The price of XRP has shown a challenging trend recently, failing to break above the $0.60 level for 4 months. Despite these difficulties, XRP has maintained important support levels, providing hope to investors.

A change in the attitude of institutions could restore the upward momentum of XRP and change the perception of cryptocurrencies.

XRP needs more interest from institutional investors

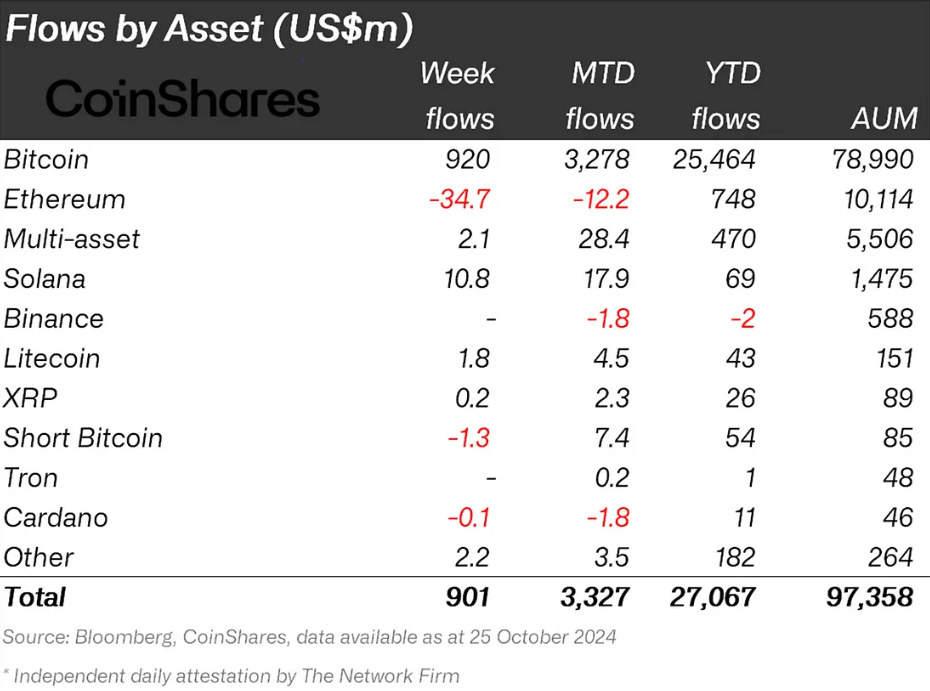

During October, institutional interest in XRP was low. This acted as a negative factor for the asset. In October, the inflows into XRP amounted to only $2.3 million, compared to $179 million and $45 million for Solana and Litecoin, respectively.

This limited inflow reflects the cautious attitude of investors, indicating that institutions are less confident in the growth potential of XRP compared to other altcoins. For XRP to grow in November, stronger institutional support is needed.

Victor Tan, the founder and CEO of TrinityPad, shared a similar view on the future of XRP in a conversation with BeInCrypto.

"The recent optimism around ETFs and high interest in 'Uptober' have not driven significant movements, but if Ripple secures more institutional partnerships or regulatory clarity, XRP could see a modest growth. Without major news, XRP may move within a range, but favorable developments could still yield 10-15% gains," Tan said.

Generally, high inflows help build trust and provide the stability needed for price growth. If institutional interest does not increase, XRP may continue to struggle to break through key resistance levels, which could limit the potential for a strong rally in the short term.

Read more: XRP ETF Guide: What Is It and How Does It Work?

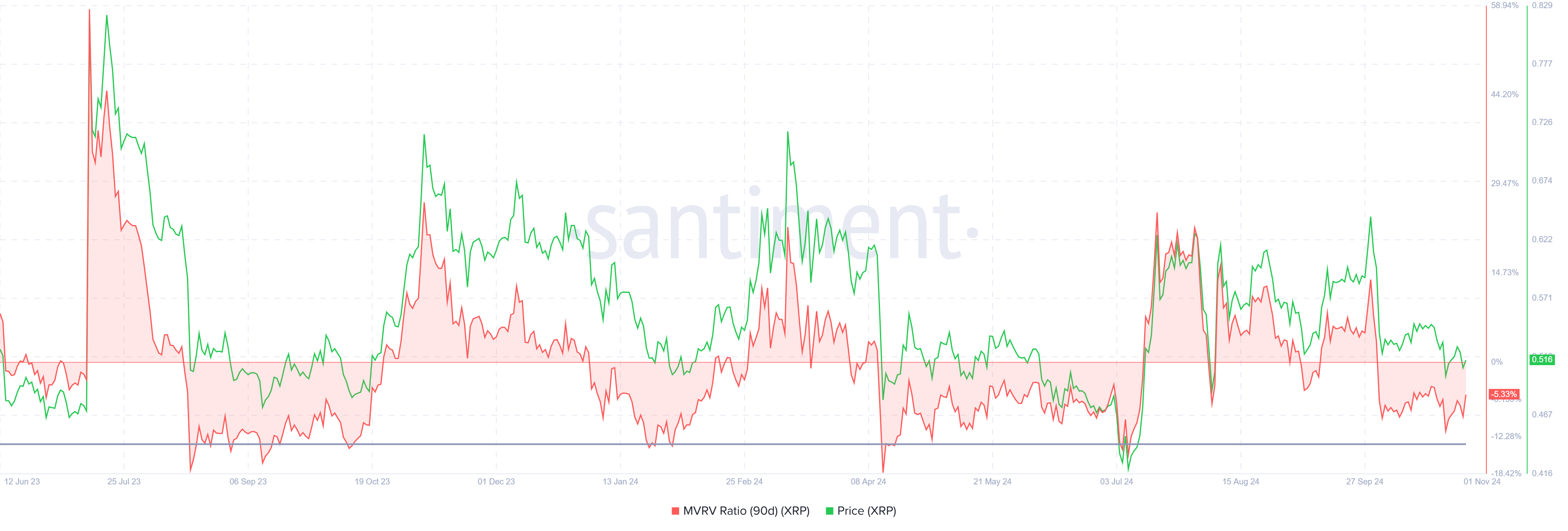

The macrotrend of XRP suggests that it is currently undervalued, as indicated by the 90-day Market Value to Realized Value (MVRV) ratio. This metric suggests that XRP is trading below its fair value, which can sometimes trigger buying interest.

However, this altcoin has not yet entered the 'opportunity zone', which is generally where accumulation is triggered when holders experience extreme losses of below -13%. If XRP enters this zone, investors may shift from selling to buying, which could help stabilize the price.

The current undervalued state of XRP alone is not enough to trigger a reversal. Without a change in attitude, XRP may maintain its undervalued status. Investors will need to see important events or market changes to regain trust and achieve a more pronounced recovery.