Author: 1912212.eth, Foresight News

On October 30, Bitcoin failed to set a new all-time high, rising to over $73,600 but falling just $100 short of $73,777. Unfortunately, the follow-up buying power was lacking, and after prolonged fluctuations, it ultimately declined. Around 9 PM on October 31, BTC accelerated its drop, briefly dipping to around $68,800 before retreating to around $69,500.

ETH also experienced a significant decline after rising above $2,700, dropping to around $2,500 and giving back its recent gains. Altcoins saw a general decline.

In terms of contract data, there was $276 million in 24-hour liquidations, with $247 million in long liquidations.

Why was Bitcoin unable to break its all-time high? How will the market perform going forward?

Harris leads in swing states, adding uncertainty to the US election

The US presidential election will officially begin on November 5, and the market often experiences significant volatility in the days surrounding it.

Reviewing the BTC market performance on the 2020 US election day, the crypto market declined in the preceding two days, then rose on the day the results were announced, followed by another two-day decline before a sustained upward trend.

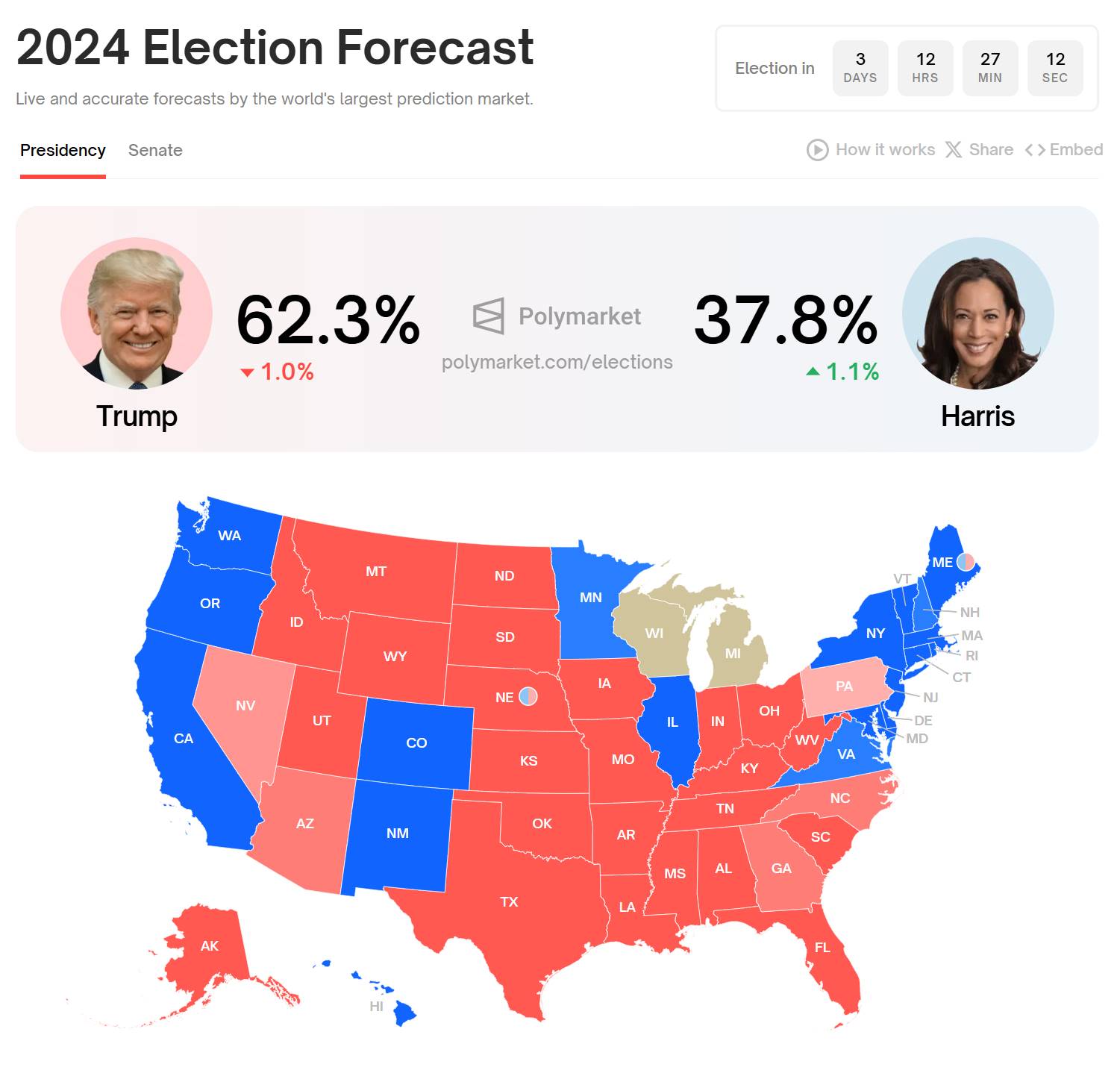

Additionally, according to a Forbes report, a recent poll shows Harris leading Trump by a slim 1% margin. In the seven key swing states that could determine the final election outcome, Harris leads Trump 49% to 48%, a shift from a week earlier when Trump led 50% to 46%.

This change further increases the uncertainty surrounding the election result. US stocks opened lower and the decline widened, with tech stocks, chip stocks, and AI concept stocks all experiencing collective declines.

However, Polymarket data shows Trump's odds of winning are significantly higher than Harris'.

Some funds, out of caution, have chosen to exit and wait, pending the final resolution of the US election.

Future market outlook

Bitcoin's fourth-quarter investment returns have performed well after its halvings in 2012, 2016, and 2020, at 97.7%, 58.17%, and 168.02%, respectively. The November 2016 return was 5.42%, and the November 2020 return was 42.95%. This month's return is still worth looking forward to.

It's worth noting that Bitcoin rose 7.35% in September, its best historical performance. Historically, when Bitcoin has risen in September, it has gone on to rise through the end of the year.

CZ hints at a bull market in 2025

In an interview at the Binance Blockchain Week main venue in Dubai, CZ stated that while he cannot predict the future, he can analyze history. From a historical perspective, Bitcoin has experienced very clear four-year cycles. 2013 and 2017 were bull markets. But 2012 was actually a "recovery year" that many people didn't trace back that far. 2016 was also a "recovery year", with 2017 then seeing a meteoric rise. 2020 was similarly a "recovery year", with 2021 being the bull market.

So based on the current analysis, 2024 should also be a "recovery year", and what will happen next year is unclear, but from a long-term perspective, the outlook for the entire industry remains very positive.

Standard Chartered analyst: Trump victory will help Bitcoin reach $125,000 by year-end

Geoff Kendrick, Standard Chartered's global head of digital asset research, stated that before the November 5 US presidential election, Bitcoin's price may see a correction, and volatility is expected to increase in the coming days. Due to traders choosing to take profits by closing positions before the election outcome, the likelihood of Bitcoin breaking above its $73,700 all-time high before the US election is decreasing.

Geoff Kendrick added that if the Republican Party (Trump) achieves a landslide victory in the US Congress, Bitcoin's price will experience greater volatility, which could drive Bitcoin to $125,000 by the end of the year and trigger a new Altcoin frenzy.