate of excise tax varies by region, generally ranging from 7% to 11%. Businesses that provide digital services or cryptocurrency trading platforms may need to collect sales tax on their service revenue, especially for consumers within Colorado.

3.1.3 Tax incentives

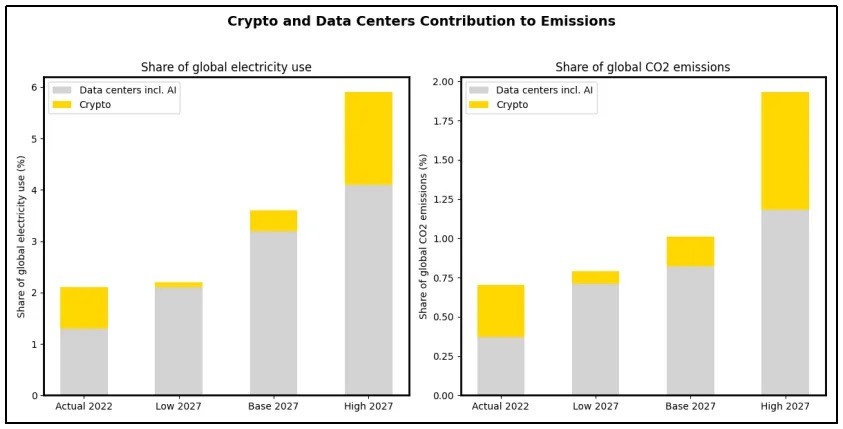

Based on IMF statistical analysis, crypto mining and data centers will account for 2% of global electricity demand by 2022. This proportion may climb to 3.5% within three years, equivalent to the current electricity consumption of Japan, the world's fifth largest electricity user.

(Chart made by myself, original picture: Chart of the Week, MACRO-FISCAL POLICY Carbon Emissions from Al and Crypto AreSurging and Tax Policy Can Help)

Cryptocurrency mining and blockchain technology are highly dependent on data centers and large amounts of energy. Like quantum computing and AI, they are industries with extremely high demands for electricity and computing resources. As a potential technology center in the United States, Colorado has demonstrated strong support for high-tech industries. For example, in the field of quantum technology, the Governor of Colorado announced a series of new tax credit incentives at the "Mountain West Quantum Enhancement Summit" in Denver, such as tax credits for purchasing equipment and establishing next-generation computing laboratories, and developing a loan guarantee program to help start-ups obtain funding, aiming to attract quantum technology companies to settle in.

Similarly, the crypto asset industry can take advantage of local tax incentives when developing in Colorado - although this policy is not entirely targeted at the cryptocurrency industry. For crypto asset miners and companies, the following tax incentives need to be noted:

Property Tax Abatements: According to Section 30-11-132 of the Colorado Local Government Code, local governments can encourage companies to make long-term capital investments in specific areas by providing property tax abatements or rebates. Cryptocurrency mining companies are such capital-intensive projects because they rely on large-scale data centers for high-intensity computing. Through agreements with local governments, these companies can obtain property tax abatements for up to 10 years. Generally, these abatement policies apply to investment projects that are identified as "Areas of Specific Local Concern" and are intended to promote local economic development.

R&D Expense Deduction: Colorado Revised Statute §31-20-101.7 provides important tax incentives for companies engaged in technological innovation. The policy allows companies to deduct 25% of their R&D expenses from their state taxes. This is particularly important for the cryptocurrency industry, especially companies dedicated to developing new blockchain applications, improving mining efficiency, and optimizing encryption algorithms. By applying for R&D tax credits, cryptocurrency companies can deduct part of their expenses for technology research and development from taxes, reducing the financial burden on the company.

Cryptocurrency tax payments: Colorado has become the first state in the U.S. to allow taxpayers to pay state taxes in cryptocurrency. Although this does not directly reduce taxes, cryptocurrency payments can provide more convenience for tax payments for businesses that rely on digital assets as their main wealth. This applies to income tax, sales tax, use tax and other taxes.

3.2 Crypto asset regulation

3.2.1 Development History

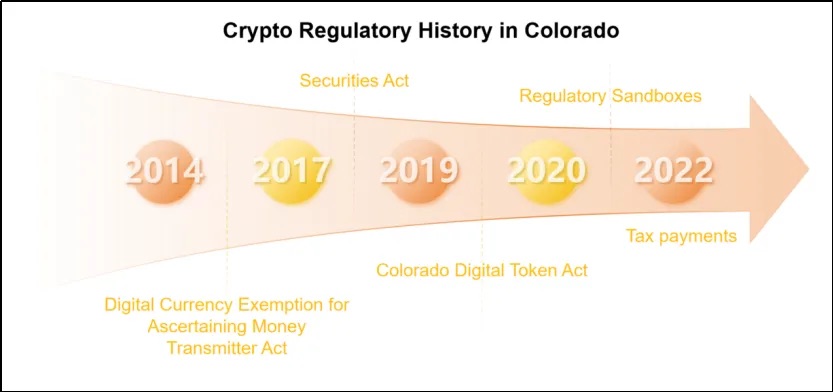

Compared with Colorado's tax policy, its extensive regulatory system and open and innovative business environment are more attractive to cryptocurrency companies. Colorado's regulatory changes on cryptocurrency have gone through the following periods:

(Chart self-made, content: The development of Colorado crypto regulation events)

Back in 2014, Colorado passed the Digital Currency Exemption for Money Transmitters Act, which states that businesses that only handle digital currencies (such as Bitcoin) do not need to apply for a money transmitter license. However, if the business also handles traditional currencies or acts as an intermediary between buyers and sellers of digital currencies, it must obtain a money transmitter license.

Colorado began to focus on the legal framework for cryptocurrencies in 2017, when the state government first considered cryptocurrencies as commodities and regulated them in the Colorado Securities Act. At this time, the state required all businesses engaged in the sale, purchase or transfer of cryptocurrencies to obtain a money transmission license to ensure that these businesses comply with federal regulations such as anti-money laundering (AML) and know your customer (KYC).

In 2018, the Colorado Securities Division issued guidance on how existing securities laws apply to cryptocurrency offerings. Companies and individuals offering cryptocurrency investments in Colorado must comply with state securities registration requirements and disclose all relevant information to potential investors.

In 2019, Colorado passed the landmark Colorado Digital Token Act, which exempts certain crypto tokens from securities registration and broker license requirements. This provides a more relaxed environment for blockchain and cryptocurrency startups and promotes the development of the industry. It aims to promote innovative applications of blockchain technology and clarify the regulatory scope of digital assets.

In 2020, Colorado established a fintech sandbox program to allow cryptocurrency companies to test new products and services in a controlled regulatory environment. This not only provides more room for innovation for cryptocurrency and blockchain companies, but also ensures that companies can develop under supervision and avoid heavy regulatory burdens.

Starting in 2022, businesses and individuals can use cryptocurrencies to pay state taxes, including income tax and sales tax. This policy marks a unique breakthrough in the state's acceptance of cryptocurrencies across the United States, and more businesses and individuals are encouraged to use digital currencies within the legal framework.

It is not difficult to see that Colorado's regulation of the crypto industry is positive and progressive. We have reason to believe that Colorado's laws will continue to be updated in the future, and the regulatory environment and the use of cryptocurrencies will continue to improve.

3.2.2 Regulatory bodies

Colorado’s cryptocurrency regulatory framework is largely based on state laws and regulations as well as guidance from federal agencies such as the Internal Revenue Service (IRS) and the Securities and Exchange Commission (SEC).

It mainly includes:

Money Transmitter Law: Any person or entity engaged in money transmission, including the transmission of virtual currency, must be licensed by the Colorado Department of Banking.

The Uniform Electronic Transactions Act (UETA) recognizes electronic signatures and records, which can include transactions involving digital assets.

Colorado Securities Act: The sale or offering of securities, including certain types of cryptocurrencies, must comply with the Act and be registered with the Colorado Securities Commissioner or be exempt from registration.

The Digital Token Act and its amendments: exempt certain digital tokens from the state’s securities laws and regulations, making it easier for companies to raise funds through initial coin offerings (ICOs) or other digital token offerings; Senate Bill 20-109 adds additional consumer protections by requiring businesses seeking exemptions under the act to disclose their token offerings and file annual reports with the Colorado Securities Commissioner

and the Department of Securities guidelines, the IRS guidelines, the Securities and Exchange Commission guidelines, etc.

Colorado has not yet developed a comprehensive regulatory framework specifically for cryptocurrencies. However, existing state laws and federal guidelines play an important role in regulating the cryptocurrency industry in the state. The government agencies that play a role include:

Colorado Department of Securities: The Department of Securities regulates the sale and issuance of securities, which includes certain types of cryptocurrencies.

Colorado Department of Regulatory Agencies (DORA): DORA regulates various industries in the state and has assigned the Department of Securities the responsibility for regulating cryptocurrency activities.

Colorado Department of Revenue: The Department of Revenue administers and enforces taxes, including income taxes, on cryptocurrency transactions.

Colorado State Banking Commission: The State Banking Commission regulates and supervises state-chartered banks, trust companies, and other financial institutions that deal with virtual currencies.

Division of Banking: As part of DORA, the Division of Banking regulates state-chartered credit unions and trust companies that provide virtual currency exchange services.

Office of Attorney General—Consumer Protection Section: The Consumer Protection Section investigates complaints related to fraudulent or deceptive practices involving virtual currencies.

3.2.3 Targets of supervision

Under Colorado's gradually improving regulatory system, the objects of regulation are more diverse, including:

Cryptocurrency exchanges and wallet service providers: Platforms help users buy, sell, and store cryptocurrencies. Under federal regulations and Colorado state law, exchanges must comply with money transmission laws and obtain a money transmission license. These businesses require AML and KYC regulations to ensure that transactions are legal and compliant.

Digital token issuing companies: According to the Digital Token Act, companies that issue digital tokens can be exempted from some securities laws when their tokens are used for consumption (rather than investment), but they are still subject to basic anti-fraud laws. Such companies need to ensure that the token issuance does not involve investment fraud and comply with relevant consumer protection regulations when issuing tokens.

Cryptocurrency miners and mining facilities: Mining companies are directly regulated by securities or financial regulations when trading crypto assets, and due to their high energy consumption, crypto mining farms are indirectly regulated by state energy policies and environmental regulations. Mining farms must comply with relevant business and tax regulations to ensure legal and compliant operations.

Fintech and blockchain startups: In Colorado, many fintech companies are innovating using blockchain technology. Companies participating in the fintech sandbox program test new technologies and products with less regulation, which provides regulatory support and innovation space for cryptocurrency-related startups, but they must also comply with basic consumer protection and privacy regulations.

Individual or institutional users: Individuals and institutions that trade cryptocurrencies, especially investment-type transactions, need to report capital gains tax or other related taxes at the state or federal level.

4. Summary and Outlook

Colorado has become a leader in the cryptocurrency field in the United States with its open policies and regulatory framework. The state has effectively reduced the operating costs of high-tech companies, including cryptocurrency companies, through flexible property tax exemptions, R&D tax credits, and equipment investment incentives, and has provided substantial support for capital-intensive and energy-intensive mining activities. In addition, laws such as the Digital Token Act simplify compliance processes, provide compliance guidance, and encourage innovative development. The regulatory system covers a wide range, from exchanges to mining companies, ensuring the standardized operation of the crypto ecosystem.

As the blockchain and cryptocurrency markets continue to expand, Colorado is expected to continue to demonstrate its innovative leadership. In the future, Colorado may attract more of the world's leading crypto companies to settle down by expanding tax incentives and optimizing the fintech sandbox program. At the same time, as energy use and environmental protection requirements increase, Colorado may promote more green energy incentives in high-energy mining companies to balance industry growth with environmental responsibility. This will further consolidate its national leading position in the field of blockchain and crypto assets.