Master Advisor Discusses Hot Topics:

The stock price of the Trump Technology Group (DJT) plummeted, and the US stock market and Bitcoin followed suit, one of the reasons being that the market had previously imagined the bull market after Trump's election to be too good to be true.

Yesterday, Trump even "generously congratulated" Bitcoin on its 16th birthday on Twitter, saying he would end Harris' "war" on cryptocurrencies, and even claimed he would "make Bitcoin in America". He didn't forget to add at the end: "Vote for me!" His intention to become the "boss" of the crypto circle is quite evident.

Even more shockingly, Fox News suddenly "turned against" Trump overnight, with public polls showing Harris leading Trump in several key states. The mouthpiece of the Republican Party has suddenly reversed, making one wonder whether the wind has truly changed, or if Fox is playing some new tricks.

In Arizona, Georgia, and Nevada, Harris is slightly ahead, while Trump is slightly ahead in North Carolina. The two are chasing each other, the gap is like a seesaw, and one wrong move could flip it over. Watching them fight is like a race to see who will drop the ball first.

Among the few questions my fans have been asking me on the phone in the past two days, one is still about how long the Bitcoin bull market will last, another is when the opportunity to buy Altcoins will come, and the third is whether the recent sluggishness of Ethereum will lead to a major correction.

Due to time constraints, I didn't go into details on the phone, so I'll write about it in more detail in this article today.

As November begins, let me share my outlook for the market in November and December. First, regardless of whether Bitcoin can set a new high or only slightly break a new high, it will face a "cold at the top" situation - the weekly chart's top divergence is about to form, indicating a long and significant correction is imminent.

It can be said that November will be the turning point for Bitcoin from bull to bear! And against the backdrop of the US election ending and the possibility of a second rate cut, the historical performance of the US stock market before and after the second and third rate cuts has not been satisfactory, often resulting in significant pullbacks.

The "water tap" of the US economy has been tightened, and the Bitcoin bubble can no longer be blown up. You can refer to the analysis I previously released, which largely explained the market outlook after the US election and rate cuts.

So the Bitcoin bull market has already reversed, and it doesn't matter how much the price rises further. The trend of a major correction will not change, and you need to understand the trend before you can talk about trading.

Secondly, although Ethereum has rebounded in the past two months, it has still struggled to break free from the bearish trend on the daily chart, repeatedly hitting the resistance at 2820. Historical data shows that during non-bull market periods in November and December, Ethereum tends to go down.

Therefore, Ethereum is likely to continue the bearish trend this time, and may even fall below the 2000 mark. At the same time, Altcoins will plummet to new historical lows, a bleak situation.

As the saying goes, "waiting a thousand years for one chance", Bitcoin and Ethereum will eventually reach a bottom. And the opportunity for Altcoins will be waiting to be discovered in this prolonged winter, and we shall see whether spring will truly come after this winter.

Finally, regarding tonight's non-farm payroll data, there is no surprise that the US economic data will significantly exceed expectations, as the data has almost never disappointed since the Fed started cutting rates.

Barring any surprises, the US non-farm payroll data released tonight will certainly exceed expectations significantly, and the next step could be for the Fed to slow down or even stop rate cuts, with the purpose of maintaining the strength of the US dollar index and the US stock market rally, because as long as the US dollar index remains strong, the US can continue to reap capital from the global market, and it will be a matter of who can outlast the other.

Master Advisor Sees the Trend:

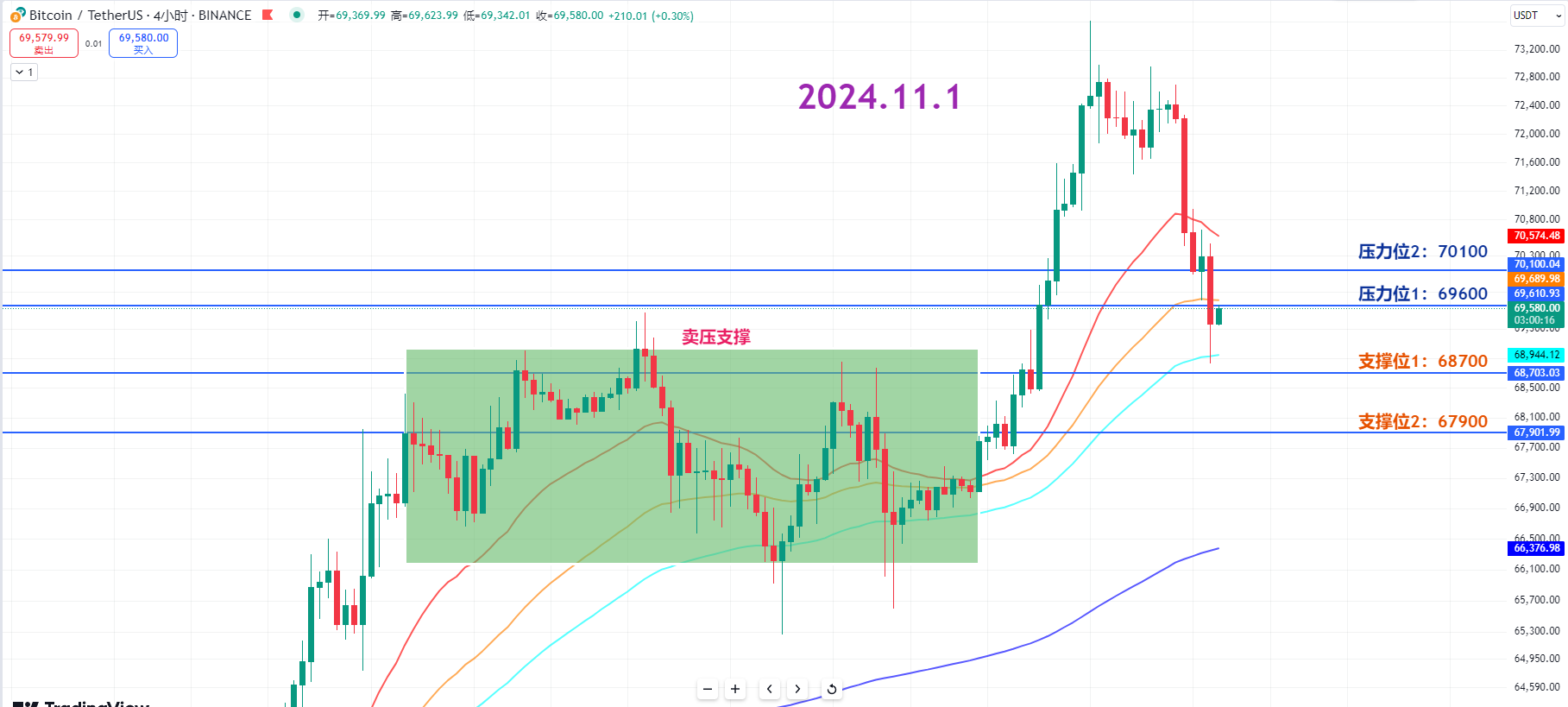

Bitcoin has dropped more than 5% from its high due to the decline in Trump's winning probability and the sharp drop in the New York stock market, giving a sense of being unable to hold on.

That said, as Trump's chances of winning the election have increased, Bitcoin's performance seems to have been pre-revealed, already digesting 50-60% of market expectations. But if Trump is truly elected on November 5th, the market may experience a major upheaval, and a roller coaster ride is not impossible.

Currently, the selling pressure seems to be providing support. This may be a short-term entry opportunity, and you can keep an eye on it, as there might be a chance to ride the rebound.

Resistance Levels:

First Resistance: 69600

Second Resistance: 70100

Support Levels:

First Support: 68700

Second Support: 67900

Trading Suggestions:

You can look for entry opportunities in the selling pressure zone, and wait for a rebound to enter. Additionally, with the election approaching, the "Trump factor" is still in play. If there is a pullback, you can keep an eye on the selling pressure zone and find a suitable average price to get back in, as the entry price is crucial.

11.1 Master Advisor's Swing Trade Preset Orders:

Long Entry: Around 68800, stop loss if it breaks down, don't hesitate, this is just a sneaky long trade, Target: 69600-70100

Short Entry: 71500-71800, stop loss: 72300, Target: 70100-69600

The content of this article is exclusively planned and published by Master Advisor Chen (public account: Crypto Master Advisor Chen). Chen can be found under the same name across all platforms. If you want to learn more about real-time investment strategies, unwinding, spot, short, medium, and long-term contract trading techniques, operation skills, and K-line knowledge, you can join Chen's learning and exchange group. A free fan experience group and community live broadcasts have already been opened.

Friendly Reminder: The only official public account (shown in the image above) is written by Master Advisor Chen. All other advertisements at the end of the article and in the comments are not related to the author! Please be cautious in identifying the authenticity, and thank you for reading.